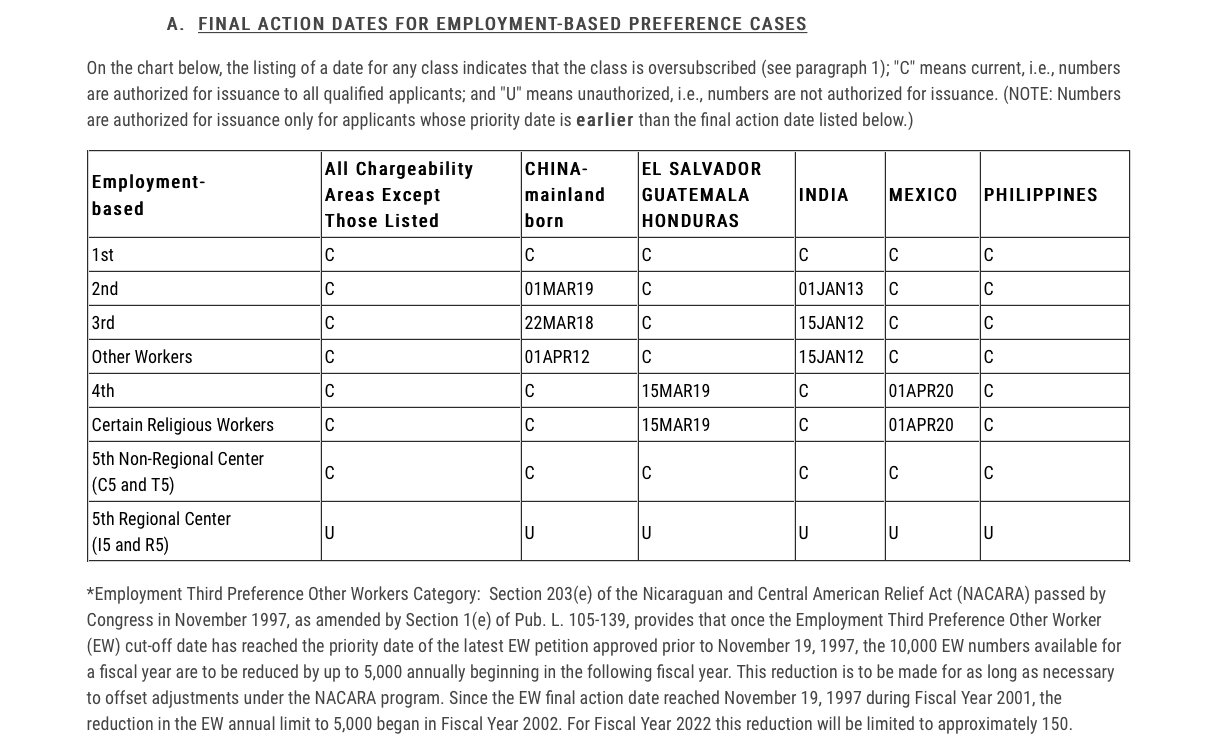

The days before the June 30, 2021, suspension of the regional center program were busy for EB-5 project developers. Many foreign nationals rushed to file their I-526 petitions at a reduced amount before the EB-5 program’s most popular investment option became unavailable. As regional center-sponsored projects offered their investors light managerial requirements and were allowed to use very flexible job creation criteria, most foreign nationals chose to invest through regional centers when pursuing the EB-5 visa.

This enthusiasm, however, was short-lived. Even though the industry as a whole expected Congress to reauthorize the regional center program in a few short months, it has been defunct for over six months at the time of writing. An appropriations bill due in December 2021 was ultimately postponed, leaving the EB-5 industry without a convenient legislative vehicle to pass reform.

Since the second half of 2021, the EB-5 industry has still attracted millions of dollars of foreign investment capital, and foreign nationals are now more aware of and comfortable with the direct EB-5 investment model.

But what about the regional center investors whose I-526 petitions were being processed as of June 30, 2021?

United States Citizenship and Immigration Services (USCIS) is no longer processing I-526 petitions from regional center investors. As a result, these foreign nationals, who made EB-5 investments in good faith and in compliance with USCIS guidelines, now find themselves unable to continue with the EB-5 process.

What consequences could this situation have on the EB-5 investment industry, and how could it be solved?

Potential Consequences for EB-5 Projects

The longer regional center investors remain in processing limbo, the more likely it is for them to try to regain their invested capital. If USCIS takes a step further and denies these I-526 petitions, then numerous EB-5 projects could face litigation. This scenario would surely undermine the EB-5 investment program’s image and discourage potential investors from pursuing the EB-5 visa. Worse still, the U.S. economy would lose out on billions of dollars of valuable funding.

Alternatives to Reauthorizing the Regional Center Program

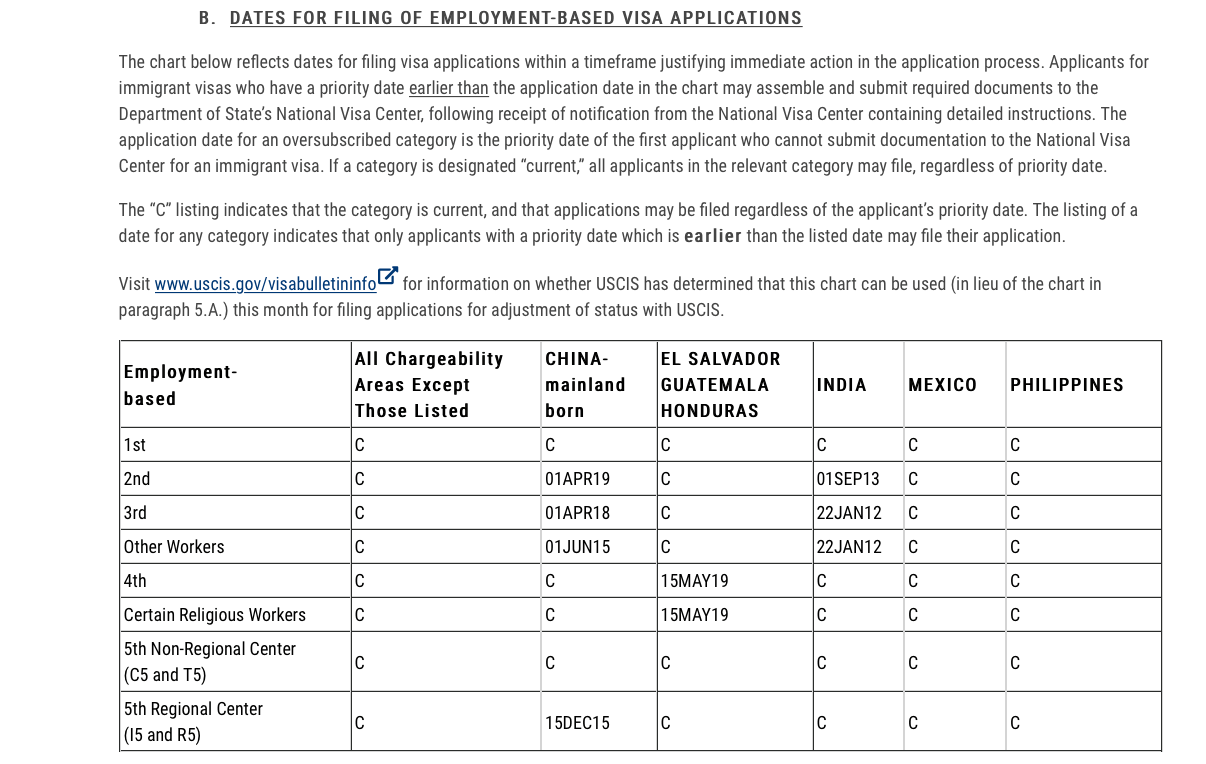

The most straightforward way to get regional center investors back on track would be for Congress to revalidate the regional center program. However, it has usually been difficult for the U.S. government to reach a consensus on what changes should be made to the EB-5 program. EB-5 reform is usually attached to a larger legislative vehicle; it is very unlikely for it to pass Congress on its own. Therefore, it remains unclear when the regional center EB-5 investment model will achieve reauthorization.

Given this uncertainty, many EB-5 industry members have sought to promote legislative action that would allow investors with valid I-526 petitions to continue with the EB-5 process regardless of whether the regional center program is authorized. Such a measure would surely restore investors’ confidence in the regional center program.

Even if no legislation aiding regional center investors is successful, it seems that USCIS may begin to process pending regional center petitions in the coming weeks or months: the agency released a statement in December 2021 announcing that it was “reevaluating” its policy of not acting on I-526 forms associated with regional centers.

In the meantime, the EB-5 industry is enjoying the many benefits of direct EB5 investment, including a more permanent and quantifiable impact on the U.S. economy, more transparent job creation, and permanence—the direct EB-5 model does not depend on reauthorization.

Even if provisions are made for regional center investors, EB-5 investors may now view the direct model as more secure and reliable. It may become the preferred investment model for foreign nationals seeking the lowest possible risk.