For years, China has been the country with the largest overall number of applicants to the EB-5 Immigrant Investor Program. As a result, Chinese investors seeking a Green Card in the United States through the EB-5 program have had to contend with challenges and delays, unlike foreign nationals from any other country in the world.

This article will examine the historical and current trends in the Chinese EB-5 visa market, exploring the number of unique challenges Chinese investors face—from visa retrogression to long processing times—while also explaining a key strategy to help overcome some of the most persistent obstacles.

How Interest in the EB-5 Visa Program From Chinese Investors Has Evolved Over Time

The demand for EB-5 visas among Chinese investors has been high for many years, but interest has fluctuated over time due to various factors. From 2010-2014, demand from Chinese investors for EB-5 visas surged as rapid economic growth swept across mainland China, increasing wealth and leading to a spike in high-net-worth individuals. In 2014, Chinese investors were issued more than 9,000 of the 10,000 available EB-5 visas.

Beginning in 2018, the EB-5 visa processing time for Chinese applicants slowed down considerably, leading to a drop in demand. Additionally, certain policy changes, particularly increased scrutiny about what constitutes a lawful source of funds (SOF), led to further declines in demand among Chinese investors.

However, Chinese investors’ demand for EB-5 visas began to rise again after the enactment of the EB-5 Reform and Integrity Act (RIA) in 2022, which introduced policy changes that increased visa availability while speeding up processing times. More on the impact of the RIA’s reforms will be explored later in this article.

The EB-5 Visa Challenges Facing Prospective Chinese Applicants

Because demand among Chinese citizens for EB-5 visas has been high for so long, they have had to face many unique challenges. This section will explore some of those challenges in greater depth.

EB-5 Visa Retrogression

Because of the sheer number of Chinese investors who are interested in the EB-5 visa program, there has been a backlog in Chinese EB-5 petitions since May 2015. As of May 2024, the backlog is still far from being cleared.

This backlog is the result of “visa retrogression,” which occurs when the demand for EB-5 visas exceeds the per-country limit in a given year. Historically, there are only 10,000 EB-5 visas available during each immigration fiscal year (October 1 to September 30). Those 10,000 available EB-5 visas include those available for the investor as well as their spouse and any unmarried children under 21. As a result, the number of families that are eligible to apply for conditional Green Cards through the EB-5 program each year may actually be much lower than 10,000.

Furthermore, the government imposes a per-country quota on available EB-5 visas to make the distribution from one country to the next more equitable. If that limit has already been reached for a particular year, then prospective EB-5 investors need to wait one additional year for their Form I-526E to be processed—a situation known as “visa retrogression.” For backlogged countries like China, where visa demand far outpaces visa supply, many investors may have to wait several years just to begin the process of applying for U.S. permanent resident status through the EB-5 program.

Long EB-5 Visa Processing Times

Chinese investors face longer wait times than foreign nationals from any other country. In fact, the situation for Chinese investors is so unique that, in 2020, the United States Citizenship and Immigration Services (USCIS) website introduced a separate estimated processing time range for Chinese investors.

The most recent estimated EB-5 visa processing times can be found on the USCIS website. These wait times indicate the amount of time it typically takes to process 80% of all applications received. That means that the vast majority of applications will be processed more quickly than the wait time provided by USCIS. However, USCIS does not give any information on the longest or the shortest EB-5 visa wait times.

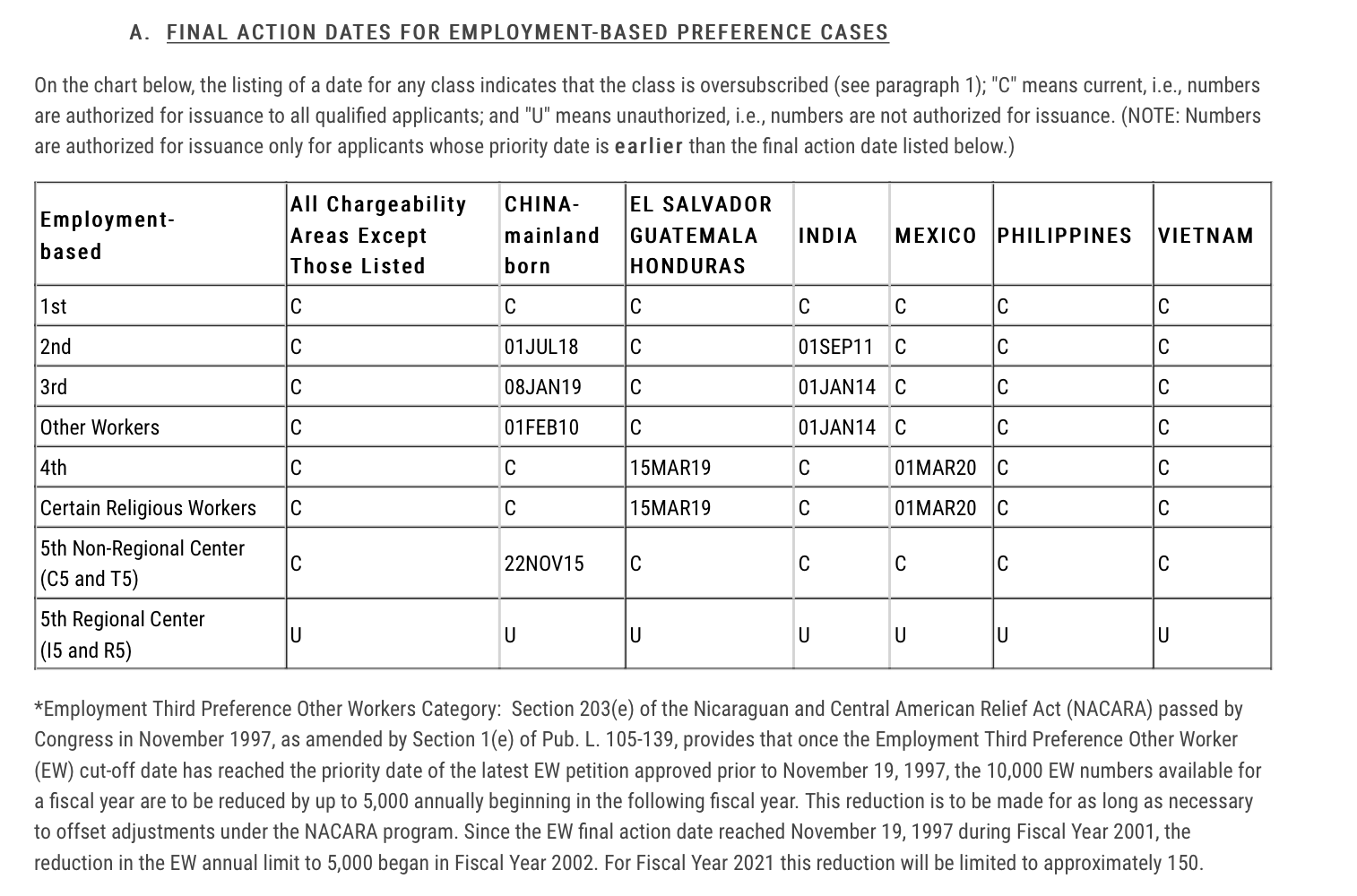

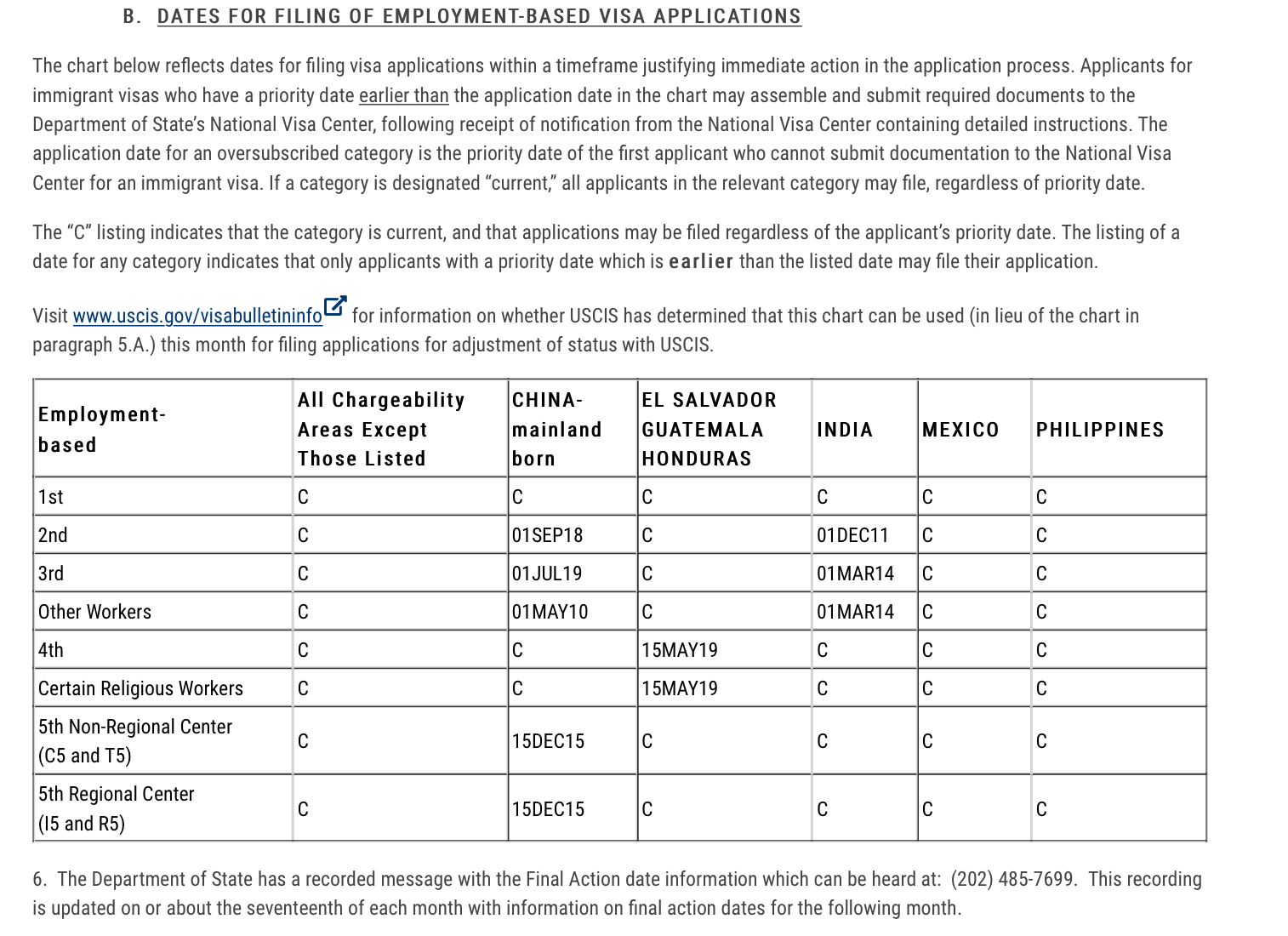

When EB-5 investors submit Form I-526E, they are given a priority date, which is the date that USCIS receives the form. EB-5 investors from every country other than China and India are eligible to apply for their visas as soon as their I-526E petitions are approved. However, Chinese EB-5 investors are subject to a final action date—they must wait until this date, which is periodically pushed forward, catches up with their I-526E priority date. As a result, EB-5 investors from mainland China may have to wait several years before they can even apply for their EB-5 visas.

The U.S. State Department’s July 2024 Visa Bulletin announced that China’s final action date remains December 15, 2015. Therefore, Chinese EB-5 investors who submitted their I-526E petitions after that date are not yet allowed to apply for their EB-5 visas as of July 2024.

Chinese EB-5 investors do not only have to wait for the final action date to advance—they must also factor in the immigration agency’s adjudication times for their I-526E petitions. USCIS (or the State Department’s National Visa Center) may take several years to evaluate a Chinese EB-5 investor’s application.

Difficulties Funding Projects and Proving Source of Funds

Restrictions on annual remittances can also be a major challenge for potential investors from mainland China. China imposes a limit of $50,000 that can be transferred out of the country each year. To combat these restrictions, Chinese investors have relied on various methods to get around the limit, such as combining funds with other Chinese nationals or transferring their money through accounts in Hong Kong. However, Chinese authorities have been tightening controls, making these transfers more challenging. Still, Chinese investors continue to explore new ways to transfer funds for investments in the United States.

These government limitations also have an impact on Chinese investors’ ability to prove the lawful source of their investment funds. This has become especially challenging as USCIS has increased its own scrutiny, demanding detailed documentation to prove the legal source of capital investment for the EB-5 program. It is highly recommended that Chinese investors—as well as investors from other countries—consult with an experienced immigration attorney to ensure their investment funds are lawfully sourced.

How Can Chinese Nationals Invest in the EB-5 Program?

When the RIA was enacted in 2022, it introduced several policy changes that made the process easier for EB-5 investors, particularly those from mainland China. The law provided the option of EB-5 concurrent filing, allowing investors to file Form I-526E and Form I-485 at the same time, helping to significantly streamline the EB-5 process.

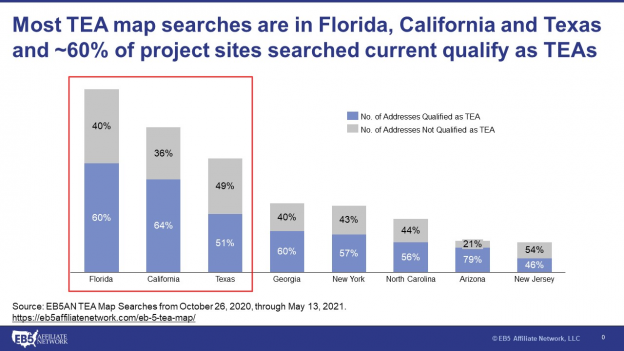

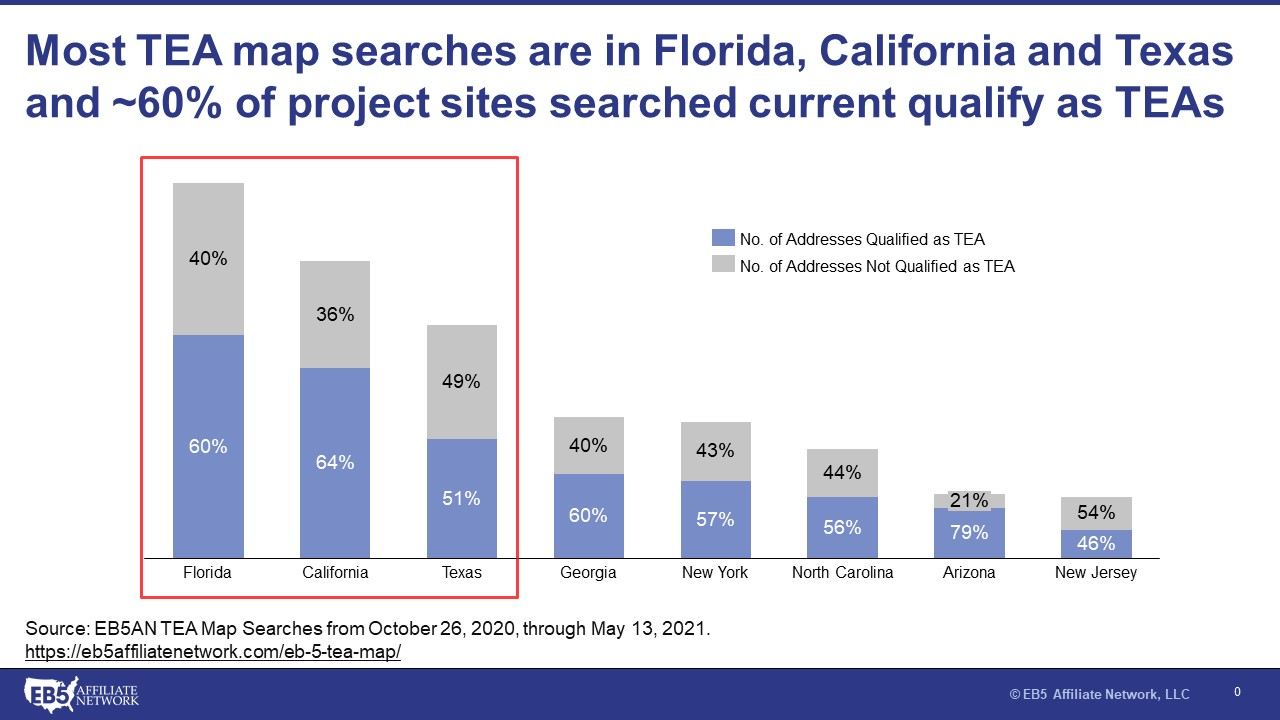

In addition, the RIA introduced new minimum investment thresholds. The updated amounts currently stand at $800,000 for projects located in targeted employment areas (TEAs), as opposed to a minimum investment of $1,050,000 for a new commercial enterprise in other areas. A TEA is defined as:

- An area with a population of fewer than 20,000 people; and

- An unemployment rate of at least 150% of the national average.

These areas are designated based on U.S. census information. The most important aspect for Chinese investors, however, is the potential to avoid visa backlogs and obtain a fast-tracked Green Card by investing in rural TEA projects. The RIA allocated 20% of available EB-5 visas to applicants investing in rural TEA projects—along with an additional 10% for high-unemployment TEAs and 2% for public infrastructure projects. As a result, while there are still some significant backlogs of EB-5 applications in the unreserved category, these set-aside visa categories have been a promising development for investors from mainland China.

Invest in TEA Projects With EB5AN

Currently, there is no additional waiting period or backlog for the reserved EB-5 visa categories. However, the availability of these visas is limited, and there is a possibility that these categories could become oversubscribed in the future. Prospective Chinese EB-5 investors are strongly advised to submit their petitions promptly to secure their place while these reserved visas are still accessible.

EB5AN has helped more than 2,300 families from 60 countries obtain U.S. Green Cards, and we can do the same for you. To begin your family’s journey toward becoming U.S. Green Card holders, schedule a free meeting with our expert team today.