United States Citizenship and Immigration Services (USCIS) has released the Visa Bulletin for August 2021, which contains thrilling news for the EB-5 investment industry. In many cases, the monthly Visa Bulletin reports long, stagnant wait times for EB-5 investors from backlogged countries. In contrast, the August 2021 Visa Bulletin has positive news for Chinese and Vietnamese investors.

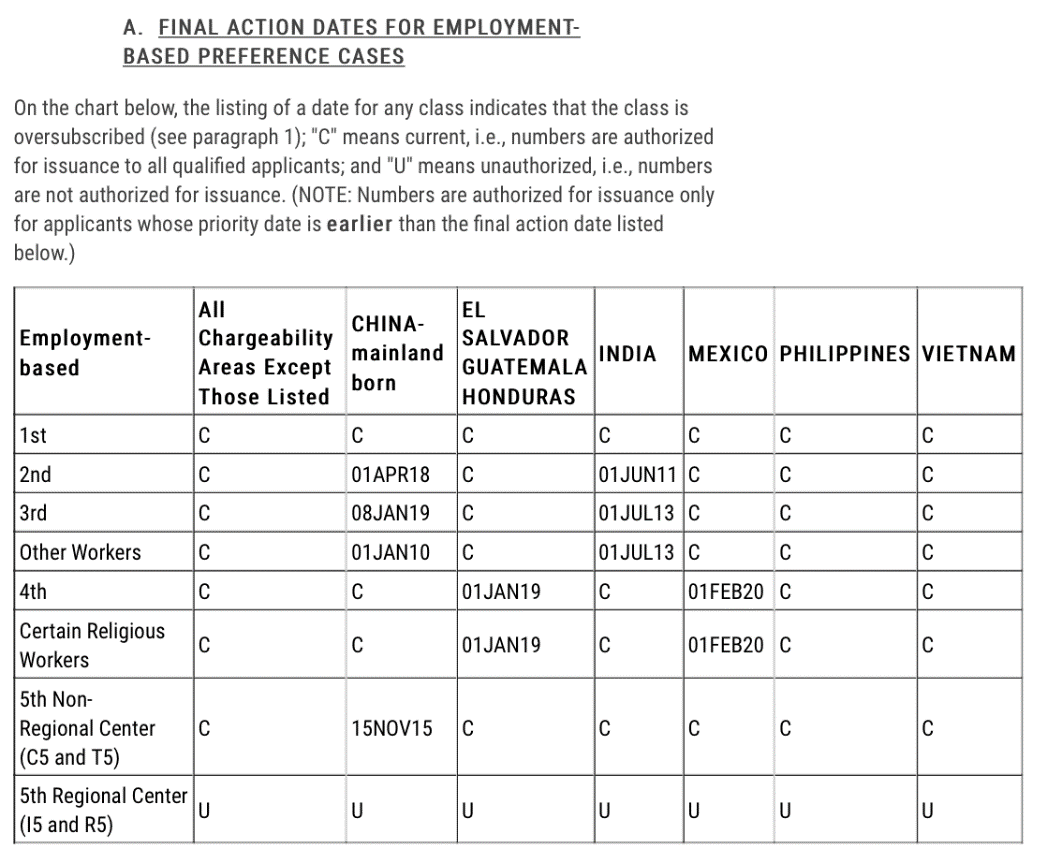

Chart A of the Visa Bulletin, “Final Action Dates for Employment-Based Preference Cases,” shows that Vietnam has finally achieved “C” (current) status. This means that the long backlog for Vietnamese EB-5 investment visas has been resolved, and Vietnamese investors no longer have to wait until the final action date catches up with their I-526 priority date. Now, every Vietnamese investor with an approved non-regional center I-526 petition is eligible to apply for conditional permanent resident status through the EB-5 program. This is certainly wonderful news for all Vietnamese foreign nationals who have made an EB-5 investment. Vietnam had been experiencing a visa backlog since 2018, but its final action date leaped forward by two years in the July 2021 Visa Bulletin.

China’s situation has also taken a positive turn: the final action date for Chinese EB-5 investments advanced one week from November 8, 2015, to November 15, 2015. This may seem like a very small step forward, but any improvements in the final action date for China are always welcome—after all, the final action date for China remained the same for almost a year prior to the June 2021 Visa Bulletin. The one-week jump in the Chinese final action date follows an even more significant two-month advancement in the July 2021 Visa Bulletin.

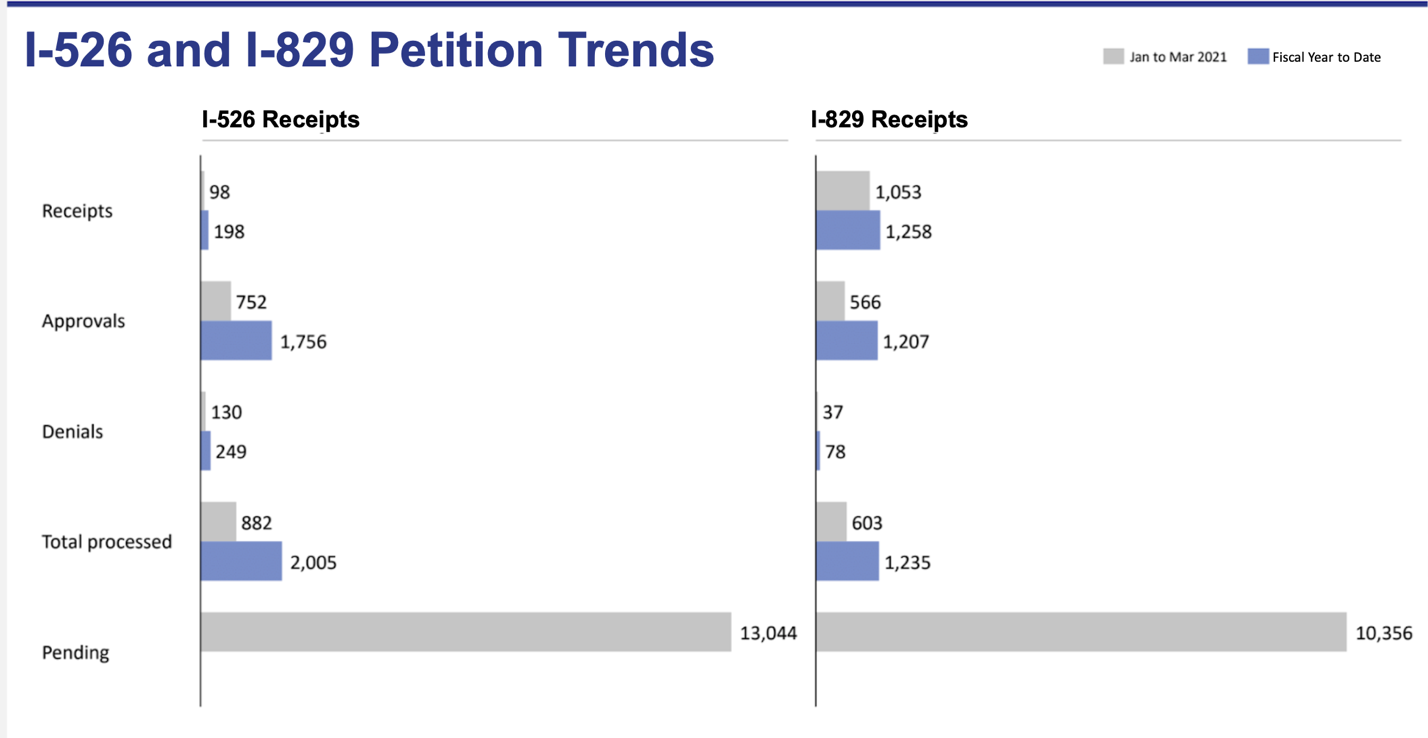

Foreign nationals planning an EB5 investment should keep in mind that the final action dates for regional center investments are all marked as “U” (unauthorized) because of the June 30 expiration of the regional center program. As of that date, USCIS is not accepting I-526 petitions associated with a regional center. Still, USCIS has asked regional center EB-5 investors to continue to answer requests for evidence (RFEs), which leaves the door open to a future reauthorization of the program. In fact, the regional center program may be reauthorized as part of a fall 2021 spending bill.

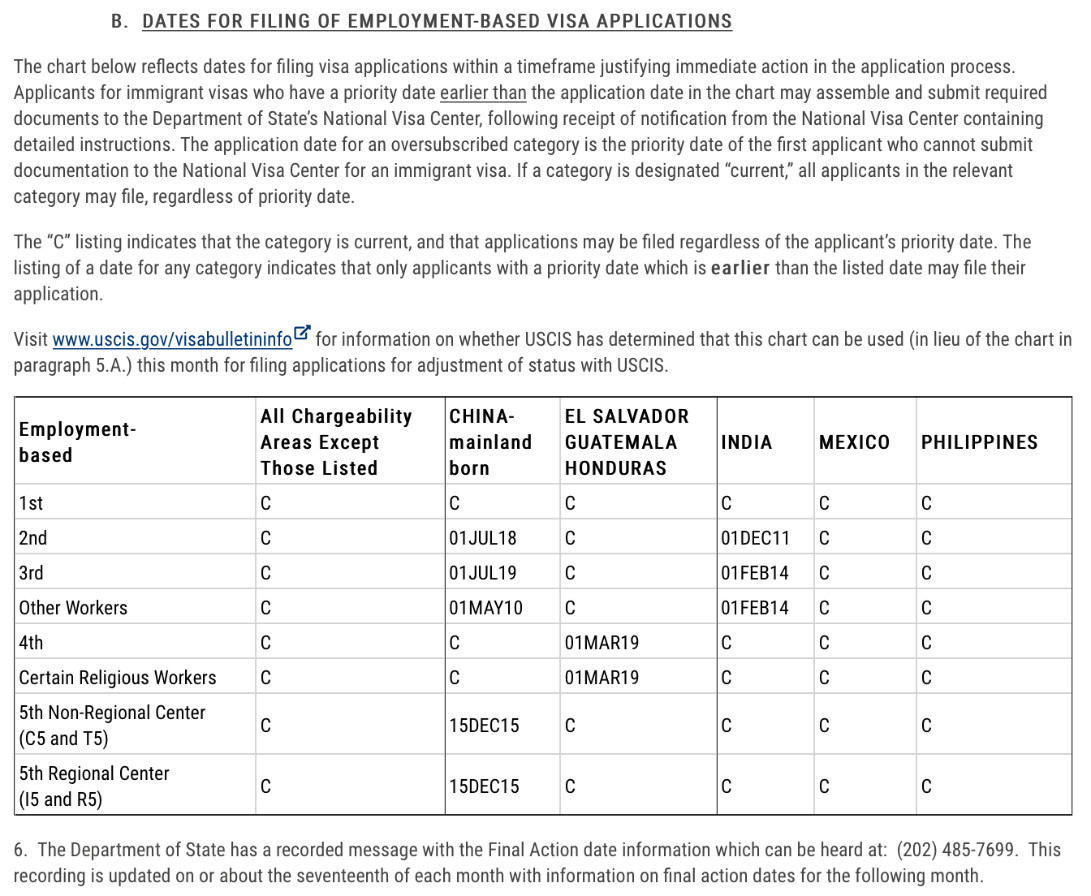

In contrast to Chart A, Chart B of the August 2021 Visa Bulletin, “Dates for Filing of Employment-Based Visa Applications,” is devoid of encouraging news. China’s date for filing of December 15, 2015, has not advanced in over 12 months. This means that Chinese foreign nationals who have made an EB-5 investment and have an I-526 priority date after December 15, 2015, are not allowed to file their visa applications with the National Visa Center (NVC).

The above news indicates that the EB-5 investment industry is changing rapidly. If you are considering an EB-5 investment, schedule a free consultation to learn more about available opportunities. EB5AN is here to guide you through the EB5 investment process and help you enjoy the many benefits of relocating to the United States.