TEA designation is critical for any EB-5 project in the market today

In today’s EB-5 market, getting an EB-5 project location designated as a targeted employment area (TEA) is important for successfully attracting EB-5 investors. If an EB-5 project is located in a TEA, the required EB-5 investment amount is only $900,000 as opposed to $1.8 million for a project not located in a TEA. Since the vast majority of EB-5 investors are primarily motivated to invest in an EB-5 project to acquire a green card, they typically have no compelling reason to risk twice as much capital in an EB-5 investment project.

To be officially designated as a TEA, an EB-5 project must be located in either (i) a rural area or (ii) a location experiencing a high unemployment rate at least 50% above the national average. When an EB-5 investor submits an I-526 immigration petition, verifiable third-party evidence and documentation are included in the petition to demonstrate that the EB-5 project and the investor qualify at the $900,000 investment level. For EB-5 investors who choose to invest in a USCIS-approved regional center, the available projects will most likely be located in TEAs.

(i) High unemployment TEA designations

To be designated as a high unemployment TEA, an EB-5 project must be located in an area with an unemployment rate of at least 150% of the U.S. national average. Since the U.S. national average unemployment rate for 2019 was 3.66%, the required unemployment rate threshold for a high unemployment TEA is 5.49% through mid-April 2021 (150% of the 3.66% unemployment rate).

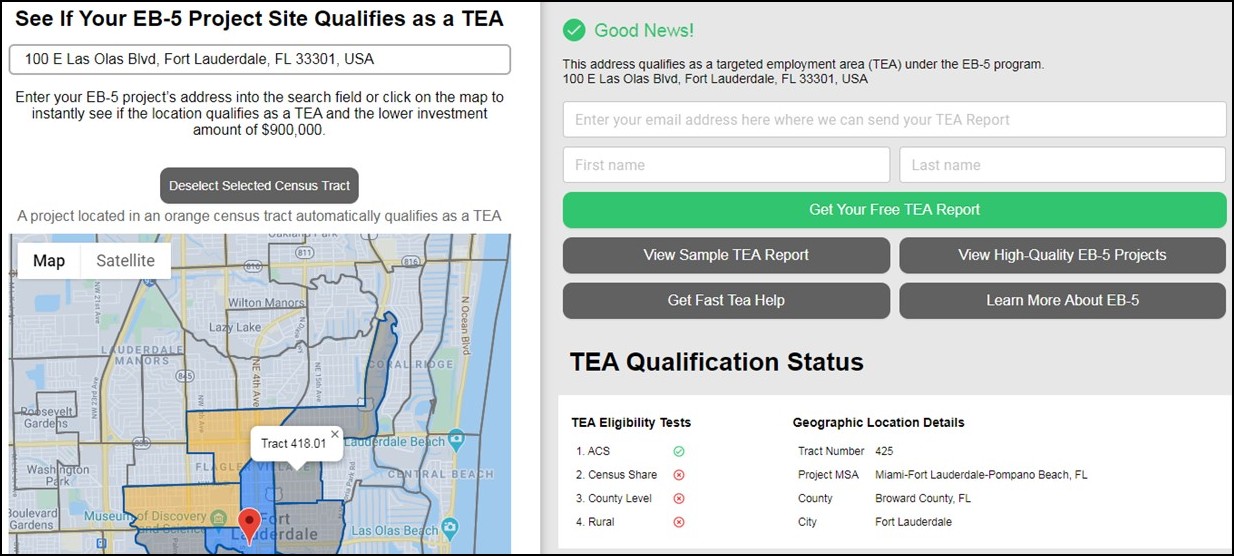

Click Image to View the TEA Map

(ii) TEA qualification in rural areas

EB-5 project locations must meet a specific set of requirements to qualify as a rural TEA. The EB-5 project in question must not be located within a metropolitan statistical area (MSA) as labeled by the U.S. Office of Management and Budget.

Additionally, the EB-5 project must not be on the outskirts of a town or city that has a population of 20,000 or more residents as determined by the most recent decennial U.S. Census. If an EB-5 project location qualifies as a rural area at the time of the EB-5 investor’s I-526 submission to USCIS or at the time the investor makes his or her investment in the new commercial enterprise, the location will be recognized by USCIS as an official TEA.

For an EB-5 project location to qualify as a rural TEA, the EB-5 investor’s I-526 petition must include documentation that demonstrates that the EB-5 project location qualifies as a rural TEA as set forth by USCIS and described above.

USCIS approval of TEA designations

TEA designations are reviewed by USCIS as part of each individual investor’s I-526 application process. TEAs are also reviewed as part of the I-924 project exemplar process for EB-5 projects in TEAs seeking preapproval from USCIS. The EB-5 visa applicant or EB-5 project sponsor must provide sufficient evidence that the EB-5 project in question is located within a rural or high unemployment TEA by submitting third-party evidence. Several forms of evidence can be used to justify that an EB-5 project and associated investments will occur within a TEA.

Acceptable forms of evidence for TEA designation by USCIS:

1. Geographic and population data from the U.S. Office of Management and Budget that demonstrate that an area qualifies as a rural TEA

2. Current unemployment data and statistics from the U.S. Bureau of Labor Statistics Local Area Unemployment Statistics (LAUS) office that justify a high unemployment TEA

3. Other statistical documentation on the local area unemployment situation and population that justifies a high unemployment TEA

If an EB-5 project chooses to pursue the $1.8 million EB-5 investment amount, the TEA designation process is unnecessary. Evidence of a qualifying TEA is only required by USCIS for EB-5 investors and EB-5 projects when a $900,000 EB-5 investment is made.

If Your Project Qualifies as a TEA, The Next Step is to Order a Report

Our TEA Report provides USCIS with a detailed, easy to follow analysis of the census tract assembly methodology and calculation needed to meet the USCIS unemployment EB-5 TEA requirements.