The choice to participate in the EB-5 Immigrant Investor Program is a decision that has the potential to change the trajectory of a prospective foreign investor’s life (not to mention that of their eligible immediate family members). The stress of navigating the complexities of today’s EB-5 marketplace and all the decisions involved in making the right EB5 investment can leave potential investors feeling anxious about such a bold move.

But ample resources and trustworthy assistance are available to help every interested investor down the path to permanent residency in the U.S. That said, it is important to understand that working with the right EB-5 investment partners is imperative and that proper due diligence in selecting who to turn to for advice is the first step to ensuring the smoothest EB-5 journey possible.

There are generally two ways a foreign national may elect to invest through the EB-5 program—direct and indirect EB5 investments. Which road to travel depends on the investor’s investment and business goals, but by and large, the most popular option among foreign investors seeking an EB-5 visa is to invest through an EB-5 regional center. Selecting a qualified project through the right regional center often eliminates much of the stress associated with U.S. Citizenship and Immigration Services (USCIS) petition submissions and compliance issues because investors work with people who are already familiar and have experience with the adjudication process.

Long-standing, experienced regional centers with established track records can be a godsend on the path to U.S. residency. However, some bad actors work in the EB-5 landscape. Learn how to determine the difference between finding the perfect project and recognizing a marketing strategy.

What Are Preapproved EB-5 Projects?

As an investor searches for the right project, they are likely to encounter EB-5 regional center projects that have been preapproved by USCIS. One of the greatest advantages of working through a regional center is easier access to preapproved projects, but it is important to understand what that means.

Saying a project is preapproved may give some prospective investors the impression that USCIS has somehow granted preference to their EB5 investment project over others in the market. This is not true. While reputable regional centers have worked hard to establish solid relationships with USCIS, understand that the agency does not offer any preference for one project over another. Every single project must be presented in the proper format, must be evaluated against the same set of guidelines, and must be officially adjudicated and approved.

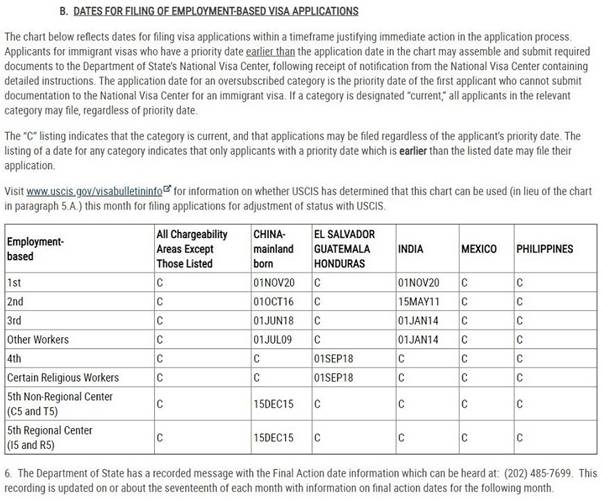

The marketing tactic of framing investment in a preapproved project as guaranteeing successful immigration outcomes stems from regional centers securing approval on an I-924 petition which, in reality, involves the evaluation of a preliminary business plan. This approval is known as an I-924 exemplar.

Marketing the I-924 exemplar to entice investors doesn’t necessarily mean a regional center should be immediately stricken from a consideration set, but it may send up a red flag depending on how far into the discussion they communicate what this approval actually means and where your project of interest actually is in the process.

If they explain exactly what they mean early on in your initial inquiry, then the project may be worth further exploration. If you don’t hear a word about what an I-924 exemplar actually means, you may be safer to pass on the investment.

Approved I-924 Exemplar and “Deference”

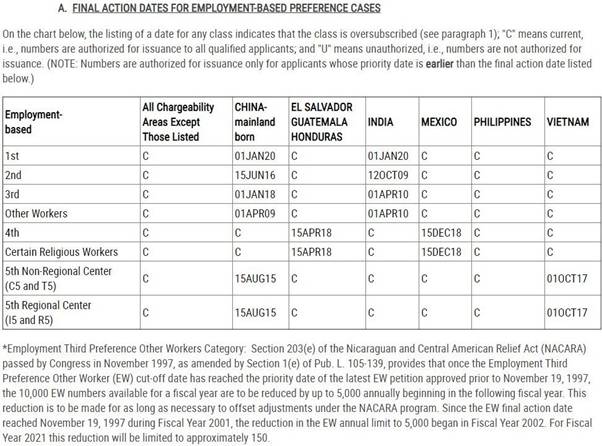

In December 2009, USCIS introduced the notion of an I-924 exemplar. The rationale was that if an EB5 investment project submission (through an I-924 petition packet) included a business plan that was evaluated and deemed to sufficiently meet EB-5 program requirements before Form I-526 submission, then USCIS provides “deference” to the I-526 petitions that use the same business plan and documents later on in the process.

Deference is simply the acknowledgement of previous evaluation of a business plan, meant to conserve already scarce USCIS agency time and resources. When an EB-5 regional project has deference, it means that when a new EB-5 investor submits their I-526 petition for adjudication, USCIS is not required to reevaluate the business plan portion of their application, but can instead focus on an applicant’s source-of-funds verification and other personal information.

Furthermore, deference does not shield a later investor’s submission from denial. An I-924 exemplar is granted when the project outlined in the original submission met all EB-5 program requirements—it was “approvable” at the time of that original filing. Because an I-924 petition can sometimes take years to process, by the time a new investor files their I-526 petition, it is quite possible that components of that original I-924 have become irrelevant or invalid.

When Policies Change After I-924 Approval

Some common aspects of a business plan that can change include economic and financial projections and project feasibility studies. Thus, it is nearly impossible to guarantee a project as preapproved and compliant with all current policies and regulations—especially with the current political and economic state of the U.S. In fact, the newest regulatory reforms for the EB-5 visa program went into effect in November 2019. So, if an investor is considering a regional center partnership on a project that was preapproved before then, chances are there would need to be changes to the plans before final USCIS project approval.

Again, an older I-924 exemplar doesn’t necessarily mean an investor should cross a current project off the list. Rather, they need to ask important questions about the validity of its supporting documents, whether a project meets the latest compliance guidelines, and if updates are available or in queue before proceeding with an EB-5 investment submission. As with any type of investment, the key is always clear communication of risk. If, however, a regional center is promising an expedited process based on outdated I-924 approvals prior to November 21, 2019, with no mention of the risks involved, it should certainly signal a hard pass.

Communicating Risks in an EB-5 Project

The primary goals of every EB-5 investment are to successfully obtain green cards for investors and their eligible family members and to have their capital investment successfully returned. To ensure both these goals are met, each investor and their immigration attorney must engage in proper due diligence at the core of their endeavors. Even when an investor uncovers risk through their own investigation, their project partners should be openly disclosing it to them as well. A lack of transparency means even further increased risk and quickly leads to questions of ethics and mistrust—neither of which is acceptable when working with the U.S. government.

On the other hand, when a regional center is open and upfront about the current status of a project, the exemplar (no matter its approval date) can become a roadmap for the success of each subsequent investor’s I-526 petition. As a leader in the EB5 investment industry, EB5AN retains a 100% approval rate with USCIS, in large part due to its level of transparency among all its partners. These include 14 EB-5 regional centers with operations in more than 20 states across the nation and over 1,800 foreign investors from 60-plus countries around the globe, as well as the governing bodies of the residency-by-investment field.

Why Investors Choose EB5AN

Besides its long-standing EB-5 industry relationships and its proven track record, foreign investors who choose an EB5 investment look to EB5AN because of the wealth of cost-free resources available to all of our partners. Whether an investor is still vetting projects and needs access to an up-to-date national TEA map, wants to pass a project through an EB-5 project risk assessment questionnaire, or is ready to run their plans through an EB-5 job creation calculator, EB5AN can help! The network also maintains a digital library chock full of industry news and insider advice.

Furthermore, the top-notch team of EB-5 investment professionals has extensive expertise in areas ranging from business and investment evaluation and strategy to immigration, securities, and tax law. Every foreign national seeking answers to EB-5 program questions is welcome to reach out. Begin to see the difference EB5AN can offer from first contact!