Filing Form I-829 is the final step before an EB-5 investor completes the EB-5 visa process and obtains unconditional permanent resident status in the United States. The three main administrative steps in the EB-5 process are filing Form I-526, applying for conditional permanent residence, and petitioning United States Citizenship and Immigration Services (USCIS) to remove the conditions on permanent residence. This guide provides a comprehensive overview of preparing and filing USCIS Form I-829, starting with a brief background of the I-526 process and the path to conditional permanent residence.

Form I-526

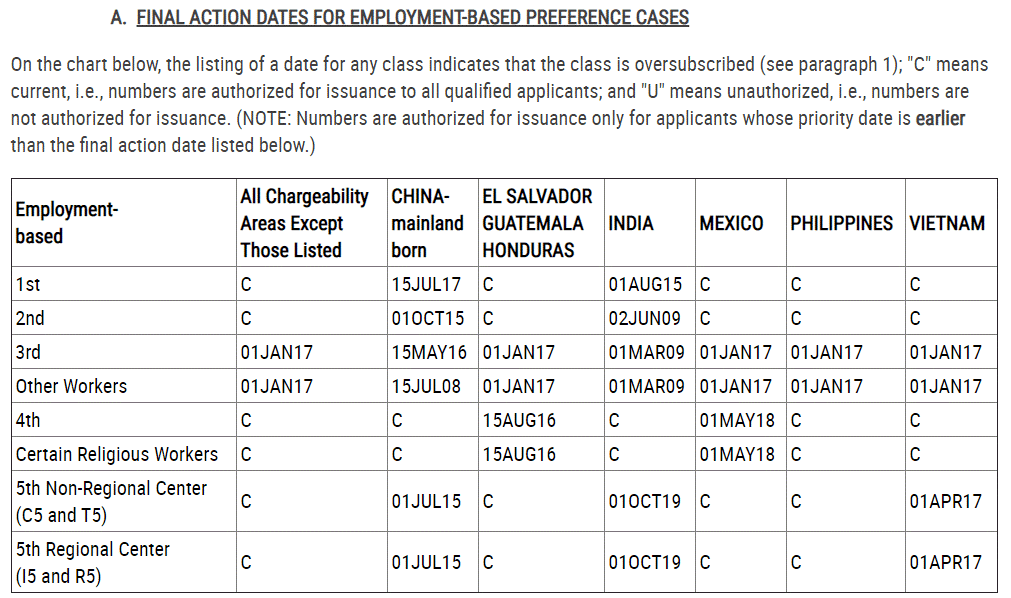

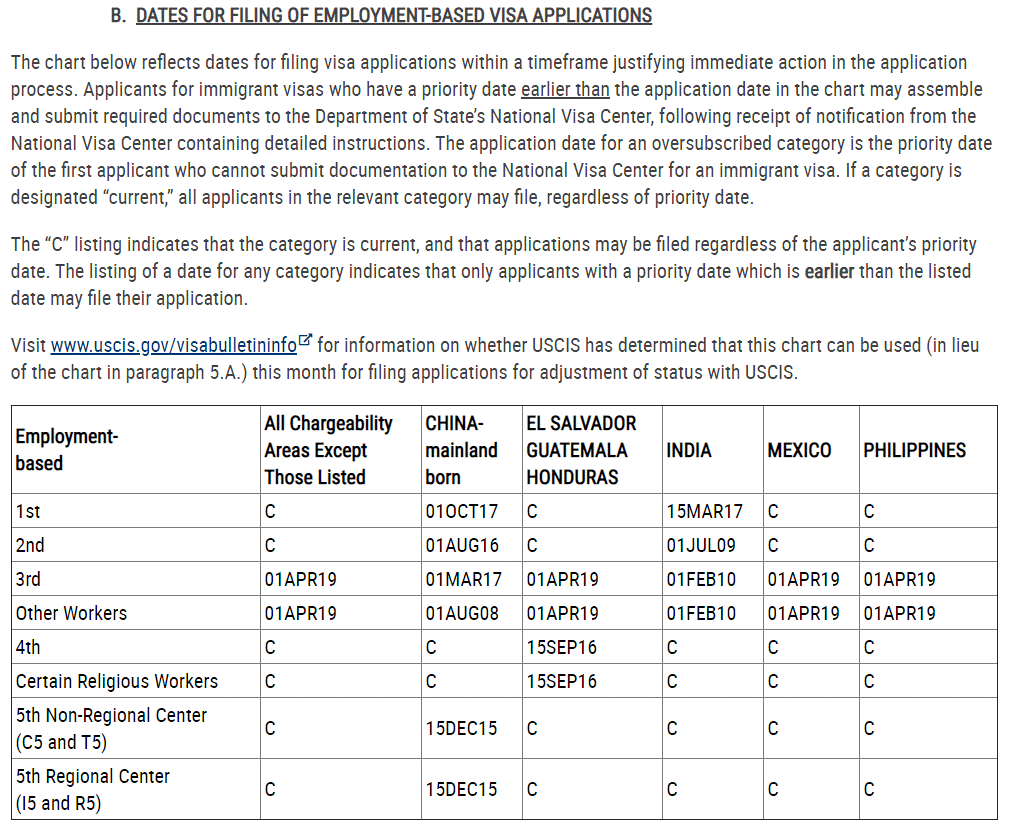

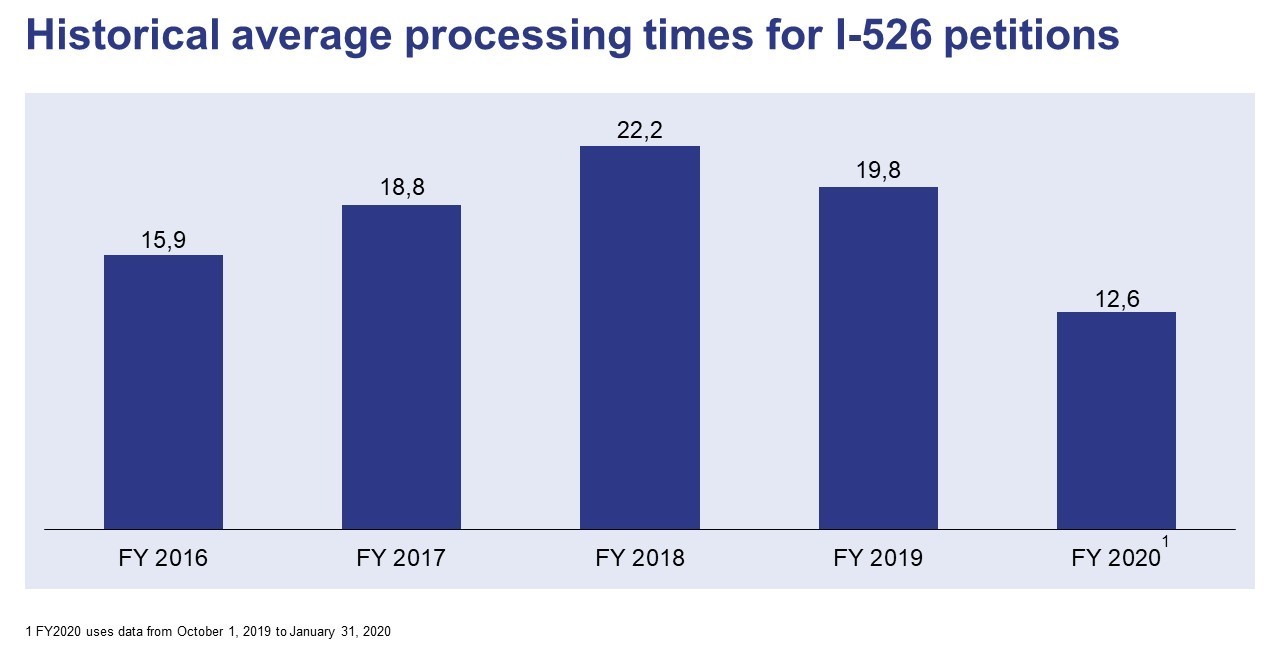

The first petition in the EB-5 process is Form I-526, which investors use to launch their EB-5 application with USCIS. EB-5 investors file their I-526 petitions after transferring their EB-5 capital to the designated account in their chosen EB-5 project, and upon adjudication, which typically takes around two years, they can apply for conditional permanent residence for themselves, their spouses, and their unmarried children below the age of 21. EB-5 investors in the United States must file Form I-485, Application to Adjust Status, to secure conditional permanent residence, while those outside the United States must submit Form DS-260 to the National Visa Center in their home countries.

Part of the I-526 petition involves demonstrating that the investor’s EB-5 funds have come from legal sources. The requirement to collect and, where necessary, translate, a large number of documents presents difficulty to many EB-5 investors. Additionally, when preparing an I-526 petition, EB-5 investors must provide the hiring schedule of the new commercial enterprise (NCE) and projections that indicate the creation of at least 10 new full-time jobs for U.S. workers, which is one of the key requirements of the EB-5 program.

When to Prepare and File Form I-829

Once an EB-5 investor and his or her family have received U.S. green cards, the family can relocate to their desired area in the United States. If the associated EB-5 project is affiliated with an EB-5 regional center, the investor is not tied to the project region and has the right to live anywhere in the United States.

The conditional permanent resident status EB-5 investors secure after I-526 approval is valid for two years. Throughout this period, the investor must maintain his or her capital invested in the EB-5 project in an “at risk” status and should refrain from excessive travel abroad to maintain permanent resident status in the United States.

In the last 90 days of conditional permanent residency, the EB-5 investor must file Form I-829. It is strongly recommended to start preparing in advance because if USCIS does not receive an investor’s Form I-829 petition within the specified time frame, the investor’s permanent resident status could be jeopardized.

Preparing Form I-829

Form I-829, Petition by Investor to Remove Conditions on Permanent Resident Status, is an EB-5 investor’s ticket to full permanent resident status in the United States. It is contingent on existing permanent resident status, so the EB-5 investor must present his or her green card on the application.

The main purpose of Form I-829 is documenting that the EB-5 investor has fulfilled the requirements of the EB-5 program. The key requirements are the establishment and continued existence of a new commercial enterprise (NCE) throughout the investment period, an investment in the NCE of the minimum required amount ($1.8 million or $900,000, depending on the project’s targeted employment area designation), and the creation of 10 new full-time, permanent jobs for U.S. workers.

EB-5 investors must submit abundant evidence with their Form I-829 petitions to demonstrate that they have met the outlined requirements. Various documents, including tax returns, bank statements, company licenses, receipts and invoices, payroll records, contracts, and more can be used to prove the validity of each EB-5 investment to USCIS.

If an EB-5 investor has a criminal history, he or she is also required to include documentation such as court records, law enforcement statements, or records of arrest with his or her Form I-829 petition.

Filing Form I-829

Form I-829 costs $3,750 to file, plus an $85 fee for biometric services, if required. Once the I-829 petition is completed, the EB-5 investor must send it to the USCIS Dallas Lockbox in the 90-day period before the expiry of his or her conditional permanent residency. On average, it takes USCIS between two and four years to adjudicate a Form I-829 petition, but the EB-5 investor and his or her family retain the right to remain in the United States as permanent residents while their application is pending.

Upon I-829 approval, the EB-5 investor will receive a new green card without conditions. This marks the end of the investor’s EB-5 journey. After living in the United States as a permanent resident for five years, the investor may apply for U.S. citizenship, if desired.