The thousands of foreign nationals who have completed the EB-5 process and are now enjoying permanent residency in the United States can attest to the fact that making an EB-5 investment is worthwhile. However, many of them would also agree that obtaining the EB-5 visa is a lengthy and not always straightforward process. United States Citizenship and Immigration Services (USCIS), along with the Department of State (DOS), have much to do in terms of improving the EB-5 investment program and making it more beneficial for investors, business owners, and local economies across the United States.

Admittedly, the EB-5 industry has had to contend with many sudden changes in the past few months. The most important of these was the June 2021 suspension of the regional center investment model, which left numerous regional center investors in a state of uncertainty: USCIS is no longer adjudicating their I-526 petitions, and it is unknown if or when the agency will reconsider this policy. Moreover, reauthorization for the regional center program is not guaranteed.

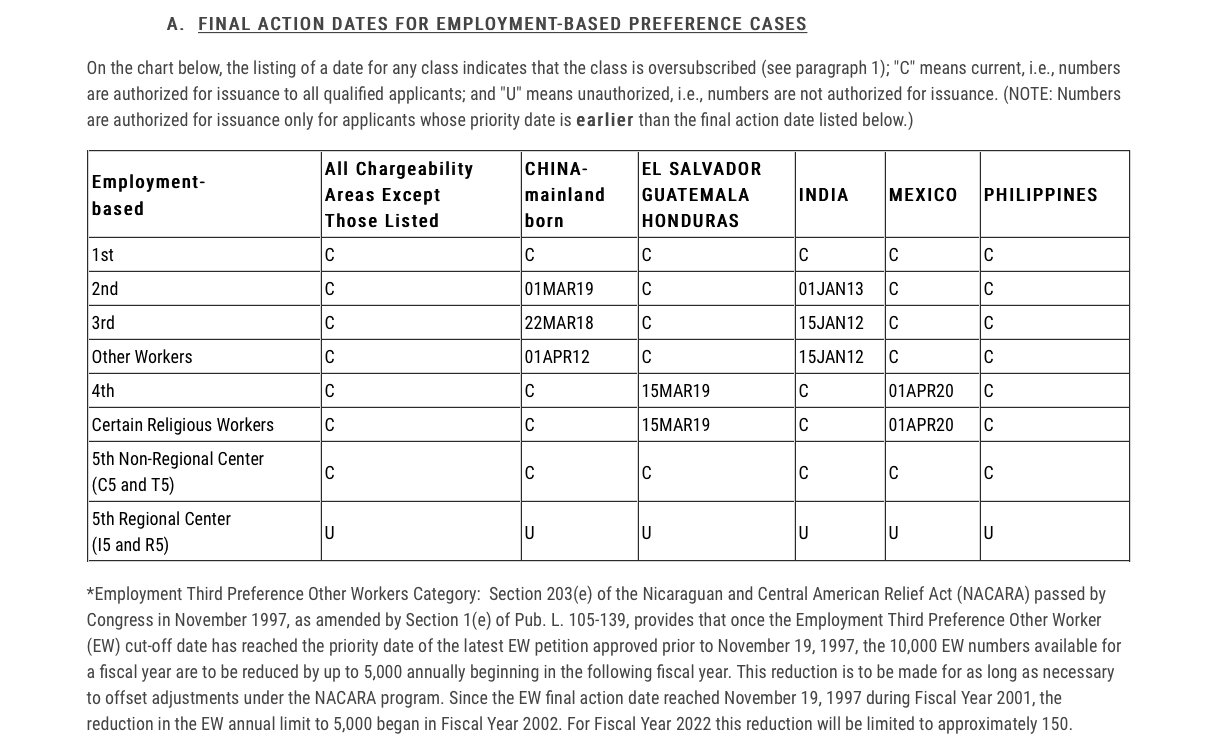

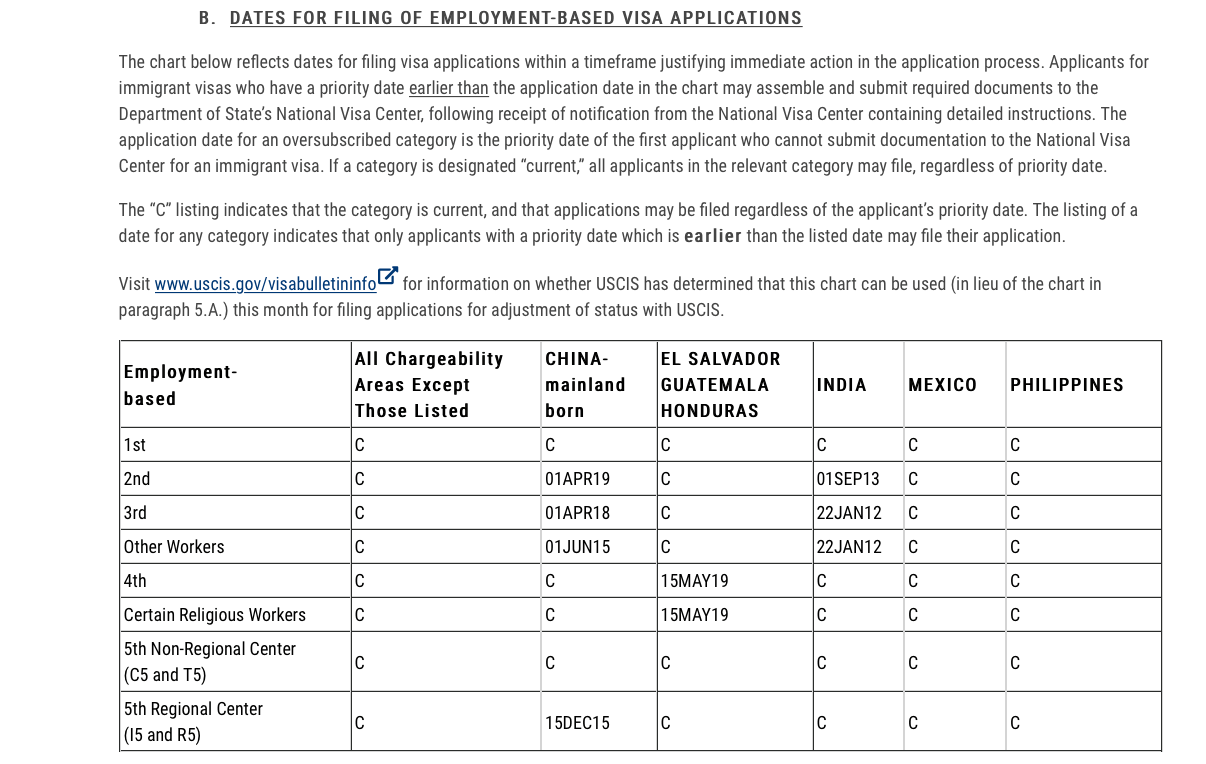

Aside from this recent issue, the EB-5 investment program has long been plagued by visa backlogs and lengthy processing times. It typically takes years for USCIS to adjudicate an investor’s Form I-526, and many countries have been subject to processing backlogs that impose even longer delays.

USCIS and the DOS should take action to address these issues and protect the interests of all EB-5 stakeholders. In fact, taking relatively simple steps could greatly reduce or even eliminate the aforementioned problems.

Expanding EB-5 Visa Allocation

Each year, the EB-5 investment program is awarded only about 10,000 visas. This number is not nearly enough to cover the huge demand for the EB-5 visa, especially from residents of Brazil, India, Vietnam, and China. All individuals who make an EB-5 investment are directly contributing to the well-being of the U.S. economy, so it is in the country’s interest to take on as many EB-5 investors as possible. Many small businesses, especially in targeted employment areas (TEAs)—which are either rural or have high unemployment—have found invaluable help in the form of EB-5 investment funding. This economic stimulus is especially important during the challenges caused by the COVID-19 pandemic.

USCIS and the DOS could choose to allocate more visas to the EB-5 program each year, perhaps awarding the program with some of its visas that have gone unused in previous years. They could also choose to consider every EB-5 investor and their family as one visa applicant. These approaches would allow far more visas to be awarded each year.

USCIS also has much to do in terms of improving the slow processing times for Form I-526, Immigrant Petition by Alien Investor. Some investors have even felt impelled to file mandamus litigation against USCIS due to the unreasonable delays. Expediting processing times would allow investors to receive their two-year conditional permanent residency much faster and make the EB-5 visa a more attractive option for foreign nationals.

Making Provisions for Regional Center Investors

As mentioned previously, USCIS has left regional center investors with pending I-526 petitions in a state of uncertainty. Because it is unclear if or when the regional center program will be revalidated, the agency should allow these investors to continue with the EB-5 process. Doing so is urgent because these foreign nationals may eventually try to get their EB-5 investment funds back through legal action, leaving EB-5 projects in an uncomfortable position.

The EB5 investment industry is far from perfect, but, despite the challenges, it continues to aid businesses across the United States. Its continued success is in the best interests of all involved.