Given that the EB-5 Immigrant Investor Program is designed to bestow U.S. permanent residency rights upon applicants in exchange for a successful EB-5 investment in a qualifying project, U.S. citizens are ineligible to participate. Foreign nationals residing in the United States on other visas may also overlook the program, since they’ve already attained residency rights. But temporary U.S. residents are just as welcome to participate in the popular residency-by-investment program as foreign nationals living overseas, and if they hope to make the United States their permanent home, an EB5 investment is a thoroughly wise investment.

The Benefits of Permanent Residency over Temporary Status

Though millions of foreign nationals dream of living in the United States, the dream is unattainable for most. Immigration is difficult, and even those who secure U.S. visas are only granted a temporary stay. The United States doles out thousands of H-1B employment visas and F-1 student visas each year, but both come with stringent restrictions on the activities the visa holder can undertake during their stay, and both are temporary, nonimmigrant visas, obliging the foreign national to return to their home country when their visa expires. Indeed, most immigrants to the United States can only stay temporarily, and depending on their visa, they may be barred from taking on employment, educational opportunities, or making multiple entries into the United States.

A permanent resident, conversely, enjoys most of the same rights and freedoms as U.S. citizens. A green card holder can live, work, and study anywhere in the 50 states without restriction. They can access the world-class health facilities that the United States boasts, they can more easily gain admission to world-renowned U.S. universities, and they may even be eligible for in-state tuition rates, which can generate thousands of dollars in savings. Upon retirement, they can cash in on their pension benefits both from overseas and from the United States, and they may qualify for Medicare and other Social Security benefits.

Making an EB-5 Investment from within the United States

If a foreign national is already residing in the United States on a different visa, be it an H-1B, an F-1, or anything else, they have the option of making an EB-5 investment and obtaining a green card. With a green card, the restrictions around employment and education fall away, and they can live indefinitely anywhere in the United States. Their immediate family members—spouse and unmarried children younger than 21—are eligible to receive green cards alongside them.

An example is an H-1B worker. H-1B visa holders may have an opportunity to obtain permanent residency, but it could take more than a decade, and they would be subject to harsh employment restrictions and visa regulations for the entire duration. With an EB5 investment, an H-1B visa holder could instead receive their green card in a few years, securing permanent U.S. residency rights to confidently settle down in the United States.

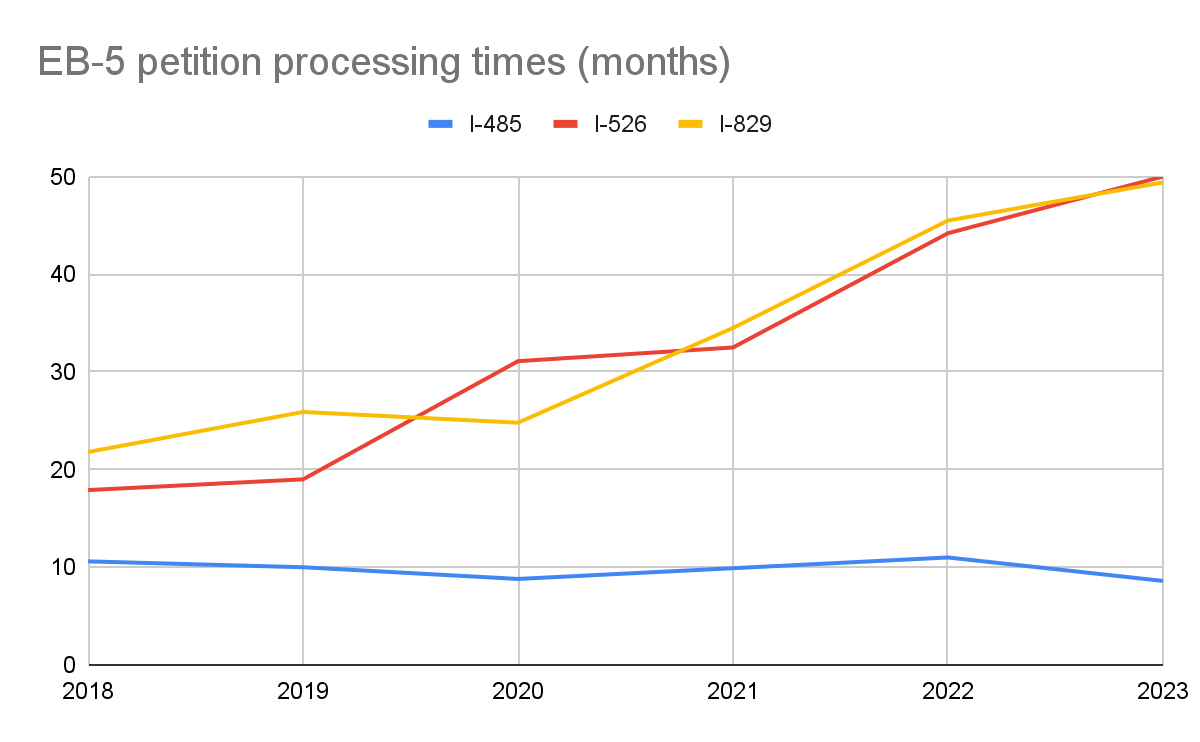

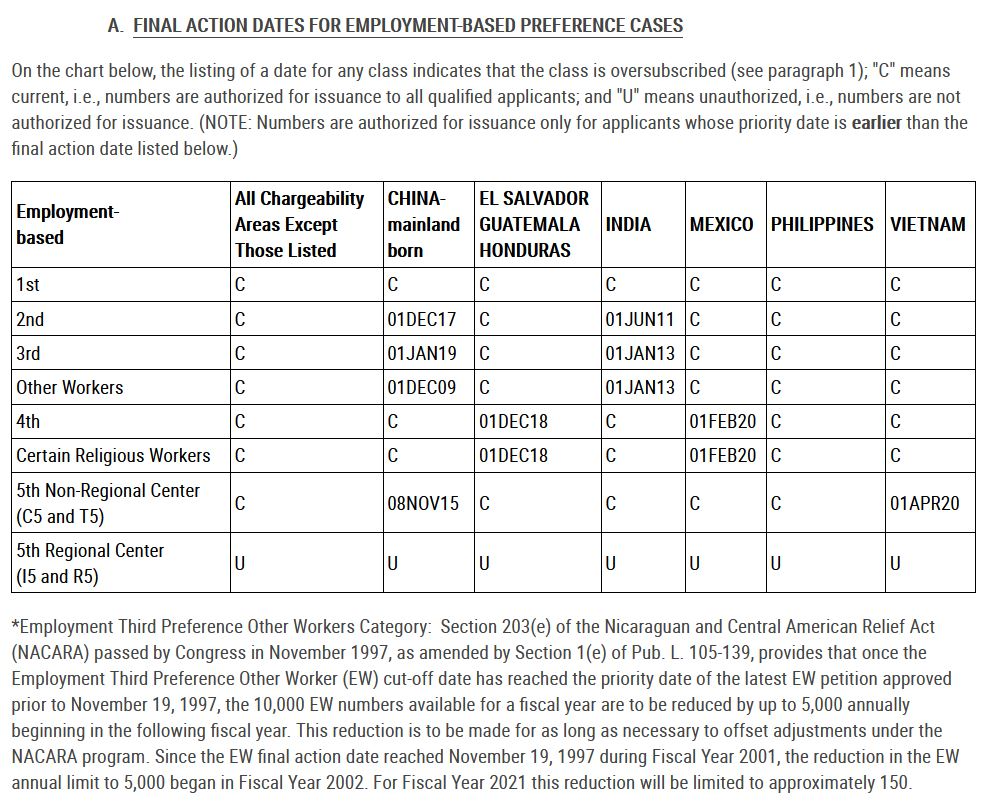

The process of making an EB-5 investment from inside the United States is essentially no different from the process for overseas investors, although domestic EB-5 investors can more easily travel to the site of their project for an in-person inspection. An investor, domestic or overseas, must select a qualifying EB-5 project and commit the minimum required EB5 investment amount to it—either $900,000, if the project is in a targeted employment area (TEA), or $1.8 million if it is not. The investor must then compile an I-526 petition, in which they must document the lawful sources of their EB-5 investment capital, as well as justify the TEA status of their project, if they are investing the lower amount of $900,000. Throughout the investment period, the investor must keep their investment capital at risk and, at the end of their two-year conditional permanent residency period, prove that their EB5 investment created at least 10 new full-time jobs for U.S. workers.

Whether an investor lives in the United States or another country, they have two choices for their EB-5 investment: direct or via an EB-5 regional center. The regional center route is the more popular option, as it allows investors to benefit from the extensive experience and expertise of the regional center operators and relaxes the job creation requirements by allowing indirect and induced jobs to count toward the 10 necessary jobs.

Adjusting Status to EB-5

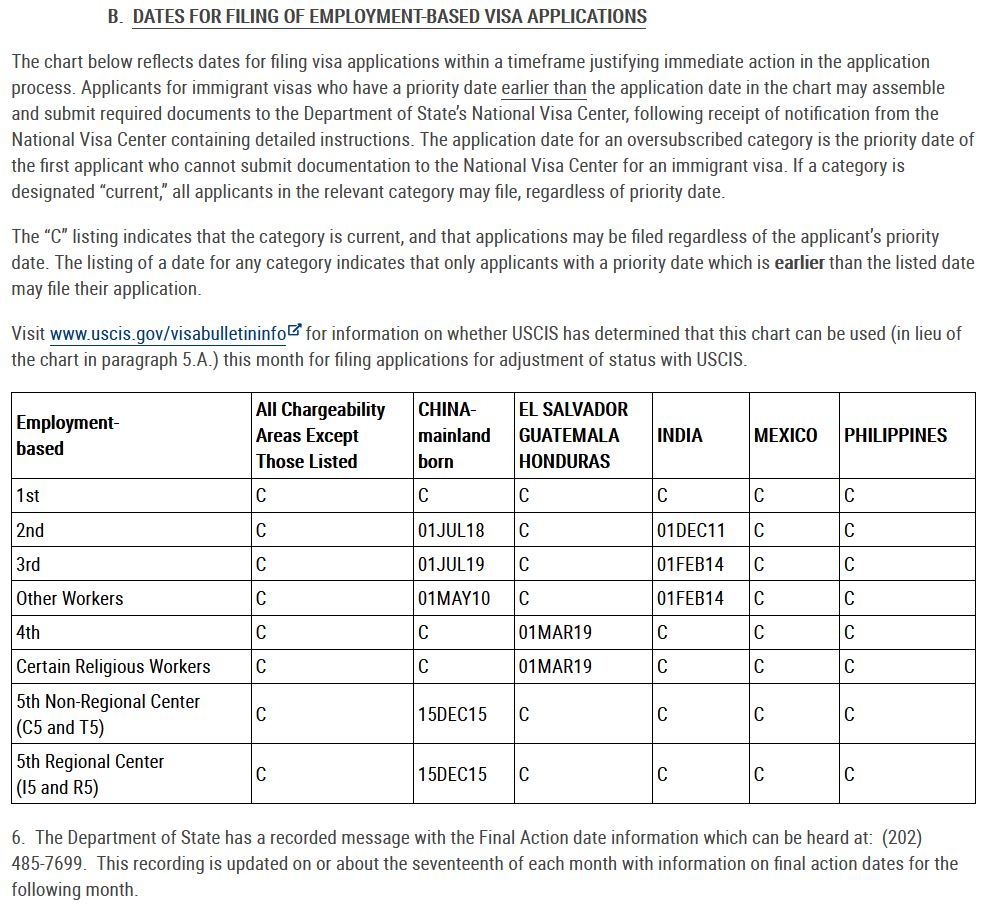

After a domestic EB-5 investor’s I-526 petition is approved, they may file Form I-485 with United States Citizenship and Immigration Services (USCIS) to adjust their status from their nonimmigrant visa to an EB-5 green card. This is a much quicker and easier process than what overseas investors face—EB-5 applicants filing from abroad must submit a DS-260 to the U.S. embassy or consulate in their country and undertake a visa interview before receiving their EB-5 visa. Some domestic applicants adjusting their status may also have to undertake a visa interview, but it’s not required in all cases.

It can take some time for USCIS to process an I-485 petition to adjust immigration status, but domestic EB-5 investors have options to increase their freedom while they wait. By filing an I-131 petition, a domestic EB-5 investor can obtain authorization to travel internationally and return to the United States while their I-485 is pending. Similarly, an I-765 petition allows an investor to obtain employment authorization, enabling them to work freely in the United States as they await their permanent resident card. An I-765 petition may not be necessary for H-1B visa holders who plan to maintain their job, but it may be indispensable to an investor who graduates from a U.S. college on an F-1 visa.