EB5AN State of Colorado Regional Center

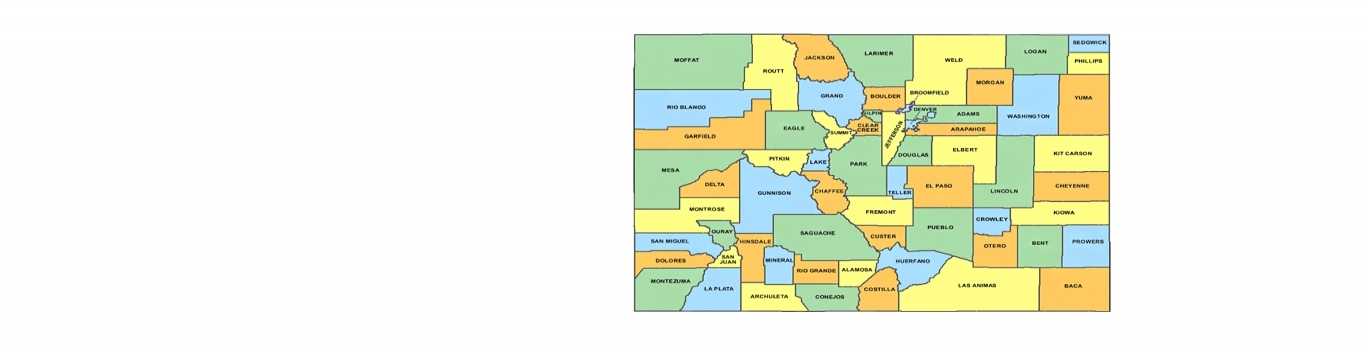

Geographic coverage: All 64 counties in the State of Colorado

View the official regional center designation letter for the EB5AN Colorado Regional Center.

Contact us now to learn more about becoming a business affiliate.

Benefits of Affiliation with our Colorado EB-5 Regional Center

Immediate Ability to Raise EB-5 Capital in Colorado

Business affiliates of EB5AN, including our Colorado EB-5 regional center, can immediately begin raising EB-5 investment funds in any of the designated geographic areas that comprise our USCIS-approved regional centers.

Indirect Job Creation Calculations

Business affiliates of our regional centers can calculate job creation through both direct and indirect job methodologies. This leads to higher job creation figures than direct non-regional center calculations of actual payroll employees.

Regional Center Affiliation Process

The regional center affiliation process can be a fast solution and a great fit for those looking to begin a project immediately. The benefits of affiliating with a regional center make this an excellent choice for many project developers.

Our experienced team will work with you to understand whether EB-5 funding is a good fit for your project and whether you qualify to affiliate with our regional centers.

The EB5AN State of Colorado Regional Center covers the entire State of Colorado, including the two largest cities in the state: Denver, the capital and most populous municipality within the state, is an American metropolis known for its frontier history. Colorado Springs is a home rule municipality that is the largest city by area in the state.

Let Us Help You to Create Your Own Colorado EB-5 Regional Center

Our Team Will Complete Your I-924 Application for a Colorado EB-5 Regional Center in Three Weeks

EB5AN has obtained full state regional center coverage in multiple states and has completed more than 100 USCIS-compliant business plans and economic impact studies. The I-924 application process is complicated and requires legal expertise, economic analysis, business plan creation, and an understanding of how USCIS adjudicates applications.

EB5AN has the internal resources to assemble all required aspects of an I-924 application. Additionally, we have extensive experience with I-924 applications and understand all the key components and common pitfalls.

There are various approaches to take when filing an I-924 form; please contact us to learn more about the process and how we can work together to get your regional center approved quickly by USCIS.

Targeted Employment Area (TEA) Qualification Report in Colorado for EB-5 Colorado Regional Center Projects

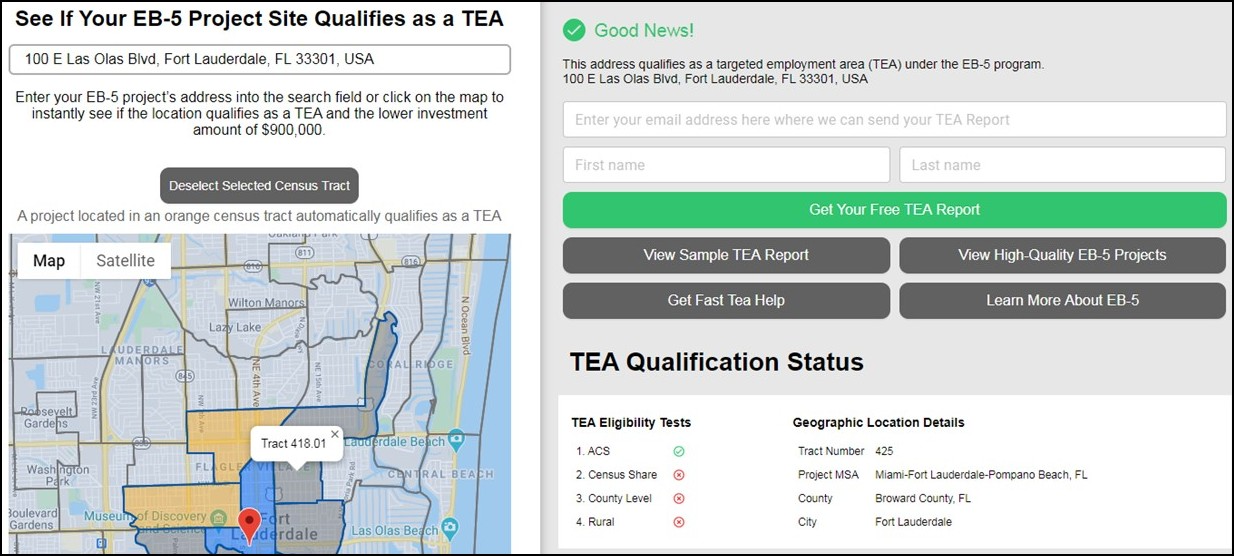

Please visit our EB-5 TEA Map to determine whether your Colorado EB-5 regional center project’s location qualifies as a rural or high unemployment targeted employment area (TEA).

Free Targeted Employment Area Map for all 50 States

Click image to view the TEA map and instantly download a free TEA qualification report.

Because TEA designation is crucial to the success of many EB-5 projects, it is important to understand how USCIS reviews TEA designation requests. Once you determine whether your Colorado EB-5 regional center project is located in a TEA, you can prepare a TEA report yourself. The free downloadable report available through the EB5AN TEA map is also suitable for submission to USCIS.

If you still need assistance with preparing your EB-5 TEA report for your EB-5 regional center project in Colorado, please contact the EB5AN team directly by phone at 1-800-288-9138 or via e-mail at info@eb5an.com, or simply order an EB-5 TEA Qualification Report.

About the State of Colorado and the Economic Climate of our EB-5 Colorado Regional Center

Our Colorado EB-5 regional center was created to provide an investment vehicle for qualified foreign investors seeking to obtain permanent resident status in the United States of America through an investment in a USCIS-approved EB-5 regional center with geographic coverage of all 64 counties in the State of Colorado.

Historically, several elected Colorado public officials, including senators and congressional representatives, have endorsed the EB-5 regional center program as a great opportunity for the U.S. economy and for foreign investors who want to immigrate to the United States and invest in a USCIS-approved Colorado EB-5 regional center such as EB5AN State of Colorado Regional Center.

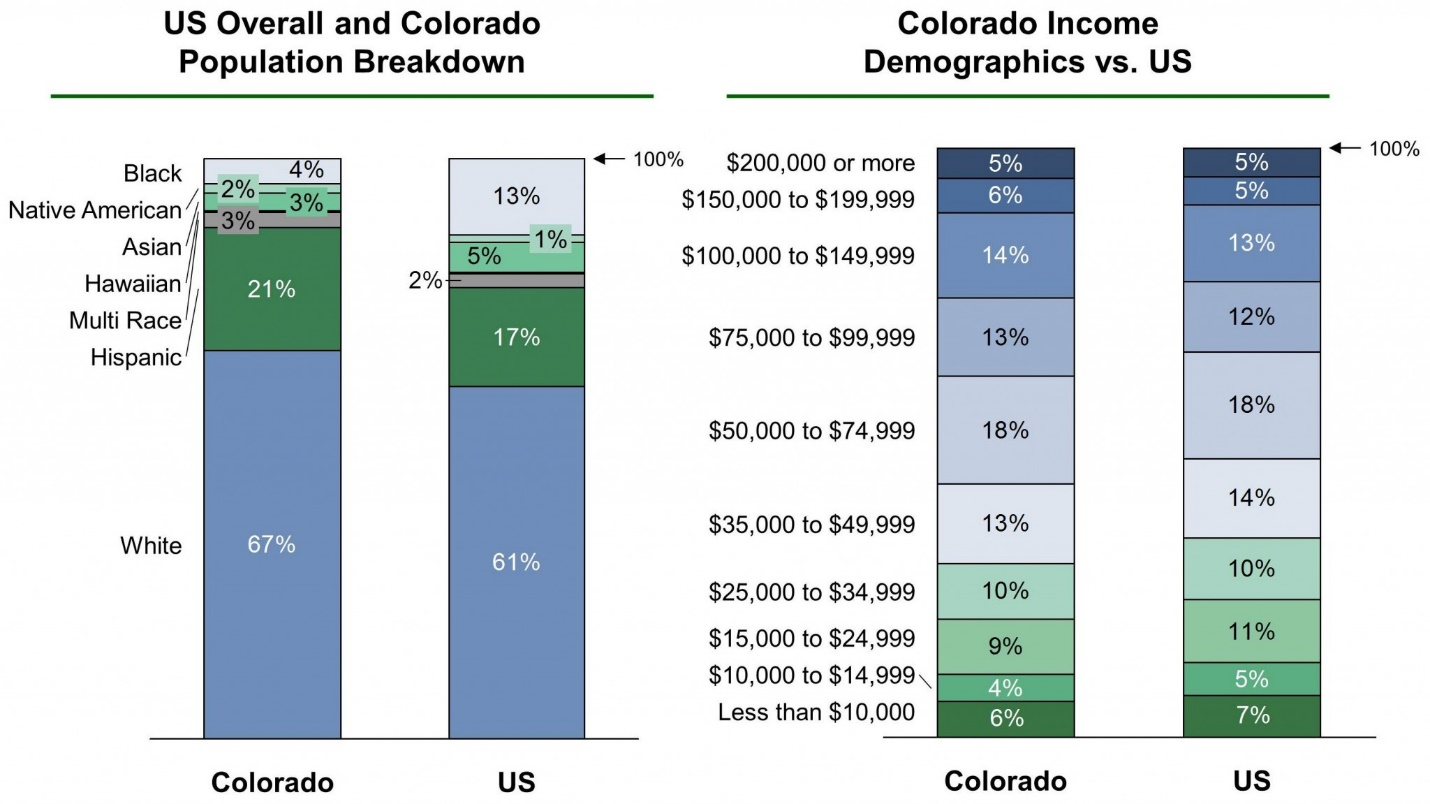

Colorado: Population and Income Demographics

According to the 2010 U.S. Census, Colorado has a population of approximately 4 million people over the age of 16. Of this, there are approximately 2.8 million people in the labor force, with 2.5 million who are employed and 232,000 who are unemployed. These population numbers represent approximately 10 million households in Colorado.

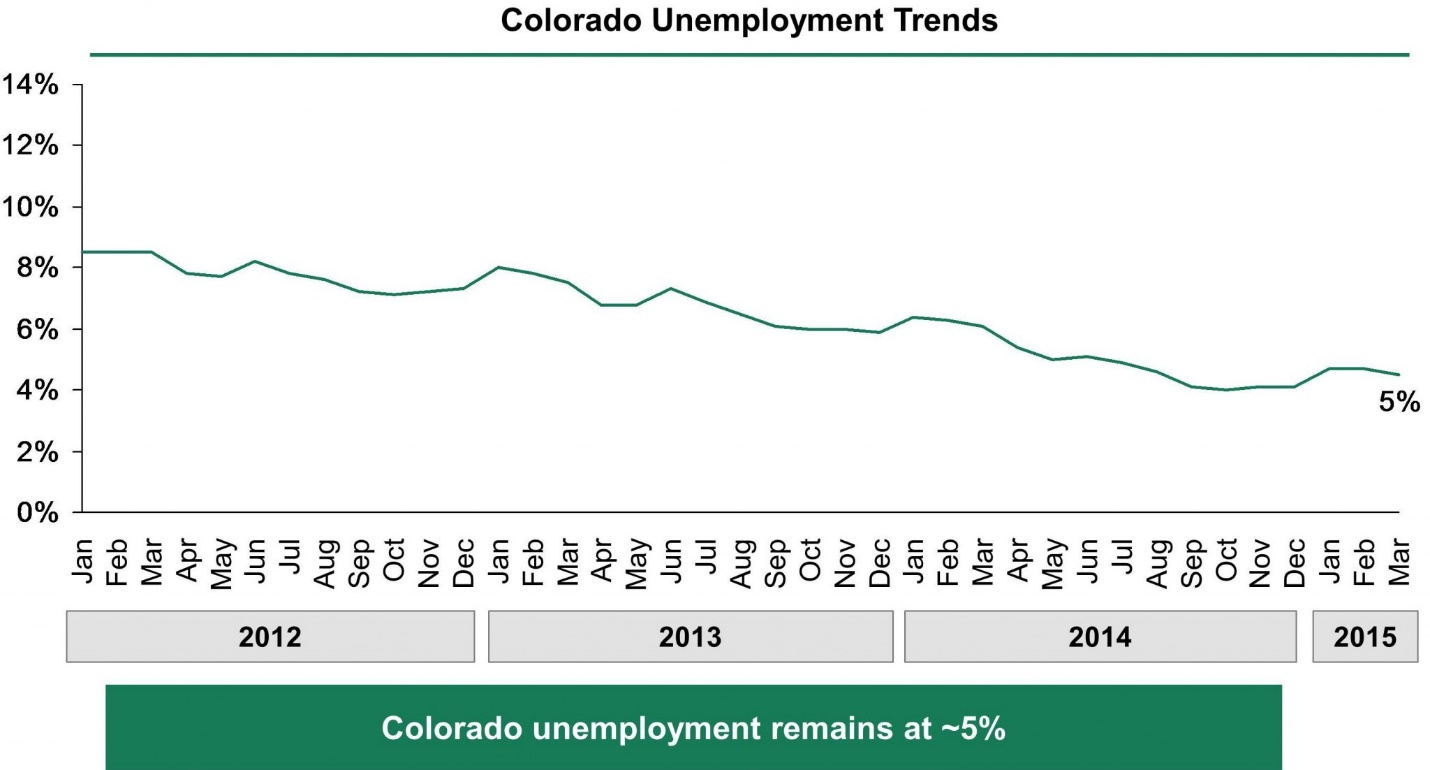

Unemployment statistics for 2014 show average unemployment in Colorado at 5%. Monthly unemployment rates are 4.7% for January 2015, 4.7% for February 2015, and 4.5% for March 2015.

Colorado: Unemployment Trends

Colorado covers an area of 104,094 square miles, with a width of 380 miles and a length of 280 miles. This implies a population density of 52 people per square mile, which makes Colorado the 37th-most densely populated state in the United States.

The capital and largest city of Colorado is Denver, and the largest metro area is the Denver-Aurora CSA. The gross domestic product (GDP) of Colorado in 2010 was $258 billion. This implies a compound annual growth rate from 2000 to 2010 of 4.13% and a per capita GDP of $46,757. Colorado has the 18th-largest economy in the United States by GDP.

Colorado’s economy broadened from its mid-19th-century roots in mining when irrigated agriculture developed, and by the late 19th century, raising livestock had become important. Early industry was based on the extraction and processing of minerals and agricultural products. Current agricultural products in Colorado are cattle, wheat, dairy products, corn, and hay.

Colorado has a flat 4.63% income tax, regardless of income level. Unlike most states, which calculate taxes based on federal adjusted gross income, Colorado taxes are based on taxable income—income after federal exemptions and federal itemized (or standard) deductions. Colorado’s state sales tax is 2.9% on retail sales. When state revenues exceed state constitutional limits, according to Colorado’s Taxpayer Bill of Rights legislation, full-year Colorado residents can claim a sales tax refund on their individual state income tax return. Many counties and cities charge their own rates in addition to the base state rate. Certain county and special district taxes may also apply.