In 2021, the EB-5 Immigrant Investor Program community has been abuzz with the very real possibility of EB-5 Regional Center Program suspension after June 30, 2021. Traditionally, the regional center program has been reauthorized in conjunction with a broader government spending bill that was guaranteed to be passed. But when Congress reauthorized the program in December 2020, it separated the regional center program from this spending bill, forcing the program to fight on its own for reauthorization. And with all the problems that have been plaguing the EB-5 program in the late 2010s, reauthorization without significant reform is unlikely.

EB-5 investment stakeholders have largely rallied behind the EB-5 Reform and Integrity Act, proposed by bipartisan senatorial duo Chuck Grassley and Patrick Leahy, but some have held out for a more favorable alternative. However, as we careen ever closer to the sunset date of June 30, 2021, there is little room to air complaints about the specifics of the bill. Even though temporary suspension is much more likely than definitive termination should the regional center fail to gain reauthorization, suspension would cause major disruptions to EB-5 investments, the individuals relying on them for a brighter future, and the developers across the United States depending on EB-5 capital to build projects and create jobs. Suspension should be avoided at all costs, even if that means embracing less-than-ideal legislation.

On November 5, 2019, a previous EB-5 reform bill, entitled Immigrant Investor Program Reform Act, was introduced to the Senate by Lindsey Graham, John Cornyn, and Chuck Schumer. A quick comparison of the two proposed acts can offer some insight into what potential future EB-5 reform bills may look like.

Judicial Reviews

In the 2010s, United States Citizenship and Immigration Services (USCIS) has come under fire for various mismanagement practices, including retroactive policy changes and I-526 petition denials based on unreasonable interpretations. Those who make EB-5 investments are not the type to be walked over and have exercised their right to litigation—and quite often, the courts side with the investors. In late 2020, for example, the U.S. Court of Appeals reiterated a ruling from district court that unsecured loans should be an acceptable source of EB5 investment funds, contrary to USCIS’s newly adopted policy of rejecting unsecured loans.

Likely due to USCIS’s appeals to the government, both EB-5 reform bills mandate that EB-5 investors exhaust a list of bureaucratic pathways before suing USCIS over a petition denial or regional center termination. The only winner here is USCIS—certainly not EB-5 investment stakeholders.

Reauthorization

Given the precarious situation of the EB-5 Regional Center Program in the first half of 2021, reauthorization is a key issue on everyone’s mind. Again, both bills are identical in their proposal for a five-year extension to the regional center program’s validity. While a five-year reauthorization is certainly a good thing, most EB5 investments take longer than five years, particularly in light of USCIS’s recent processing times. If the regional center program is extended for five years, it won’t be long until the community needs to push for further renewal.

Fees

Administrative fees are a necessary evil, and considering that USCIS just barely skirted a massive furlough of 70% of its workforce in the middle of 2020, the agency is clearly hurting for cash. Higher fees are likely one of USCIS’s top demands from Congress, and indeed, both bills delivered, promising higher fees for investors and regional centers alike. Under both bills, investors must include a $1000 “Petition Fee” or “Integrity Fund Fee” with their I-526 petition, and regional centers must pay an annual fee of $20,000, reduced to $10,000 if they are registered as a nonprofit or managed fewer than 21 investors in the applicable year. Any regional center found to not be compliant with EB-5 regulations could additionally expect fines to the tune of 10% of the total EB-5 investment capital under the center’s control.

But the Immigrant Investor Program Reform Act doesn’t stop there. In addition to the above fees, this bill further requires EB-5 investors to pay a whopping $50,000 fee, called the “Program Improvement Fee,” when they file their I-526 petition. Regional center hopefuls filing an I-924 petition would additionally have the option to pay $50,000 for “premium processing,” effectively selling quick processing times.

Visa Backlogs

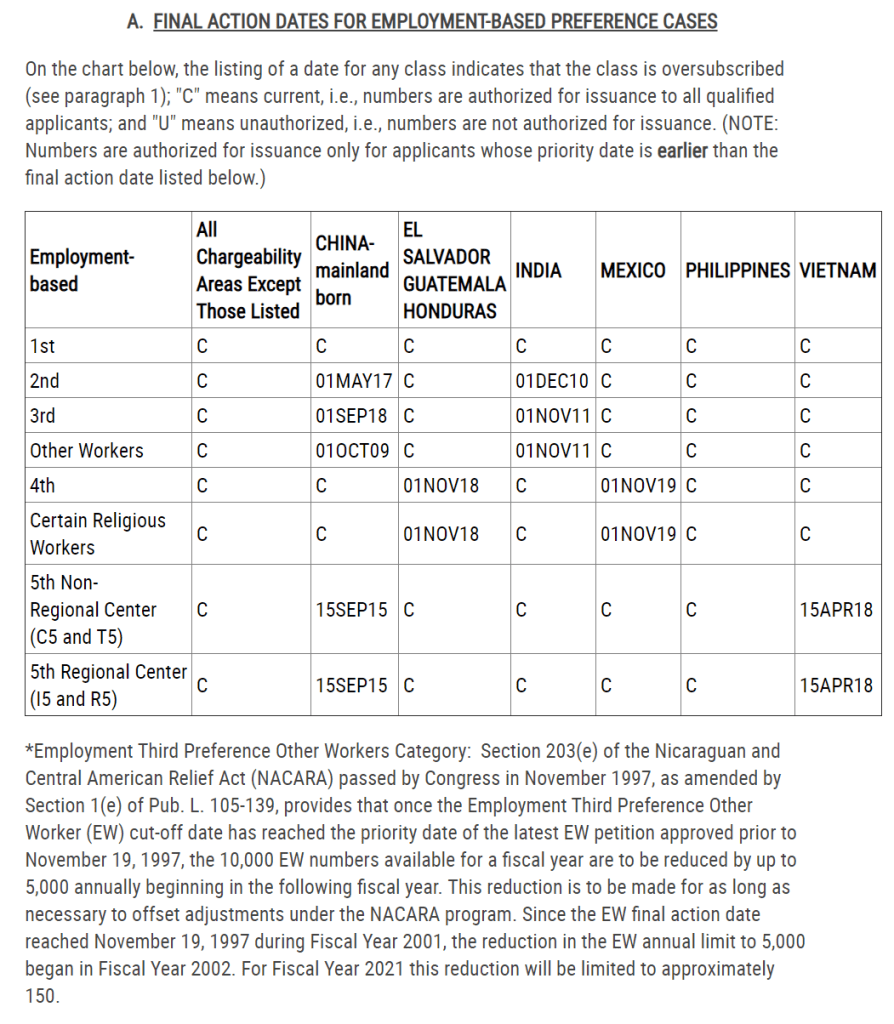

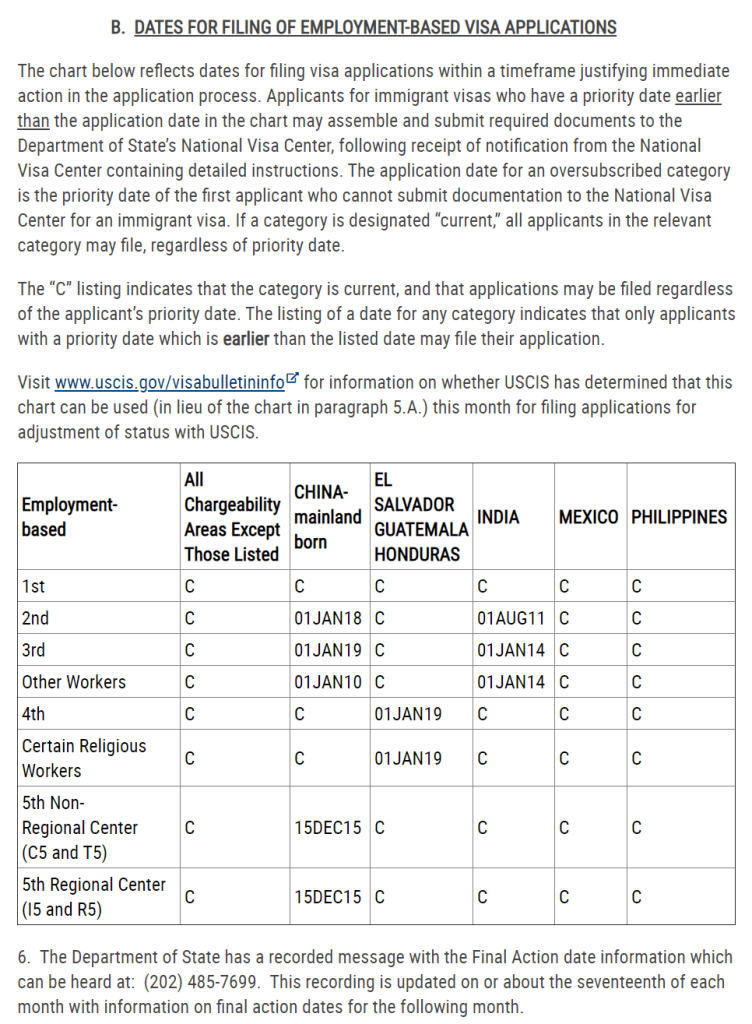

Out of all the problems that the EB-5 program has experienced in the late 2010s, visa backlogs are among the worst for EB5 investment participants. Country caps on visa allocation have resulted in petitioners from high-demand countries—notably China and Vietnam—being subject to long waits, as their EB-5 demand has exceeded their country limit. Both bills deal lightly with the issue of visa backlogs, although the solutions are likely insufficient to address the woes of the EB-5 investment program.

The EB-5 Reform and Integrity Act has laid out “reasonable processing times” for different EB-5 petitions and proposes to give USCIS one year to conduct a feasibility study to determine the fees necessary to process EB-5 petitions within these timelines. This strategy would see I-526 petitions processed within eight months at the latest, but it fails to address country limits on visas. Another upside of this bill is the protections it offers to good-faith investors who find themselves wrapped up in fraud, significant material changes, regional center termination, and other major complications. Such investors would be given six months to strike an agreement with another regional center and invest whatever additional capital is necessary to create their obligatory 10 jobs.

The Immigrant Investor Program Reform Act takes a different approach, setting aside 30% of visas for applicants making EB-5 investments in newly defined targeted employment areas (TEAs). This is clearly favorable for new investors, offering them a faster path to a permanent life in the United States and developers faster access to their EB5 investment capital. The victims are existing EB-5 investors—the ones who have already been waiting years for their future in the United States. Even the developers of the projects in which they have invested would benefit, given the additional time they could deploy their EB-5 investment capital. The bill’s provision for these investors is “parole,” which can allow foreign nationals entry and residency in the United States before they are officially admittable. However, parole is remarkably difficult to obtain and may thus be a nonsolution.

One positive of the Immigrant Investor Program Reform Act, however, is strong protections for aging children. Under current EB-5 policy, children’s ages are frozen only while the I-526 petition is pending, putting families with approved I-526 petitions awaiting visa availability at risk of their children aging out of eligibility for an EB-5 green card. The Immigrant Investor Program Reform Act would guarantee green card eligibility for any dependent considered a child at the time the I-526 petition is filed, effectively eliminating the risk of aging out.

Investment Amounts and TEA Designations

The EB-5 investment community is still reeling from the enactment of the Modernization Rule in November 2019, which increased the minimum required EB5 investment amount by 80% and restricted TEA designations. Following this massive hike, EB-5 demand dropped significantly, and further increases would only serve to further restrict access to the EB-5 program.

The EB-5 Reform and Integrity Act offers no amendments to the Modernization Rule’s changes. The Immigrant Investor Program Reform Act does—and quite substantially. First, it would significantly decrease the difference between the TEA and non-TEA investment amounts, placing the TEA investment amount at $1 million and the non-TEA amount at $1.1 million. The bill also proposes redefining TEAs as Opportunity Zones rather than high-unemployment areas. Whether this change would be beneficial to a particular area would depend, and given that unemployment rates can change, an area that benefits one year may not the next. A case in point is New York City, which in 2019 would have benefited from the proposed change but now, in 2021, after the devastation of the COVID-19 pandemic, benefits more from the current high-unemployment TEA definition.

Overall

Which EB-5 investment program reform bill is superior is up to each individual to decide. What’s important to note is that the alternative Immigrant Investor Program Reform Act is generally not substantially different from the EB-5 Reform and Integrity Act, and both have myriad flaws. Embracing the EB-5 Reform and Integrity Act as an important pathway to EB-5 reauthorization doesn’t mean the EB5 investment community has to stop pushing for reform and change later—but for now, the best solution would be to focus on the pertinent and looming issue of EB-5 Regional Center Program expiration, and the EB-5 Reform and Integrity Act is the only realistic solution.