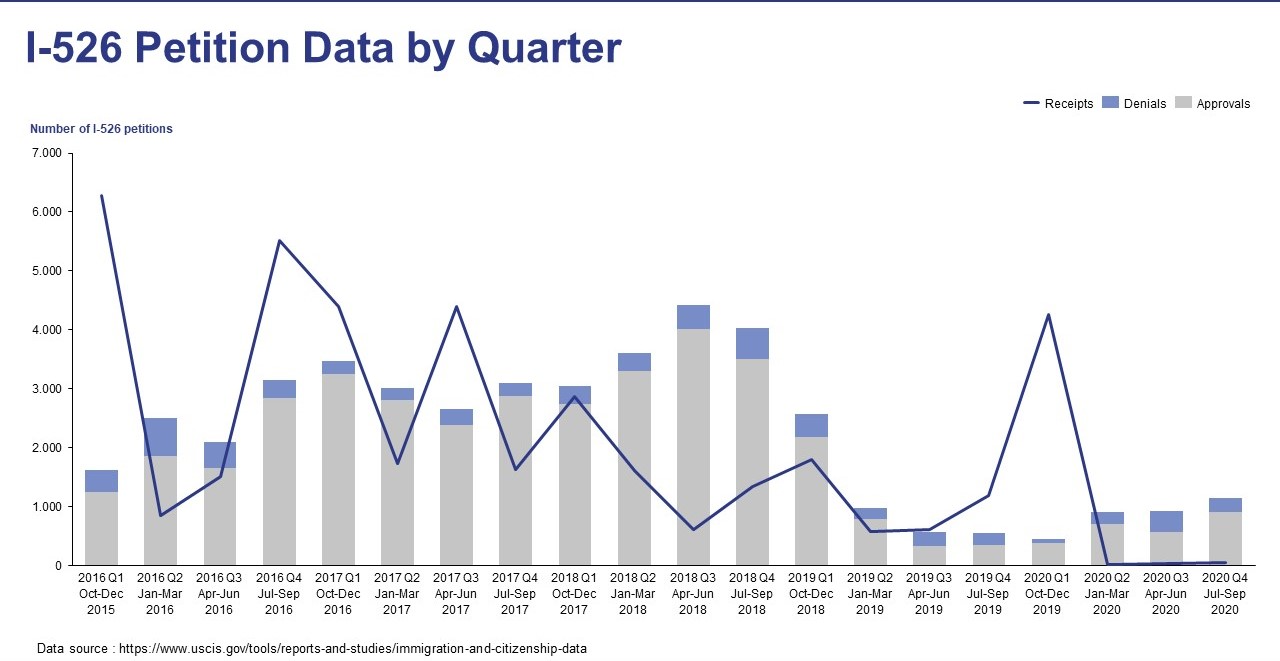

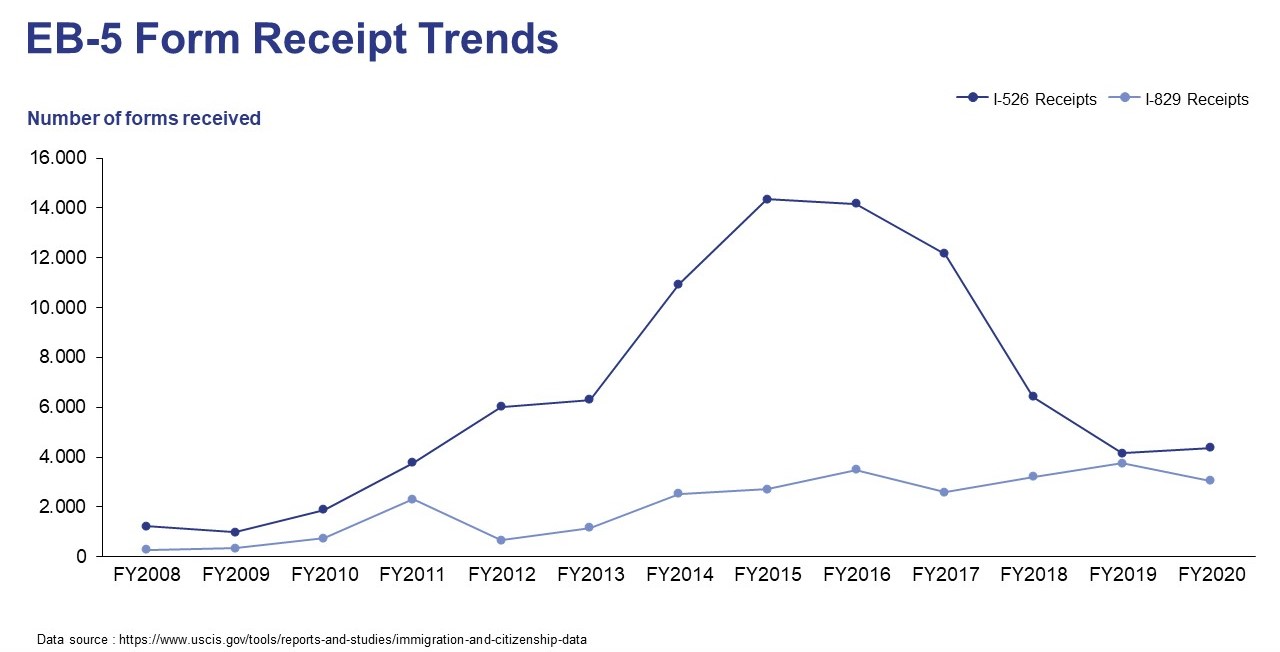

The EB-5 Immigrant Investor Program has remained a favorite U.S. immigration program among foreign investors since its inception in 1990, promising U.S. green cards for a qualifying investor and their immediate family members upon the completion of a successful EB-5 investment that creates at least 10 new jobs for U.S. workers. With EB-5 demand particularly surging in China, Vietnam, and India, it is the program’s popularity itself that presents complications, since only a limited number of U.S. green cards are allotted to the program annually.

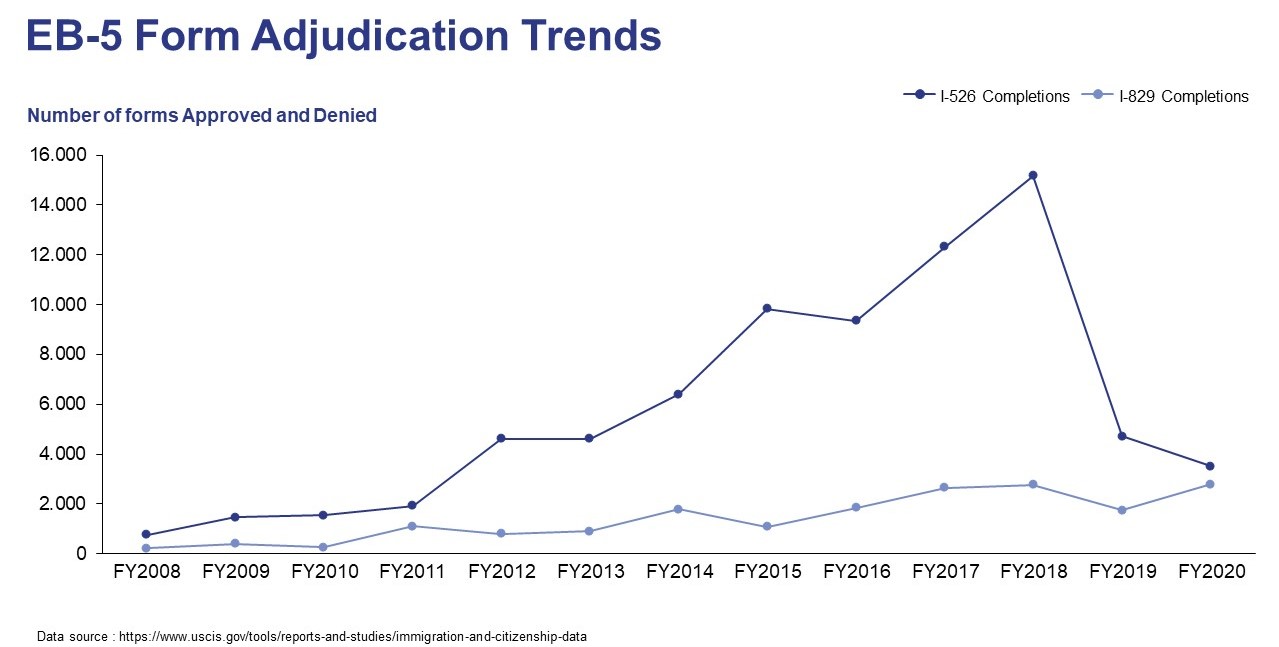

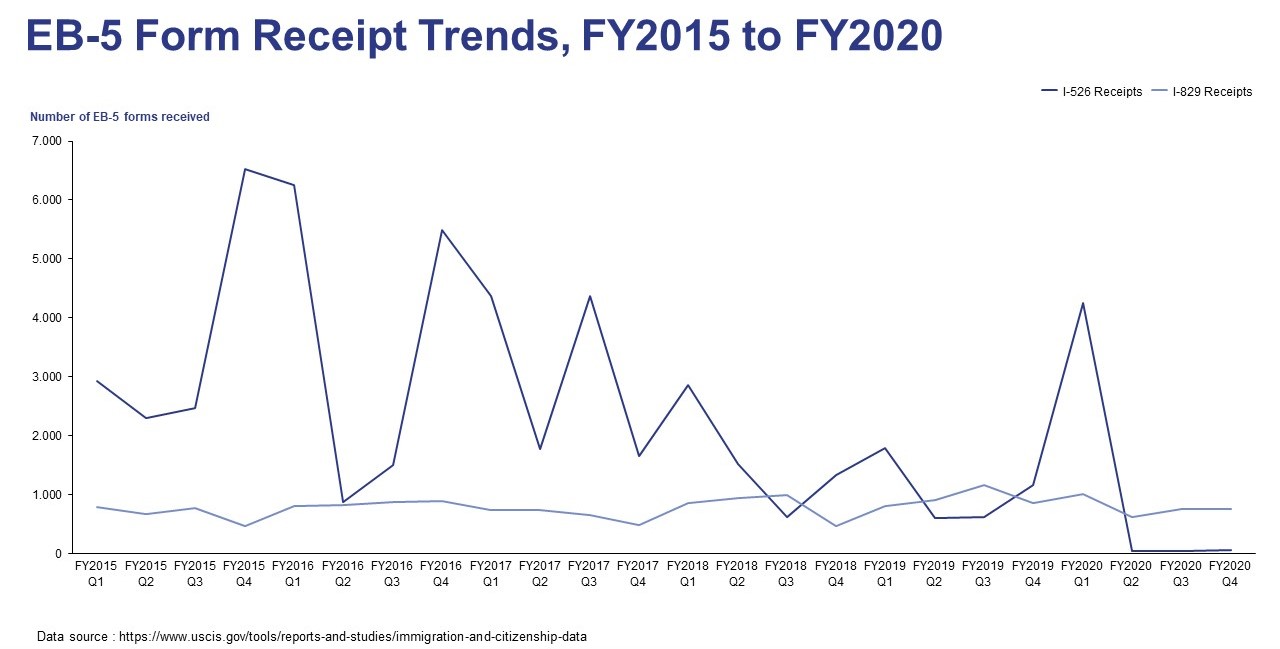

To partake in the EB-5 program, an investor must inject the minimum required EB-5 investment amount in their selected new commercial enterprise (NCE), which, in turn, consolidates the EB5 investment funds from all participating investors and funnels it into a job-creating entity (JCE), usually for a term of five years. Until 2014, this arrangement worked smoothly, with EB-5 investors fulfilling EB-5 requirements and exiting the investment by the end of the five years. However, newfound popularity in 2014 led to skyrocketing EB-5 demand that the relatively low annual supply of EB-5 visas wasn’t equipped for. The result was massive backlogs in countries such as China, Vietnam, and India, with China and Vietnam still backlogged as of December 2020. With backlogs elongating processing times, it wasn’t long until the five-year investment term was insufficient for some EB-5 investors to satisfy the program requirements.

Since one of the key EB-5 program requirements is that EB-5 investment funds remain at risk throughout the full investment period, EB-5 investors who have failed to meet EB-5 requirements by the end of five years have no choice but to redeploy their EB5 investment capital. Failure to redeploy would constitute a violation of EB-5 requirements, as the investor’s capital would no longer be at risk.

EB-5 redeployment is further complicated by legal requirements governed by the U.S. Securities and Exchange Commission (SEC), which serves to protect domestic and foreign investors alike in U.S.-based securities offerings. When the Investment Companies Act of 1940 and the July 2020 Policy Alert from United States Citizenship and Immigration Services (USCIS) are added to the mix, it’s clear that NCEs have a number of legal hurdles to navigate in executing EB-5 redeployments.

Problems with Investor Advisers

The Advisers Act rules that a general partner or managing member of the NCE may act as a “private fund adviser,” in which their reporting obligations differ somewhat from those of other fund advisers. Private fund advisers are permitted in EB-5 redeployments, but the level of regulation depends on whether the adviser is offering advice to the entire body of limited partners based on the objectives of the NCE or to individual EB-5 investors based on their individual goals.

The SEC has stated it will not take action if a private fund adviser offers advice to the NCE’s limited partnership, as they will be seen as furthering the objectives of the NCE and not the investors. A private fund adviser may also inquire as to whether a limited partner would prefer distributions to be paid out in cash or in kind, but they would be prohibited from offering advice or otherwise attempting to sway the limited partner’s decision in either direction. Were the private fund adviser to take such action, they would be subject to additional SEC regulation.

Exemptions under the Investment Companies Act of 1940

In most NCEs, the majority of assets comprise of a promissory note representing the deployment of EB-5 investment capital to the JCE, which classifies most NCEs as investment companies under the Investment Companies Act of 1940. To participate in the EB-5 program, most NCEs must thus fall into one of two key exemption categories within the act: Section 3(c)(1) or Section 3(c)(5)(C). Section 3(c)(1) stipulates that a securities issuer will not be considered an investment company if it has fewer than 101 investors and does not offer its securities publicly, while Section 3(c)(5)(C) exempts securities issuers whose promissory note is secured by qualifying real estate assets.

Under which section an NCE’s exemption is granted is irrelevant, but what is important is that the exemption still stands at the time of redeployment. Since the NCE’s circumstances may change with time, when it wishes to redeploy EB5 investment funds, it must determine whether it still satisfies the requirements of its exemption. If not, it must determine whether another Investment Companies Act exemption could apply.

USCIS’s Policy Alert

USCIS cannot override the regulations of the SEC or the Investment Companies Act of 1940, so no matter what, NCEs and investors must adhere their rules. USCIS regulations come next, and in July 2020, USCIS released a new Policy Alert on EB-5 redeployments.

According to the Policy Alert, any redeployment must be through the same NCE for the purposes of furthering the NCE’s objectives. If the investor is working with an EB-5 regional center, their redeployment must additionally be through the same regional center. However, the JCE need not be the same, and the commercial activity and location of the project are also permitted to differ. EB-5 investment capital initially deployed in a targeted employment area (TEA) may even be redeployed in a new area that does not qualify for TEA status.