Worldwide, people dream of a life in the United States. From Hollywood to McDonald’s, U.S. culture has permeated nearly every corner of the world, and the wealth and freedom in the United States are well known across the globe. The United States welcomes millions of visitors every year, but for many, their right to stay in the United States is only temporary.

For foreign investors with the necessary means, the EB-5 Immigrant Investment Program can make their dreams of a permanent life in the United States a reality. The program was established in 1990 to attract foreign investors to help foster local economies and create new jobs. In return for his or her EB-5 immigrant investment, the foreign investor—and his or her spouse and eligible children—receives a U.S. green card.

EB-5 Program Requirements

The new commercial enterprise (NCE) receiving the EB-5 immigrant investment must be a for-profit entity engaged in ongoing lawful business activity. The NCE can be structured as a corporation, limited liability company, partnership, joint venture, or any number of additional business structures, but it must have been established after 1990, when the EB-5 program was first enacted.

To obtain a U.S. green card, EB-5 investors must provide evidence that their capital has funded the creation of at least 10 new full-time jobs. The exact specifications can vary depending on the type of investment the investor has made. EB-5 investors must also demonstrate that they obtained their investment capital from lawful sources.

Targeted Employment Areas

How much must an EB-5 immigrant investment be? The minimum required investment amount depends on the targeted employment area (TEA) designation of the chosen EB-5 project. TEA projects are those located in an urban area with a higher-than-average unemployment rate or a rural area with fewer than 20,000 inhabitants. EB-5 investors who invest in a TEA project have to transfer at least $900,000, while investors working with EB-5 projects without TEA designation must invest at least $1.8 million.

Regional Center Investment

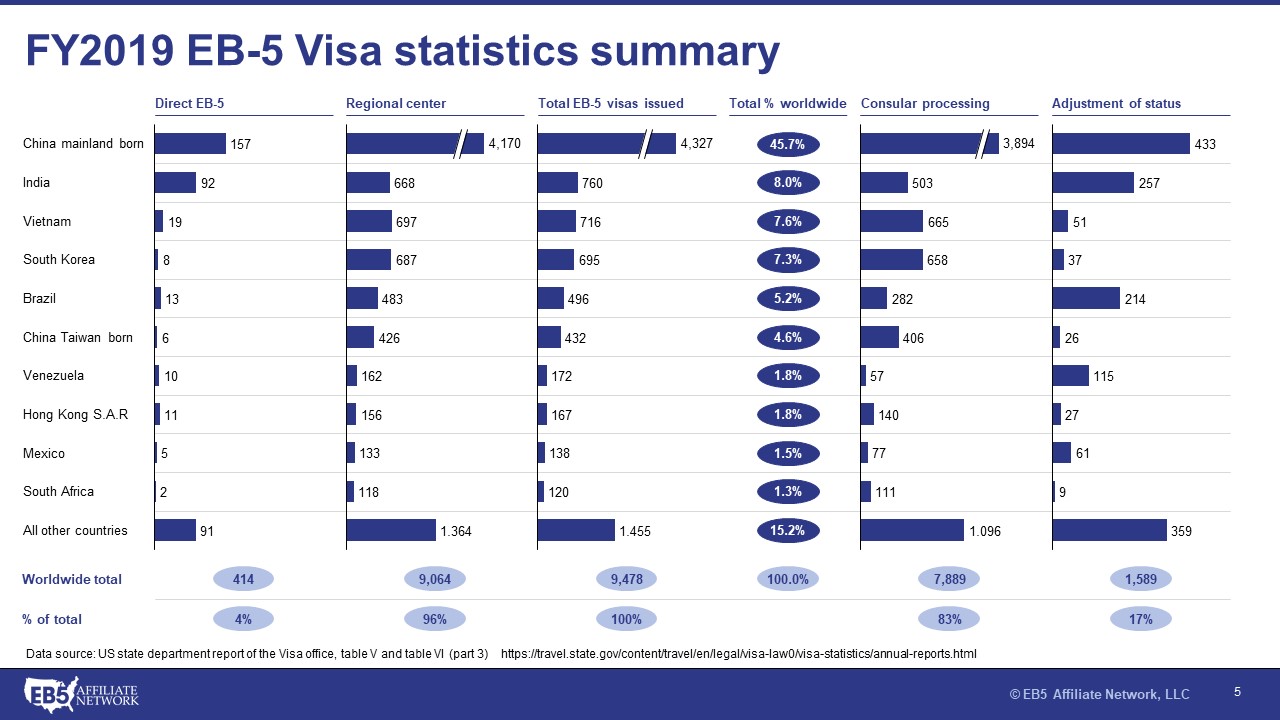

There are two different pathways a foreign investor can choose to make an EB-5 immigrant investment. The first is direct investment, wherein the investor works with the project developer directly, participating heavily in managerial activities in the NCE. In the case of direct investment, EB-5 investors must prove that their investment has created at least 10 direct jobs (i.e., construction jobs or jobs on the NCE’s payroll).

The second EB-5 investment path is regional center investment. The majority of EB-5 investors choose to work with regional centers because the regional centers carefully hand-pick high-quality EB-5 projects with low financial and immigration risk. Additionally, EB-5 regional center investors are not required to dedicate significant amounts of time to managing the NCE.

EB-5 immigration investment through a regional center offers one more important benefit: relaxed criteria for the job creation requirement. In addition to direct jobs, EB-5 investors working through regional centers may also count indirect and induced jobs toward the 10-job minimum. Indirect jobs are defined as those filled by external individuals and companies providing supplies and services to the NCE, while induced jobs are those created in the local community as the NCE’s employees spend their wages. To include such jobs on his or her EB-5 application, an investor must hire an economist to calculate the job creation using accepted methodologies.

I-526 and I-829 Petitions

An investor’s EB-5 application officially begins when he or she files an I-526 petition to United States Citizenship and Immigration Services following the transfer of the required EB-5 immigrant investment capital to the designated account (usually an escrow account). Upon approval of the I-526 petition—which typically takes around two years—the investor is eligible to apply for a U.S. visa, as long as there is one available.

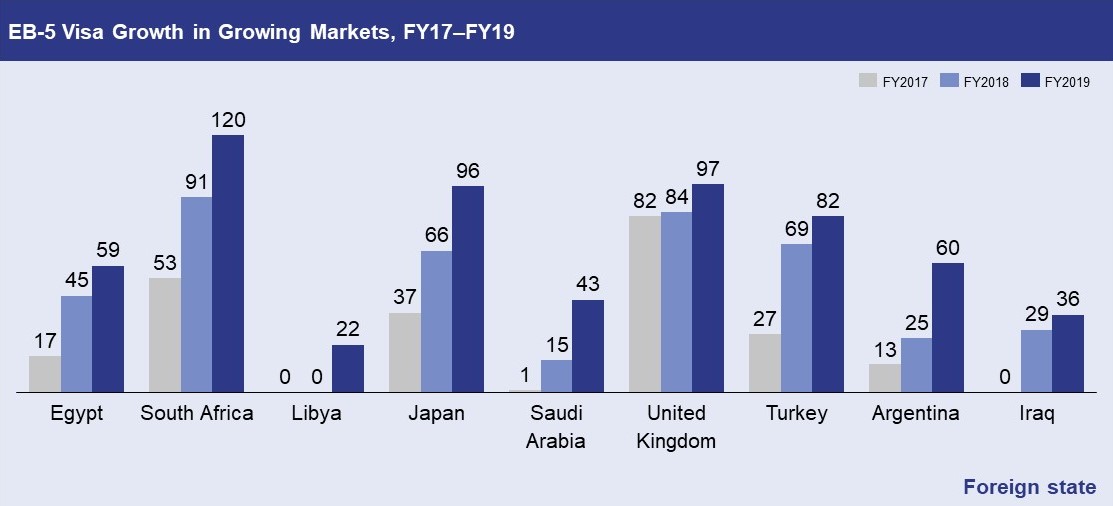

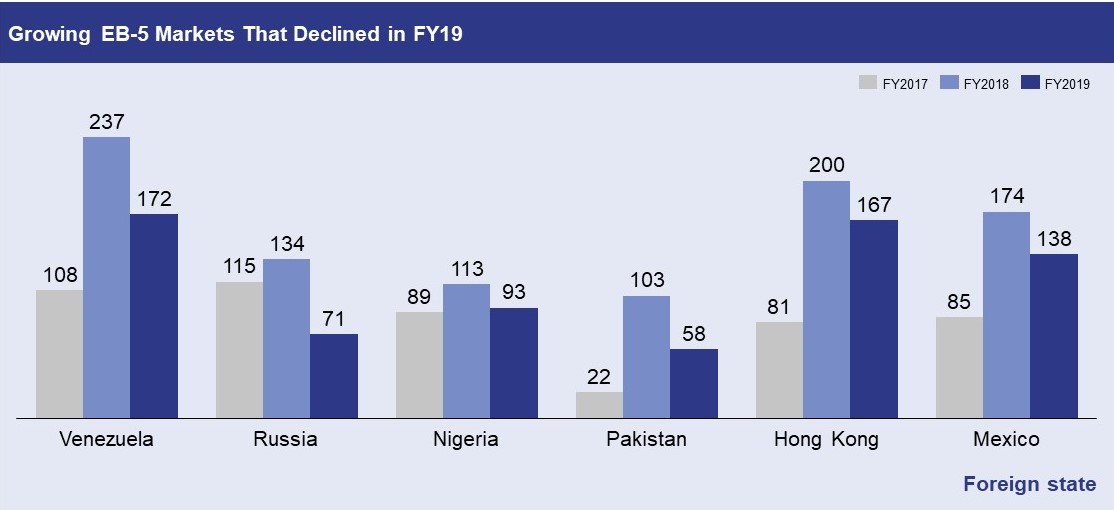

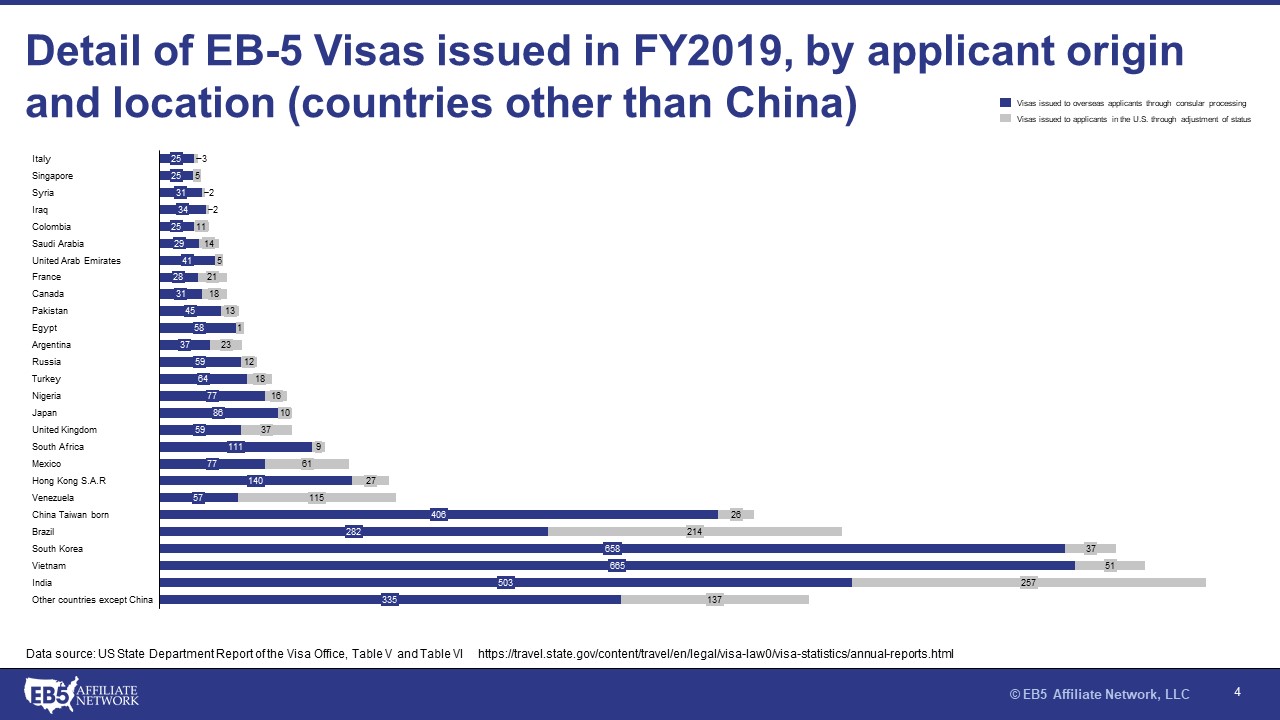

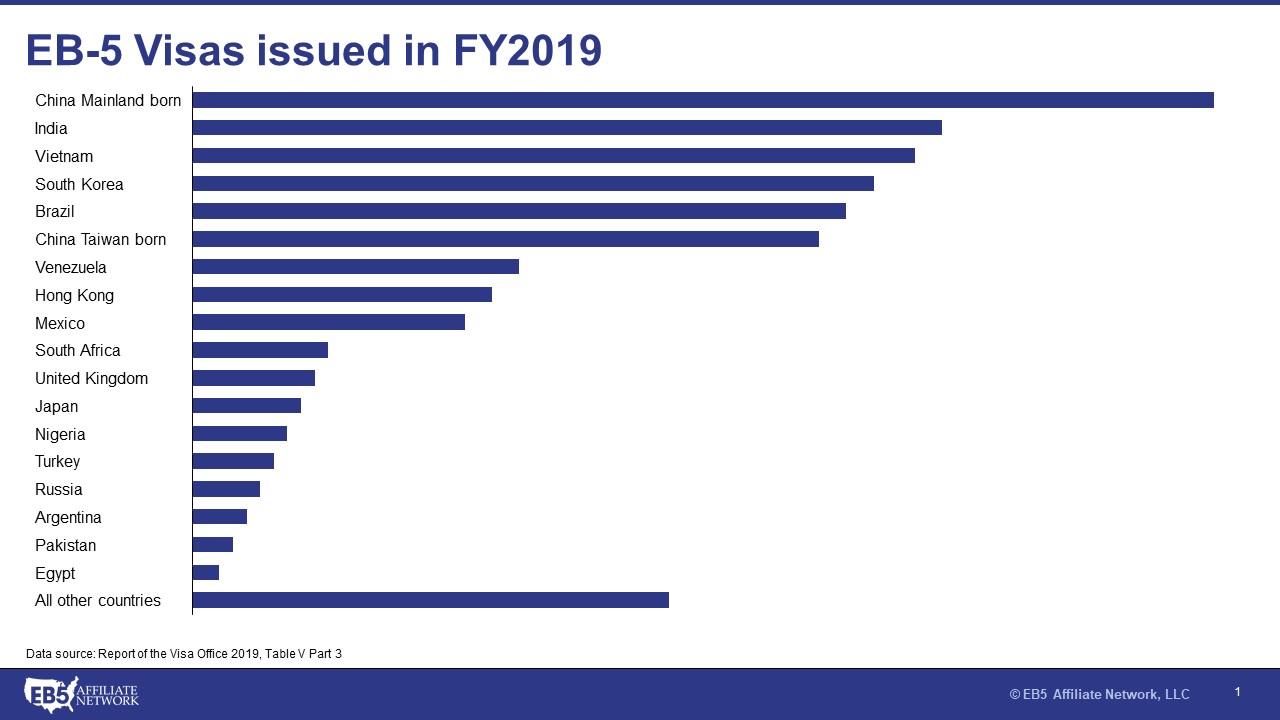

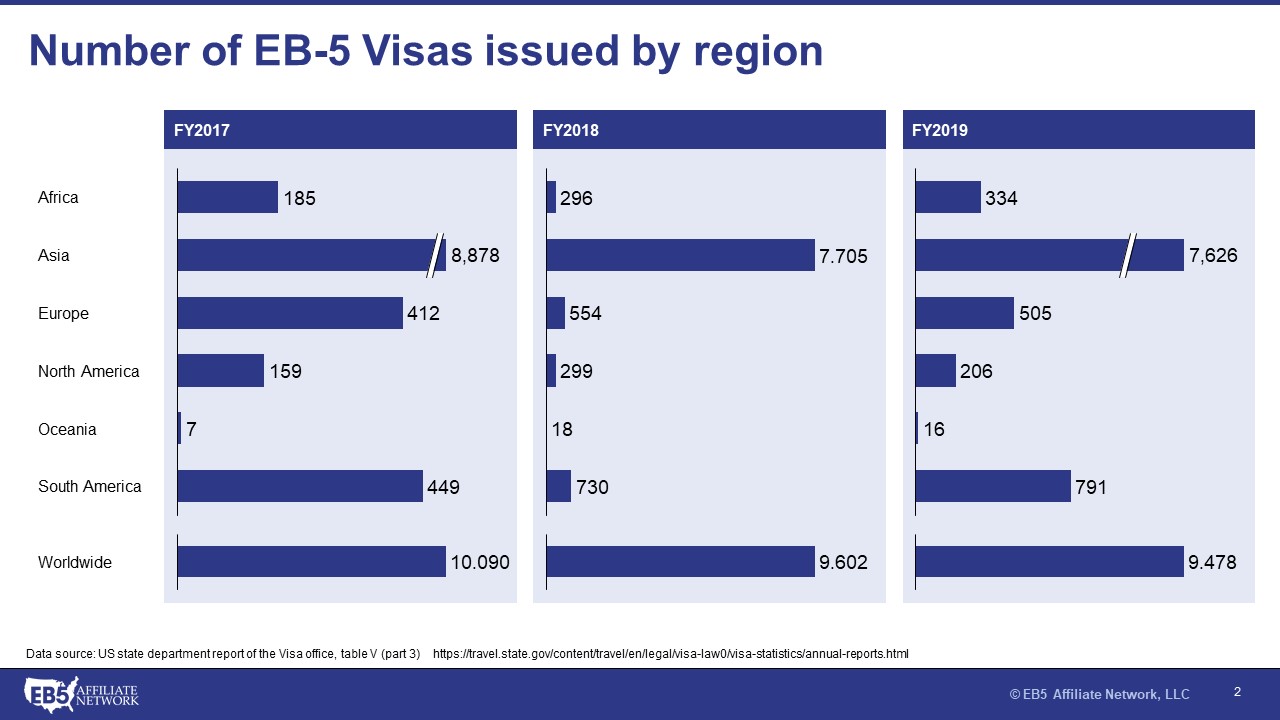

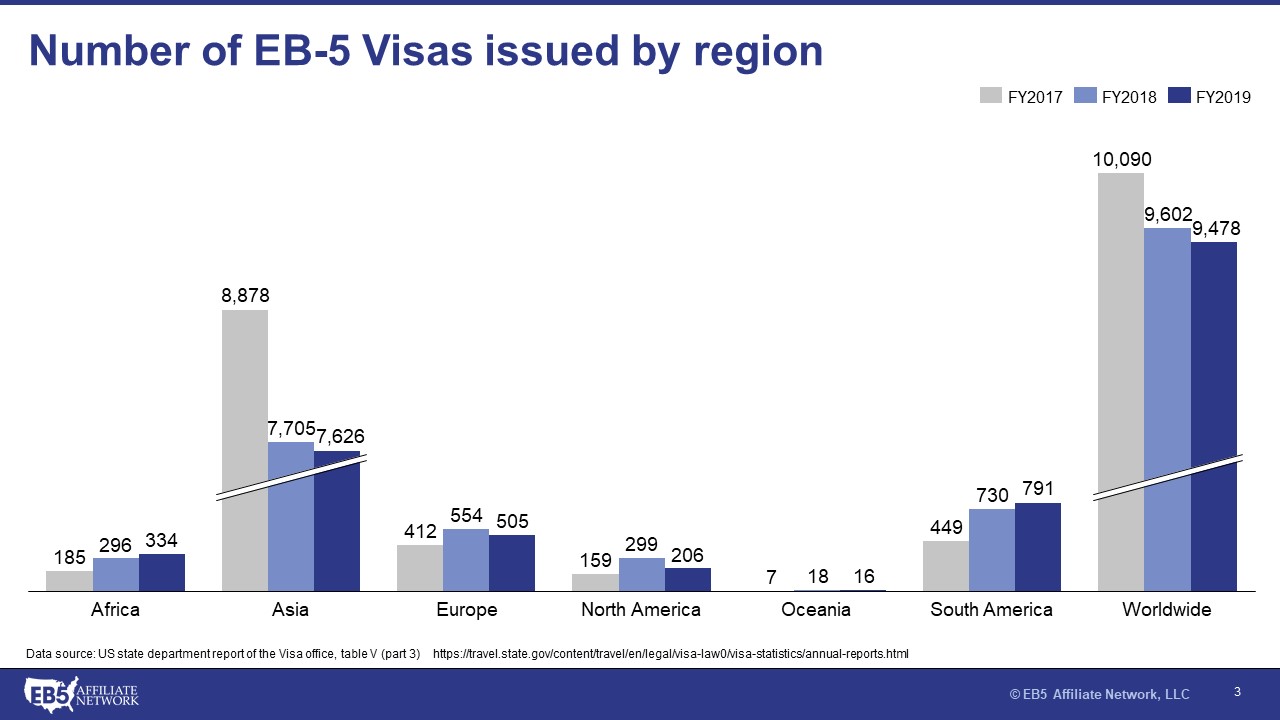

EB-5 visas are limited to around 10,000 per fiscal year, and no one country is permitted more than 7%, regardless of demand or population. Therefore, investors from overrepresented countries, such as Mainland China, naturally experience a delay in their EB-5 process. Investors stuck in backlogs should keep an eye on the monthly Visa Bulletin, which reveals when they can apply for a visa.

EB-5 conditional permanent resident status is initially granted for two years, after which the immigrant investor must file an I-829 petition to remove the conditions. If the EB-5 immigrant investment meets all the requirements—the creation of 10 full-time jobs and continuous at-risk status—the investor and his or her family will be granted unconditional permanent residency to enjoy a new, free life in the United States full of valuable opportunities.