The United States Citizenship and Immigration Services (USCIS) oversees the EB-5 Immigrant Investor Program. This program allows foreign individuals to invest in U.S. businesses and apply for Green Cards.

Investors can invest in a new commercial enterprise directly or via a regional center; this choice is entirely up to them. Within the EB-5 program, a regional center is an organization that USCIS designates to facilitate investments and help the local economy grow.

Audit of Regional Centers

Compliance reviews of regional centers have already been standard practice, but the EB-5 Reform and Integrity Act of 2022 (RIA) introduced a new audit requirement. USCIS made an announcement about this on April 9, 2024, and started the audit process on April 23.

The agency stated that “regional center audits enhance the integrity of the EB-5 program by helping us verify information in regional center applications and annual certifications as well as associated investor petitions.” This is to keep the EB-5 program trustworthy and ensure compliance with its rules. Under this provision, regional centers must be audited every five years.

USCIS’s Audit Process

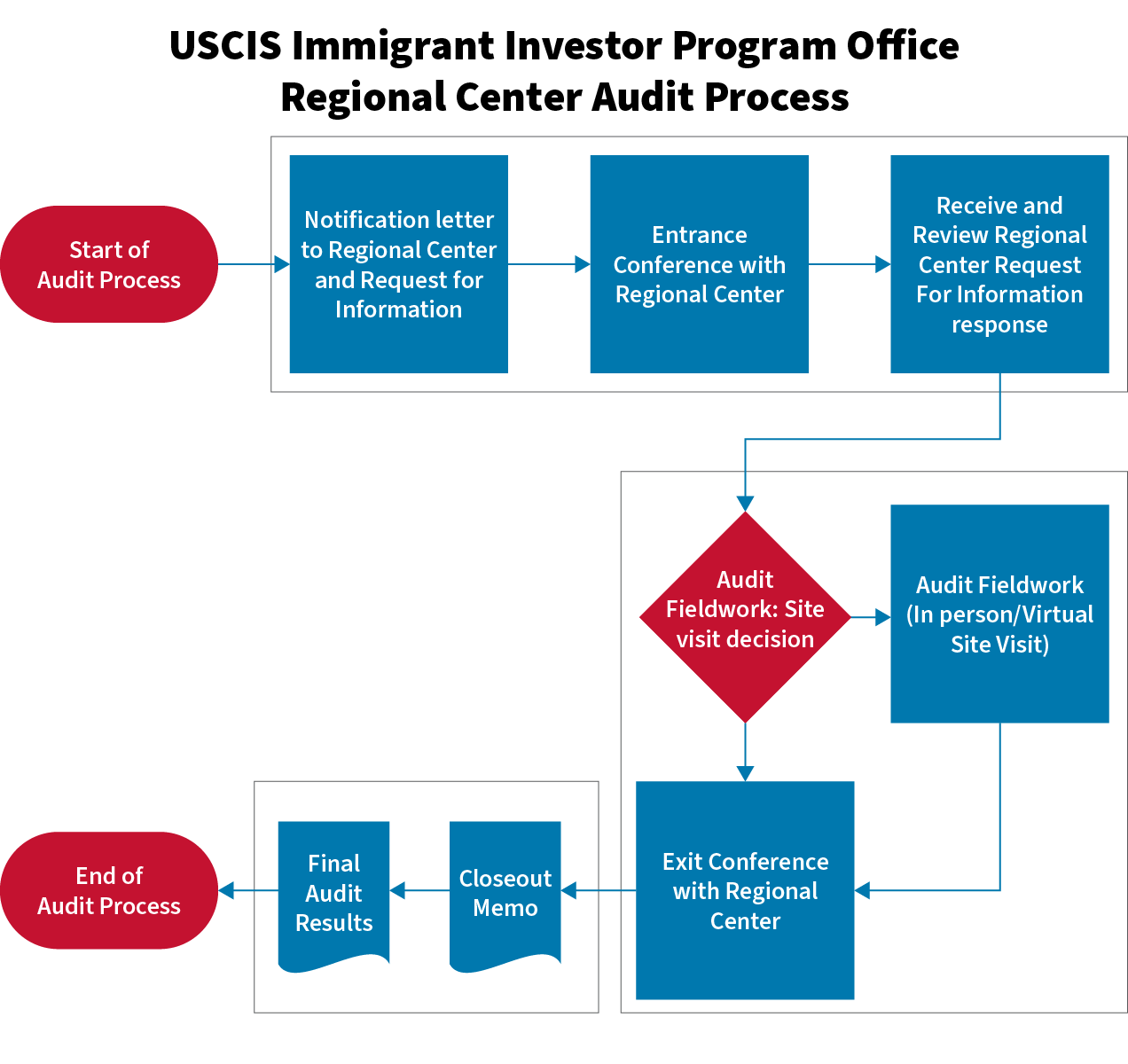

The USCIS manages the audit process for each regional center on a case-by-case basis. Numerous factors can cause audit timelines to be different, such as the regional center’s average response time and any issues present in the audit processes.

Source: USCIS

Pre-Audit Intimation

USCIS sends an official notification letter to the selected regional center, initiating the audit process. The letter likely includes the audit’s scope and schedule. It also includes instructions on cooperating with the USCIS audit officials. This intimation ensures that the audit process goes smoothly.

In response to the USCIS’s request for an audit, the chosen EB-5 regional center needs to gather all the records needed by the INA. This includes everything from new and up-to-date financial records to ledgers.

During Audit

During these audits, USCIS checks the paperwork. They verify that investor funds go into the projects and evaluate how well the regional centers follow applicable laws. In addition, they conduct in-person interviews with the regional center’s management teams, staff, and other involved stakeholders. Besides assessing the regional center’s compliance with program requirements—such as creating jobs for U.S. workers—USCIS also looks at its capacity to attract and manage EB-5 investments.

Starting April 23, USCIS has standardized these evaluations. They use the Generally Accepted Government Auditing Standards (GAGAS), also known as the Yellow Book. These standards provide a method for conducting fair and thorough audits.

Auditors physically visit the regional centers to inspect them as part of the auditing process. If the regional center’s representative shows no interest in being present during an audit, USCIS can cancel the visit at any time. If this happens, USCIS will finish the audit report with the information they have access to, noting that the regional center asked for the site visit to be canceled. Moreover, a regional center can have its accreditation revoked if it does not cooperate with the audit or attempts to obstruct it.

Post-Audit

After an audit, USCIS sends a Notice of Audited Findings (NOAF) or a Notice of Intent to Terminate (NOIT) to the regional center. In these notices, USCIS explains what the audit revealed and gives the regional center a chance to respond to and settle any issues the agency raises.

The recently established EB-5 Regional Center Audits webpage provides detailed information regarding how regional centers can prepare for and participate in audits.

Findings of the Audit Process

As previously mentioned, the agency implemented the audit requirement in order to eliminate regional centers that do not adhere to the rules established by USCIS. By doing this, the U.S. government aims to protect foreign investors and the EB-5 program.

If the audit results are unfavorable for the regional center, this does not necessarily impact its designation status or the immigration procedures of foreign investors who have invested in projects the regional center has sponsored.

However, if a representative from a regional center refuses to follow the rules or tries to prevent USCIS from auditing its documents and operations, the agency will end the audit and write in its report that the regional center was not cooperative. The regional center may then lose its designation.

Stay Informed With EB5AN

It is essential that regional centers cooperate fully with USCIS throughout the audit process and take it seriously. Failure to comply with program requirements or to address issues raised during an audit could result in the termination of the regional center’s designation, which would have severe consequences for both the regional center and its investors.

By following audit requirements and staying transparent, regional centers can continue to attract foreign investors and support the integrity of the EB-5 program.

EB5AN owns over 10 EB-5 regional centers that cover the entire continental United States, and has helped more than 2,300 families from 60 countries relocate to the United States as lawful permanent residents. We offer our clients first-rate, low-risk EB-5 regional center projects with a 100% USCIS project approval rate to date.

Book a free consultation with our team today to learn how we can help you through every step of the EB-5 process.