Since 1990, when the EB-5 Immigrant Investor Program was launched, many foreign nationals have participated in EB-5 and obtained U.S. permanent resident status . Unlike other U.S. immigration opportunities, that can take a long time to process, the EB-5 Program is one of the quickest ways to secure a green card.

One key requirement of the EB-5 Program is for foreign nationals to comply with the United States Citizenship and Immigration Services (USCIS) regulations. These regulations are fairly complex and can be highly specific in terms of the information that USCIS needs.

For this reason, the EB-5 process can be difficult to navigate alone, without the help of an experienced EB-5 attorney.

In this article, we will take a look at the role of EB-5 attorneys and explore how you, the investor, can go about choosing one that will suit your specific needs. We will also shed some light on the fees that you can expect to pay as a foreign investor.

The EB-5 Immigrant Investor Program: A Quick Overview

What Does an EB-5 Attorney Do?

What to Look Out For When Selecting an EB-5 Attorney

How Can EB5AN Help You, the Investor?

The Steps to Hire an EB5 Attorney

Some Insights on Rates and Fees

Secure the Right EB-5 Attorney for Your Case

The EB-5 Immigrant Investor Program: A Quick Overview

The EB-5 Immigrant Investor Program is an initiative that allows foreign investors to secure visas and, eventually, green cards by investing a specific amount of capital in a U.S.-based business that generates jobs.

Investors will come across the terms “new commercial enterprise, or NCE,” and “targeted employment area, or TEA” a lot within the U.S. EB-5 Immigrant Investor Program context.

Here is what these terms mean:

New commercial enterprise (NCE):

An NCE refers to the business entity in which an EB-5 investor makes their capital investment. It can be a for-profit entity engaged in various types of commercial activities, such as manufacturing, real estate development, hospitality, or any other legal business.

Targeted employment area (TEA):

A TEA is a specific geographic area designated as such by the U.S. government based on specific criteria. TEAs are categorized as two main types:

High unemployment TEA: An area with an unemployment rate at least 150% of the national average.

Rural TEA: A rural area outside a metropolitan statistical area or a city with a population of fewer than 20,000.

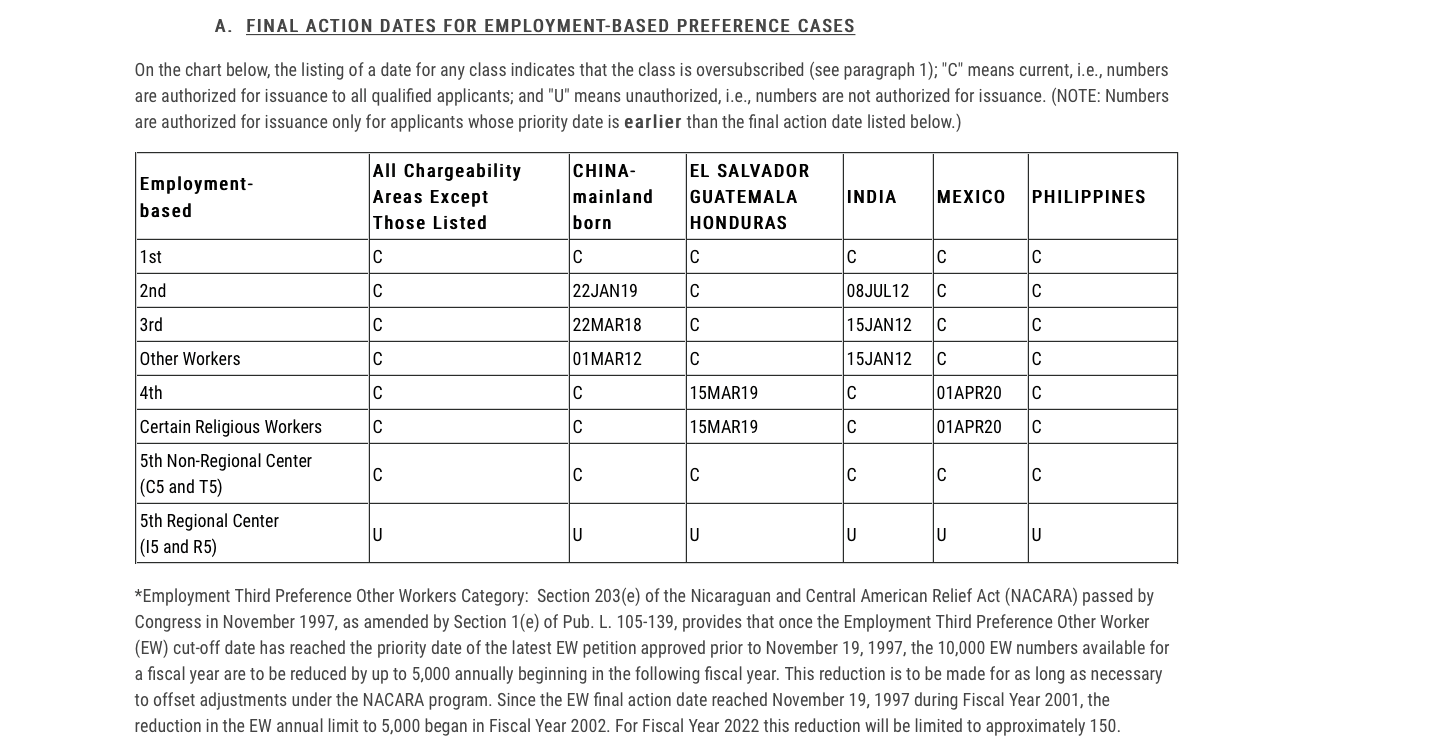

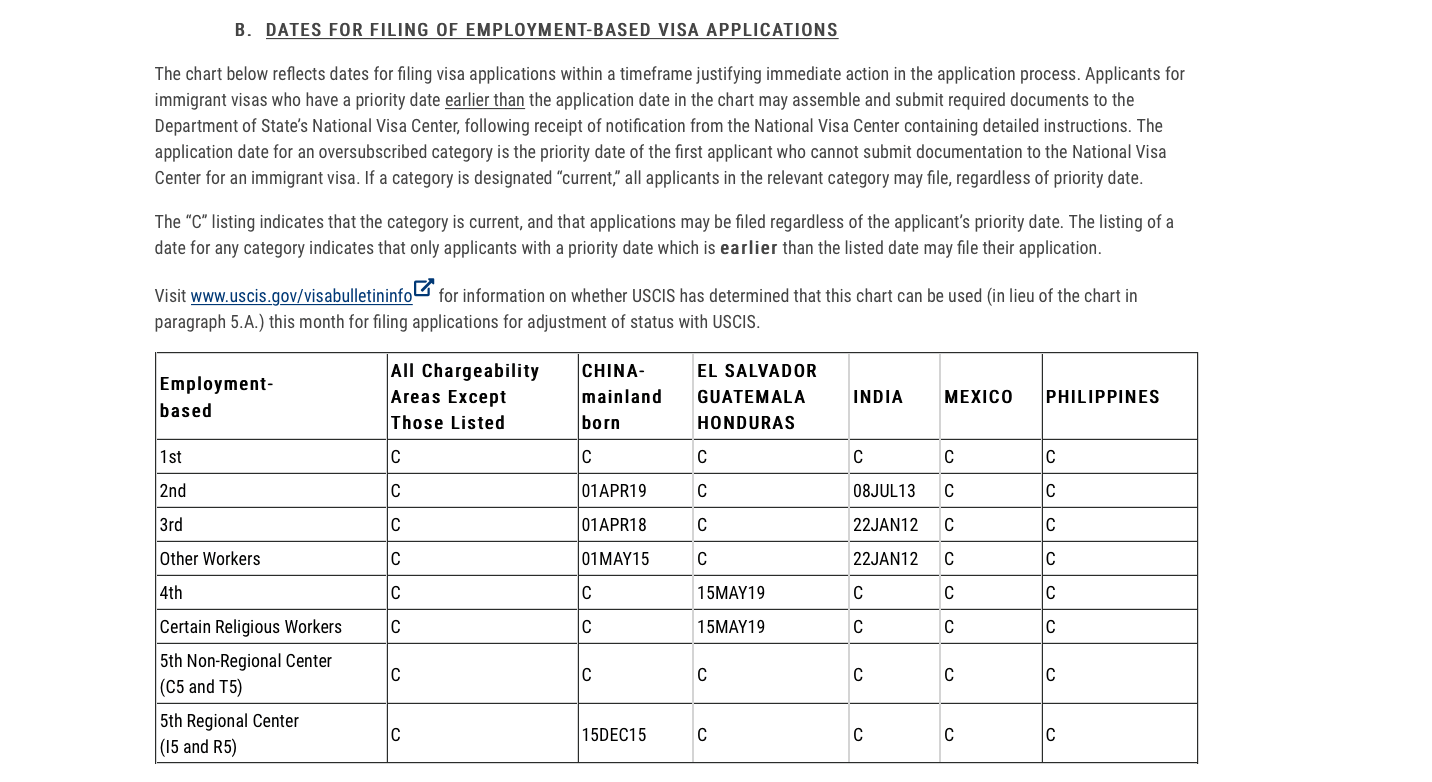

EB-5 applicants need to invest either $1,050,000 in non-TEA projects or $800,000 in a targeted employment area (TEA).

What Does an EB-5 Attorney Do?

Guide investors through the investment process

An EB-5 attorney guides investors through the entire investment process, from explaining the requirements of the program to preparing and submitting all the necessary paperwork.

Conduct research on potential projects

These attorneys conduct thorough research on potential investment projects that the investor may have identified, to ensure they meet program criteria. In some cases, they may already have solid EB-5 investment opportunities on their books for a foreign investor to explore.

Help navigate complex immigration procedures

Immigration attorneys help investors by providing services such as filing visa petitions and preparing supporting documentation. They also make sure investors adhere to program rules, such as meeting job creation requirements and maintaining their investments.

Should any issues arise during the application process, EB-5 attorneys advocate on behalf of their clients. Essentially, they serve as trusted partners who help investors achieve their goal of obtaining permanent residency in the U.S. through the EB-5 Program.

What to Look Out For When Selecting an EB-5 Attorney

It’s crucial for EB-5 investors to work with an immigration attorney who has experience in the EB-5 industry. Immigration counsel can help an investor make sense of the EB-5 Program’s requirements throughout every step of the process.

EB-5 investors must choose their immigration counsel very carefully. Working with an immigration attorney who lacks EB-5 experience could seriously jeopardize an investor’s chances of success.

When evaluating potential attorneys, EB-5 investors should look for the following characteristics:

❗A solid track record

The most reliable immigration attorneys have a history of successfully preparing I-526 and I-829 petitions for their clients. All reputable immigration attorneys should be willing to disclose their past success rates.

Of course, investors must keep in mind that past success does not guarantee that their upcoming visa petitions will be approved. In addition, if an immigration attorney has a high success rate but has only worked with a few EB-5 investors, the success rate becomes less meaningful.

❗Effective communication

Ideally, immigration attorneys should be easily accessible and available to answer their clients’ questions quickly and clearly. Foreign investors should always remember that it is important to communicate with their attorney in a transparent way.

❗Positive client testimonials

If an immigration attorney can provide positive client testimonials, their reliability increases substantially. EB-5 investors should ask for references from the attorney’s other clients, and look for online reviews of the attorney’s services.

❗A source-of-funds strategy

Gathering the legal source-of-funds evidence for Form I-526 is a particularly challenging aspect of the EB-5 process. Immigration attorneys should have a solid strategy for helping their clients compile the necessary evidence and be willing to devote significant time and effort to completing Form I-526.

How Can EB5AN Help You, the Investor?

✅ EB5AN’s solid track record

EB5AN has an impressive track record in the field of EB-5 immigration and investment. With a strong history of successful projects and satisfied investors, we at EB5AN have consistently demonstrated our expertise in navigating the complex EB-5 Program requirements.

Our experience in project development, regional center operations, and compliance ensures that investors receive reliable guidance and support throughout their immigration journey.

Whether it’s job creation, capital deployment, or I-526 and I-829 petition approval, EB5AN’s proven track record speaks to our commitment to ensuring successful EB-5 investments for foreign investors across the United States.

✅ EB5AN’s communication strategy

Through our commitment to clarity, accessibility, transparency, and timeline adherence, EB5AN excels in effective communication. We simplify complex EB-5 Program details, which makes them easy to understand for clients.

Our team is readily available and responsive, which ensures that clients get the support they need, when they need it. We are transparent about program intricacies, which allows us to empower clients to make informed decisions.

✅ EB5AN’s testimonials

Clients consistently praise us at EB5AN for our transparent communication, accessibility, and ability to simplify complex matters. Read through our wide range of client testimonials to see why foreign investors choose us as their immigration attorney.

Here is one example from Siddharth, who says:

“After doing a lot of Google research to really be sure about the project I was going to invest in, I found EB5AN. A few good things stood out for me, including the pedigree of the founders. It gave me comfort to see that the team I was corresponding with were all highly qualified, intelligent individuals who had worked for global organizations.”

✅ EB5AN’s source-of-funds strategy

EB5AN’s due diligence process ensures that the source of funds is thoroughly reviewed and any potential issues are identified and addressed promptly. By working closely with EB5AN, investors can streamline the process of documenting the lawful source of funds.

In addition, our personalized approach means that strategies are tailored to the specific financial circumstances of each investor.

All EB-5 investors will benefit from working with a competent, experienced immigration attorney. EB5AN can help investors find the most reliable attorneys in the EB-5 industry today.

Of course, all of our investors are free to choose their own attorneys, and no immigration attorneys work for EB5AN.

The Steps to Hire an EB5 Attorney

Selecting an experienced attorney is essential for a successful immigration process, so foreign investors should take their time to make an informed decision.

Conduct some thorough research

Begin by researching and identifying immigration attorneys with expertise in the EB-5 Program. You can use online resources, referrals, or legal directories to create a list of potential attorneys.

Here are some pointers for you to consider:

Experience: Check the attorney’s experience in handling EB-5 cases, including their success rate and years in practice.

Specialization: Ensure the attorney specializes in immigration law and has a focus on EB-5 cases.

Track record: Investigate their track record of approved EB-5 petitions and successful investor cases.

Fees: Understand the attorney’s fee structure, including any hidden costs or additional fees.

Team: Inquire about the attorney’s support team and resources available to handle your case.

Ethical record: Check whether the attorney has any disciplinary actions or ethical violations on their record.

Immigration association memberships: Check whether the attorney is a member of reputable immigration law associations, which could indicate their expertise in the field and ensure current knowledge of policy or procedural changes.

Arrange a consultation

Schedule consultations with the attorneys on your list. During these consultations, discuss your specific EB-5 immigration needs and concerns.

Evaluate the attorney

Evaluate each attorney’s experience, track record, and communication style. Consider their past success with EB-5 cases and how well they address your questions and concerns.

Fees and service agreements

Inquire about the attorney’s fees, payment structure, and any additional costs. Review the terms of engagement, including the scope of their services and responsibilities.

Obtain references

Ask for references from previous clients or check online reviews to gauge client satisfaction and the attorney’s reputation.

Select your attorney

Based on your research, consultations, and evaluation, choose the EB-5 attorney who best aligns with your needs and goals.

Review and sign the engagement agreement

Once you’ve made your selection, formally retain the attorney by signing an engagement agreement. This document will outline the terms and conditions of your working relationship.

Some Insights on Rates and Fees

There is no doubt that the EB-5 Program is very much an investment in your future in the United States.

Let’s dive into some key insights about the rates and fees involved when considering the EB-5 Immigrant Investor Program. Understanding these financial aspects is essential for anyone looking to pursue U.S. permanent residency through the EB-5 pathway.

Attorney fees

There are three fees that you will need to be aware of when hiring an immigration attorney to help you navigate the EB-5 process. These include:

I-526 Petition (Immigrant Investor Petition) legal fees: These are fees charged to prepare and file the I-526 petition. Complex cases may result in higher fees. Of course, all fees will vary across each immigration attorney and each particular client.

I-829 Petition (Petition to Remove Conditions) legal fees: Fees for the I-829 petition, filed toward the end of the two-year conditional residency period, are also charged.

Consultation fees: Some attorneys charge a consultation fee for an initial assessment of your eligibility and options.

Additional services: Attorneys may offer services beyond the petition filings, such as due diligence on EB-5 projects, assistance with selecting a regional center, or other related services. The cost for these additional services can vary widely.

Petition filing fees

Petition filing fees are the official charges associated with submitting the necessary immigration forms to U.S. Citizenship and Immigration Services (USCIS) as part of the EB-5 Visa process. These fees cover the cost of processing and reviewing your petitions.

These fees currently include:

- I-526 Petition: The filing fee for the I-526 petition, which is $3,675.

- I-829 Petition: The filing fee for the I-829 petition, which is $3,750.

(The above filing fees will be raised significantly starting in April 2024.)

Secure the Right EB-5 Attorney for Your Case

In the highly complex landscape of the EB-5 Immigrant Investor Program, securing the right immigration attorney can make all the difference. EB5AN offers all the expertise and guidance that you need to navigate this process easily and successfully.

With a track record of excellence, transparent communication, and a commitment to your immigration goals, EB5AN is your trusted partner. Take the next step toward your EB-5 journey by contacting us today. Your path to U.S. permanent residency awaits!