Making an EB-5 investment is one of the best ways a foreign national can pave the way to permanent immigration to the United States. EB5 investments are relatively straightforward and are open to nationals of any country, as long as they possess the capital means to make an EB-5 investment. However, it’s not quite as easy as funneling capital into a qualifying EB-5 project and relocating permanently to the United States. EB-5 investors do face stringent requirements that shield against fraudulent activity and ensure the EB-5 Immigrant Investor Program benefits the U.S. economy as originally intended by Congress.

Failure to meet the requirements of the EB-5 program generally results in the denial of an investor’s I-526 petition or I-829 petition, depending on where in the EB5 journey the infraction occurs. United States Citizenship and Immigration Services (USCIS) may first issue a request for evidence (RFE), however, if the information in an applicant’s petition is unclear or inconsistent, giving the investor a second chance to clarify their fulfillment of the program requirements. For the most part, an investor can satisfy the requirements by being an honest, good-faith investor using lawfully obtained capital. To avoid becoming entangled in a fraudulent project, investors are encouraged to conduct careful due diligence of any EB-5 project and regional center they consider working with. (Even though the regional center program expired on June 30, 2021, industry experts are confident that it will be reauthorized shortly.)

Minimum Required Investment Amount

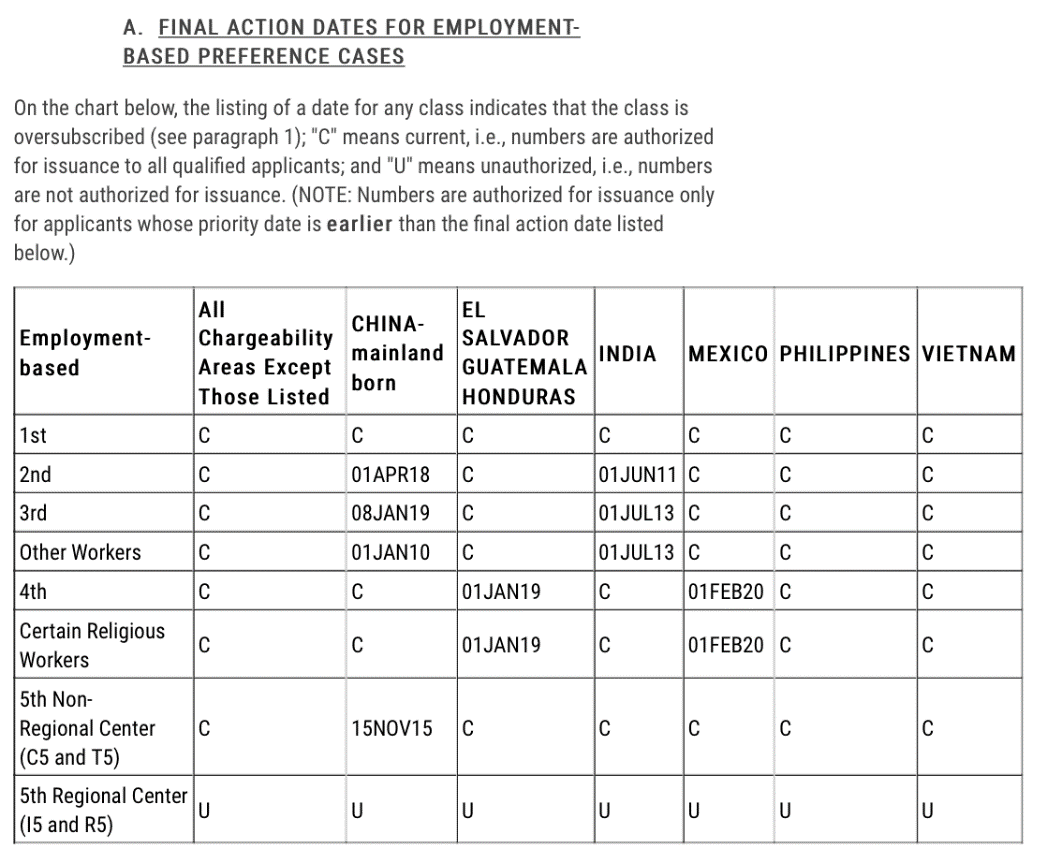

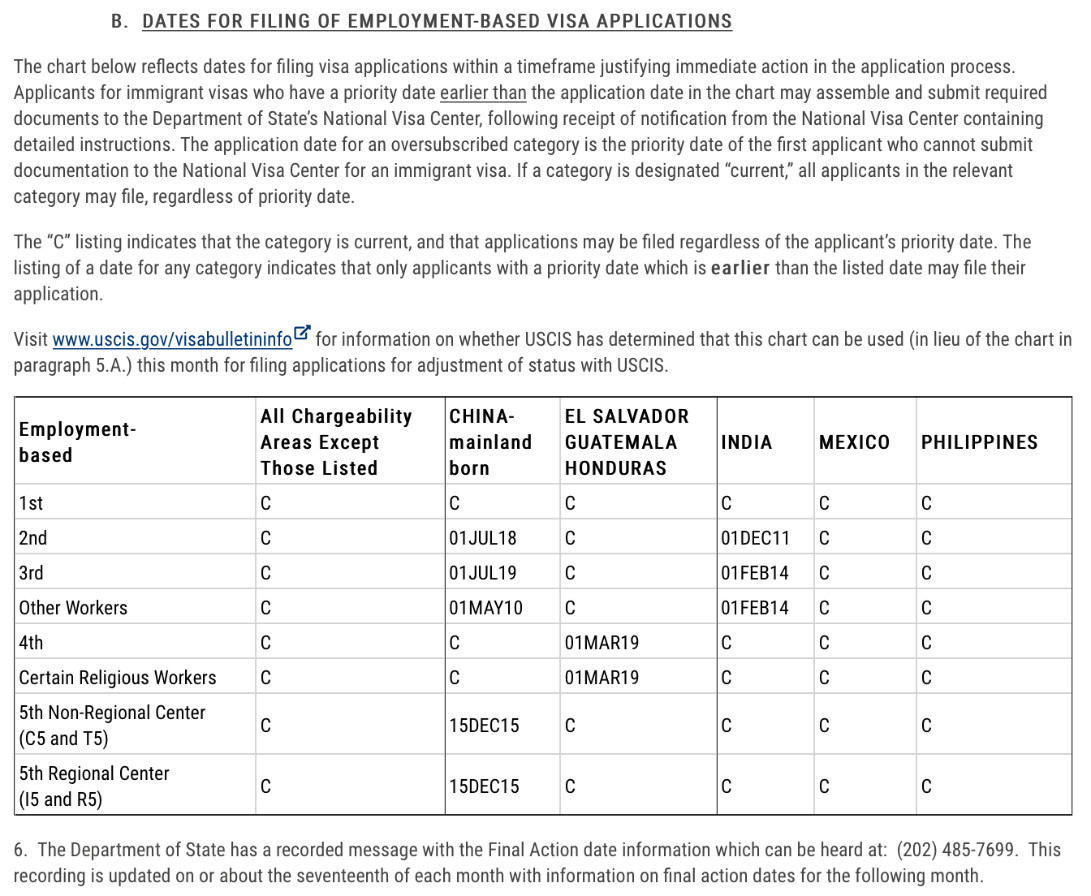

The most straightforward EB-5 investment program requirement is the minimum required investment amount. While there is no maximum amount, an investor must commit at least the minimum amount to their EB5 investment project to qualify for the immigration benefits. As of June 22, 2021, the minimum investment amounts are $500,000 for targeted employment area (TEA) projects and $1,000,000 for non-TEA projects.

Eligible New Commercial Enterprise

When Congress drew up the EB-5 program in 1990, they introduced certain conditions on which organizations applicants could funnel their EB-5 investment capital into. New commercial enterprises (NCEs), as they are termed in EB-5 law, must be for-profit entities conducting ongoing lawful business activities. As long as the activities are legal and ongoing, there are few restrictions, although the most popular types of EB-5 projects tend to be real estate development and hotels. The investment object must also have been created after 1990—hence the “new” in “new commercial enterprise”—or, if formed before 1990, must be using the EB5 investment capital to expand or restructure the enterprise.

Alternatively, an EB-5 investor can take the less-traveled route of investing in a troubled business. Congress has defined strict terms for what qualifies as a troubled business—the entity must have been established at least two years prior to the applicant’s EB-5 investment and have suffered a net loss of at least 20% of the entity’s value within the one- to two-year period preceding the investment.

Whether an investor invests in an NCE or a troubled business, they always face the requirement to be involved in the management of the entity. This can turn prospective investors with little managerial experience—or those who simply don’t have the time or desire to manage the business—away from the EB-5 program. However, regional center investors usually work around this requirement by signing on as a limited partner, fulfilling this requirement simply by voting remotely on policy formation decisions.

Job Creation

The EB-5 job creation requirement is arguably the most important to Congress—it’s the primary reason why the EB-5 program is a boon to the U.S. people. Indeed, the EB-5 rules stipulate that to reap the immigration benefits the EB-5 program offers, a foreign national’s investment must fund the creation of at least 10 new jobs for U.S. citizens or permanent residents. The jobs must be held for at least two years. The job creation requirement is somewhat flexible, with those who make an EB5 investment through a regional center presented with a relaxed route to job creation.

Direct EB-5 investors must show the creation of at least 10 new jobs on the payroll of the NCE—and depending on the type of business, hiring 10 full-time employees may not be realistic. This effectively restricts the type of businesses that can qualify as direct EB-5 investment projects. The solution is regional centers, which allow investors to count indirect and induced jobs toward the job creation requirement. Under this model, the NCE’s expenditures on goods and services, as well as the wages its employees spend in the local community, are calculated to determine the job creation impact the EB-5 investment has likely had on the region. A third-party economist using approved job calculation methodology must be hired for this calculation.

Job creation is proven in the I-829 petition—the final petition of an EB-5 investment journey. Investors file the I-829 petition after living in the United States as a conditional permanent resident for two years, and approval of the I-829 petition sees the conditions on the applicant’s permanent resident status removed. In the I-526 petition, investors must simply demonstrate the likelihood of the project to generate the 10 jobs.