The Visa Bulletin for December 2021 contains important news for the EB-5 investment industry: as of December 2021, all direct EB-5 investors with approved I-526 petitions will be able to apply for and receive their conditional residence visas. This development is particularly significant for Chinese EB-5 investors, who had been subject to a final action date and a date for filing since 2015.

However, regional center investors with pending I-526 petitions are unable to benefit from the Department of State’s (DOS’s) removal of the cutoff dates. Since the EB-5 Regional Center Program has been suspended, United States Citizenship and Immigration Services (USCIS) is no longer processing I-526 petitions associated with regional centers.

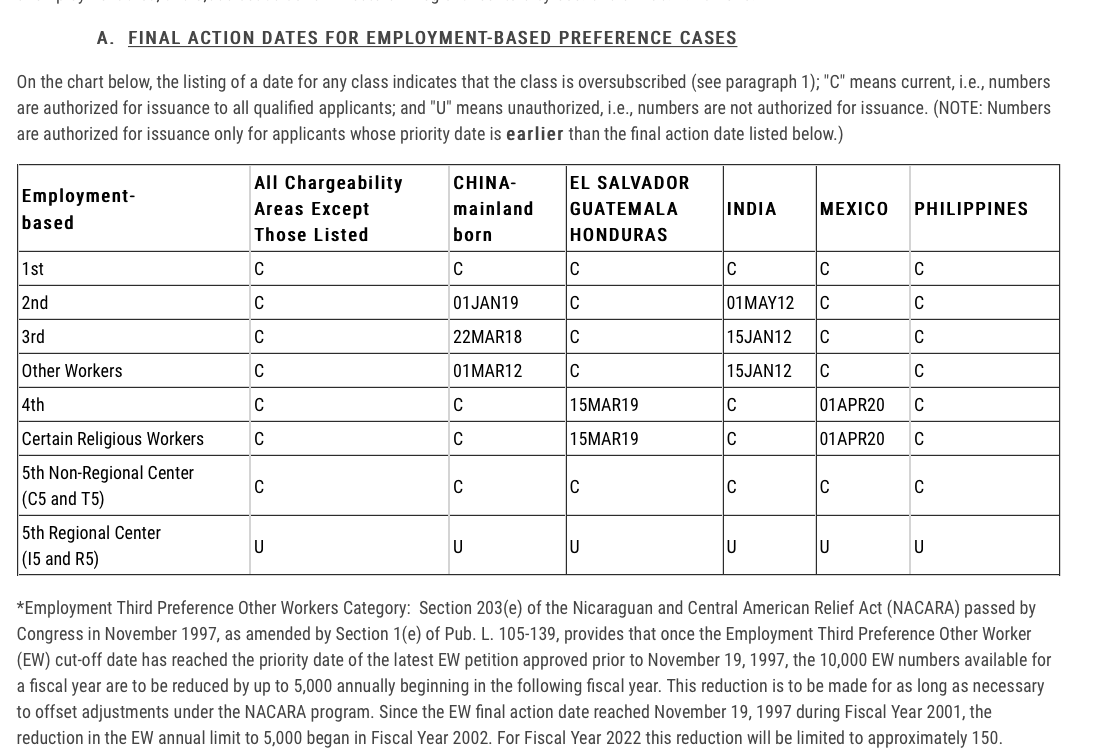

Chart A, “Final Action Dates for Employment-Based Preference Cases”

Chart A of each Visa Bulletin indicates the final action dates for backlogged countries, which dictate when investors can receive their EB-5 visas. As of December 2021, direct investors from every country, including China, have achieved “C” (current) status. They are no longer subject to a final action date and can receive their EB-5 visas as soon as these are available. (Investors should note that the DOS may reestablish a final action date for China if the demand from that country threatens to exceed the overall number of available EB-5 visas.)

The regional center values in Chart A are marked as “U” (unauthorized) due to the expiration of the regional center program. Still, the Visa Bulletin states that Chinese regional center investors will be subject to a November 22, 2015, final action date if the program is revalidated.

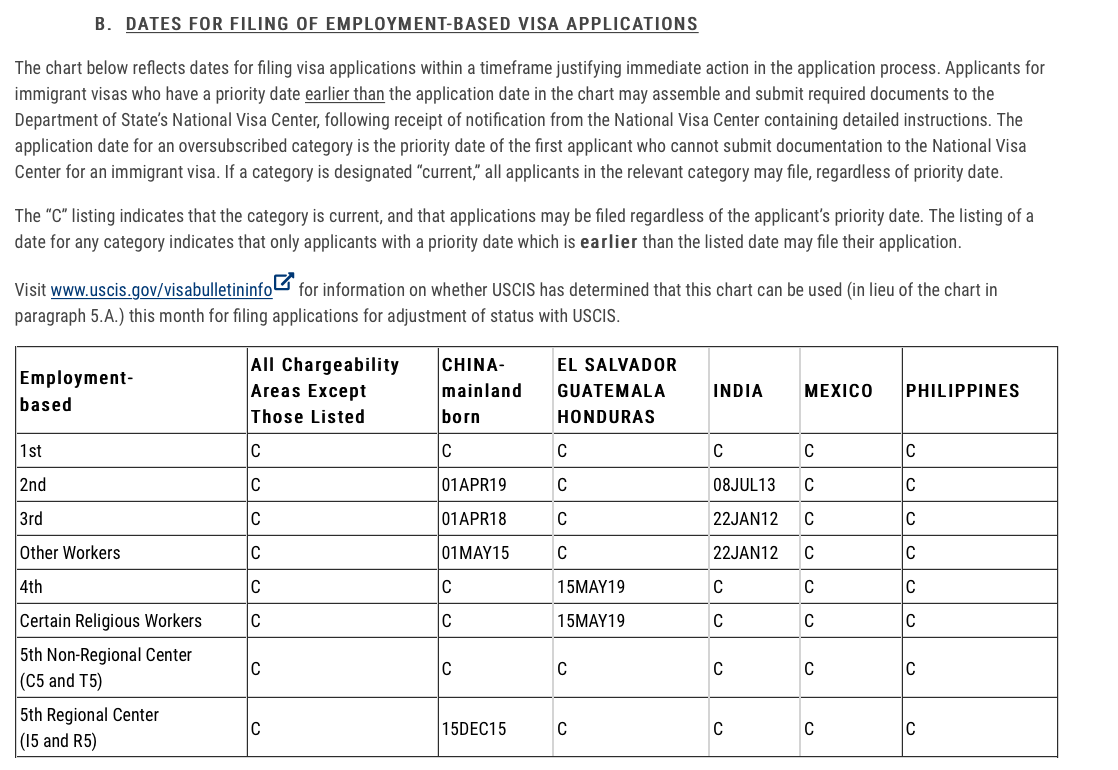

Chart B, “Dates for Filing of Employment-Based Visa Applications”

Chart B contains the dates for filing, which determine when EB-5 investors from backlogged countries can apply for their visas. As of December 2021, direct investors from all countries are no longer subject to a date for filing, so they can apply for their visas upon receiving approval for their I-526 petitions. The date for filing for Chinese regional center investors, however, remains at December 15, 2015; it has not advanced in more than a year.

The Importance of Reauthorizing the Regional Center Program

The suspension of regional center EB5 investment has prevented numerous visa applicants from moving forward with the EB-5 process. Moreover, the EB-5 investment program was allotted a record number of 19,880 visas for the 2022 fiscal year. Once the regional center program is reauthorized, USCIS and the DOS will be able to take advantage of the large number of available visas and reduce the EB-5 backlog substantially.

An Ideal Time to Make a Direct EB-5 Investment

Foreign nationals now have a valuable, and likely temporary, opportunity to invest in direct EB-5 projects at only $500,000 and without being subject to a cutoff date. Potential investors should act quickly to identify a suitable direct EB-5 investment project and begin the EB-5 process.