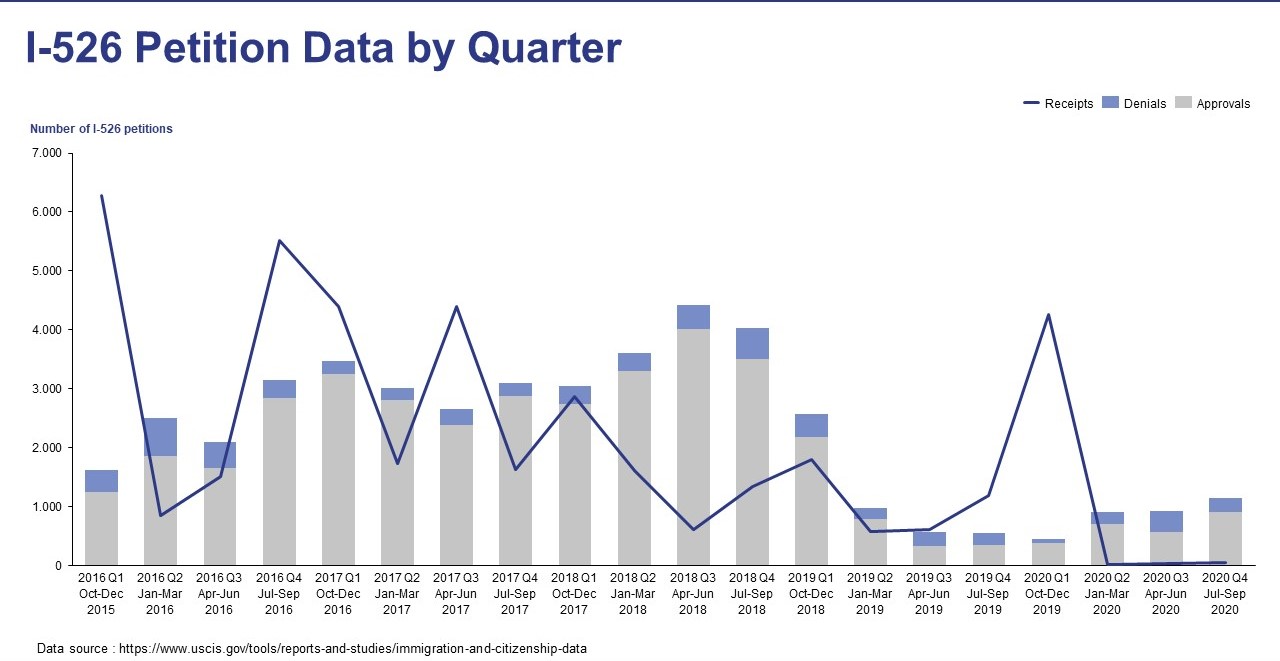

According to statistics pulled from the United States Citizenship and Immigration Services (USCIS) data for FY2020 Q4 (July–September 2020), new I-526 receipts at the immigration body are the lowest they’ve been in years. While it’s easy to see diminished demand as a reason to steer clear of the EB-5 Immigrant Investor Program, it may actually be an ideal time to dive into an EB-5 investment. Many of the problems that have plagued the residency-by-investment program throughout the 2010s can be traced back to the lengthy backlogs for investors from select countries, and a decrease in new demand offers a chance to reduce the backlogs.

What Does the Data Say About I-526 Petition Receipts?

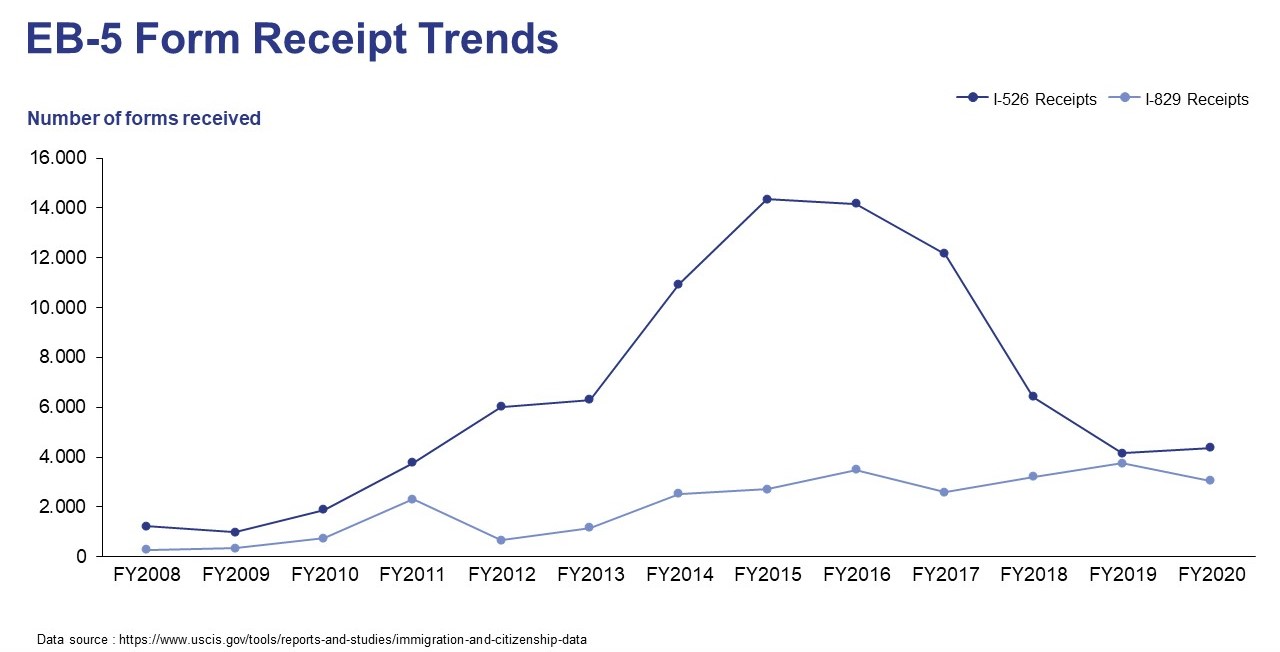

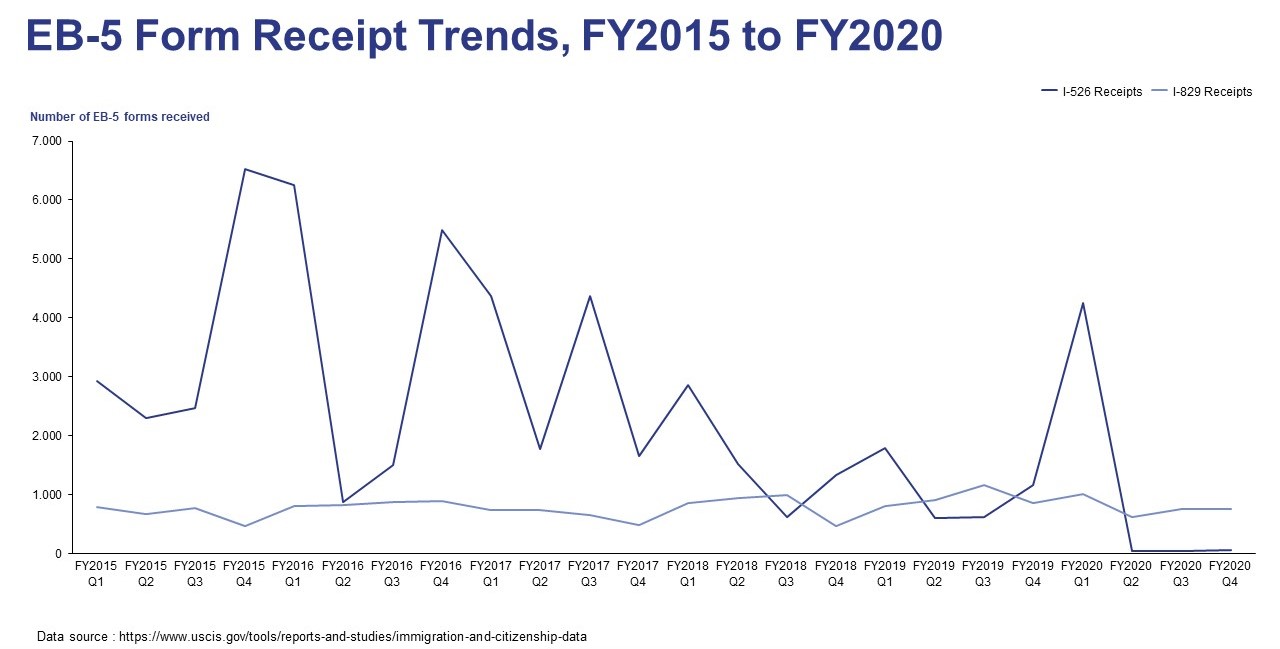

The USCIS data makes clear the decrease in I-526 receipts compared to most years in the 2010s, with the exception of FY2019. A record-low year in many regards for the EB-5 program, FY2019 saw only 4,194 new I-526 petitions filed, meaning FY2020’s 4,378 represents a 5% increase.

A spike in filings in the first quarter of FY2020 is also clear. The Modernization Rule, which came into effect on November 21, 2019, pushed up the minimum required EB5 investment amounts by 80%, raising the regular amount from $1 million to $1.8 million and the targeted employment area (TEA) amount from $500,000 to $900,000. With more than 97% of all FY2020 I-526 receipts being filed in the first quarter, it’s clear a deluge of applicants jumped on the chance to secure an EB-5 investment at the lower amount.

Unforeseen at that time was the COVID-19 pandemic, which continues to devastate the globe even now in February 2021. Temporary suspensions at U.S. embassies and consulates, coupled with strict lockdowns and the general shutdown of public life around the globe, are expected to have also contributed to the sudden decrease in new I-526 petitions. USCIS received only 114 I-526 petitions throughout the three remaining quarters of the fiscal year.

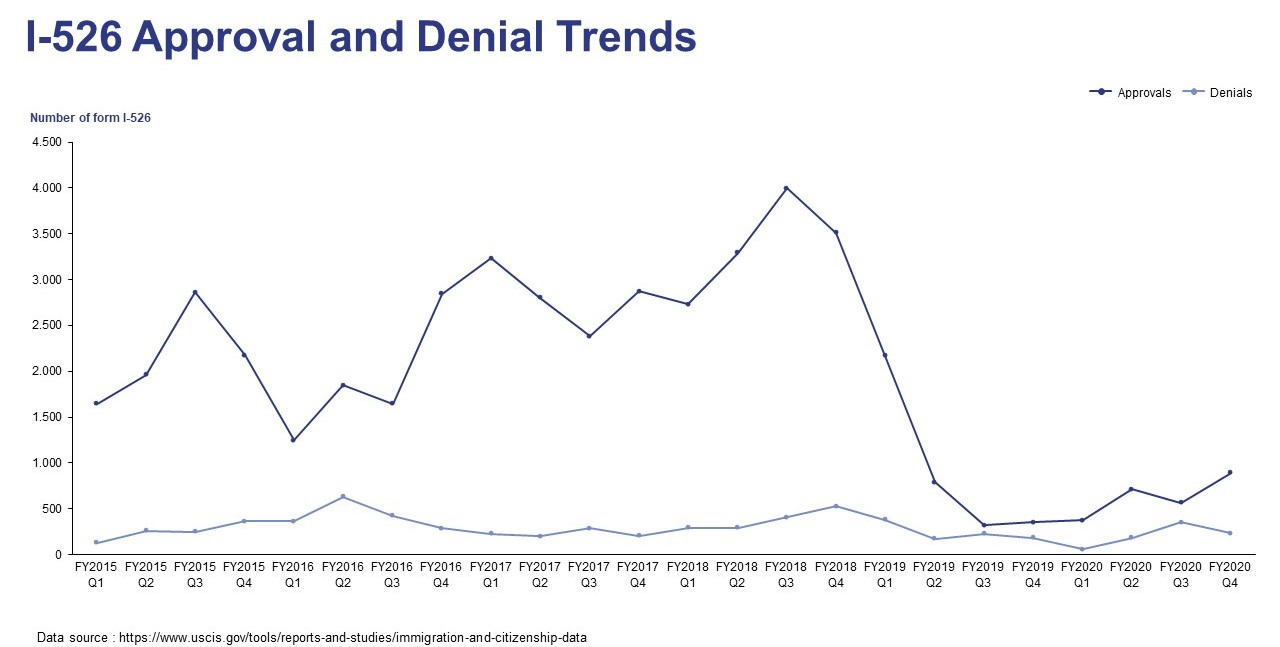

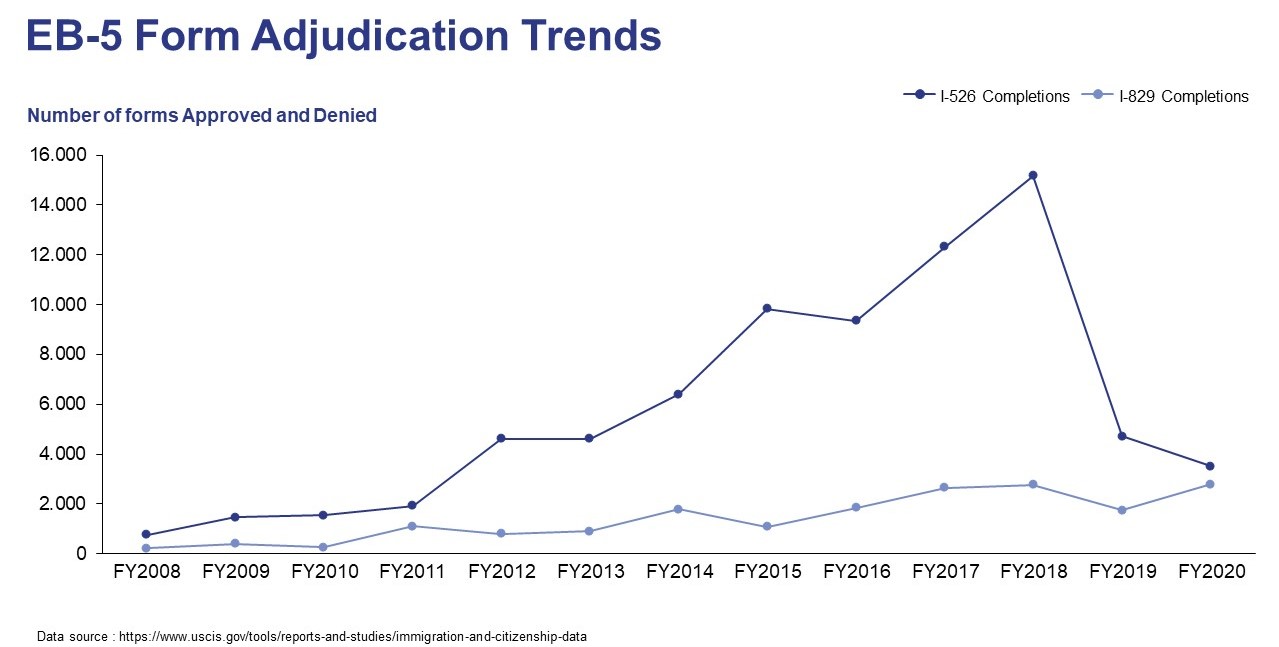

Adjudications of I-526 petitions also fell in FY2020, but not as starkly as receipts. The EB5 investment world has grown used to a snail’s pace at the Immigrant Investor Program Office (IPO) under Sarah Kendall’s leadership, with the FY2019 figures falling dramatically from all-time highs in FY2018 even without a pandemic wreaking havoc on the world. FY2020 I-526 adjudications were down 27% from even FY2019 numbers, but the good news is that they are trending upward, with FY2020 Q4 exhibiting the highest number of I-526 adjudications since FY2019 Q1. The ratio of approvals to rejections is also trending favorably, with the 79% of approved petitions in FY2020 Q4 up from 62% in the previous quarter.

In terms of the seemingly endless backlogs at USCIS, the flood of new I-526 receipts in FY2020 Q1 had a substantially negative effect. USCIS closed out FY2019 with 13,763 petitions stuck in the backlogs, but the rush to beat the increased minimum EB-5 investment amounts in FY2020 Q1 pushed the figure to 17,468. The almost complete cessation of new filings throughout the rest of the year allowed USCIS to reduce the number to 15,063, but the agency still has a long way to go to eliminate the backlogs.

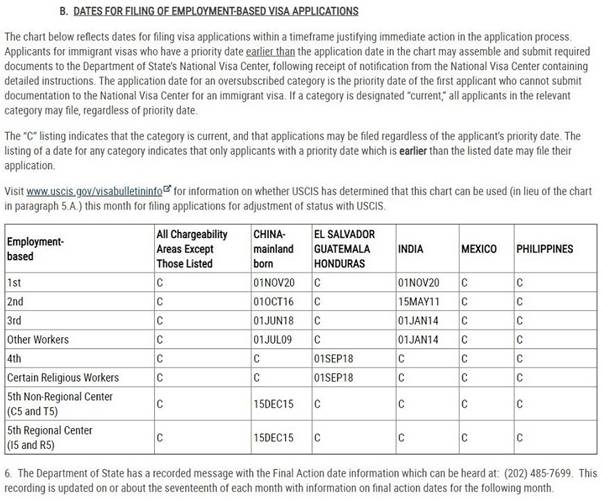

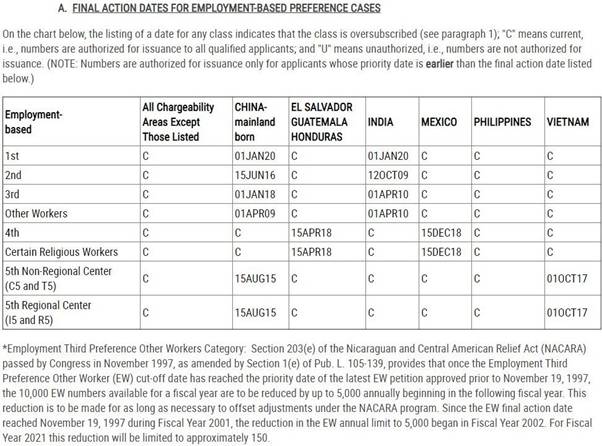

How EB-5 Investors Can Benefit

A time of diminished interested in the EB-5 program may actually be the perfect time to jump into an EB5 investment. Fewer I-526 petitions means less competition and more EB-5 visas available for an investor and their family members, resulting in a faster EB-5 journey. The EB-5 outlook in FY2021 is particularly favorable for new applicants considering an EB-5 investment, with the scores of unissued visas in FY2020 resulting in thousands being rolled over to the EB-5 program in FY2021. With 18,567 visas allocated to the EB-5 program, the IPO can dish out more than double the usual number of EB-5 visas in FY2021. This massive increase allows the country caps to increase to around 1,300 visas, presenting USCIS with a unique opportunity to cut down the Chinese and Vietnamese backlogs. Leftover visas, which could be as many as 7,000–8,000, could go to Chinese and Vietnamese nationals who have been left in processing purgatory for years.

Naturally, this situation is advantageous to those already engaged in an EB5 investment but stuck in backlogs, but it also offers benefits for new EB-5 investors. In particular, cutting down the massive Chinese backlog could substantially reduce estimated waiting times for new EB-5 investors from China, and if few Chinese peers similarly make EB-5 investments going forward, the situation will be even more favorable.

FY2021 essentially presents USCIS with a chance to “catch up” on the backlogs that have prevailed since 2014. With almost double the average number of yearly EB-5 visas and record-low interest, it’s unlikely the EB-5 program will ever see another opportunity like this again. Though many foreign investors are shying away from an EB5 investment, it may, in fact, be the best time to get involved with the EB-5 Immigrant Investor Program.