To say that people around the world dream of a life in the United States would be an understatement. With the world’s strongest economy, world-renowned higher education institutes, and state-of-the-art health care facilities, the United States offers a life that people in most countries can only dream of. Billions around the world have also fallen in love with the United States thanks to Hollywood, and as the world’s leading media exporter, the United States attracts awe-struck visitors to its borders each year.

Visiting or living in the United States short term is one thing, but for those looking to make the United States their permanent home, the process is trickier. Save for marrying a U.S. citizen or permanent resident, the only permanent path to immigration is usually employment-based, and attaining a work visa can be difficult, whether due to political reasons—such as the Trump administration’s immigration ban in 2020—or systemic reasons, with the H-1B visa putting applicants through a lottery system due to excessive demand.

That’s where the EB-5 Immigrant Investor Program comes in. For a one-time passive investment of $1.8 million or $900,000, depending on the targeted employment area (TEA) status of the project, foreign nationals can gain U.S. permanent resident status for themselves, their spouse, and their unmarried children below the age of 21. Largely seen as one of the fastest and easiest pathways to U.S. immigration, the EB-5 program welcomes thousands of investors and their families to the United States every year.

Overview of the EB-5 Program

The EB-5 program was formed in 1990, when Congress voted to pass an immigration bill that packaged a number of immigration programs together. One was the EB-5 program, or the employment-based fifth-preference program, whose purpose was to stimulate the U.S. economy and drive job growth in high-unemployment and rural areas.

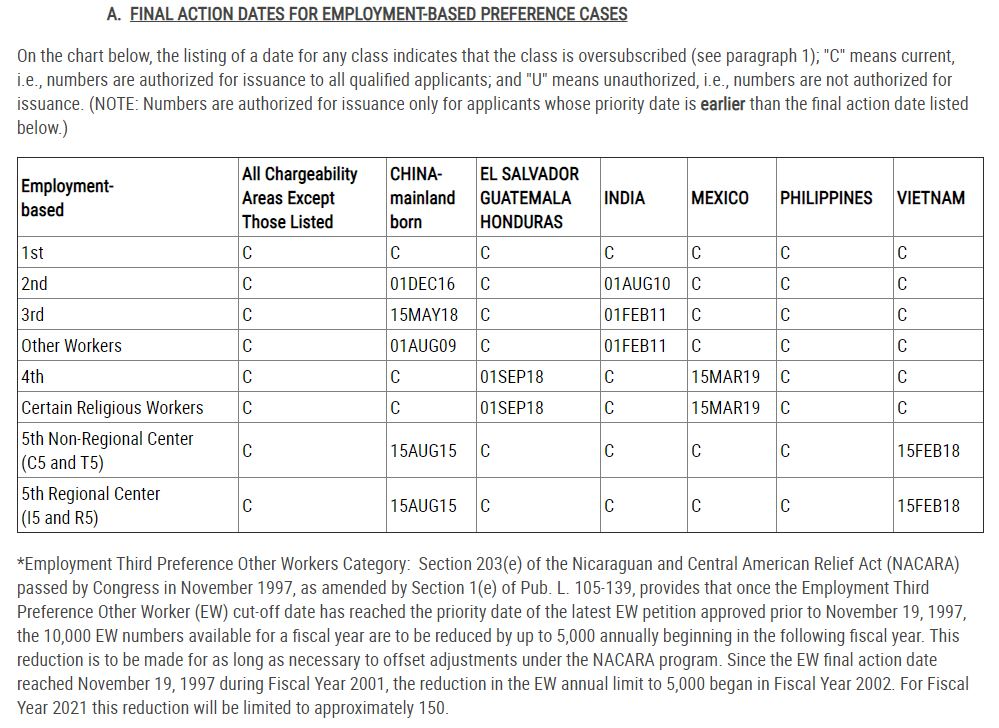

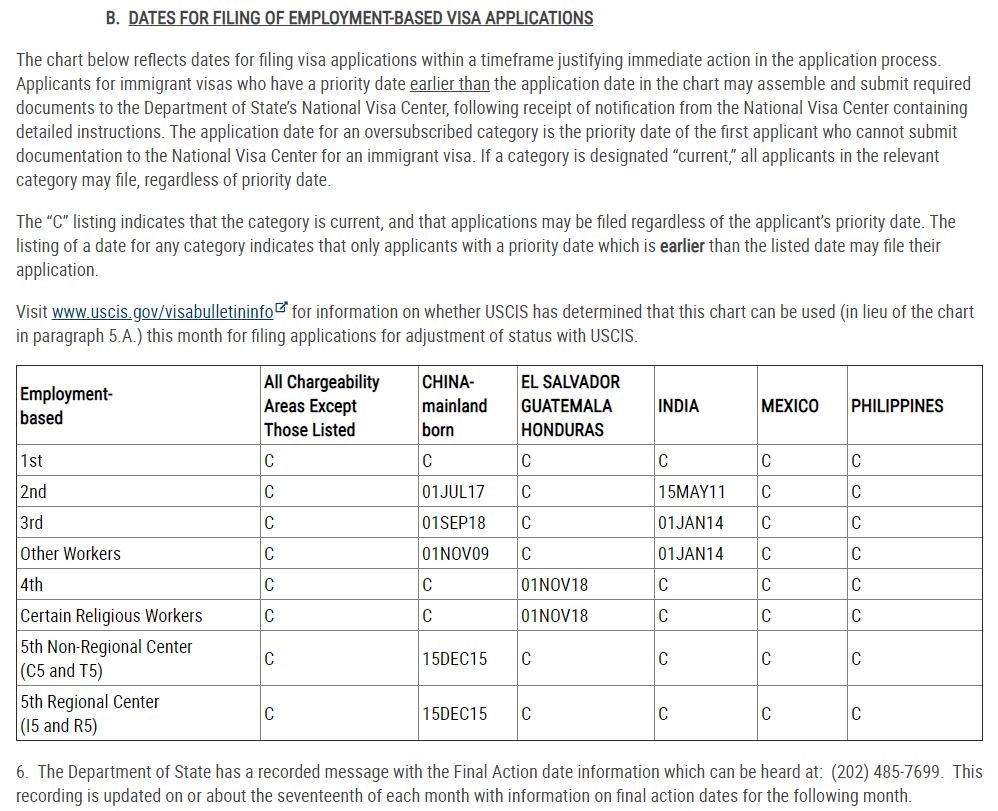

For an EB-5 investment to procure its investor a U.S. green card, it must satisfy the various requirements of the program. If United States Citizenship and Immigration Services (USCIS) adjudicators believe an EB5 investment as presented in an I-526 petition is more likely than not to fulfill the program requirements, they grant the petitioner two-year conditional permanent resident status. Within the final 90 days of the conditional permanent residency period, the investor must file an I-829 petition outlining how the EB-5 investment indeed met the program requirements. Approval of the I-829 petition results in the removal of the conditions from the investor’s permanent resident status.

EB-5 Requirements

While EB-5 program requirements can be challenging to satisfy, they are generally not as restrictive as requirements for conventional immigration programs. In the EB-5 program, an investor’s language skills, educational background, and professional qualifications are irrelevant. To gain U.S. permanent residency rights through the EB-5 program, an investor must invest the required amount of lawfully obtained capital in a qualifying EB-5 project for the duration of the two-year conditional residency period and ensure that the EB5 investment results in job creation for U.S. workers.

Minimum Required Investment Amount

There is no maximum EB-5 investment amount, but investors must inject a minimum amount of capital to qualify for the immigration benefits. For regular EB-5 projects, the minimum amount is $1.8 million, but for TEA projects, it’s halved to $900,000. TEAs are characterized by unemployment rates 50% higher than the national average or a population of less than 20,000.

Lawful Source of Funds

The capital an investor infuses into an EB-5 project must have been legally obtained in order to confer the investor immigration status in the United States. EB5 investment capital can be sourced from virtually anywhere as long as the investor can prove its lawful origins. Investors are advised to work with EB-5 legal counsel to determine the best fund sources to document.

At-Risk Status

Investors must maintain their EB-5 investment capital at risk throughout the entire investment period, including the full two-year conditional permanent residency period. In other words, the capital must incur the possibility for both loss and gain at all times. Lengthy backlogs have led to the need for some investors to redeploy their capital to maintain the at-risk status.

Job Creation

Given that the EB-5 program’s fundamental goal is economic stimulation and job creation, an EB5 investment must fund the creation of at least 10 new, full-time jobs in the United States before the investor may qualify for immigration benefits. The precise conditions of the job creation requirement depend on whether the EB5 investment has been injected directly into an EB-5 project or through an EB-5 regional center, with regional center investments enjoying relaxed requirements.

Direct EB-5 Investment vs. Regional Center EB-5 Investment

The EB-5 program presents two pathways to a U.S. green card: direct investment in a qualifying project or indirect investment through a regional center. Both routes have their merits, and both end in the same outcome, should an EB-5 investment be successful. However, most EB-5 investors opt for the regional center due to the relative security and freedom it offers.

Direct investment is the best option for experienced business managers who want to make the most of their financial returns. In this pathway, the investor is generally involved in the day-to-day management of the new commercial enterprise (NCE), requiring them to live near the project. The minimum 10 jobs must be direct hires of the NCE or construction jobs that last at least two years.

Regional center investment, conversely, pools EB-5 investment capital from numerous investors together into an investment in a larger project. Reputable regional centers are run by business experts who conduct careful due diligence on projects before offering them, generally rooting out projects in TEAs to procure a lower required EB5 investment amount for investors. In most cases, simply signing on as a limited partner is enough for an investor to satisfy the involvement requirement, and job creation is significantly easier, with indirect and induced jobs estimated through a professional third-party economic calculation able to be counted.

Why Invest in the EB-5 Program?

The reasons for setting up a permanent home in the United States are plentiful. From the world-class educational opportunities—both at the university and public school level—to the cutting-edge technologies at U.S. medical facilities, to the high levels of peace and stability the country experiences, a life in the United States can be the best investment a foreign national can make in their family’s future. With the right to live, work, and study anywhere in the United States, permanent residents can live the American dream, taking pride in having fostered their new country’s economy through their EB-5 investment.