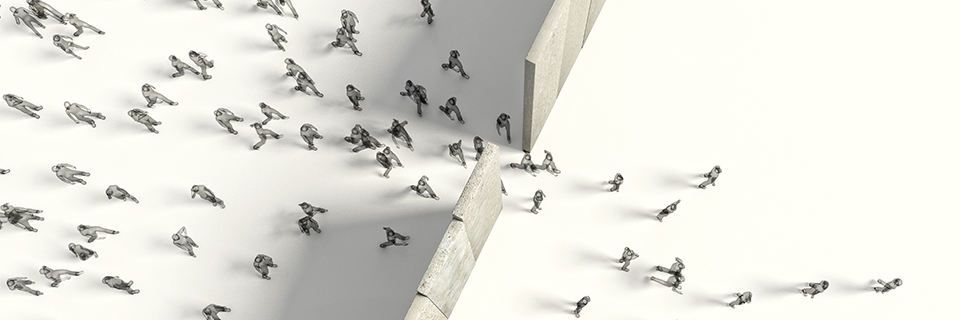

Immigration industry experts around the globe are taking time to hash out the myriad of challenges faced in recent years, how they impact this sector, and how they will likely continue to do so. In particular, the United States’ residency-by-investment initiative, the EB-5 Immigrant Investor Program, is expected to face its own unique set of challenges.

Regulatory updates rolled out in late 2019 coupled with the COVID-19 outbreak in early 2020 were some of the most significant catalysts for what have emerged as 2020 industry trends. Learn seven emerging EB-5 investment activity trends around the globe and understand the virus’s role in shaping them. Review the regulation changes implemented before the health and economic crises that ensued. Finally, take a look at how various actors participating in the program are following through.

All told, while it may seem like a volatile time for the EB-5 program, industry experts are holding on for the ride. They are confident that the shifts the industry makes in compensating for the challenges the program faced in FY2020 and will continue to face will only strengthen the program in the end.

Seven Global Trends Among EB-5 Investor Activities

There are a number of key observations from around the globe that industry experts have made in FY2020 that are likely to have significant impacts on immigration to the United States on the whole and specifically to the EB-5 Immigrant Investor Program going forward.

- Latin America’s pandemic and currency issues have deflated EB-5 stakeholders’ hopes for the market.

- Due to political strife between China and Hong Kong, investment activity wasn’t as strong from the special administrative region (SAR).

- Recent years have shown Vietnam as a rising star in the EB-5 immigration sphere behind China’s waning EB-5 investment activity.

- Although Vietnamese EB5 investment activities have generally begun to increase, the pandemic has curtailed much of the country’s investor undertakings (as to be expected).

- South Korea is garnering a lot of industry attention for the activities of a handful of key migration agents and their work with a number of sub-agents, which haven’t appeared to be hampered by the pandemic.

- Investors from Russia and others in the Commonwealth of Independent States in the region have shown a significant amount of interest in U.S. immigration programs

- South Africa has been acknowledged as a likely up-and-coming EB5 investment player to keep an eye on.

COVID-19’s Role in 2020 EB-5 Industry Trends for the U.S.

The fact of the matter is, the COVID-19 pandemic led to a liquidity crisis to which very few people are immune. Naturally, this has drastically reduced the number of eligible EB-5 applicants who can readily allocate capital to an EB5 investment project.

Even the highest-net-worth candidates are re-evaluating their desires for residency in the United States. Ultimately, the impact the virus has had on EB-5 investors really depends on the market. Some foreign nationals are looking at the challenges the pandemic has caused within U.S. borders. Others are realizing they would prefer to have a place to go in times of crisis in their country of origin.

Another shift that may appear insignificant on its surface is that EB-5 program issuers have found it necessary to adjust their day-to-day business dealings to the digital space in a bigger way in the wake of the pandemic. A good example is marketing. Where program marketers used to be able to bring a project to market in a traditional way – person-to-person meetings, etc. – they’ve had to shift to a more digitized approach – think video conferencing, for instance. That said, there may be a long-term benefit to maintaining some of the digital shifts meant to temporarily aid in the continuation of their efforts.

By and large, public health and political issues seem to have propelled much of the EB-5 participant activity in 2020. However, these two catalysts aren’t the only ones impacting the industry.

Three Impacts of EB-5 Regulation Updates from November 2019

Enough time has passed since the EB-5 program regulation updates were implemented in November 2019 that several impacts have revealed themselves, including an increase in the amount of EB5 investment capital required to participate and stricter guidelines on targeted employment area (TEA) requirements, which have shifted the EB-5 investor pool in some notable ways.

Fewer, More Affluent EB-5 Investors

Sheer mathematics has led to fewer, more affluent investors. The minimum investment required to participate in the EB-5 investment program nearly doubled from $1 million to $1.8 million (or from $500,000 to $900,000 when investing in a TEA). Furthermore, some experts believe that fewer investors in the EB-5 program also means the necessary strengthening of the safeguards that protect them.

Greater Levels of Sophistication

Increased minimum EB5 investment amounts and increased safety measures have also yielded a seemingly more sophisticated group of participants. On the investor side, participants have paid greater attention to due diligence and investment safeguarding than in past years. As for stakeholders, there are fewer of them managing more of the business, which has heightened their stakes, bringing out higher levels of sophistication there as well.

Expansion of EB-5 Investments into Rural Areas

Stricter target employment area (TEA) requirements have disqualified most EB-5 projects that previously maintained TEA designation, while new geographical areas eligible for TEA status have opened up. Overall, these shifts have led to a greater percentage of investors infusing EB-5 capital into program-approved rural projects. Under new rules, EB-5 professionals are also getting creative with how to gain new TEA designation.

How EB-5 Project Developers Are Reacting to Regulation Changes

Advisors on the project development side are likely to begin counseling developers on effectively observing the market and rising to meet potential investors’ needs as opposed to simply putting together a project that works best for themselves. Some of the advice already surfacing on what a savvier EB-5 investment participant might be looking for when selecting a program-approved project includes topics such as:

- Being able to meet tighter investment requirements like job creation and TEA designation

- Guaranteeing I-526 completion and shoring up odds of approval

- Having a clear understanding of the impact of COVID-19 on development in specific sectors like hospitality, travel, and retail

Over the long haul, experienced professionals in the residency-by-investment space around the globe will be eyeing individual markets and the shifting socioeconomic conditions investors face. This widening lens among investors and their counterparts is likely to result in increased competition against the United States from other strong residency candidates, like their neighbor to the north, Canada, or New Zealand.

President of LCR Capital Partners Joseph Haggenmiller made an important note to consider as well. He said that due to current political administration and rhetoric, the appeal among affluent families around the world of moving to the United States has waned. He believes the United States may not be a number one destination choice any longer. Changes are happening politically, however, and time will tell. The hope remains that a shift back to a more welcoming attitude toward immigration by the U.S. government would help repair the damage to the nation’s reputation as a dream destination to work, live, and raise a family.

What EB-5 Program Facilitators Can Expect in the Near Future

Ultimately, what is crystal clear for all of us working in the EB5 investment space is that the markets with economic stability are going to fare better sooner if they aren’t doing well already. Markets have never advanced on the same timeline in the history of the EB-5 investment program, and that fact remains the same now. Industry professionals are, however, saying that emerging and underdeveloped markets will likely face greater challenges in recovering from the impacts of the global pandemic. This means larger, better-developed foreign markets with more stable economies will be better target markets for EB-5 program participation in the interim.

In fact, many EB-5 professionals are already beginning to hedge their bets and batten down the hatches for a winter wave of the COVID-19 pandemic. Despite the challenges that seem to keep coming – global health and economic crises, tightened EB-5 investment requirements, the waning reputation of the United States in general – industry players remain hopeful. Stakeholders would do best to follow their lead as we in the industry continue to navigate ourselves to recovery.