Lengthy processing times for I-526 petitions (the first visa petition filed by EB-5 investors) have long plagued the EB-5 Immigrant Investor Program, leaving qualified investors in limbo for years waiting for their conditional permanent resident status. For those unfortunate to hold a passport from a backlogged country—as of January 2023, China and India—waits are even longer.

Despite the ever-growing processing delays, United States Citizenship and Immigration Services (USCIS) has done little to address inefficiency, instead focusing on staying afloat amid financial difficulties.

The long processing times have been turning prospective participants away from pursuing an EB-5 investment, and it’s understandable—the time and effort required for an EB5 investment may not be worth it if an investor is satisfied with Canada’s or Australia’s residency-by-investment program or if they have children in danger of aging out of eligibility for a U.S. Green Card.

However, in 2023, the situation is looking up for EB-5 processing times, and it may just be the perfect time to jump into an EB-5 investment.

The EB-5 Immigrant Investor Program

The EB-5 Immigrant Investor program is one of the fastest and most reliable ways to receive a U.S. Green Card. In exchange for one passive qualifying investment, a foreign investor, their spouse, and all unmarried children under the age of 21 can receive permanent resident status in the United States.

The minimum EB-5 investment in a new commercial enterprise (NCE) or job-creating entity (JCE) is $1,800,000. If the chosen EB-5 project is located in a targeted employment area (TEA), meaning a rural area or an area of high unemployment, then the minimum investment is lowered to $800,000.

Through the EB-5 program, the immigrant investor and their eligible family members can live, work, and study anywhere in the United States without restriction, and without an employer or educational visa sponsor. They can even apply for U.S. citizenship after holding a Green Card for five years.

What is an I-526 Petition?

An I-526 or I-526E petition is essentially an investor’s “application” to qualify for the EB-5 immigrant visa process. This form, along with much supporting documentation, is to prove that the investor has made the minimum EB-5 investment in a qualifying new commercial enterprise (NCE) and that the NCE used their lawfully-sourced EB-5 capital to create a minimum of 10 full-time jobs for U.S. workers.

The EB-5 Reform and Integrity Act of 2022 split the formerly unified EB-5 immigrant petition into two separate petitions, depending on the nature of the foreign national’s capital investment:

- Form I-526, Immigrant Petition by a Standalone Investor, is for direct EB-5 investors.

- Form I-526E, Immigrant Petition by a Regional Center Investor, is for immigrant investors who pool their investment with other EB-5 investors through a USCIS-approved regional center.

A significant 94% of successful EB-5 Green Card applicants are regional center investors, according to a recent study of USCIS processing data.

Direct investors may only count W-2 employees of the NCE towards their job creation requirement. Regional center investors may count both direct employees and indirect jobs sustained through econometric modeling.

Once an immigrant investor’s I-526 or I-526E petition is approved, the investor, their spouse, and all unmarried children under the age of 21 will receive a two-year U.S. Green Card, granting them conditional permanent resident status in the United States.

Conditional permanent resident status lasts for two years. During this time, investors may live, work, or study anywhere in the United States. Their EB-5 investment must remain “at-risk” and the 10 or more jobs created must be sustained for a minimum of two years.

What is an I-829 Petition?

During the last 90 days of the two-year conditional permanent resident status, an immigrant investor’s immigration attorney files their I-829 petition with USCIS.

- Form I-829 is a petition to remove conditions from an investor’s conditional Green Card, and grant them full permanent resident status in the United States.

In order to do this, investors must compile supporting documentation to prove that their lawfully-sourced EB-5 investment actually did create and sustain 10 or more full-time jobs for U.S. workers, and that the investment itself did remain “at-risk” the entire time, as planned in the investor’s I-526 petition.

Once the I-829 petition is approved, an investor, their spouse, and all unmarried children under the age of 21 will receive full U.S. Green Cards, granting permanent resident status in the United States.

Immigrant investors may live, work, or study anywhere in the United States, without restriction, permanently. They will also have the option to become a U.S. citizen, only five years after establishing conditional permanent residency.

Estimated Processing Times Don’t Match Historical Average Processing Times

USCIS publishes up-to-date and historic processing times for nearly all forms associated with the EB-5 program on its website. However, those who aren’t familiar with how USCIS presents its data should be warned: these processing times may not mean what you think.

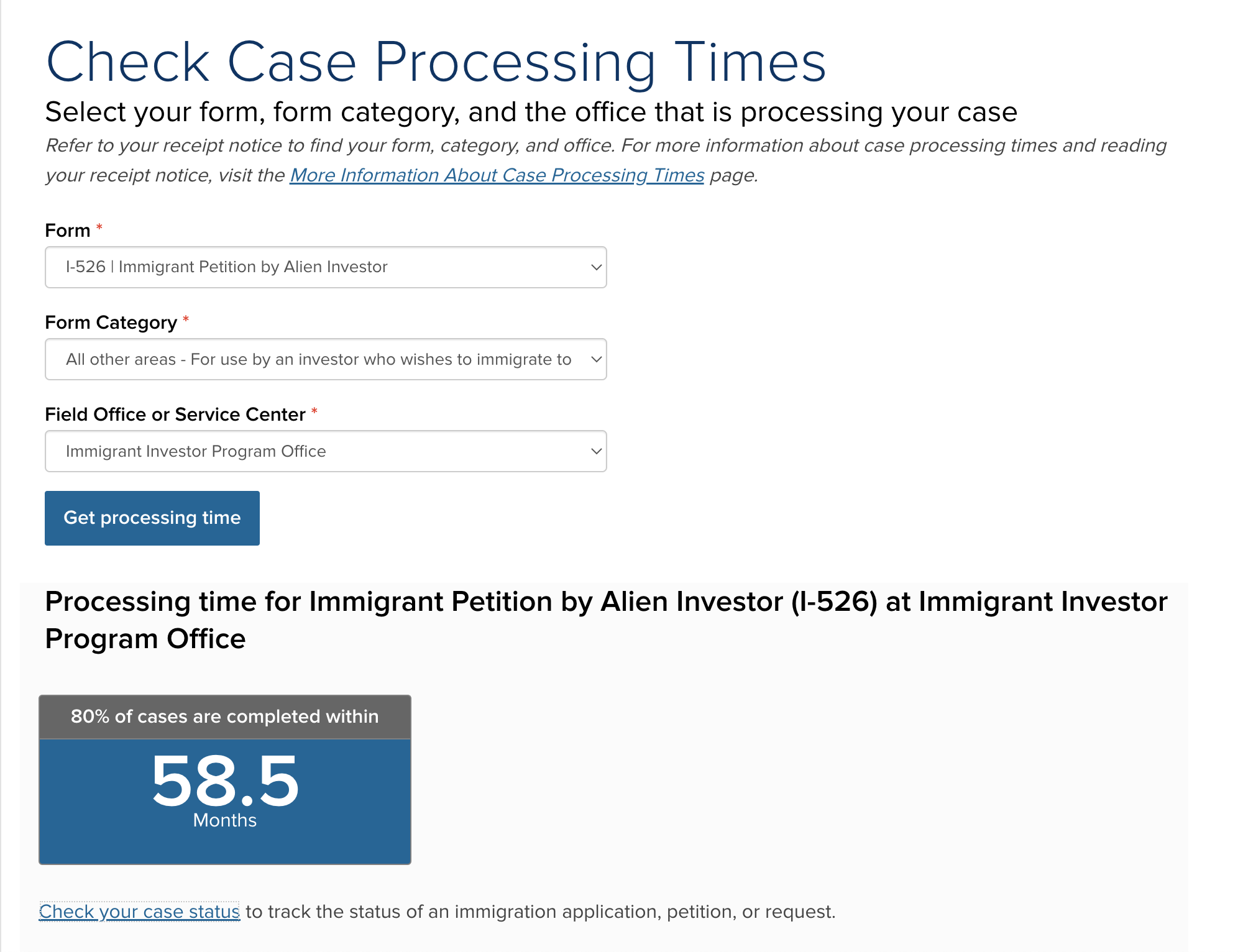

When an investor first searches for current I-526 processing times on the USCIS website, they will come across this number “58.5 months”, current as of January 2023.

This is not the average processing time. This is not the median processing time. This number represents the time it took to process 80% of all I-526 petitions adjudicated in the previous six months.

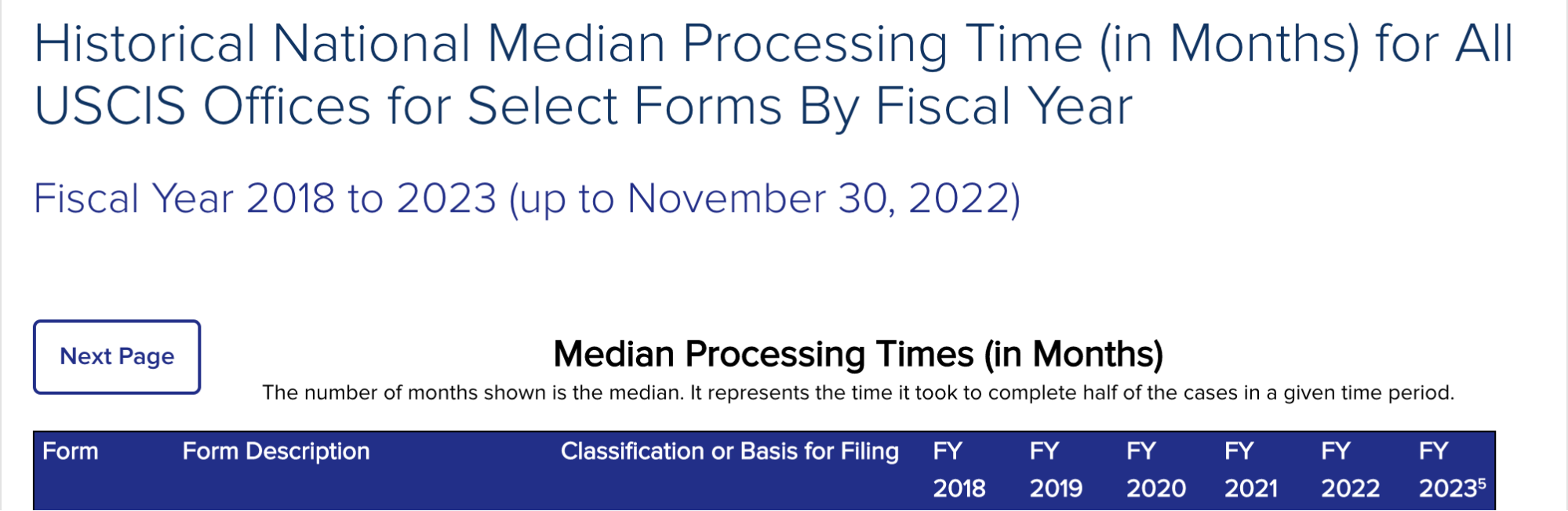

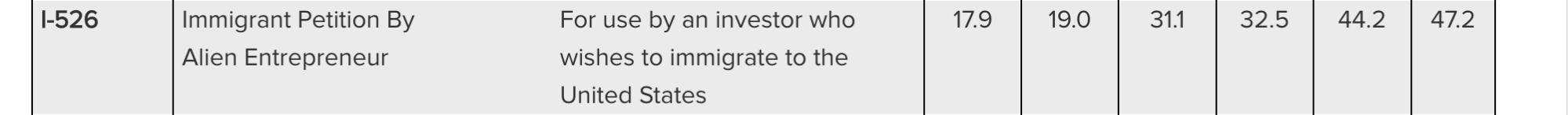

On the USCIS website, the historic I 526 processing time data section shows the median number of months it took USCIS to adjudicate all I-526 petitions. The median means the point by which 50% of the petitions were adjudicated.

As of January 2023, the median number of months it took to process I-526 petitions for FY 2023 was 47.2 months, or just under four years from the date of submission.

This means that half of all I-526 petitions were adjudicated in less than that time. It also means that, for many investors, the I 526 processing time is even significantly shorter than the median number.

When a prospective investor sees 47.2 to 58.5 months listed as the estimated processing times for an I-526 petition, they may lose motivation to make an EB5 investment. But the estimated processing time range is misleading for numerous reasons, the first being that the majority of I-526 petitions are processed outside the range.

Indeed, the lower number indicates the time by which 50% of petitions are adjudicated, while the higher number shows the time by which 80% of petitions are processed. If the estimates are 100% accurate, that leaves only 20% of petitions processed as long as or longer than this time range, with 50% processed sooner than indicated.

Thus, even without changes to the EB-5 program, an investor’s petition has a high chance of being adjudicated far before they might expect. But changes are likely to come to the EB-5 program—changes that could significantly speed up the EB5 investment process and the efficiency of the Immigrant Investor Program Office.

EB-5 Reform in Congress

The COVID-19 pandemic, and the subsequent global and governmental shutdowns, had an outsize impact on EB-5 processing times. The already increasing processing rates for EB-5 petitions skyrocketed due to the months-long consular shutdowns.

The EB-5 Reform and Integrity Act of 2022, passed and signed into law on March 15th, 2022, brings many welcome reforms to the EB-5 program. This bill was a bipartisan partnership, meaning it is an act of Congress that has support from members of both of America’s two major political parties, the Republicans and the Democrats.

The bill seeks to both preserve the legal integrity of the regional center program and reduce processing times back to their pre-pandemic levels. To that end, Congress has allowed concurrent filing of I-526 petitions and I-485 petitions to adjust immigration status. This will reduce the need for an additional form processing wait time—and consular processing—for those foreign nationals already legally residing in the United States under another visa, such as the H-1B.

The bill also asks for an additional fee of $1000 from regional center investors, money which goes to the U.S. Treasury’s sovereign fund to pay the adjudication of EB-5 visas. With more money, more adjudicators can be hired, speeding up processing for all.

Biden’s Proposed USCIS Reform

The EB-5 Reform and Integrity Act isn’t the EB-5 program’s only shot at reform in 2023. The Biden administration has also proposed an overhaul to the U.S. immigration system as a whole.

Inside a Biden-backed bill titled the U.S. Citizenship Act of 2021 were provisions to accelerate processing for all visas, including the EB-5 immigrant visa, as well as various proposals that would result in more visas available to EB-5 investment participants.

For example, the bill endeavored to recapture unused visas and reuse them in the same program the next fiscal year instead of rolling them over to other programs. This could prove crucial for the EB-5 program to retain the thousands of extra visas allocated to it in FY2021.

Another proposal—one that would see spouses and dependent children exempted from employment-based visa quotas—would free up thousands of EB-5 visas annually that would otherwise be claimed by investors’ immediate family members.

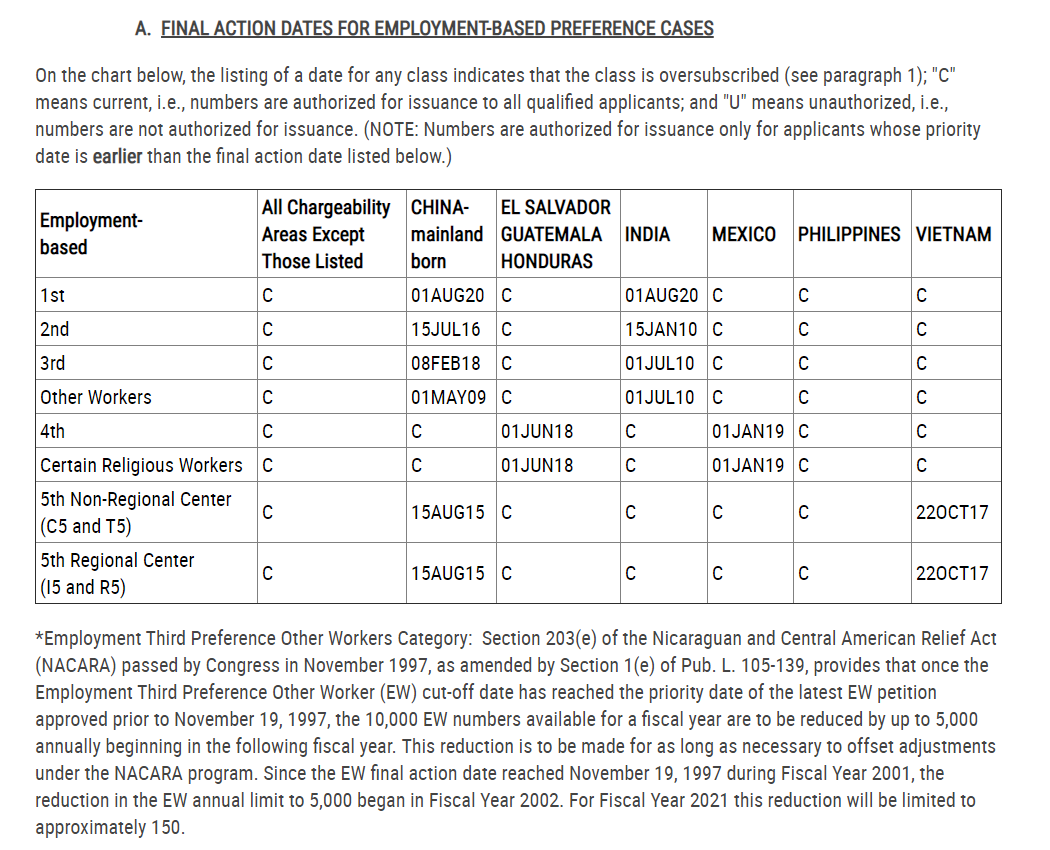

For Chinese investors, who may hesitate to make an EB-5 investment given the massive backlog of Chinese EB-5 petitions, Biden’s proposed USCIS reform offers important changes. One of them is a mandate for USCIS to clear its many lengthy backlogs, which could finally end the years-long wait Chinese EB5 investment participants have been subject to.

A second change is the abolishment of country-based limitations, which would free up countless EB-5 visas for investors from China, Vietnam, and other high-population, high-demand countries.

Beat the Rush: The Best Time to Invest Is Now

Though only one of these bills has so far passed into law, the best time to make an EB-5 investment is before the next one is passed.

Although the U.S. Citizenship Act of 2021 did not pass Congress in its original form, the bill’s very existence points to a greater strategy in both the Biden administration and Congress as a whole, towards reopening and even expanding avenues to legal immigration in the U.S., and reducing processing wait times for all immigrants, including the EB-5 program.

It is clear that, though these additional reforms would not directly reform aspects of the EB-5 program, the changes they would bring would have a massive positive effect on the EB-5 industry was the Biden administration to continue its commitment to reduced processing times.

Considering the massive, wide-reaching, and positive effects these proposed changes would have on the EB-5 industry, enactment of either one (or, better, both) could see a flood of new I-526 applications, and those who beat the rush would clearly be in a preferable position.

The outlook for new EB-5 applicants may look bleak, given the data. But the reality is that the pandemic has been impacting processing times with the EB-5 program, and Congress has now taken steps to fight back.

With a combination of accelerated processing times and a larger supply of EB-5 visas, investors may receive their U.S. permanent residency rights far more quickly than expected.

Start your family’s Green Card journey today by contacting EB5AN at info@eb5an.com or scheduling a free consultation.