There has been a recent increase in problems arising during the transferring of investment funds for EB-5 immigrant investors. Several countries, including China, Vietnam, and Ethiopia, have instituted regulations regarding how much currency they will allow to be changed into U.S. dollars and have imposed stringent requirements regarding the transfer of investment funds to the United States. In addition, United States Citizenship and Immigration Services (USCIS) has imposed additional requirements regarding how investment funds are sourced, making it difficult to use traditional methods of transferring international funds to meet the investment requirement. Several similar changes in local currency laws have also contributed to the difficulties.

As just one example, China created regulations at the beginning of 2017 that mandated discovery of the reason for the requested currency exchange and proof that it is not for immigration or on behalf of another individual. Several months later, additional regulations instituted a maximum transfer amount of RMB 50,000 each day per person, which is equivalent to $7,500, when transferring funds out of China. At the same time, USCIS now requires any third parties assisting investors in exchanging currency to provide proof of legitimate fund sources. This further complicates the process of transferring funds.

With all these barriers to investment fund transfers, what solution is there to be able to move forward?

One Possible Solution: Digital Currency

Digital currency allows individuals to send funds electronically without using a bank or other financial institution. Its value is based on supply and demand rather than individual exchange rates of various currencies. Also known as cryptocurrency, this type of currency is entirely electronic.

How Does It Work?

Digital currency transactions are recorded on a ledger of sorts, referred to as a “block chain” ledger. The ledger is maintained by companies commonly known as “mining companies.” Any changes to recorded transactions can only be completed by the stipulation of all involved parties.

As payment for maintaining the ledger, mining companies receive digital currency, which they will frequently turn around and sell to specialized brokers, who will then sell the currency to individual buyers through a cryptocurrency exchange market.

The most popular digital currency in today’s market is bitcoin.

Bitcoin as an Example

In order to use bitcoin, an individual must first set up an online bitcoin wallet that will allow for an exchange with the currency used in the individual’s country of origin. He or she can then use the local currency to purchase the bitcoin and store it in the wallet. The mining companies record the transaction onto a public ledger. The ledger, while recording details about the transactions, does not record information regarding the names of the parties involved, so these parties can maintain anonymity.

After depositing bitcoin into his or her wallet, an individual is then able to transfer it as a form of payment to other bitcoin users or exchange it through a cryptocurrency exchange. In the case of EB-5 investments, investors would need to use a cryptocurrency exchange in the United States and then exchange the bitcoin for the correct amount of U.S. dollars based on the current market rate. This method bypasses using a bank or other financial institution that may otherwise have limits on amounts or types of transactions. Once the foreign investor has successfully purchased U.S. dollars with bitcoin, he or she can then invest the money into a selected EB-5 project to begin the EB-5 immigration process.

Using a cryptocurrency exchange is not always necessary for the transfer of bitcoin. Individuals can sell or transfer bitcoin and other forms of digital currency directly by self-publishing the transaction on the publicly accessible block chain ledger.

Difficulties Associated with the Use of Digital Currency

While the use of digital currency to exchange or transfer funds seems relatively simple, changes in government regulations in some countries are complicating its use. China, for example, recently passed a regulation banning the use of digital currency to exchange funds. Bitcoin and other forms of digital currency may still be used in China for purchases by those who already “own” the currency, but the use of cryptocurrency exchanges has been prohibited. While the decision was made in an apparent effort to protect China’s economy, it creates difficulties for EB-5 immigrant investors trying to transfer investment funds from China to the United States.

Despite these regulations, the digital currency market attempted to remain afloat through the increase of direct transactions that did not require the use of cryptocurrency exchanges. It was successful in its efforts to circumvent the regulations imposed by the Chinese government. As a result, the Chinese government has recently suggested that it has plans to permit the use of cryptocurrency exchanges in the future but with added restrictions. Plans include the development of a licensing program so that the government will still be able to oversee the digital currency market. At this point in time, it is unknown what type of effect government oversight will have on the digital currency market. However, the digital currency market has proven its resilience by continuing to grow despite efforts by various countries to restrict its use.

Government regulations in select countries are not the only concern regarding the use of digital currencies. There are several other factors that may create difficulties for EB-5 immigrant investors who wish to use digital currency to be able to transfer funds for their investments. Three of these factors are listed as follows:

The Ever-Changing Exchange Value of Cryptocurrencies

The exchange values of digital currencies, unfortunately, are not stable. Since they are based on a constantly fluctuating market value, the potential for a drastic decrease in value after an EB-5 investor has purchased the currency and before he or she is able to exchange it for U.S. dollars is very real. If this occurs, the investor will no longer have the required funds for an EB-5 investment, resulting in a delay in the process while the investor obtains additional needed funds.

Additional Costs Related to Government Regulations

As exchange rates for some currencies are controlled by local governments (such as the Chinese RMB/Yuan), an investor may be confronted with additional costs due to inequivalent exchange rates. Digital currency exchange rates are controlled solely by the supply and demand of the market; thus, they may differ substantially from individual country exchanges rates.

Restrictions on How Much Digital Currency Can Be Purchased at a Time

Most digital currency exchanges have placed limits on the amount of digital currency an individual can purchase at one time. Limits may cover the purchases in a day, a week, a month, or more. Even the most popular exchanges in the United States impose such limits. For example, in the state of New York, an individual cannot purchase more than $8,000 bitcoin in a single week, which is approximately 21 bitcoins at the current exchange rate. These limits may pose a challenge to investors, as they make it difficult for investors to exchange the needed amount of funds in a timely manner.

Where Digital Currencies are Headed

The use of digital currency as a means of transferring funds is expected to continue to grow globally. While it is currently only one way to transfer funds, its use has increased rapidly over the years as well-known companies have begun to permit its use. Microsoft and PayPal are among those, as they now accept bitcoin as an appropriate form of payment.

However, digital currencies are still relatively new and, as such, carry with them unknown variables and have not yet gained the trust of investors. There is not a lot of detailed information available to potential investors about the process of digital currency transactions, and many are concerned about the fluctuating market value of the currency and the lack of global acceptance of its use. However, as more difficulties arise in the process of exchanging currencies through traditional methods, digital currencies are expected to rise in popularity. Countries may continue to attempt to regulate the use of digital currency, much like China already has. However, ways have been found to circumvent regulations in a way that is impossible to do with direct exchanges of local currencies. Due to this, it is expected that digital forms of currency will be in greater demand by EB-5 immigrant investors who are located in countries that have rigid regulations regarding the exchange of local currency in an effort to protect their economy.

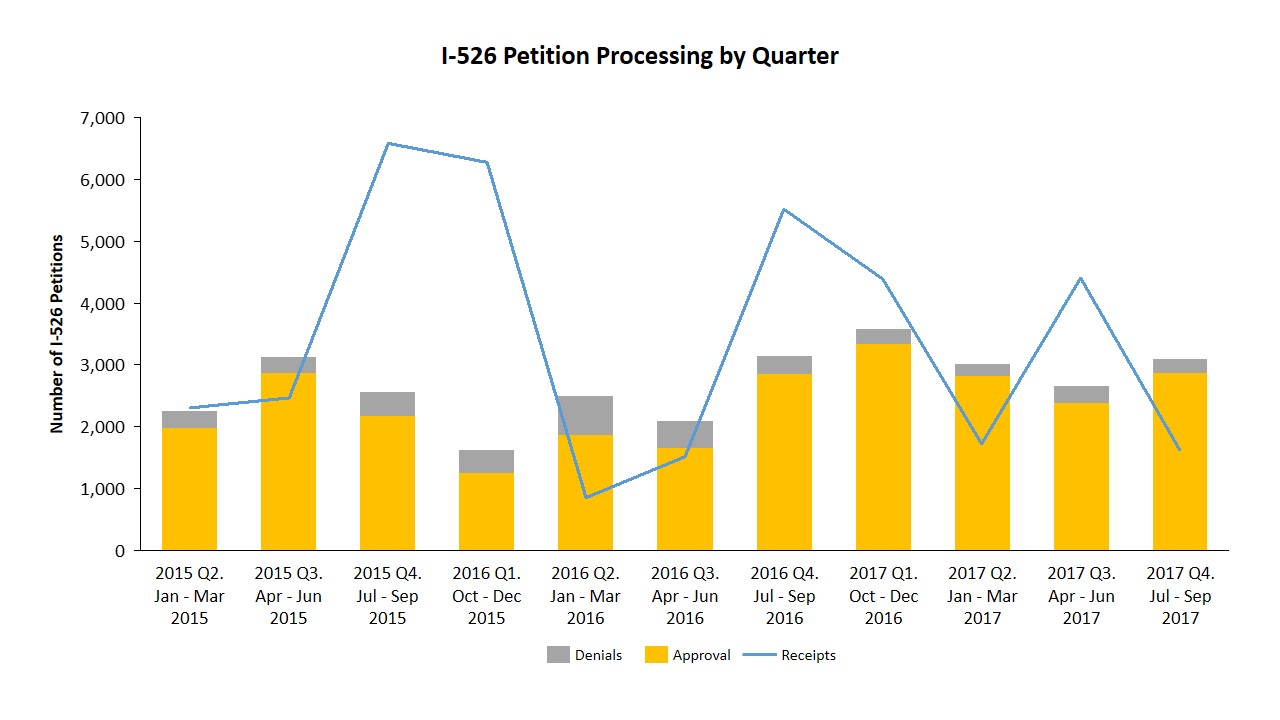

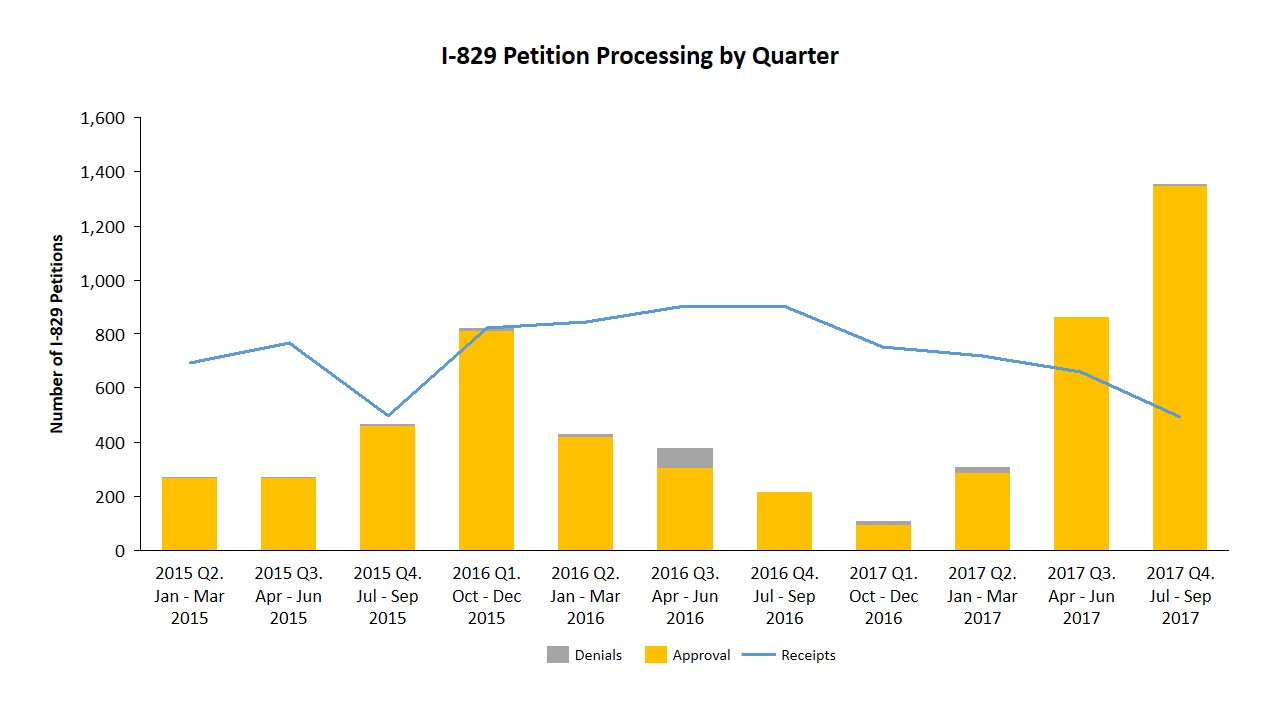

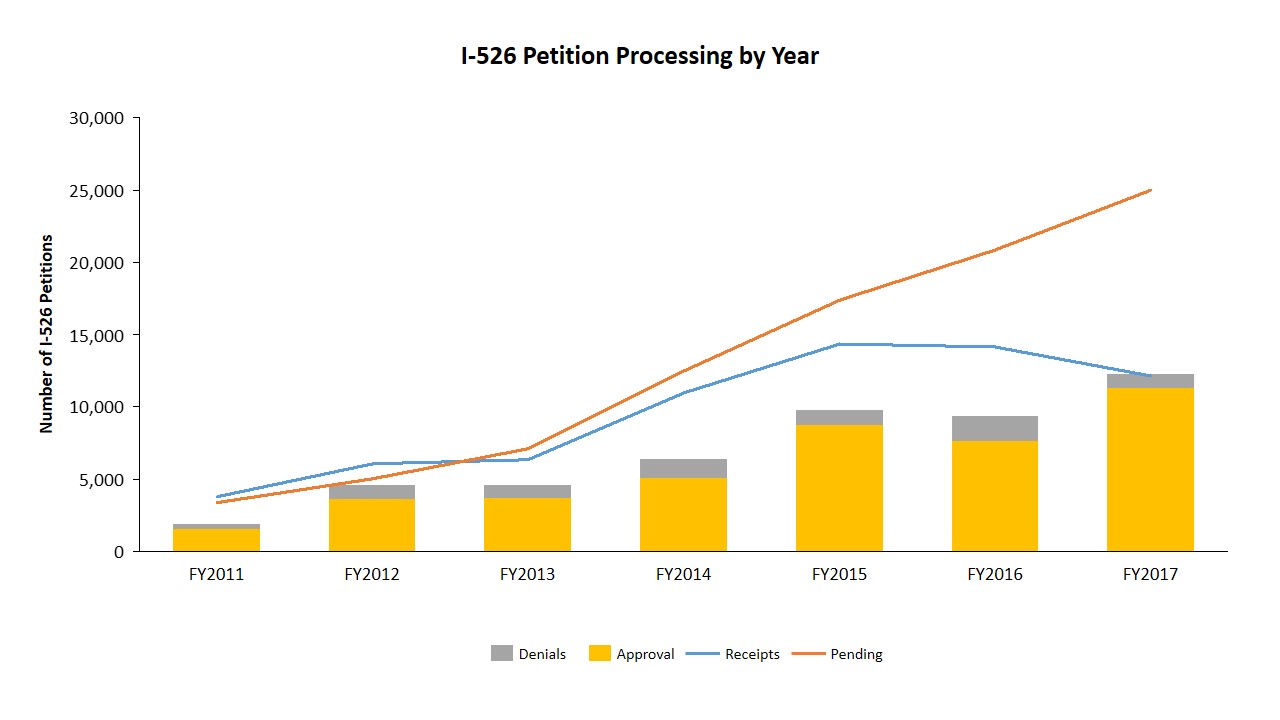

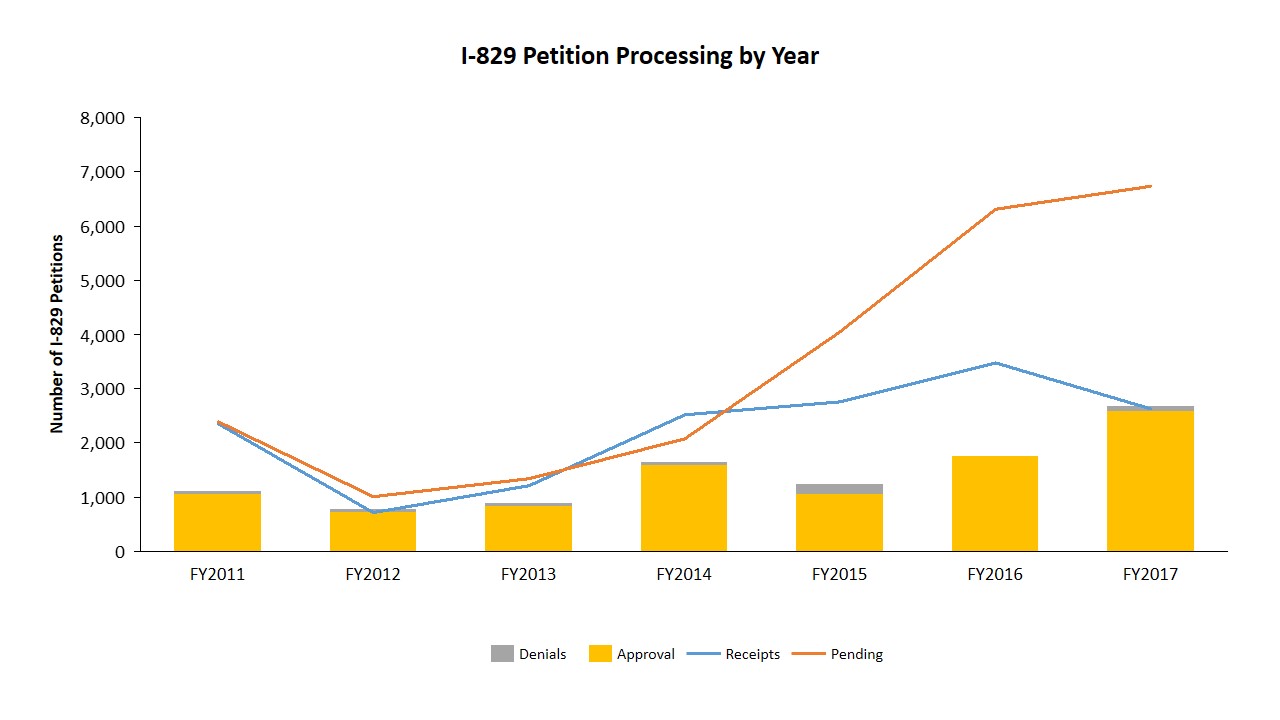

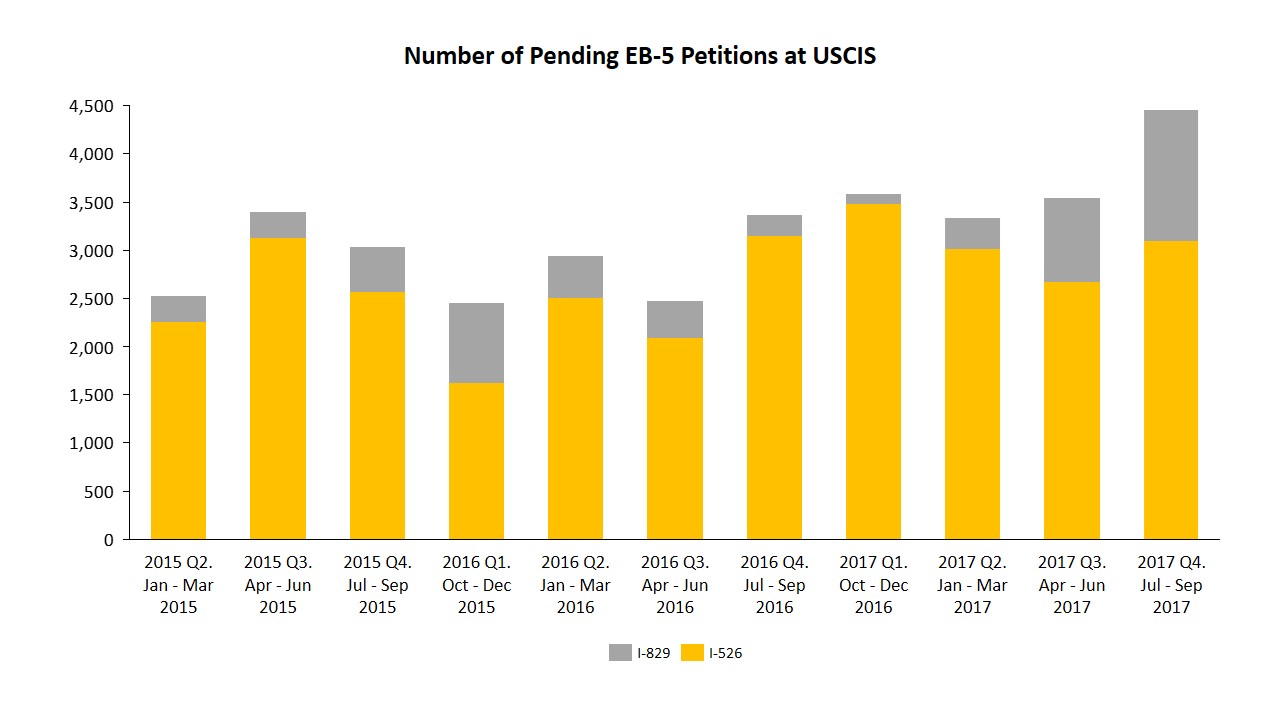

Overall, the number of I-526 forms received during the 2017 fiscal year decreased by 14% from the 2016 number, and the number of successfully processed forms increased by 31%. Similarly, 24% fewer I-829 forms were received, and 42% more were adjudicated. Despite the positive changes, the high number of I-526 forms received in 2017 combined with the number of still-pending petitions will take years to process with the current annual immigrant visa issuance limit of 10,000.

Overall, the number of I-526 forms received during the 2017 fiscal year decreased by 14% from the 2016 number, and the number of successfully processed forms increased by 31%. Similarly, 24% fewer I-829 forms were received, and 42% more were adjudicated. Despite the positive changes, the high number of I-526 forms received in 2017 combined with the number of still-pending petitions will take years to process with the current annual immigrant visa issuance limit of 10,000.

The expectation is that processing times will continue to improve during the next fiscal year, adhering to the trend of the past five years. IPO is in the process of adding to its staff in its efforts to continue reducing those times.

The expectation is that processing times will continue to improve during the next fiscal year, adhering to the trend of the past five years. IPO is in the process of adding to its staff in its efforts to continue reducing those times.