In the past, there was much confusion and controversy about whether unsecured loans can be used to fund investments for the EB-5 Immigrant Investor Program. Unlike a secured loan, an unsecured loan is one that is not backed by any specific collateral. Instead, lenders approve these loans based on the principal borrower’s creditworthiness, income, debt-to-income ratio, and other factors.

In the context of the EB-5 visa program, a foreign national’s EB-5 investment can have a wide variety of source of funds (SOF). For example, funds from an investor’s paycheck wages or personal savings, proceeds from stock or property sales, an inheritance, or a gift are all legal sources of funds. If using a loan, best practices generally advise that investors use a secured loan, often with property or some other personal assets owned by the investor to be used as collateral. But historically, the United States Citizenship and Immigration Services (USCIS) did not have clear instructions for how to structure a loan for the EB-5 program. As a result, some investors attempted to use unsecured loans, taking money from a third party to make their EB-5 investment.

However, in 2015, USCIS decided that funds derived from unsecured loans were considered “indebtedness,” not cash. As a result, USCIS began denying the I-526/I-526E petitions of many EB-5 investors. This led to the landmark ruling in Zhang v. USCIS that helped clarify the uncertainty surrounding the question of unsecured loans, eventually leading to the conclusion that unsecured loans are permissible for EB-5 investments, but only if certain criteria are met.

This article will explain how financing for EB-5 visa projects typically works, the history of using secured loans and unsecured loans for EB-5 investments, and the outlook for investors who may be considering using a loan to finance an EB-5 investment.

How Funding for EB-5 Visa Projects Works

Using Unsecured Loans to Fund EB-5 Projects Before and After Zhang v. USCIS

The Outlook for EB-5 Investors

Start the Process of Obtaining a U.S. Green Card With EB5AN

How Funding for EB-5 Visa Projects Works

The EB-5 visa program stimulates economic growth and creates jobs in the United States by luring foreign investment in exchange for U.S. Green Cards for investors and their family members. Investors, along with their spouse and unmarried children, are able to live and work in the United States throughout the application process. During that time, they first obtain conditional permanent resident status—also known as a conditional Green Card—and are eligible to apply for permanent resident status—also known as a U.S. Green Card—after two years.

EB-5 program applicants must invest at least $800,000 in a new commercial enterprise (NCE) or in a troubled business that they will restructure or expand. Since the EB-5 Reform and Integrity Act (RIA) was passed in 2022, the minimum investment threshold for projects located in targeted employment areas (TEAs) has been $800,000, while the threshold for other projects is $1,050,000. A TEA is roughly defined as:

- An area with a population of fewer than 20,000 people; or

- An unemployment rate of at least 150% of the national average.

EB-5 investors can choose to make their EB-5 investment either directly or, like the vast majority of EB-5 program applicants, through a regional center. Unlike with a direct investment where the individual invests capital directly into an NCE, regional centers are organizations set up to combine funds from several EB-5 investors and manage the allocation of that capital on their behalf.

One of the first steps in the EB-5 visa process is submitting Form I-526 or I-526E (regional center investors submit Form I-526E). Form I-526E demonstrates investors’ eligibility for the EB-5 program, and includes supporting documentation about the individual’s identity, their selected EB-5 project, and their source of funds (SOF).

In order to demonstrate that an EB-5 investor’s source of funds were lawfully obtained, they may need to submit a considerable amount of documentation to USCIS, including bank statements, invoices, sales receipts, securities agreements, purchase contracts, property documents, mortgage agreements, promissory notes, and more. Compiling all of the necessary documentation to prove legal source of funds for the EB-5 program can be complex, so it is highly recommended that EB-5 investors hire an experienced immigration attorney and EB-5 program experts to ensure accuracy and completeness.

Using Unsecured Loans to Fund EB-5 Projects Before and After Zhang v. USCIS

Historically, EB-5 investors have had to clearly demonstrate that their investment funds were secured through lawful means. Whether or not USCIS accepted unsecured loans from EB-5 investors was generally a case-by-case matter, as some of these loans were accepted if the investor could show a credible plan for how they would repay the loan.

The Zhang v. USCIS case involved EB-5 investors Huashan Zhang and Masayuki Hagiwara, who borrowed money from their own businesses to invest in an NCE. At a 2015 USCIS stakeholder meeting, it was determined that cash resulting from a third-party loan—like a loan from one’s business—was in fact “indebtedness,” which would require collateral. As a result, the investors’ EB-5 applications were denied.

After a District Court ruling, the U.S. Court of Appeals for the District of Columbia determined that USCIS’s demands for collateral on such loans should not have been imposed, ruling that cash derived from such a loan was to be considered a viable source of EB-5 investment capital.

As a result, the Zhang court case finally helped clarify the USCIS policy on unsecured loans. This clearly shifted the burden of proof to the EB-5 investor, but also provided clearer criteria for evaluating whether unsecured loans would be accepted as a lawful source of funds for an EB-5 capital investment. Some practical considerations investors should address include:

Providing Clear Documentation

The EB-5 investor must provide clear and comprehensive documentation to demonstrate the lawful source of the loan and the terms of the loan agreement.

Demonstrating the Ability to Repay

The investor must provide a clear plan for repaying the loan, considering several factors like the investor’s income, personal assets, and creditworthiness.

Demonstrating Lawful Source of Funds

The investor also must prove that the funds for the loan were obtained through lawful means and were not derived from any illegal activities.

Proving That the Investment Is “At Risk”

The investor must prove that the loan cannot be guaranteed by the assets of the NCE or the EB-5 investment project. Rather, the investor must bear the risk of repayment.

Proving That the Loan Was Obtained From an Independent Third Party

The EB-5 investor must prove that the loan was obtained from an independent third party, rather than from the NCE or any other affiliated party.

The Outlook for EB-5 Investors

Ultimately, the Zhang v. USCIS decision established stricter requirements for the acceptance of unsecured loans for the EB-5 program, but also clearer guidelines. By emphasizing the importance of providing thorough documentation, demonstrating the investor’s repayment ability, and proving the lawful source of investment funds, the decision actually provided much-needed clarity for both investors and adjudicators. By standardizing the process of evaluating loans across all EB-5 visa applications, the Zhang decision made it easier for investors to navigate the process.

Still, it is important for prospective EB-5 investors to remain cautious when considering this type of loan for their source of funds. Investors should always consult with experienced EB-5 program experts and immigration attorneys before submitting their Form I-526E with an unsecured loan.

Start the Process of Obtaining a U.S. Green Card with EB5AN

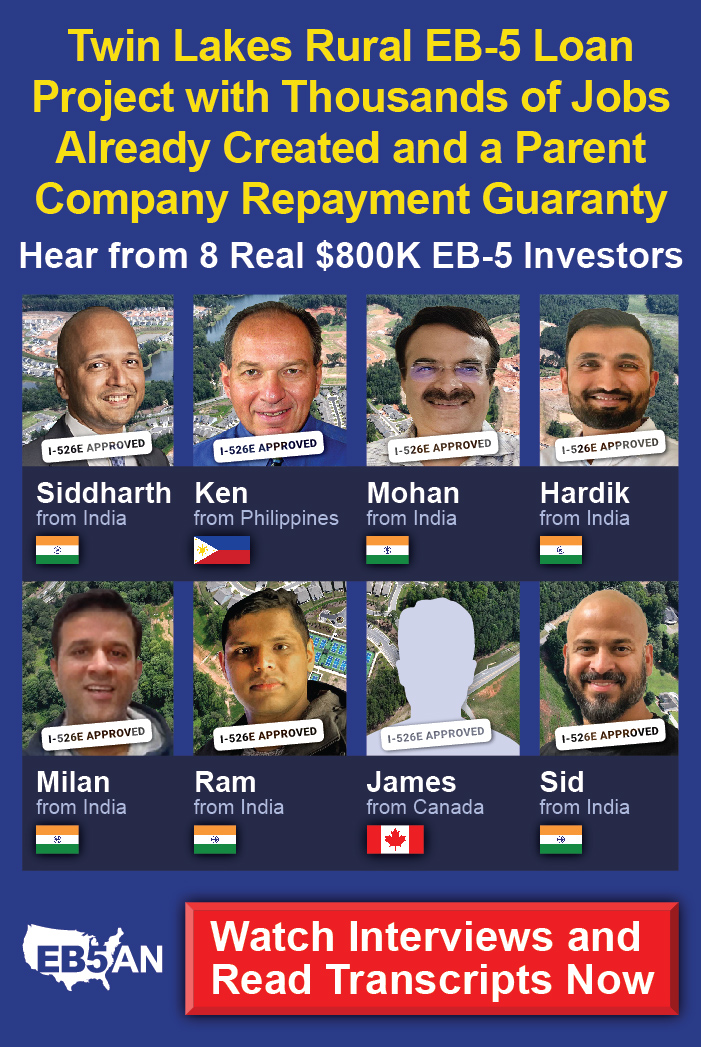

Whether you’re considering using an unsecured loan to finance your EB-5 investment or not, EB5AN has the experience and expertise to help navigate every step of the EB-5 visa application process.

EB5AN has helped more than 2,300 families from 60 countries obtain U.S. Green Cards. Our expert team has more than a decade of experience, and offers clients first-rate, low-risk EB-5 regional center projects with 100% USCIS project approval rate to date.

To begin your family’s journey toward becoming U.S. Green Card holders, schedule a free meeting with EB5AN today.