Starting November 10, 2020, Sarah Kendall and the Immigrant Investor Program Office (IPO) took two weeks out of their not-so-busy adjudication time to disappoint the EB-5 investment industry and avoid questions during their virtual industry forum. Although the event has now ended, interested EB-5 industry participants can access the material from the first day in PDF form, as a YouTube video, or as a presentation to Invest in the USA (IIUSA).

Tidbits of Positive News

To be fair to the IPO, the presentation included a few positive updates alongside the disappointment. The IPO acknowledged two problems plaguing the EB-5 program in November 2020 and affirmed its dedication to solving them: different days scheduled for I-829 biometrics appointments for EB-5 investors and their family members, and the delayed transmission of approved I-526 petitions to the National Visa Center. According to the IPO, the biometrics scheduling issues are due to a bug in the system, and the delayed I-526 transmission is the result of temporary understaffing.

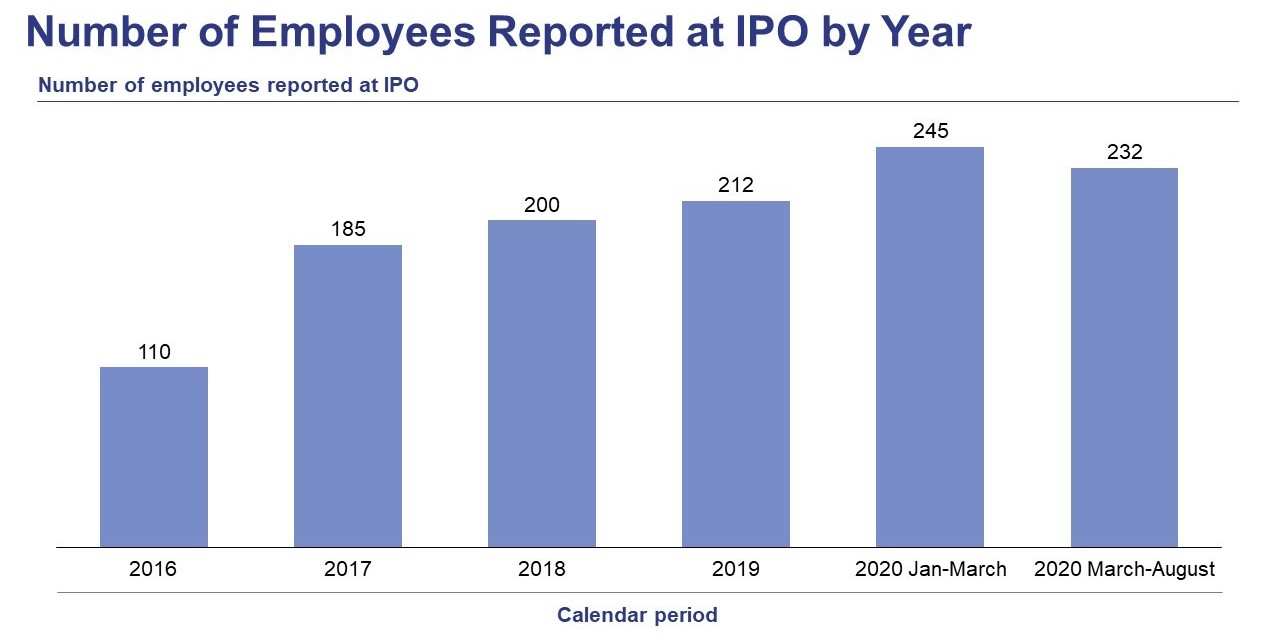

The IPO also revealed the number of dedicated staff working on EB-5 petitions—232 people. The figure is down 13 people from March 2020, but fortunately for those involved with EB5 investments, there hasn’t been a lot of attrition. Considering that United States Citizenship and Immigration Services (USCIS) was threatening to furlough around 70% of its staff in August 2020, EB-5 participants should be relieved to see most IPO staff have retained their jobs. Due to the COVID-19 pandemic, most of them have been completing their work from home since March 2020.

Most Questions Sidestepped

Unfortunately, the rest of the conference generally consisted of at best unfavorable news for EB-5 investors and other program stakeholders and at worst no news. The IPO masterfully sidestepped various pertinent issues and questions, rendering the presentation of little use to those with EB-5 investments.

Prior to the engagement, IIUSA drafted a list of questions to pose at the IPO conference, but the IPO’s response hardly inspired confidence. Ignoring the majority of the questions, the IPO offered little insight on the key EB-5 investment concerns of stakeholders during the turbulent times of 2020. In particular, the IPO ignored questions pertaining to the policy manual, changes to policy on the source and path of EB5 investment capital, country-based I-526 processing data, and changes to the redeployment policy.

Often, the questions the IPO did answer weren’t of much use to those in the EB-5 industry, either. Adopting a trick straight out of the “uncaring bureaucrat” playbook, the IPO regurgitated vague, publicly available information already published elsewhere instead of engaging with the questions presented. In this way, the IPO was able to avoid clarifying stakeholders’ uncertainties on such issues as the visa availability approach adopted in April 2020, processing times, and updates to the redeployment policy.

Finally, the IPO did not permit any interaction during the conference, leaving EB-5 stakeholders to stew in their disappointment without any opportunity to ask their pressing questions. Sarah Kendall made a live appearance during the IIUSA meeting, but there was no reason for it—given that she simply read off her talking points from the PDF and did not allow for questions, a prerecorded video would have made no difference.

Faster Processing Times for Previously Reviewed Projects

Though indirectly, the IPO did answer one question in the minds of many individuals with active EB5 investments: whether, under the visa availability approach, I-526 petitions from countries with available visas are assigned for adjudication on a first-in, first-out basis. It seems the most important factor after visa availability is whether USCIS has previously reviewed the EB-5 project, either via an exemplar I-924 petition or a previous EB-5 investor’s I-526 petition. This is in line with anecdotal accounts and creates an additional layer of inequality in the EB-5 process.

Processing Productivity Remains Low

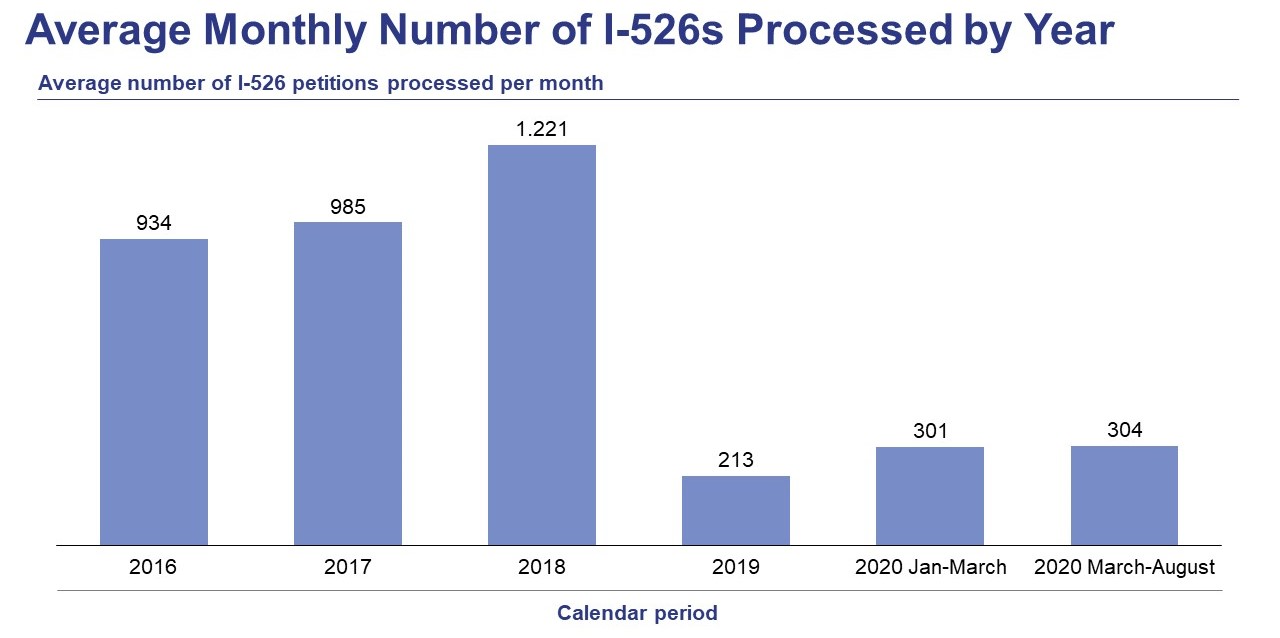

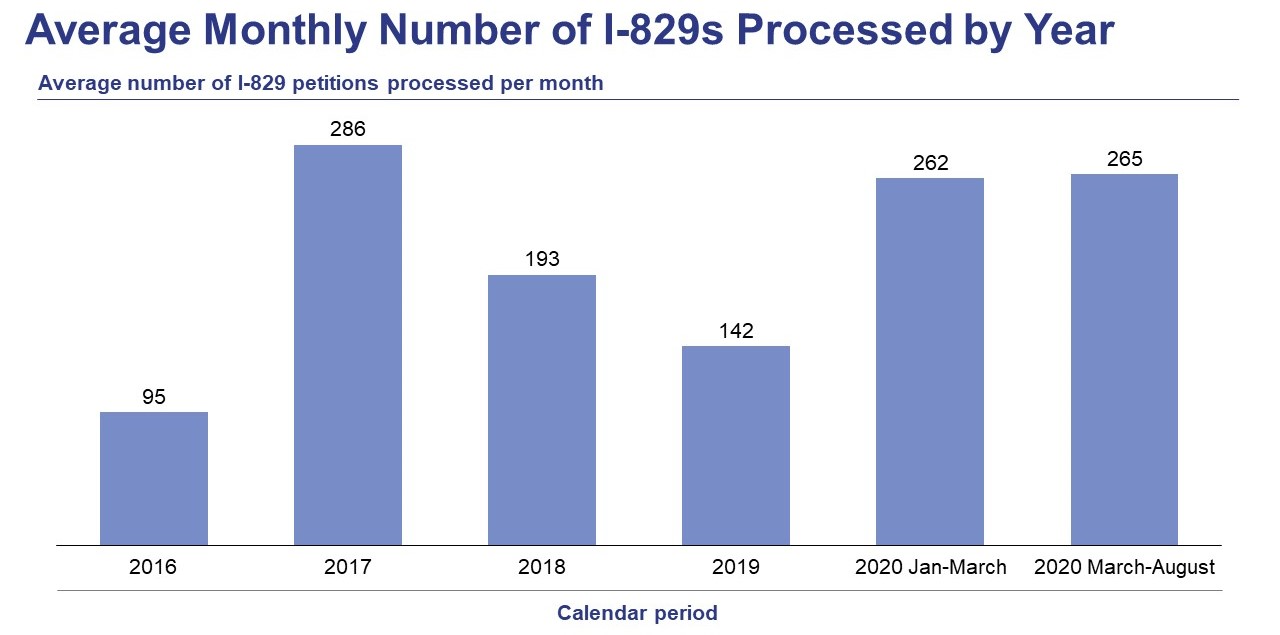

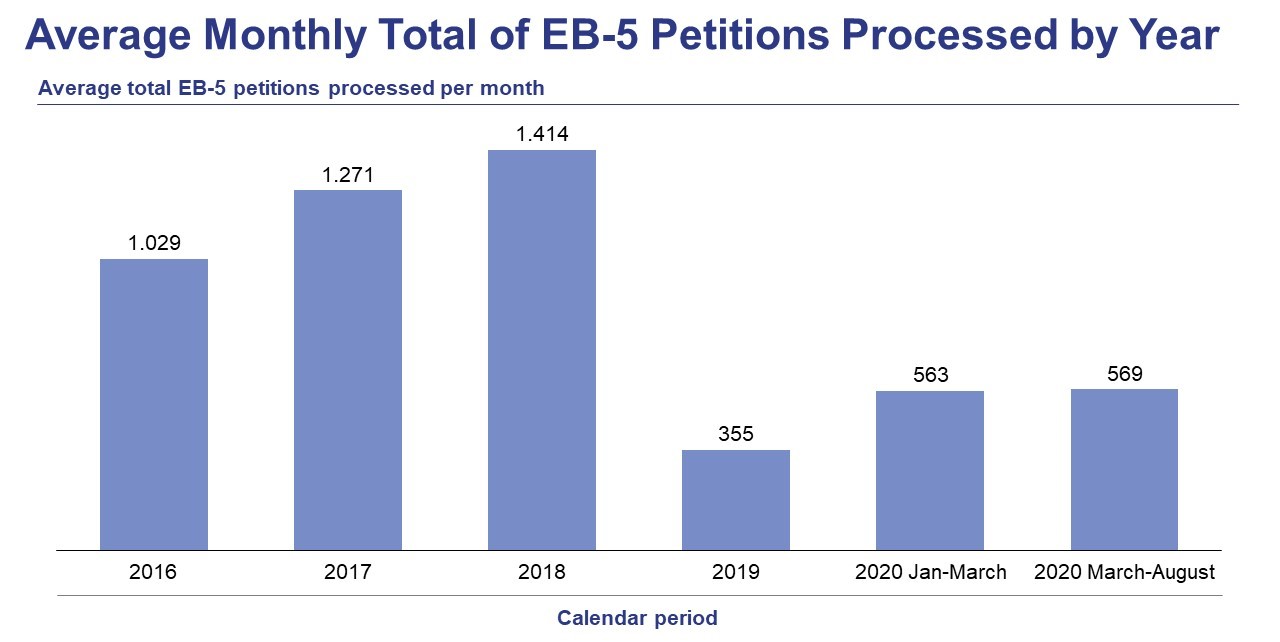

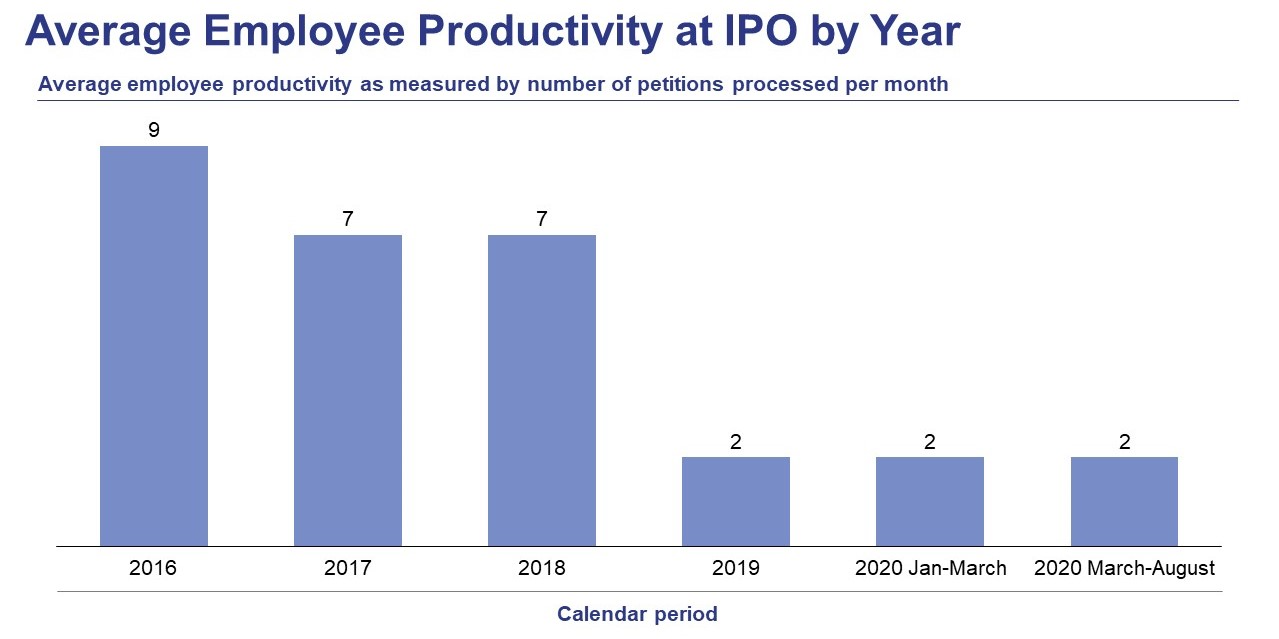

I-526 and I-829 processing has remained low since Sarah Kendall took over at the IPO, a stark contrast from the record-high productivity in FY2018 under her predecessor Julia Harrison. Updates from the IPO on processing data from March to August 2020 show this trend has been maintained well into 2020, with the IPO adjudicating a dismal average of 304 I-526 petitions and 265 I-829 petitions per month.

Not only did Kendall fail to increase productivity throughout FY2020, but she also failed to apologize for the astoundingly poor performance of the IPO under her watch, which is causing significant harm to the EB-5 industry. Furthermore, instead of predicting future increases in productivity, she highlighted the figures as favorable by comparing them to those of mid-2019, which recorded her lowest processing productivity figures. At this adjudication rate, foreign nationals who have made an EB-5 investment from a low-demand country will be waiting upwards of three years for adjudication, while investors from high-demand countries such as China or Vietnam could expect to wait more than five years.

The below graphs illustrate the effects of Sarah Kendall’s leadership of the IPO. It is evident that she is prioritizing I-829 petitions at the expense of I-526 petitions, stifling new interest in the program and impacting the ability of EB-5 project developers to reliably obtain EB-5 capital for their projects. The EB-5 industry can only hope productivity increases in FY2021.