A targeted employment area (TEA) is a rural area or an area characterized by high unemployment that would benefit from the economic growth brought about by foreign investment. To encourage investment in these areas, the required EB-5 investment amount for projects located in TEAs is lower than for projects located outside these areas. Currently, investment in a TEA project requires only $800,000 instead of the usual $1,050,000.

Most EB-5 investors are driven by the desire to obtain green cards, so the opportunity to risk less capital is attractive. Consequently, it is often easier to find the required number of investors for EB-5 projects located within TEAs. Thus, TEA designation benefits communities, investors, and project developers. Investors and project developers can request TEA designation for areas that qualify.

Types of TEA Designation

To secure TEA designation, an EB-5 project must be located in either an area with high unemployment or in a rural area. Additionally, United States Citizenship and Immigration Services (USCIS) has the sole authority to determine whether an area qualifies as a TEA.

High Unemployment TEAs

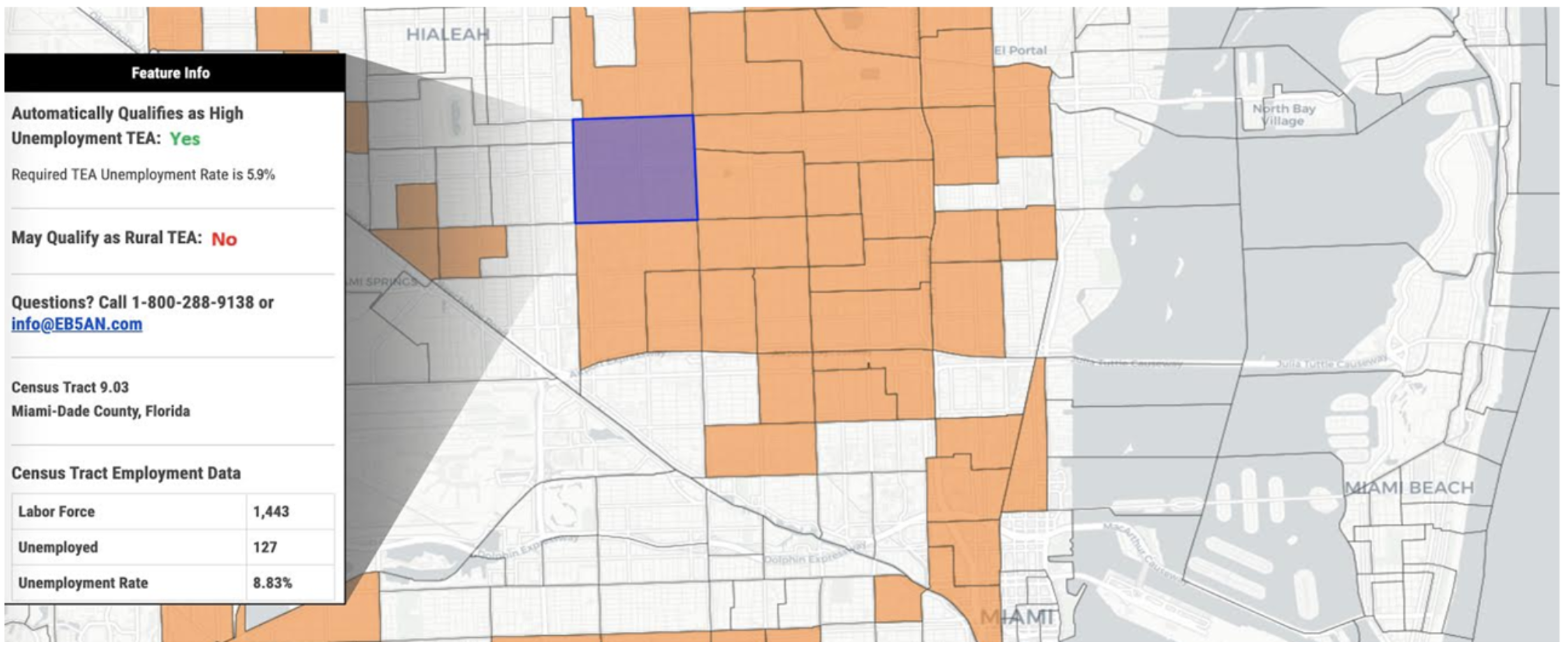

To qualify as a high unemployment TEA, an area must have an unemployment rate of at least 150% of the national average. For example, the U.S. national unemployment rate was 5.32% in 2019. Therefore, to be designated a high unemployment TEA in 2019, an area needed an unemployment rate of at least 7.98%.

High-unemployment TEAs can include cities and towns with a population greater than 20,000 residents, according to the most recent 10-year U.S. Census, in or outside metropolitan statistical areas (MSAs) as identified by the Office of Management and Budget.

Rural TEAs

To qualify as a rural TEA, a project location must not be located within an MSA or on the outer borders of a town or city with a population of more than 20,000 residents, according to the most recent 10-year U.S. Census.

Securing TEA Designation

When filing Form I-526 or I-526E, EB-5 investors must submit relevant data and calculations demonstrating that their project is located in a TEA.

Three main types of evidence are acceptable for demonstrating TEA status:

- Geographic data and population statistics obtained from the U.S. Office of Management and Budget that show that an area qualifies as a rural TEA.

- Up-to-date unemployment data obtained from the U.S. Bureau of Labor Statistics Local Area Unemployment Statistics (LAUS) program showing that the area meets the requirements for a high unemployment TEA.

- American Community Survey (ACS) data, a five-year demographics survey that collects unemployment data by census tract.

Because unemployment rates and population levels change over time, geographic areas that previously qualified as TEAs may no longer qualify in the future. Consequently, investors cannot base their claims that they qualify for the lower investment amount on the fact that immigrant investors who invested in the same project at an earlier date qualified for the lower amount. Therefore, each investor must prove that the project location qualified as a TEA at the time of investment or at the time of filing the I-526/I-526E petition, as set out in chapter 2, section 5 of the USCIS Policy Manual.

Investors do not need to prove that the area remains a TEA at the time of filing the Petition by Investor to Remove Conditions on Permanent Resident Status, Form I-829. If the unemployment rate in the area decreased, for example, between the initial TEA designation and the filing of the I-829 petition, the investment contributed to increasing employment levels and thus contributed to the aims of the EB-5 program.

Key Facts about TEA Designation

1. Projects sponsored by USCIS-approved regional centers typically fall within TEAs. To find out whether a project falls within a TEA, consult the EB5AN TEA map.

2. The TEA designation process is unnecessary for investors who want to invest the full required amount in EB-5 projects (currently $1,050,000). Only those who want to invest the reduced amount (currently $800,000) need to invest in TEAs.

3. USCIS has sole authority to designate TEAs.

If Your Project Qualifies as a TEA, The Next Step is to Order a Report

Our TEA Report provides the relevant state agency with a detailed, easy-to-follow analysis of the census tract assembly methodology and calculation needed to meet the EB-5 TEA requirements.