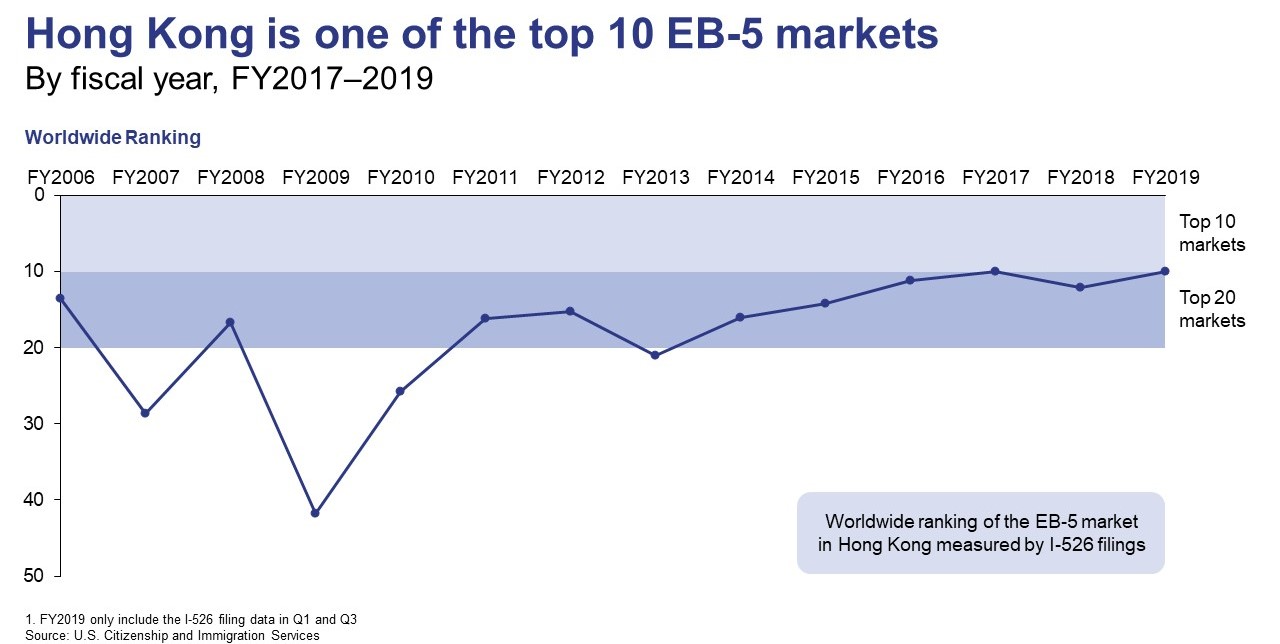

Hong Kong has long been a hotspot of EB-5 demand. Since the early days of the EB-5 Immigrant Investor Program, Hong Kong investors have been eager to invest in qualifying EB-5 projects and obtain permanent resident status in the United States. In the ’90s, Hong Kong was among the top 10 countries for EB-5 demand, and although this ranking dropped from around FY2000 to FY2010, it has since jumped back up, with Hong Kong once again landing among the top 10 EB-5 countries in FY2019.

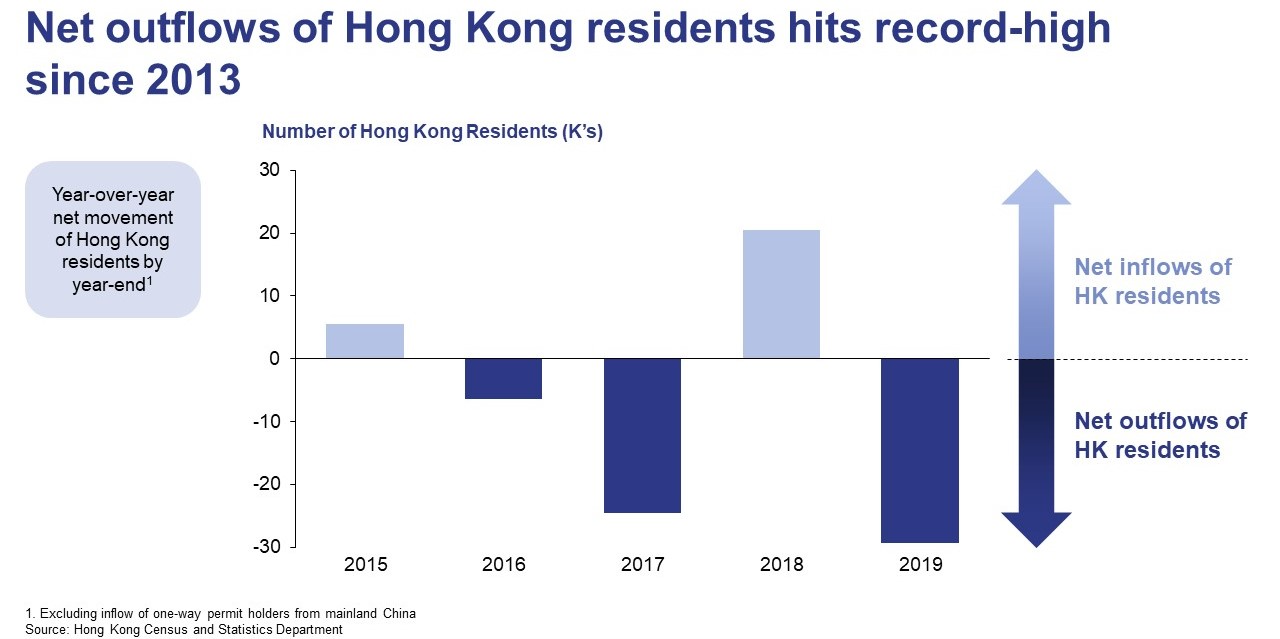

The reasons are many—from political tension with China to an overcrowded living situation. Statistics from the Hong Kong Institute of Asia-Pacific Studies and the Chinese University of Hong Kong indicate emigration intent is high in the special administrative region (SAR). Fortunately for Hong Kong EB-5 investors, investors from the country have also historically enjoyed low rejection rates and speedier adjudication than applicants from most other nations.

Growth in EB-5 Demand from Hong Kong Since FY2015

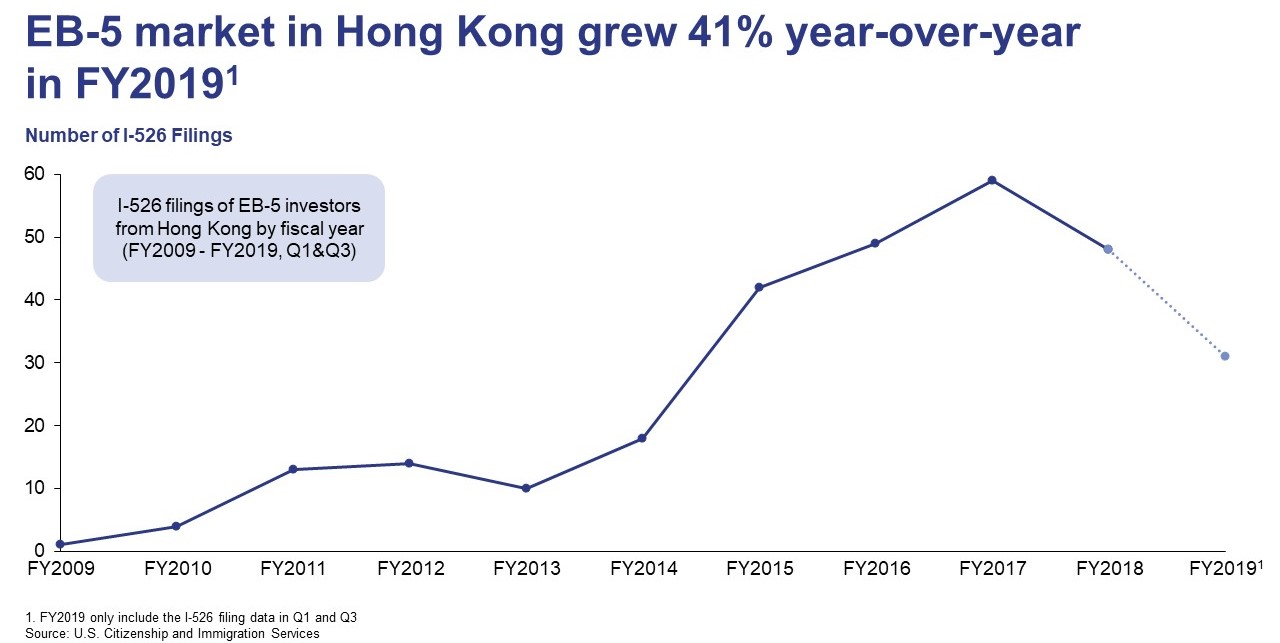

Investor interest from Hong Kong in the EB-5 program was relatively low in the ’00s, with only a single Hong Kong investor participating in FY2009. Demand increased to an average of 12 between FY2010 and FY2014, but FY2015 demonstrated a marked difference: the number of Hong Kong EB-5 investors shot up to 48, from 18 in FY2014. The figure peaked in FY2017 at 59 and has fallen a bit since, but EB-5 demand in Hong Kong remains significantly higher than before FY2015, with an average of 50 investors between FY2015 and FY2018.

Hong Kong EB-5 Investors a Boon to U.S. Economic Stimulation Efforts

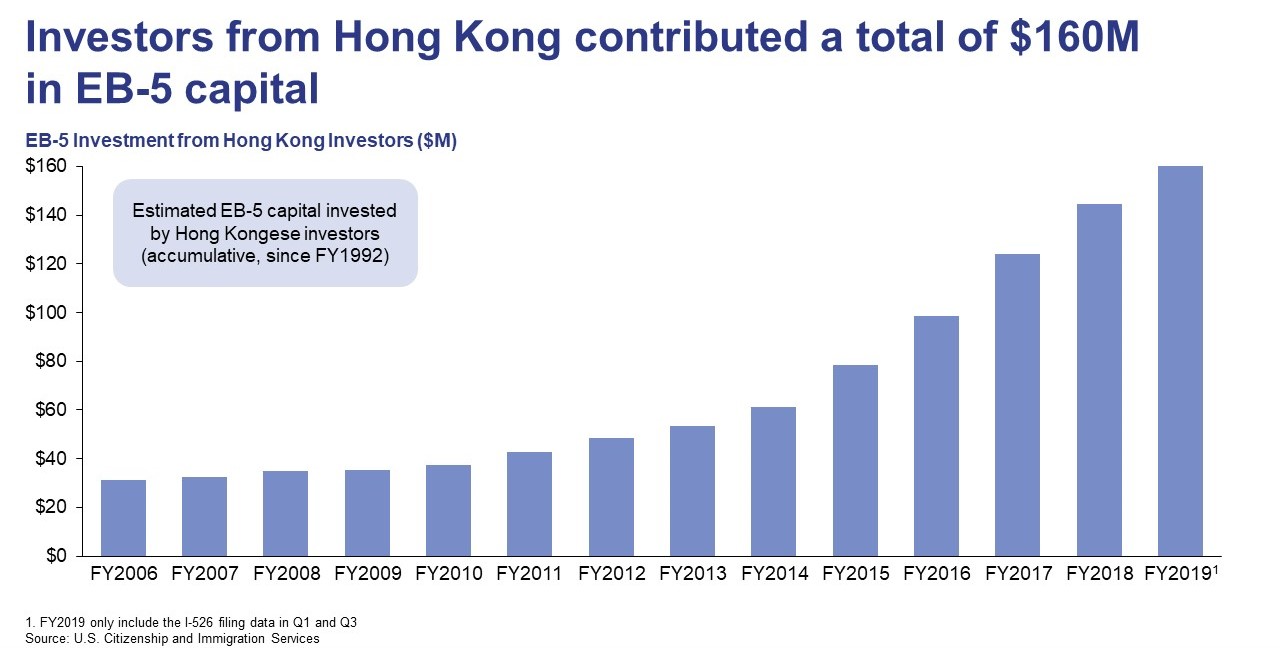

The EB-5 program is fundamentally a method for the U.S. government to stimulate the economy and foster the creation of new jobs, and Hong Kong investors have played an important role in boosting the U.S. economy thus far. As of FY2019, it’s estimated that EB-5 investors from Hong Kong have contributed more than $160 million to the economy, creating countless new jobs for U.S. workers. In fact, given the boom in EB-5 demand in Hong Kong since FY2015, it’s estimated that Hong Kong EB-5 investors pour around $21 million into the United States each year.

Hundreds of Hong Kong Investors Have Successfully Completed the EB-5 Program

Between FY2000 and FY2019, the United States has welcomed around 700 EB-5 investors and their immediate family members from Hong Kong. A large portion of these investors are recent immigrants, with 367 Hong Kong investors and their families gaining permanent resident status in the United States between FY2018 and FY2019. The introduction of a controversial national security law by Beijing authorities and Hong Kong’s subsequent revocation of special status in regard to U.S. immigration may quash future EB-5 demand from the SAR, since it places Hong Kong investors in the massive Chinese EB-5 backlog, or it could fuel demand, given the increased desire many Hong Kongers may have to permanently emigrate.

Hong Kong Investors Overwhelmingly Prefer TEA Projects

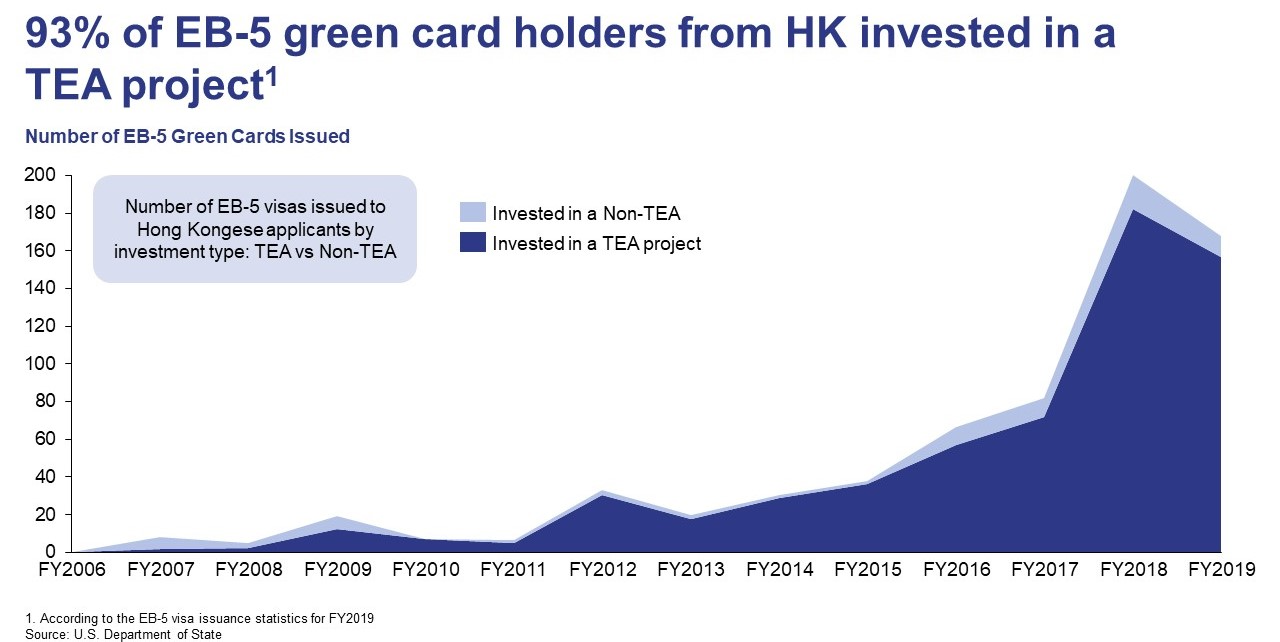

Data shows that EB-5 investors from Hong Kong overwhelmingly invest in EB-5 projects in targeted employment areas (TEAs), which qualifies them for a lower EB5 investment amount. While the general minimum required investment amount is $1.8 million, TEA projects qualify for a lower minimum amount—$900,000. Until FY2010, Hong Kong EB-5 investors generally worked with non-TEA projects, when the general minimum required investment amount was $1 million, reduced to $500,000 for TEA projects (the amounts were increased in November 2019 in accordance with the Modernization Rule). From FY2010 onward, however, investors from Hong Kong have largely opted for the lower EB-5 investment permitted for TEA projects. In FY2019, a whopping 93% of Hong Kong EB-5 investors chose the TEA route.

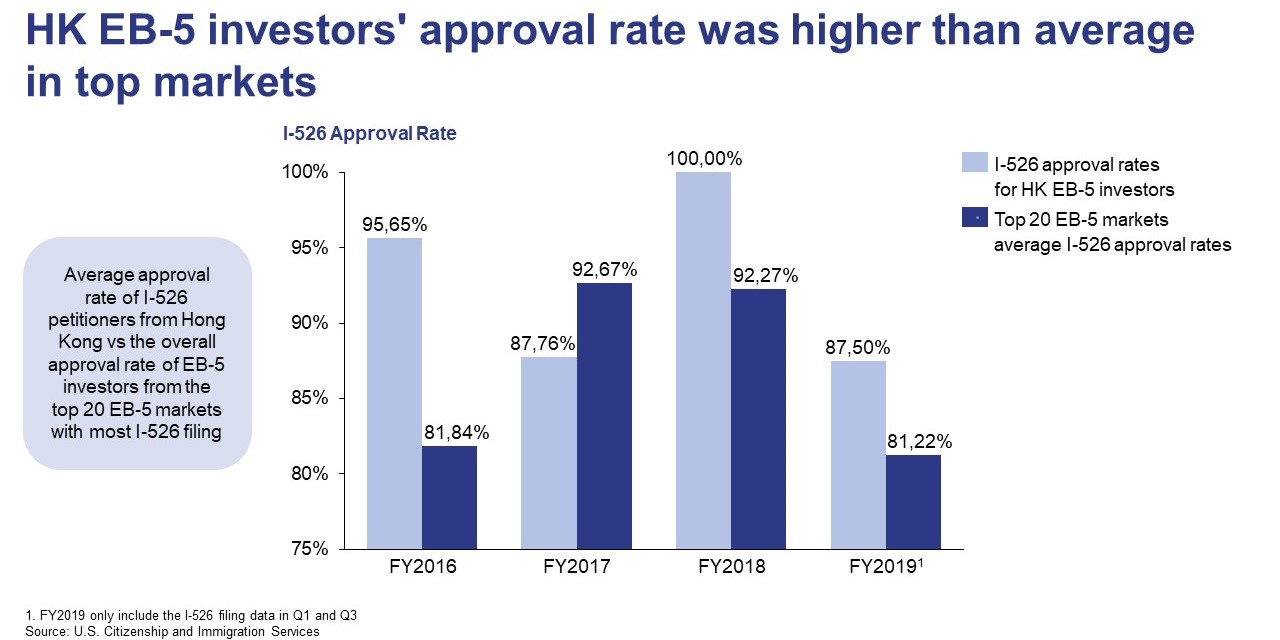

Hong Kong EB-5 Investors Enjoy Higher-Than-Average Approval Rate

Year over year, the approval rate for Hong Kong EB-5 investors has been high. It’s worth noting that the approval rate for EB-5 investors anywhere is high—proper due diligence, careful adherence to program requirements, and close collaboration with an experienced immigration attorney ensure consistently high outcomes. Looking at Q1 and Q3 of fiscal years 2016 to 2019, however, it’s clear that Hong Kong investors are generally approved at a higher rate than EB-5 investors from the other top 20 EB-5 markets, with the approval rating fluctuating between 87.5% and 100%.

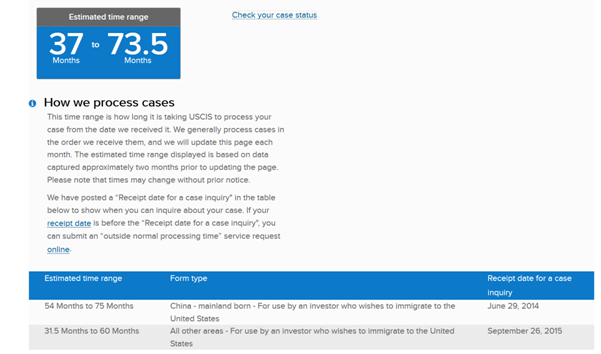

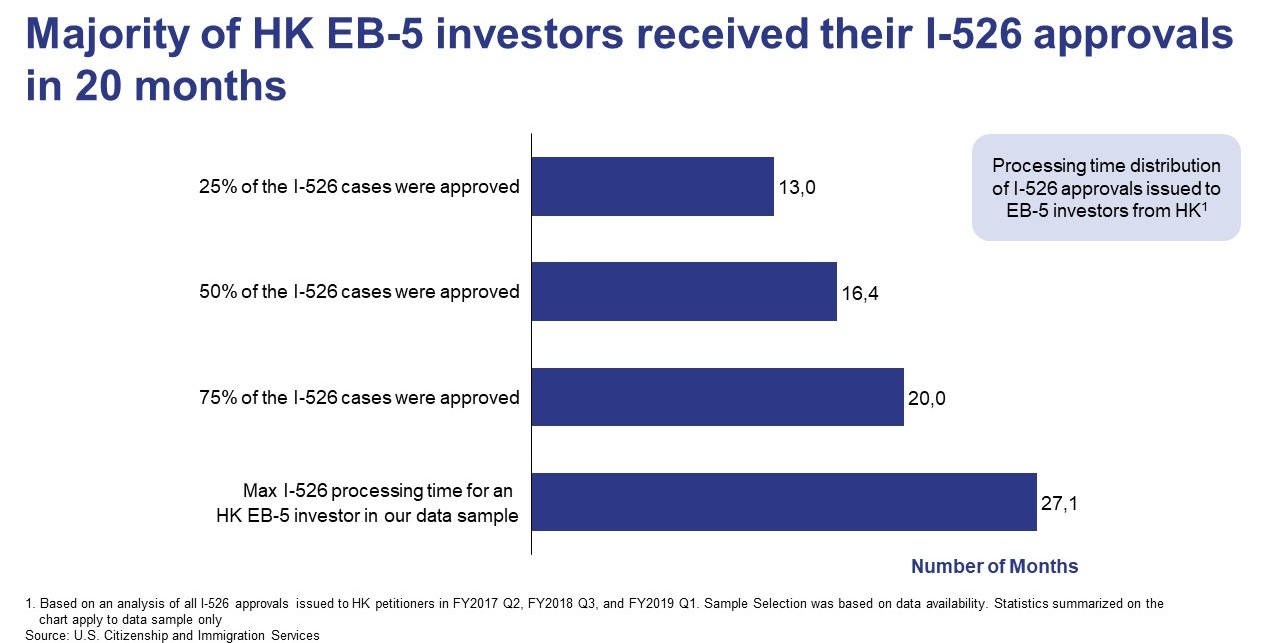

Hong Kong I-526 Petitions Receive Fast Adjudication

I-526 adjudication speeds can be a tricky subject, with some investors known to wait more than five years, while others receive approval within a few months. Hong Kong EB-5 investors are on the low end of the spectrum, enjoying faster-than-average adjudication times. In different quarters in FY2017, FY2018, and FY2019, a quarter of Hong Kong applicants received I-526 approvals within just 13 months, half received approvals in around 16 months, and three-quarters received approvals in 20 months. The longest wait time was around 27 months—far quicker than the long waiting times for Chinese investors—and some investors had their I-526 petition adjudicated in just 1.8 months.

One significant factor that facilitates the EB-5 process for Hong Kong investors is that it is easy to obtain documentation in English. Investors from any country may participate in the EB-5 program, but United States Citizenship and Immigration Services (USCIS) requires all non-English documents to be translated, increasing the preparation time and effort for investors and complicating the adjudication process for USCIS. With English documentation readily attainable in the SAR, Hong Kong EB-5 investors have a natural advantage over investors from most other countries.