Participants in the EB-5 Immigrant Investor Program are often concerned about United States Citizenship and Immigration Services (USCIS) processing times—and for good reason. Their immigration plans, and those of their immediate family members, are effectively on hold until their permanent residency status is confirmed.

Unfortunately, the estimated processing time ranges provided on USCIS’ official government website can be misleading and difficult to understand. The time it takes to process applications can fluctuate depending on factors like the number of applicants and service center productivity. It’s normal to have to wait two to three years between making a qualifying EB-5 investment and receiving conditional permanent residency status.

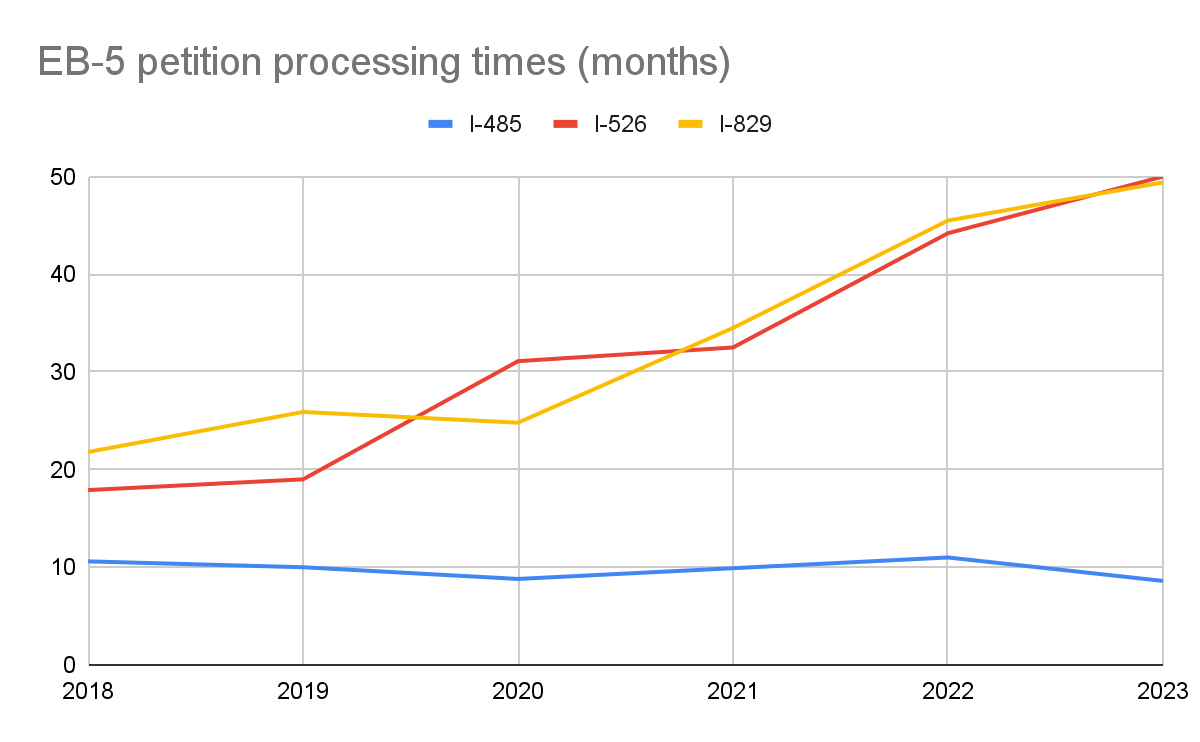

A better way to assess how long you’ll have to wait for your petition to be accepted is by looking at the historical processing data. These provide you with median processing times for each visa form for each year.

This article explains what factors affect form processing times, how USCIS reports processing data, and how to reduce your form processing time.

⚠️ This article is for EB-5 investors

USCIS waiting times apply to all different kinds of visa applications. This article focuses on the EB-5 visa process. However, much of the information is relevant for those applying for other visa types.

What Impacts USCIS Productivity?

How Does USCIS Report Processing Times?

How Fast Is Form I-526E Processed?

What Causes Slow Processing Times?

How to Speed Up Your Form Processing Time

- File Form I-829 at the right time

- Fill all documentation and evidence correctly

- Work with a regional center

- Expedite your petition

USCIS Processing Times: Conclusions

What Impacts USCIS Productivity?

The productivity of USCIS and the Investor Program Office (IPO) tends to fluctuate based on leadership changes. There was a particularly notable decline in 2019 and 2020 under the leadership of Sarah Kendall.

The number of EB-5 petitions submitted by investors and the resources available to USCIS processing centers also impact the organization’s productivity.

Thankfully, EB-5 processing times are beginning to stabilize. This is down to two main factors:

- USCIS is back to full strength after the COVID-19 pandemic and is working through the subsequent backlog.

- The Reform and Integrity Act of 2022 introduced several measures to allow new applications to be processed quickly.

💡 What Is the Reform and Integrity Act of 2022 (RIA)?

The RIA made many changes to the EB-5 Immigrant Investor Program. This law aims to make the program more efficient, transparent, and less vulnerable to fraud.

Some of the processing improvements it introduced include:

⏩ New, more efficient I-526E cycle time methodology: USCIS has said that it will group and process I-526E forms based on the business they invest in. This will make processing cycles more efficient.

⏩ Priority processing for rural targeted employment areas (TEAs): USCIS prioritizes the processing of I-526E forms from petitioners who invest in projects located in a rural TEA. Many have recently obtained Form I-526E approval in as little as 11 months.

⏩ Reserved visas for TEA projects: EB-5 petitioners who invest in a TEA-located project will be entered into a special reserved visa category. This is useful for investors whose countries have a backlog of visa applications, as it effectively allows them to skip the queue.

How Does USCIS Report Processing Times?

USCIS publishes two figures that indicate processing times:

- The time it took to process 80% of applications over the last six months. The latest figure for any visa type can be found on the official government Check Case Processing Times page. This figure isn’t particularly helpful, as most investors will have their petitions processed much faster. However, it ensures investors have realistic expectations of how long their applications may take to process.

- USCIS historical processing times. USCIS publishes historic data on the median processing time over the course of a year for each form type. The median represents the midpoint of processing times, with 50% of applications processed faster and 50% processed slower than the median. The figure for the current year is based on the data collected thus far.

The two figures combined give some indication of how long investors may have to wait. Here’s the latest processing data, as of November 2023:

| Form | Historic median processing time | 80% of all petitions over the last 6 months processed within: |

| I-526: Immigrant Petition By Alien Entrepreneur | 50 months | 55 months |

| I-485: Application to Register Permanent Residence or to Adjust Status (employment-based visa) | 8.6 months | Depends on local USCIS offices |

| I-829: Petition by Investor to Remove Conditions on Permanent Resident Statu | 49.4 | 67 months |

| I-924: Application For Regional Center Designation Under the Immigrant Investor Program | 22.1* | N/A |

*The data for Form I-924 is from 2021. At the time of writing this article, no new data was available.

When reading processing data, it’s worth considering that:

- Around 50% of investors are likely to have their forms processed quicker than the median processing time

- Around 20% are likely to have to wait longer

- Extreme outliers can increase the “time it took to process 80% of applications” figure

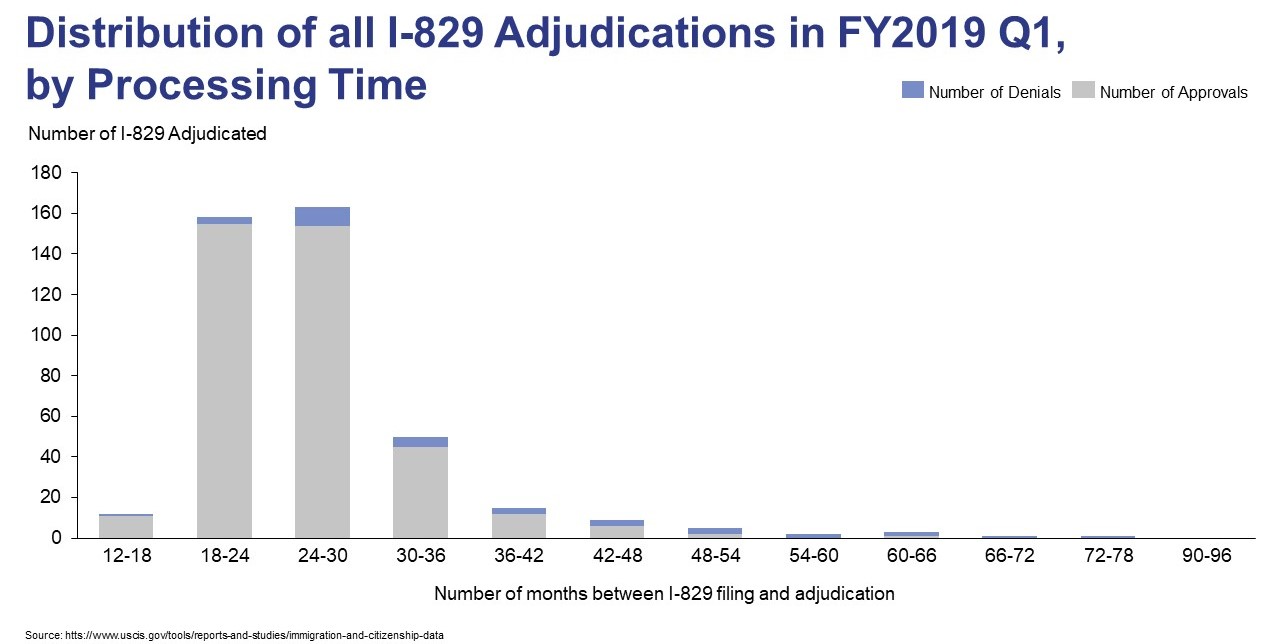

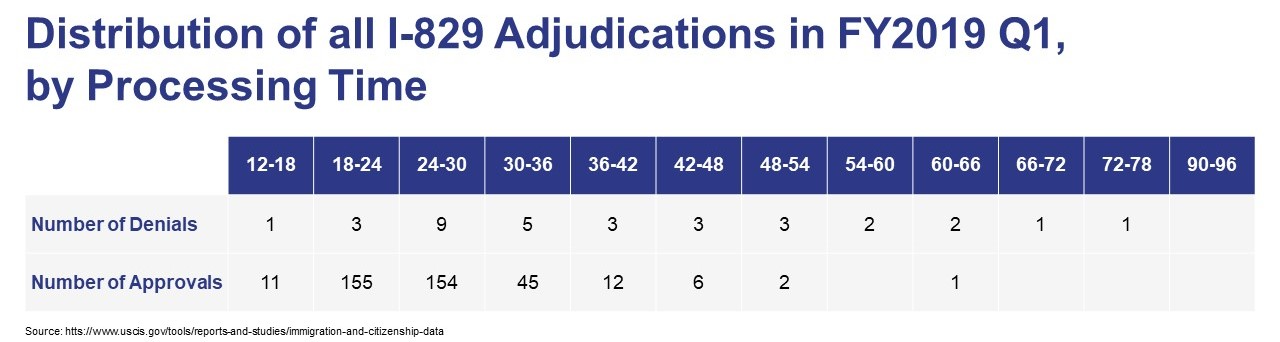

The graph from 2019 below helps to illustrate this. It shows USCIS I-829 processing times for Q1 of that year. According to historical data, the median processing time for 2019 was 25.9 months. However, we can see that a large number of cases were completed in a shorter amount of time.

It also shows that one petition took up to 78 months to process. This is likely to have been a complex case. For example, there may have been questions over whether the applicant posed a national security risk.

I-526 and I-829 processing times are getting longer

Unfortunately, median processing times for Forms I-526 and I-829 have increased in recent years. I-485 normal processing times have remained roughly consistent.

The increase in waiting times for Forms I-526 and I-829 isn’t the result of USCIS not processing petitions quickly. In fact, earlier this year, USCIS reported an 83% increase in processing efficiency for I-526E and I-526. The cause of the problem is more likely that the number of new investors filing an application petition or request increased in the last year.

How Fast Is Form I-526E Processed?

USCIS has yet to release specific data on I-526E processing times. However, we’ve seen I-526E petitions for projects in rural TEAs gaining approval in less than three months. In our experience, most of these petitions take an average of six months.

This suggests that I-526E petitions will be processed quicker than standard I-526 forms. Note that there may still be a processing delay if problems with your application arise.

As mentioned above, investors in rural TEA projects may be able to get I-526E approval in less than 12 months, as they now qualify for priority petition processing under the RIA.

Also, while investors from China and India were previously forced to experience significant delays due to their country’s backlog of EB-5 applications, they can now avoid these delays by investing in a TEA project.

What Causes Slow Processing Times?

Slow processing times could be due to issues with your petition or at USCIS, including:

- High numbers of petitions being submitted, meaning USCIS takes longer to process new applications

- A visa backlog experienced by the investor’s home country

- The investor hasn’t filled in their form correctly

- The investor has broken an immigration regulation or the law

- USCIS discovered evidence that the investor represents a national security concern

How to Speed Up Your Form Processing Time

EB-5 investors have very little control over USCIS processing times. There are, however, things you can do to speed up the process:

File Form I-829 at the right time

Form I-829 should be filed within 90 days before your two-year conditional Green Card expires. If you leave it until after your conditional residency expires, your ability to gain a permanent residency card will be jeopardized. It will also be rejected if you file it more than 90 days before the expiry date.

Fill all documentation and evidence correctly

To get each petition approved, you need to fill it out in full and provide concrete evidence to support it. For example, Form I-829 requires evidence that your investment has created 10 full-time jobs. Gaps in documentation or poor evidence could lead to your form being rejected or slow down its processing time.

Work with a regional center

There are several ways that working with a regional center will help speed up processing time for EB-5 forms. Examples include:

- Exemplar projects: Regional centers can submit exemplar project proposals. Once an exemplar is approved by USCIS, the project section of I-526E forms for applicants investing in that project will automatically be accepted.

- Support with forms: Regional centers work closely with USCIS, therefore, they know what a good petition looks like. They can help investors fill out forms and provide the right evidence.

- Documenting job creation data: Regional centers document job creation data on behalf of their investors.

Expedite your petition

You can ask for some forms to be expedited. However, you need to have a specific, compelling reason. These include:

- Severe financial loss

- Humanitarian or emergency reasons

- A non-profit organization has requested it because it will benefit the United States’ cultural or social interests

- It’s in the interest of the United States government

- Errors made by USCIS

USCIS Processing Times: Conclusions

The EB-5 Immigrant Investor Program is an ideal way for foreign nationals to gain a Green Card by investing in a USCIS-approved project. But long processing times can be a worry—especially when it affects your family’s immigration plans.

Our advice is to assume that your application could be delayed when making your immigration plans. This way, you and your family will have a plan in place if complications arise. Once you gain permanent residency status, you can apply to become a U.S. citizen by submitting an application for naturalization.

For more information on EB-5 processing or to get help filing your petitions, get in touch with EB5AN. We’ve helped hundreds of EB-5 investors to gain permanent residency status in the U.S. Book a free consultation and discover how we can do the same for you.