EB-5 capital is popular among real estate developers. It provides low interest rates and doesn’t require them to guarantee any returns.

It’s also non-recourse funding. In other words, project developers benefit from limited liability and investors usually cannot pursue developers for repayment.

But your project can only attract EB-5 funding if investors think it will help them meet the requirements of the EB-5 Immigrant Investor Program and gain their Green Cards.

This article explains how real estate companies can use EB-5 capital to fund projects, including how they can make their projects attractive to EB-5 investors.

What Is EB-5 Capital?

Why EB-5 Capital Is Attractive to Real Estate Developers

What Makes an EB-5 Project Attractive to Investors?

- Projects Located in a Targeted Employment Area

- Good Job Creation Potential

- Project Job Cushion and Investor Immigration Risk

Access EB-5 Capital for Your Project With EB5AN

What Is EB-5 Capital?

EB-5 capital refers to funding acquired under the EB-5 Immigrant Investor Program and invested in qualifying U.S. business ventures.

Congress established the EB-5 program in 1990 to stimulate U.S. economic growth by using foreign capital investment to create domestic jobs. In return, qualified foreign investors gain lawful permanent residence in the United States.

Each EB-5 applicant must invest in a new commercial enterprise (NCE) and keep the money invested for at least two years. During this time, the project that the EB-5 applicant invests in needs to fulfill certain criteria on their behalf. The most important of these requirements is to create 10 full-time jobs for U.S. workers.

At the end of the two-year period, and assuming they have fulfilled all of the EB-5 requirements, the investor can apply for unconditional permanent resident status in the United States.

An EB-5 applicant can make an investment either directly or via a regional center.

- Direct investment is when the investor puts funds directly into the NCE. An NCE can only have one EB-5 direct investor. The investor is usually involved in the day-to-day management of the business.

- A regional center is an organization set up to pool EB-5 funds from several investors and manage the allocation of these funds to the project. The investor has few management responsibilities.

Because regional centers pool funding from multiple foreign investors, they can fund larger projects that are lower risk and more likely to fulfill the investors’ job creation requirements. Investing via a regional center also tends to be safer because a regional center generally has a balanced capital structure that does not depend entirely on EB-5 funds for project completion.

Project developers who want to access EB-5 capital from multiple investors can apply to United States Citizenship and Immigration Services (USCIS) for regional center status. However, doing so is often complex and time-consuming.

A better approach may be to partner with an existing regional center.

More than 95% of EB-5 applicants invest via a regional center. Most investors see this kind of investment as a safer and more convenient pathway to lawful permanent residency.

Why EB-5 Capital Is Attractive to Real Estate Developers

Interest rates have increased significantly in recent years. At the same time, traditional sources of funding have become harder to come by. This has made alternative sources of funding like EB-5 capital more popular.

The benefits of EB-5 foreign investor capital for real estate developers include:

- Cost savings, with access to capital at low interest rates ranging from 1% to 6%.

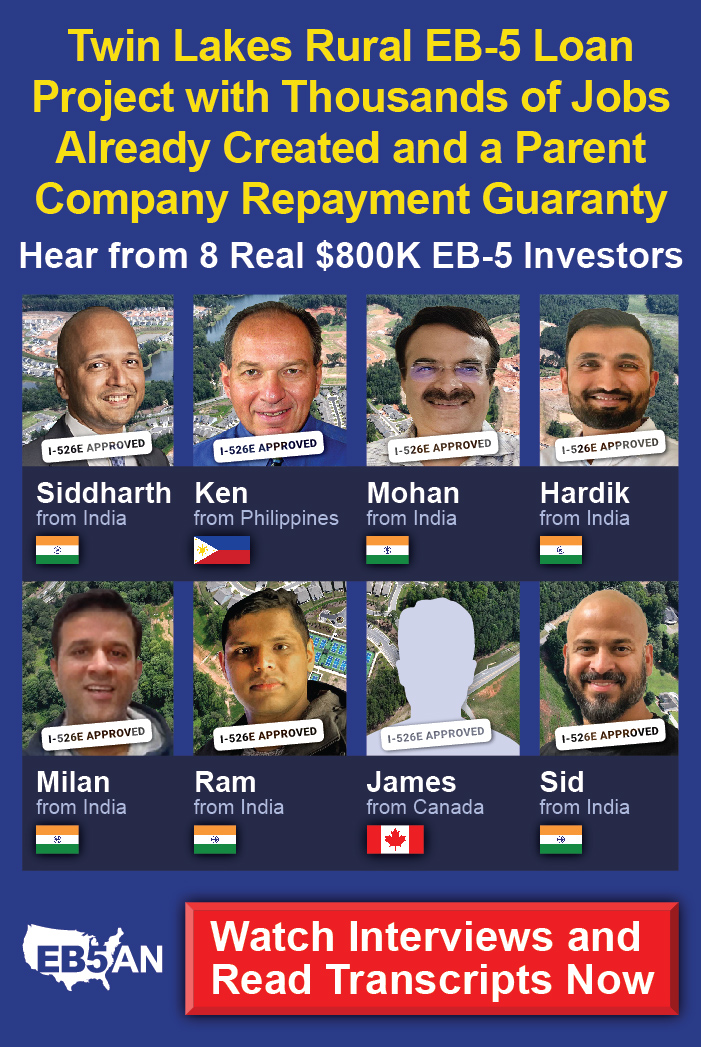

- Large pool of EB-5 investors, each looking to invest at least $800,000 in a project.

- A shorter and more straightforward approval process than traditional financing.

- Longer repayment periods that give developers more time to finish projects.

- No collateral required.

- Non-recourse funding.

- Flexible financing options that can be customized to project needs.

- Easier to meet regulatory requirements because of EB-5 job creation requirements.

- Greater potential for additional financing with proof of EB-5 financing.

- Risk mitigation by diversifying sources of capital beyond traditional lending.

- Potential eligibility for economic development incentives from local authorities.

What Makes an EB-5 Project Attractive to Investors?

Any real estate project can help an investor meet the EB-5 requirements they need to get a Green Card. However, projects that enable them to do this with minimal risk and cost are more likely to attract EB-5 investment.

Here are some of the factors that EB-5 investors look out for when choosing an investment:

Projects Located in a Targeted Employment Area

The EB-5 Immigrant Investor Program ordinarily has an investment threshold of $1,050,000. This does not apply to projects located within high unemployment (150% of the national average) or rural areas. These places are called targeted employment areas (TEAs) and their investment threshold is only $800,000. Some infrastructure projects also qualify for this lower investment minimum.

Targeted employment areas are subject to change as unemployment rates and population change. For example, in 2023, the national average unemployment rate was 3.7%, so for an area to qualify as a TEA based on this unemployment level, it must have an unemployment rate of 5.55% or higher.

For any developer interested in adding EB-5 financing to its capital stack, project location is a vital consideration. While projects located outside TEAs can receive EB-5 capital, few projects do. For EB-5 investors, investing in a project not located within a TEA means risking more capital with no upside. Since EB-5 investors are seeking U.S. permanent resident status and not strong returns, they will seek projects with the lowest financial risk.

Projects located outside TEAs can still draw EB-5 capital, but this is typically based on relationships, unique project appeal, or a higher rate of return.

Real estate projects located in TEAs are more likely to attract EB-5 funding.

Good Job Creation Potential

As already mentioned, each EB-5 investment must produce at least 10 full-time jobs. These jobs must be created within two years following the approval of the EB-5 investor’s immigration petition (Form I-526 or I-526E) by USCIS.

The way employment creation is calculated depends on the way the project receives EB-5 capital. If the project receives investment funds directly from a foreign investor, only jobs created directly by the new commercial enterprise can be counted.

For projects sponsored by a USCIS-designated regional center, however, indirect and induced jobs may be counted in addition to direct jobs.

Direct Jobs

Direct jobs are those created directly by the project. These jobs must be full-time, permanent positions filled by U.S. workers—also, they cannot be filled by EB-5 investors or their dependent family members.

Indirect Jobs

Indirect jobs are those created as a result of the project’s needs. These ancillary jobs are created through the spending of project funds on materials, supplies, and any necessary services from real estate brokers, engineers, architects, and so on.

Induced Jobs

Induced jobs are those created by the project’s economic impact within the region as people employed by the project (directly) and those employed because of the project (indirectly) spend their money.

How Jobs Are Counted

While direct jobs can be demonstrated fairly easily, indirect and induced jobs must be calculated using accepted statistical or economic forecasting methodologies and demonstrated in a credible economic report, typically prepared by an economist.

Most EB-5 investors are more likely to be attracted to regional center projects due to more flexible job creation requirements than those under the direct investment model.

Project Job Cushion and Investor Immigration Risk

While the EB-5 program requires only 10 job positions per investor, having a greater number of job positions that can be counted toward an investor’s employment requirement lessens their immigration risk. Creating these excess jobs before they are required is known as a “job cushion.”

For example, some projects create the necessary number of jobs through construction expenditures before ever receiving any EB-5 capital. If an EB-5 investor were to invest in such a project, their immigration risk would be effectively eliminated. This project would therefore be very attractive to EB-5 investors.

Each EB-5 investor needs to generate 10 jobs within two years. Because of this, any funding or construction delays can put an EB-5 investor’s visa application at risk. Projects with higher risks of delays, shortfalls, or overruns—and especially those that rely on a certain level of EB-5 capital for completion—will be less attractive to potential EB-5 investors.

Employment creation is at the core of the EB-5 Immigrant Investor Program, and so real estate projects that will create (or have created) the necessary employment—and thereby have low immigration risk—are likely excellent candidates for the inexpensive mezzanine financing available through EB-5 investment.

EB-5 investors will be attracted to projects that are well-financed and have a significant job cushion.

Access EB-5 Capital for Your Project With EB5AN

Navigating the regional center program can be daunting for real estate developers. Fortunately, EB5AN is here to help, offering professional advice to developers who want to:

- Access EB-5 funding.

- Apply for regional center status.

- Purchase a regional center.

- Sell an existing regional center.

For assistance with everything from choosing the best investment model to submitting regional center petitions and applications, book a call with our EB-5 team today.