Form I-485 allows foreign nationals living in the United States to apply to adjust their immigration status to lawful permanent resident. This allows them to receive a Green Card. Applicants can remain in the United States while they await adjudication of their petitions.

In this article, we will explain everything you need to know about Form I-485. We will also introduce you to the EB-5 visa program, which is one of the best ways to get a U.S. Green Card.

What Is Form I-485?

Foreign nationals can file Form I-485, Application to Register Permanent Residence or Adjust Status, to change their non-immigrant status to lawful permanent resident status. This means they will become a U.S. Green Card holder.

To do so, they must meet a series of U.S. Citizenship and Immigration Services (USCIS) requirements.

Let’s take a closer look at who can and cannot file this important form, and what a successful application looks like.

Who Can Apply?

A successful I-485 applicant must meet a series of eligibility requirements.

Most importantly, an I-485 petitioner should be lawfully and physically present inside the United States. They must have entered the country lawfully; in other words, they were admitted or paroled by a U.S. immigration officer, entered with a valid visa, and were carrying proper documentation. An immigrant visa must also be available for such an applicant, per the USCIS Visa Bulletin.

Beyond these requirements, foreign nationals who fall into one of several USCIS eligibility categories may apply for a Green Card. The main ones are:

- Family-based.

- Employment-based.

- Humanitarian.

A successful applicant must also avoid certain conditions or activities that may get their petition rejected.

Who Cannot Apply

Some foreign nationals are not eligible to receive Form I-485 approval. Individuals who demonstrate one or more of the following “inadmissibility grounds,” as described in the Immigration and Nationality Act, are likely to be disqualified from getting this form approved.

- Major health problems, including carrying certain infectious diseases.

- Criminal record that includes being convicted of a serious crime.

- Security concerns that suggest a threat to U.S. national security.

- U.S. immigration law violations.

- Other miscellaneous concerns at USCIS’ discretion.

Furthermore, USCIS will generally not approve Form I-485 from an applicant who has done one or more of the following:

- Entered the United States as a crewman.

- Entered the United States as an informant or witness.

- Entered the United States while traveling through it to visit a different country.

- Been subjected to removal proceedings because of terrorist activities.

However, not all of the aforementioned issues will automatically cause an applicant’s Form I-485 to be denied. In some cases, you may be eligible to receive a waiver.

Consult an experienced immigration attorney to determine whether a waiver may apply to your particular circumstances.

Step-by-Step Instructions: How to Compile and File Form I-485

Be prepared to complete each of the following steps and provide the following types of evidence to file Form I-485.

Use the Latest Version

Look up and fill out the latest version of Form I-485, using the USCIS website. Also be sure to study the filing instructions closely.

Should You File Online or by Mail?

At the time of writing, it was not possible to file an I-485 electronically. However, it is possible to file other related forms online, such as the N-400, Application for Naturalization and I-130, Petition for Alien Relative. To do so, create an account on the USCIS webpage and sign up to receive updates using your alien registration number.

The I-485 must be printed and filled out as a hard copy. Send it to the appropriate filing location. To do so, look up the lockbox address that corresponds to your physical address and mail it in to a USCIS service center or USCIS field office when ready.

Gather Documentation

You must provide a great deal of evidence and many supporting documents to get approval from USCIS of your Form I-485. The time needed to complete this step will vary between individuals. Evidence required includes:

- Proof of eligibility: If you file Form I-485 concurrently with your I-526/I-526E immigrant petition, include a copy of the I-526/I-526E. If you do not engage in concurrent filing, include a copy of Form I-797, Approval or Receipt Notice. This is an acknowledgment from USCIS that it received the immigrant petition. Either document shows the individual may apply to adjust status.

- Personal records: Copies of your birth certificate, marriage certificate (if you are married), and divorce certificate (if you are divorced).

- Photos: Two of the same passport-style photos (glossy and on a white background) taken during the 30-day period before you filed your I-485.

- Passport and immigration documents: Copies of every page of your passport (or a different government-issued identity document) and documentation proving you were inspected by an immigration officer and admitted or paroled into the United States.

- Criminal history documentation: Records of your criminal history, if you have one.

- Medical documentation: Records of your vaccinations and medical exams.

- Biographic information: Each eligible immediate relative should complete and file Form I-130, Petition for Alien Relative. The day that USCIS receives Form I-130 is called the priority date.

Include the Correct Filing Fee

You must also include the correct filing fee. The amount is $1,440 (including biometric services), effective April 1, 2024.

Use the Correct Mailing Address

Applicants must mail hard copies of their I-485 petitions to the appropriate USCIS lockbox.

A lockbox facility collects documentation and filing fees. It also makes a preliminary decision on whether to accept or reject of the application based on the fee paid. If you are rejected at this point, you probably sent the wrong fee amount.

Petitioners should file their I-485s by mail or courier service to one of the lockboxes below, depending on the delivery service they select. Addresses change from time to time, so check the list of USCIS direct addresses for the latest guidance before submitting your form.

USCIS Dallas Lockbox

U.S. Postal Service (USPS)

USCIS

Attn: I-526/E

P.O. Box 660168

Dallas, TX 75266-0168

FedEx, UPS, and DHL Deliveries

USCIS

Attn: I-526/E (Box 660168)

2501 S. State Highway 121 Business

Suite 400

Lewisville, TX 75067-8003

Attend a Biometrics Appointment and Green Card Interview

USCIS may contact you to set up a biometrics appointment. If so, they will need you to provide photographs, fingerprints, and/or your signature.

Several months later, USCIS may also reach out to set up an interview. You can expect them to confirm your identity and ask you additional questions related to your I-485 during the meeting.

If applicable, USCIS will inform you of the time, date, and location of your appointments.

Receive Employment Authorization Document (EAD)

If you need to get a work permit, file Form I-765, Application for Employment Authorization. Submitting this means you can request an EAD.

Once your I-485 is approved, an EAD is not required if you wish to work in the United States. Lawful permanent residents of the United States do not need one. The Green Card itself is evidence of employment authorization.

Form I-485 Estimated Processing Times

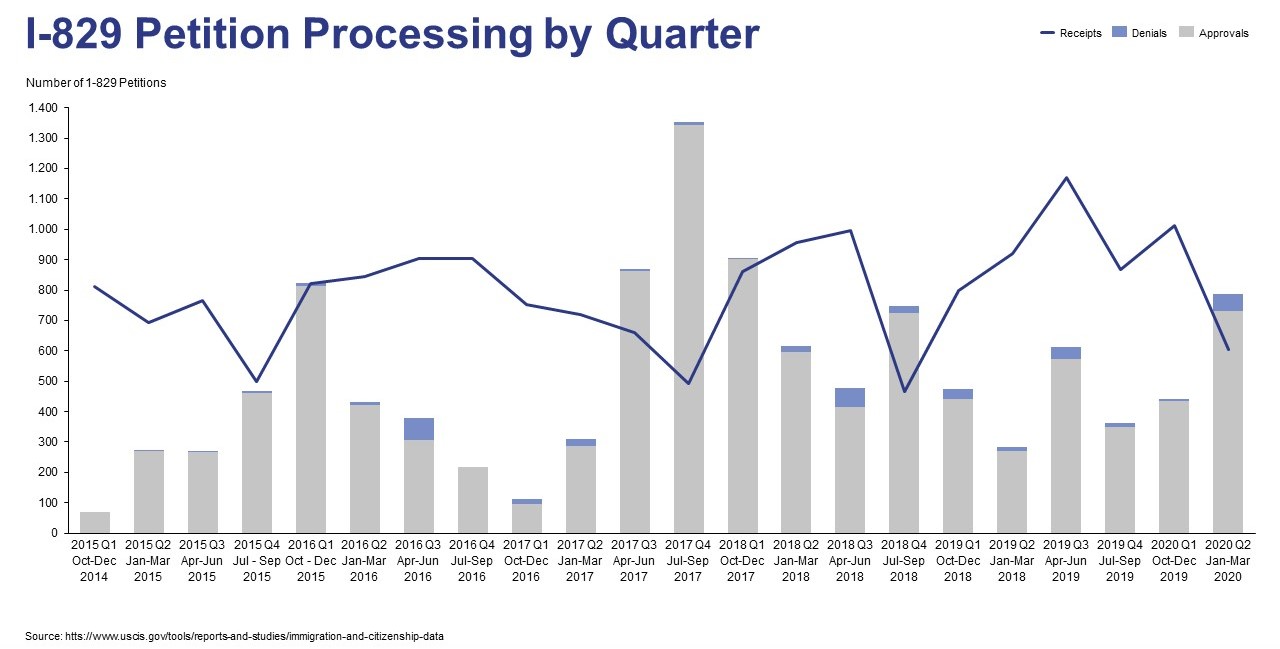

An adjustment to your U.S. resident status is a huge and often lengthy step. It’s not uncommon for EB-5 participants to wait years to secure their Green Cards.

Factors such as different caseloads between local USCIS offices, the basis for the application, and whether the paperwork is correct and complete can cause Form I-485 processing times to vary widely among applicants.

For example, USCIS adjudicates 80% of employment-based I-485 filings submitted to the California Service Center within 20.5 months. However, it decides on 80% of employment-based I-485 applications filed with the Orlando, Florida USCIS field office within 38 months—almost twice as long.

USCIS calculates these estimated processing times based on how long it took them to adjudicate 80% of their cases during the preceding six months and updates the figures on the USCIS website regularly.

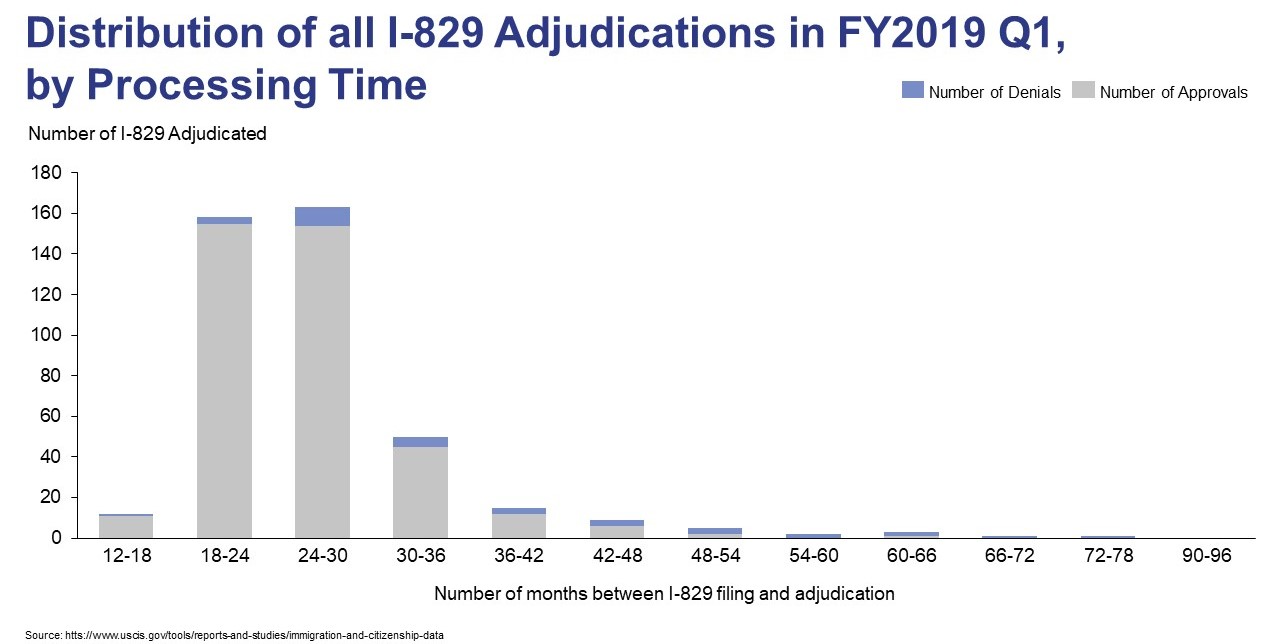

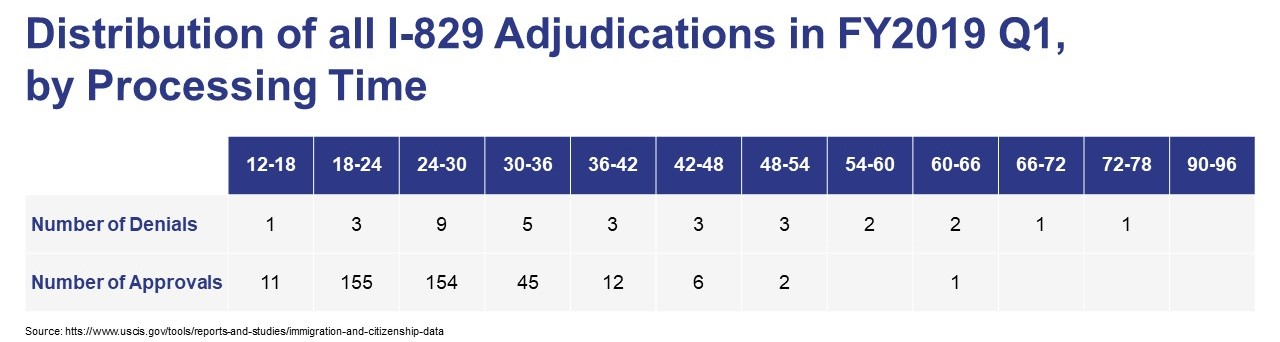

Within two years of getting Form I-485 approved and receiving conditional permanent residency, you must file an I-829 petition to have those conditions removed and become a U.S. permanent resident.

Save Time with Concurrent Filing of Form I-485 and Form I-526

Thanks to the passage of the EB-5 Reform and Integrity Act of 2022, qualified investors living in the United States on non-immigrant visas may concurrently apply for adjustment of status while filing their I-526E petitions.

Concurrent filing allows EB-5 investors to enjoy the benefits of being lawful permanent residents.

While they wait for their I-485s to be adjudicated, foreign investors and their families can apply for work authorization and travel permits. The latter, also known as an advance parole document, permits a noncitizen to return to the United States after completing temporary travel outside of the country.

The EB-5 Immigrant Investor Program: One of the Best Ways to Get a Green Card

If you are an immigrant already living in the United States, you may be able to obtain your Green Card by making an EB-5 investment.

Each year, numerous foreign nationals invest in the EB-5 program domestically, receiving U.S. permanent resident status for themselves and their qualified immediate family members upon successful completion.

Let’s explore in greater detail what this program is, who may qualify to participate, and how to complete the EB-5 process successfully.

What Is the EB-5 Immigrant Investor Program?

Foreign nationals with the means to invest foreign capital proven to be lawfully obtained in an approved EB-5 project have an opportunity to secure Green Cards for themselves and their eligible family members through the EB-5 Immigrant Investor Program.

This immigrant visa program is a pathway toward U.S. permanent resident status that has been available to foreign investors since the 1990s. It was proposed as a solution to a downturned U.S. economy and functions as a pathway to Green Cards (and citizenship, if desired) in return for an infusion of foreign capital into program-approved projects across the country.

Minimum EB-5 Investment Requirements

In most cases, the minimum requirements to gain U.S. permanent resident status through the EB-5 program are as follows:

- A $1,050,000* investment in a program-approved new commercial enterprise (NCE).

- The creation of 10 new full-time jobs for U.S. workers.

- Capital proven to have derived from lawful sources that remains “at risk” throughout the investment period.

*If an investment is made in a designated TEA (targeted employment area), then the minimum investment required is reduced to only $800,000.

Essentially, there are seven basic steps in the EB-5 investment process. The next section provides a brief overview of how the EB-5 investment process works through a firm like EB5AN.

Seven Steps of the EB-5 Investment Process with EB5AN

EB-5 investors are not required to consult an attorney or firm that specializes in EB-5 investment processing. That said, many foreign investors understand the value in having access to experienced professionals for questions and concerns. Additionally, working with a specialized EB-5 investment team is a way to ensure a program participant’s EB-5 investment is handled appropriately throughout the process.

Here is how the investment process works through EB5AN:

- Initiate the EB-5 investment process.

- Prepare the supporting documentation for your capital investment.

- Finalize your EB-5 investment partnership.

- Make the appropriate capital funds transfer.

- Petition for your conditional Green Card status.

- Conduct the necessary government interviews and/or request an adjustment of status.

- Complete your program terms, petition for the removal of conditions, and recuperate your EB-5 investment (plus any gains your investment may have realized).

Most investors can have their immigration status adjusted within just a few years. However, navigating the complexities of the program is not always easy.

When the EB-5 Program Can Become Complex

While the EB-5 program provides one of the quickest routes to a U.S. Green Card, every step of the journey has its own set of rules, which can be tricky.

For example, processing delays are common. However, most investment terms are not so flexible. When an investment period extends beyond the funding terms, an option to redeploy EB-5 capital to maintain the required at-risk status may seem like the best choice.

For these reasons, it is always advisable to partner with an experienced EB-5 attorney to ensure your immigrant visa journey toward a Green Card is as smooth as possible.

Partway through their EB-5 journey, investors who meet all of the EB-5 investment requirements may seek to update their immigration status through Form I-485, which we addressed earlier.

Save Time and Effort with EB5AN

Adjusting your immigration status via Form I-485 is just one step in a broader EB-5 process. Receiving lawful permanent residence in the United States will open many doors for you and your family.

However, the EB-5 process can be quite difficult and risky for those who are inexperienced and go it alone. Mistakes can lead to denials. To give your application the best odds of approval, be sure to work with a professional team.

An industry leader, EB5AN has helped more than 2,300 families from 60 countries relocate to the United States as lawful permanent residents. Our expert team has more than a decade of experience, and offers clients first-rate, low-risk EB-5 regional center projects with 100% USCIS project approval rate to date.

If you have questions about anything from how to select a project and seek legal counsel to the implications of becoming a Green Card holder, book a call with us today to receive in-depth support from our EB-5 team.