The U.S. government’s administrative decisions regarding the EB-5 Immigrant Investor Program have occasionally resulted in sudden or unexpected changes to the program’s regulations. For example, the EB-5 industry was rocked by the news that the regional center program had expired on June 30, 2021. Under the program, foreign nationals were able to make EB-5 investments through economic units known as regional centers. EB-5 investment projects affiliated with regional centers enjoyed less strict job creation requirements—they were allowed to count direct, indirect, and induced employment. Therefore, foreign nationals who made a regional center EB-5 investment could create the 10 required jobs more easily than if they were only counting direct employment. Further, these investors only had to show United States Citizenship and Immigration Services (USCIS) that their EB-5 investment funds had been spent according to the regional center project’s business plan. Regional center projects consequently became the most popular way to make EB-5 investments.

However, this changed after the Senate failed to pass the EB-5 Reform and Integrity Act, a bill that would have reauthorized the regional center program through 2026. Senator Lindsey Graham blocked the request for a unanimous consent vote on the bill. The Senate went on summer recess, and the regional center program thus expired on June 30, 2021.

Despite this temporary setback, foreign nationals planning an EB-5 investment can rest assured that the EB-5 program is still up and running. Given the program’s many economic benefits, the U.S. government will likely continue to support EB-5 investments. Interested foreign nationals can still invest in EB-5 projects directly and apply for permanent resident status.

What Are Direct EB-5 Investments?

Direct EB-5 investments are made not through a regional center but directly in the EB-5 project in question. They differ from regional center investments in many other ways. For example, a foreign national who makes a direct EB5 investment is usually much more involved in the day-to-day operations of the business. Direct EB-5 investors gain significant control over their investment but have to spend significant time and resources overseeing the business. As a result, direct investors typically want to make sure that their EB-5 investment yields significant returns, and they are usually responsible for making sure that the project complies with all applicable laws. In contrast, many regional center investors are only interested in gaining permanent resident status through their EB-5 investment and are not heavily involved in business operations.

Perhaps the most important difference between direct and regional center investments is the way job creation is calculated. As mentioned previously, regional center projects can count direct, indirect, and induced jobs. On the other hand, non-regional center EB-5 projects can count only direct employment. Direct employment involves hiring employees on the EB-5 project’s payroll—these must be full-time jobs and last at least two years to be counted toward the requirement of 10 total jobs. For the most part, such jobs are either ongoing operational positions associated with the EB-5 project or construction jobs. In addition to these guidelines, USCIS sets out many other criteria for directly created jobs.

Moreover, foreign nationals who are looking for direct investment opportunities should note that non-regional center EB-5 projects are structured very differently from regional center projects. A major difference is that the new commercial enterprise (NCE) and the job-creating entity (JCE) must essentially be the same. The NCE is the business that receives the EB-5 investment, and the JCE is the project development entity in charge of creating the required jobs. Due to this requirement, the sources of funds, investment terms, and role investors play can be radically different for direct and regional center projects.

All of the above information indicates that making a direct EB5 investment requires careful planning and significant effort to ensure that the project complies with USCIS guidelines. It can be difficult for EB-5 investors to keep track of the plethora of regulations governing direct investments, so they would do well to hire experienced EB-5 consultants and a knowledgeable immigration attorney. The expertise these professionals provide will prove to be indispensable. Many EB-5 investors who did not work with EB-5 professionals or take the time to learn about USCIS regulations were unable to receive their coveted permanent resident status.

Historical Trends in Direct EB-5 Investments

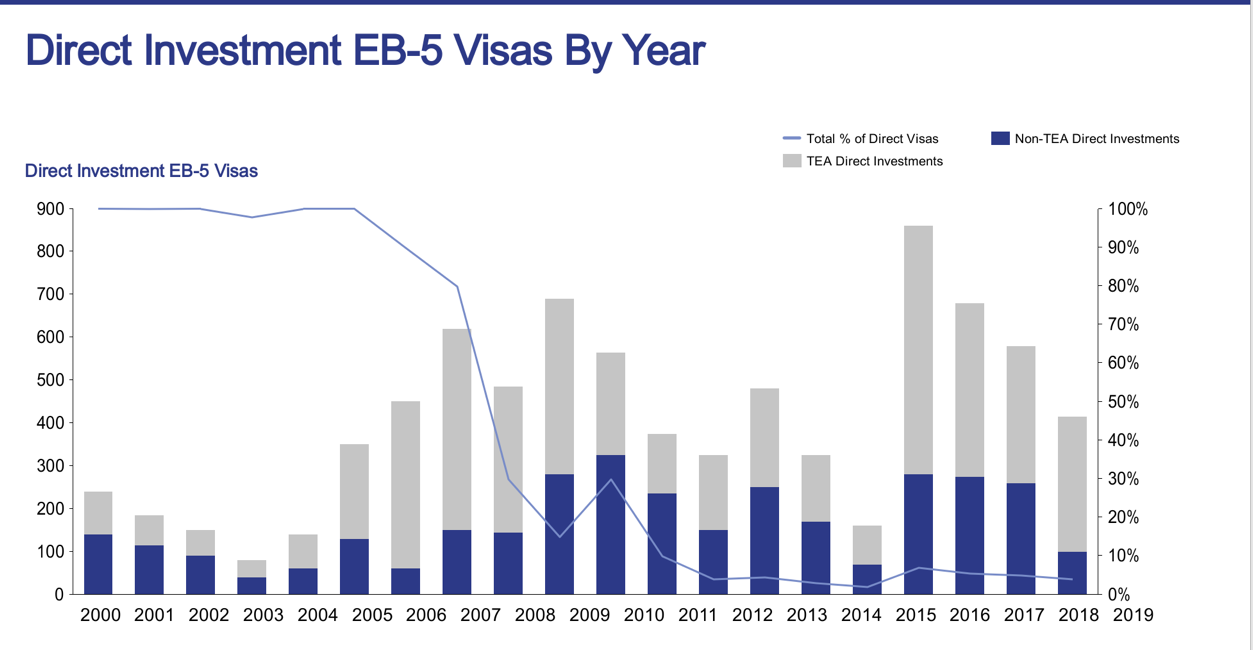

The following graphic shows several intriguing trends in the history of direct EB-5 investments:

Even though regional center investments have usually been more common in recent years, direct investments have enjoyed several periods of popularity—until the 2008 economic crisis, it was more common for EB-5 investors to receive their visas through direct investments. 2015 was another positive year for direct investments because the regional center program’s looming expiration date motivated foreign residents to choose non-regional center projects, which have no expiration date.

Direct EB-5 investments will likely surge in popularity given the temporary suspension of the regional center program, and EB-5 investors will be able to take advantage of the reduced minimum investment amounts of $500,000 for targeted employment area (TEA) projects and $1,000,000 for non-TEA projects. As these investment amounts may be raised, foreign nationals interested in making an EB5 investment should act quickly. Book a free consultation with EB5AN to learn more about available projects.