The EB-5 program has seen some changes in recent years, including increased investment fund requirements and more restrictive targeted employment area (TEA) designation, but these are not the only challenges the program faces. Adding to the problem are the lengthy quota backlogs in major EB-5 investor countries and the ever-increasing United States Citizenship and Immigration Services (USCIS) processing times. Considering the additional factor of record-breaking rates of regional center terminations, EB-5 investors today are faced with unprecedented challenges to receive their EB-5 visa and gain U.S. permanent residency.

Regional Center Terminations Threaten Investors’ Visa Approval

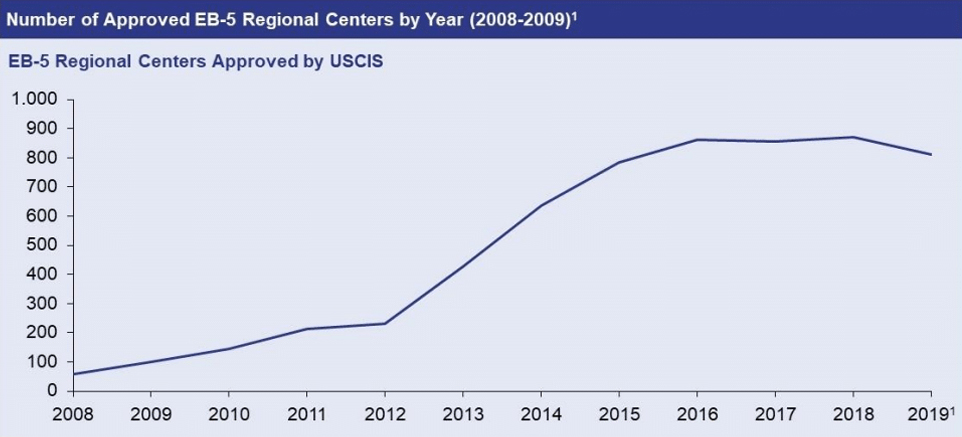

In light of the modified requirements of the EB-5 program, regional centers are being shut down at record-breaking rates. The higher amount of required investment funds reduces the number of investors, which, in turn, results in some regional centers failing to stimulate their local economies to the satisfaction of USCIS.

The problem for investors is that if the regional center through which they are investing is terminated mid-project, investors who have not yet received conditional residency may see their EB-5 petitions denied. The long quote backlogs and growing USCIS processing times exacerbate the problem because they require regional centers to remain in operation for longer. Investors beginning the EB-5 investment process now must choose a regional center they believe will still be in operation several years down the road.

For investors outside of China, Vietnam, India, and other countries with major backlogs, the long processing times still pose a risk. In 2010, the processing times were just seven to nine months, but this jumped to 54–90 (4.5–7.5 years) in 2019. Therefore, all EB-5 investors, regardless of country of origin, must carefully select a reputable EB-5 regional center that is likely to continue operations for many years to come.

Choosing a Reliable EB-5 Regional Center

The importance of working with an experienced, reputable EB-5 regional center to safeguard one’s investment and EB-5 visa approval cannot be overstated. Prospective investors need to sufficiently research the regional centers covering the area in which they intend to invest in order to ensure the lowest possible likelihood of premature termination. Working with a network that runs multiple regional centers and possesses vast experience—such as EB5AN (EB5AN)—is the safest bet for any EB-5 investor.

While regional centers are being terminated around the country due to a failure to stimulate the local economy, EB5AN is thriving, with no danger of being shut down. With 14 regional centers that offer coverage of more than 20 states, as well as Washington, D.C., EB5AN is extensively experienced with EB-5 projects and knows the ins and outs of working with USCIS. The team keeps up to date on all metrics and regulations related to the EB-5 program, ensuring continued adherence and, consequently, reliable longevity.

Affiliating with an EB5AN regional center also speeds up the investment process, allowing investors to start raising EB-5 capital immediately. The network’s project documentation services can also facilitate and expedite the paperwork process involved in EB-5 investment, as well as ensure that all the forms are properly filled out, helping investors gain approval.

While the conditions surrounding the EB-5 program may be becoming more restrictive, the program remains a lucrative opportunity for investors with the necessary funds. For those investors, navigating the changing environment in the EB-5 world simply requires more caution, forethought, and careful research to locate a regional center that offers high chances of success. EB5AN, with its vast network of regional centers, proven track record, and 1500+ active investors, represents an opportunity for EB-5 investors to most securely invest in the future for themselves, their family, and the United States.