2020 has been an unprecedented year for everyone, with almost no one on the planet left unaffected by the COVID-19 pandemic. The virus and the subsequent government measures to contain it have upturned economies, destroyed livelihoods, torn apart families, and ended lives. The EB-5 Immigrant Investor program has not escaped COVID-19’s wrath, either, as the pandemic-induced suspension of routine visa services at U.S. embassies and consulates left countless EB-5 investors stranded indefinitely with no pathway to enter the United States.

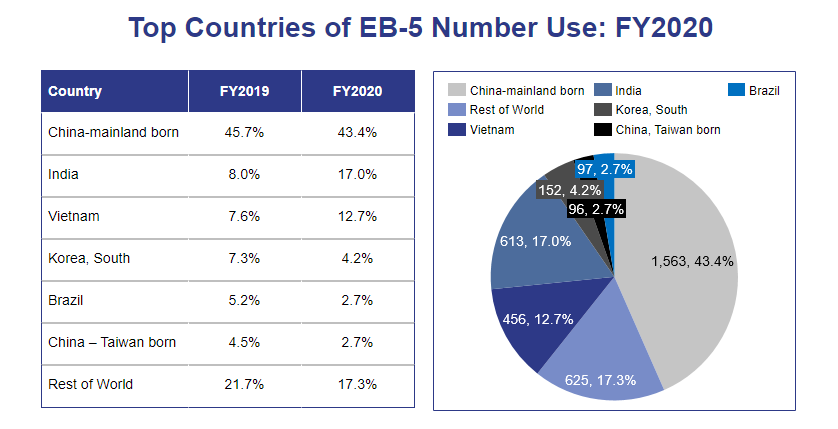

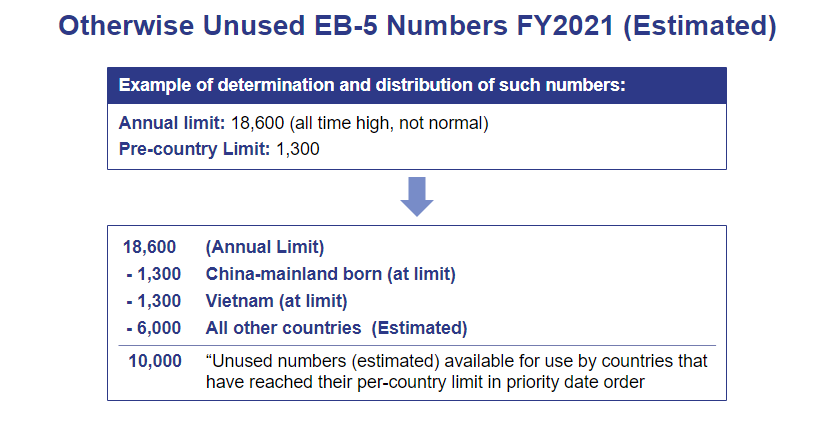

Surprisingly, the pandemic has also aided the EB-5 program in various ways. For example, the near-total shutdown of immigration also resulted in a lack of family-based visas being issued in FY2020, which saw thousands of unused visas roll over to the EB programs for FY2021. Entitled to 7.1% of all EB visas in a given year, the EB-5 program has been allocated more than 18,000 visas for FY2021 – nearly double the typical number.

With 2020 having been the most unpredictable year in recent history, it’s difficult to foresee what 2021 will bring. The COVID-19 virus still lingers in the air, threatening to further pause public life, so until an effective vaccine is widely distributed, life cannot return to normal as we know it. Below are a couple factors that could influence the EB-5 program as we tumble into 2021.

EB-5 Regional Center Program Sunset Date Fast Approaching

2020 has been the year of the unpredictable, and little would be more unpredictable in the EB-5 program than the discontinuation of the EB-5 Regional Center Program. A temporary program that has been subject to continuous reauthorizations since its debut, the EB-5 Regional Center Program allows foreign nationals to make an EB-5 investment through a qualified regional center rather than directly in an eligible EB-5 project, enabling the pooling of EB5 investment capital for maximum economic stimulation and job creation. Regional centers are heavily favored by EB-5 investors for the relative security they provide, including through relaxed job creation requirements, but until the program is made permanent, it will undergo constant review and reauthorization from the U.S. government.

On December 11, 2020, the Regional Center Program was extended by a single week until December 18, 2020. Throughout the week, Congress engaged in discussions to pass the federal funding bill in which the Regional Center Program reauthorization is included. If the bill fails to pass, a government shutdown will ensue, and the Regional Center Program may expire. Given that the bill likely includes stimulus checks and various forms of aid for struggling small businesses and U.S. workers who have lost their jobs due to the pandemic, it is a complicated matter for Congress, and it’s entirely possible that Congress will pass another short-term extension to win more time for negotiations.

COVID-19 Vaccines to Favor Developed Countries

With COVID-19 vaccines approved by major countries such as the United States, Canada, and the United Kingdom, the world can finally see the light at the end of the long, dark tunnel constructed by the COVID-19 pandemic. With these three countries having already administered their first doses of the highly anticipated vaccine, 2021 is lining up to be a better year than 2020.

However, not all countries will have equal access to a COVID-19 vaccine. While many developed countries have already purchased abundant supplies of the perceived panacea, some developing countries lack the funds and resources to secure doses for their own populations. They can take advantage of excess vaccines redistributed by developed countries and the World Health Organization, but any delays will leave a country in the economic dark longer, and developed countries will inevitably have earlier access to COVID-19 vaccines.

The United States, which leads the world in medical innovation and research, has produced five of the most promising COVID-19 vaccinations, pumping them out at record speed thanks to the billions of emergency dollars funneled into research and development. Naturally, any US-produced vaccinations will be made available to all countries to quash the pandemic globally, but only after the United States has already secured sufficient doses for its own population.

Early access to vaccinations for developed countries presents two opportunities for the EB-5 program. First, with vaccines secured and beginning to be rolled out, it’s time for countries like the United States, Canada, and the United Kingdom to unleash their economic recovery plans. In the United States, the foreign capital from EB5 investments can aid countless companies as they rebuild or help brand-new businesses gain footing in this unstable environment, accelerating the economic recovery and producing new, full-time jobs for the millions of newly unemployed Americans.

The other important role the EB-5 program can play in 2021 is benefiting foreign investors from developing countries. Countries like China, India, and Vietnam may not have the same widespread access to COVID-19 vaccines as the United States, rendering a U.S. green card all the more appealing. Investors the world over may opt to make an EB-5 investment so they can move their life to a highly developed country with the world’s leading economy, state-of-the-art medical facilities, and a strong and early recovery from the debilitating effects of the COVID-19 pandemic.