U.S. Department of State (DOS) Chief of Visa Control and Reporting Division Charles Oppenheim held a virtual keynote address on EB-5 visa availability in mid-November 2020. This webinar followed the opening of the new fiscal year for the EB-5 Immigrant Investor Program, at which time United States Citizenship and Immigration Services (USCIS) allocates its annual visas. Usually, about 10,000 visas go to the EB-5 program.

Generally, these are enough for around 3,000 EB5 investment participants, considering most apply for EB-5 visas for themselves, their spouse, and their eligible dependent children. That said, an unprecedented 2020 has left the EB-5 program holding nearly double its annual allotment. Oppenheim’s robust presentation provided a detailed outlook on where consular processing stands and on how EB-5 visas may be distributed throughout the remainder of FY2021. It held particularly relevant information for EB-5 investment participants from Asian countries, including China, Vietnam, and India.

Especially notable were his thoughts on how consulate activity slowdown is likely to affect FY2021. He also addressed how adjustment of status could be a solution to the bottlenecking of EB-5 visas this year and clues as to why that solution is not likely to be implemented. He discussed several other contributing factors to how he sees the year’s EB-5 Visa Bulletins taking shape as well.

Normal Consulate Activity on EB-5 Investment Visas Yet to Resume

U.S. consulates and embassies the world over experienced temporary closures in the wake of the global pandemic, and in August 2020, reports began to surface of these offices beginning a process of phased reopening. However, Oppenheim has “no idea” when consulates will actually return to a normal level of EB-5 processing activities. Why is this important? Because, as we saw in 2020, EB-5 investment visa distribution hinges on normal consular processing of visa applications.

General EB-5 industry consensus has been that the halt in visa issuance throughout much of FY2020 would naturally result in an influx of available EB-5 visas in this fiscal year. Yet, as the first quarter of FY2021 ends, it seems professional opinions on that prediction are shifting. A continuation of slowed consular operations, for instance, has left Oppenheim estimating that actual EB5 investment visa distribution will be far less than the number of visas theoretically available to EB-5 investors in this fiscal year.

Oppenheim Compares EB-5 Visa Availability to Issuance

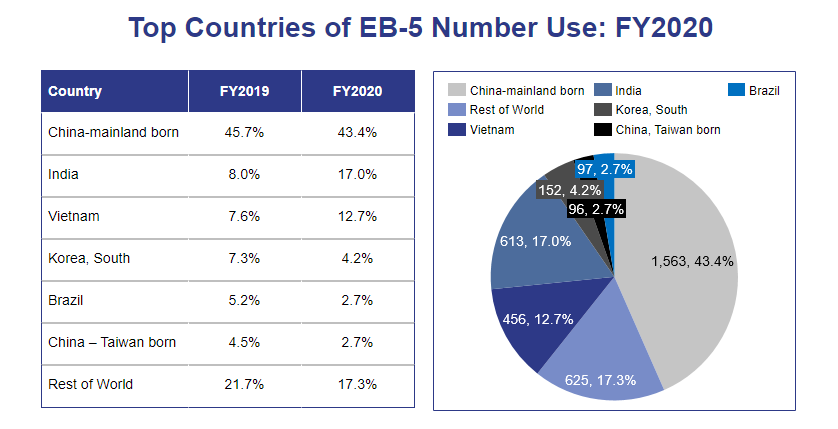

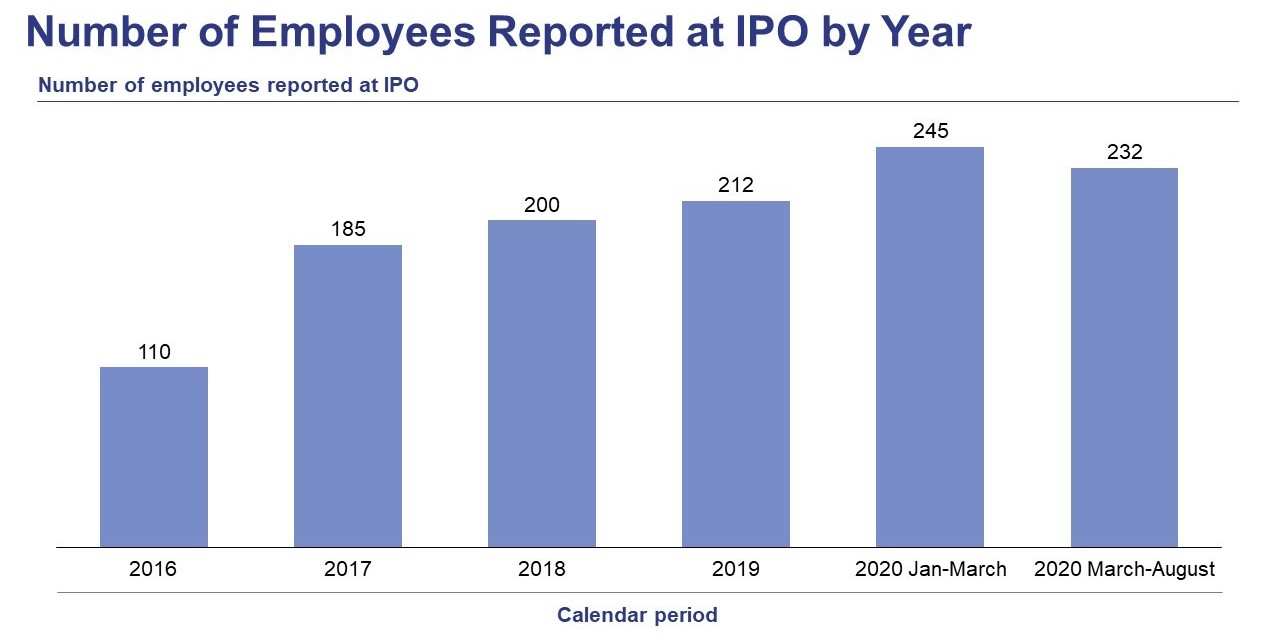

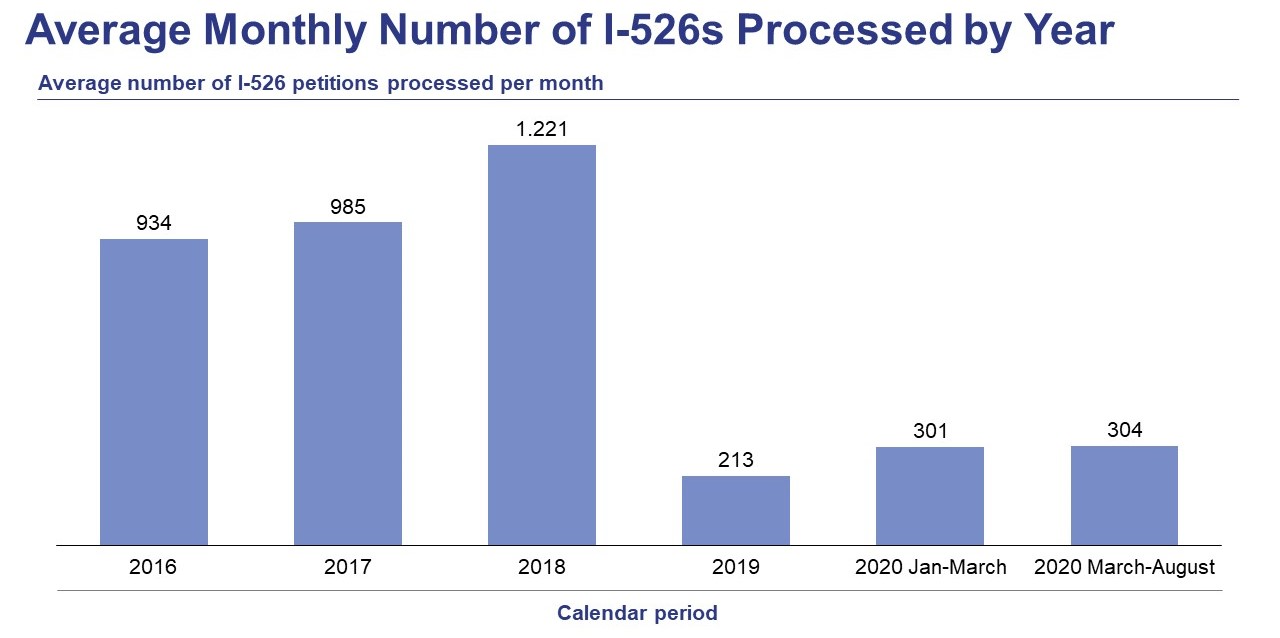

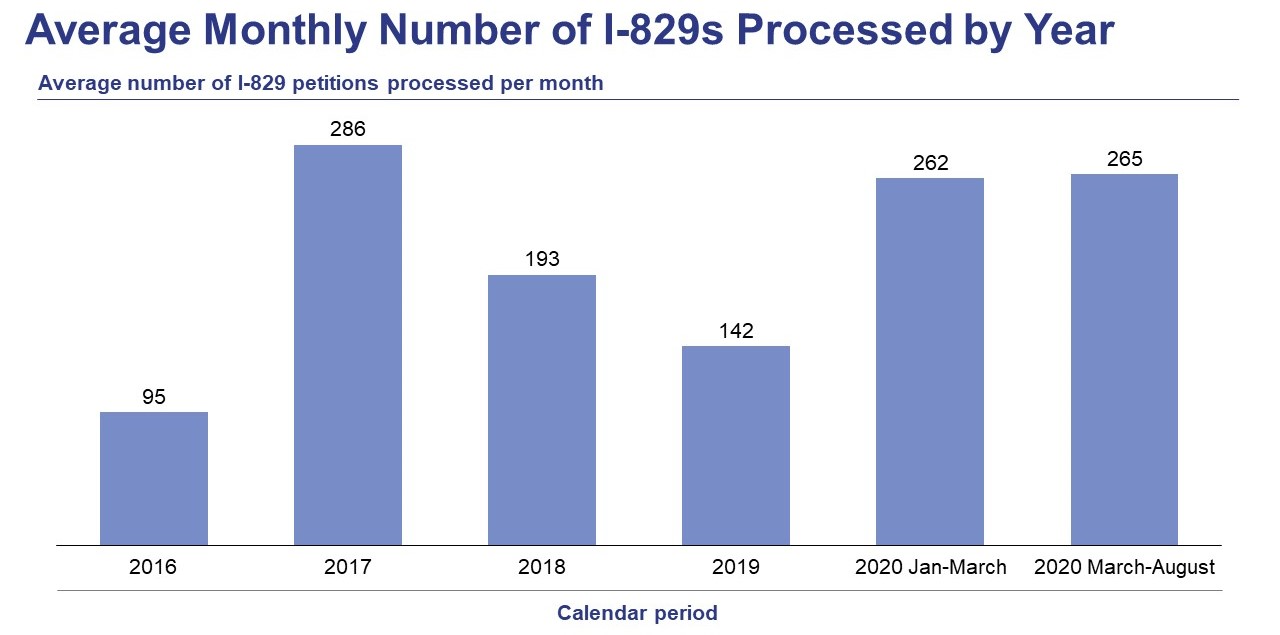

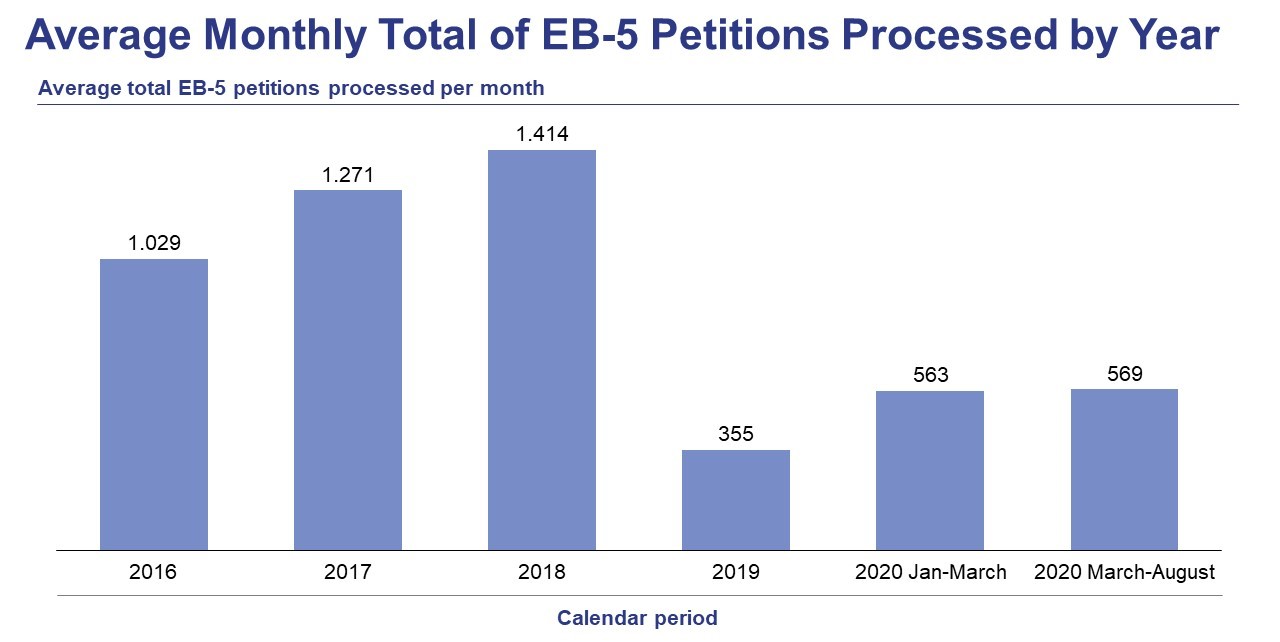

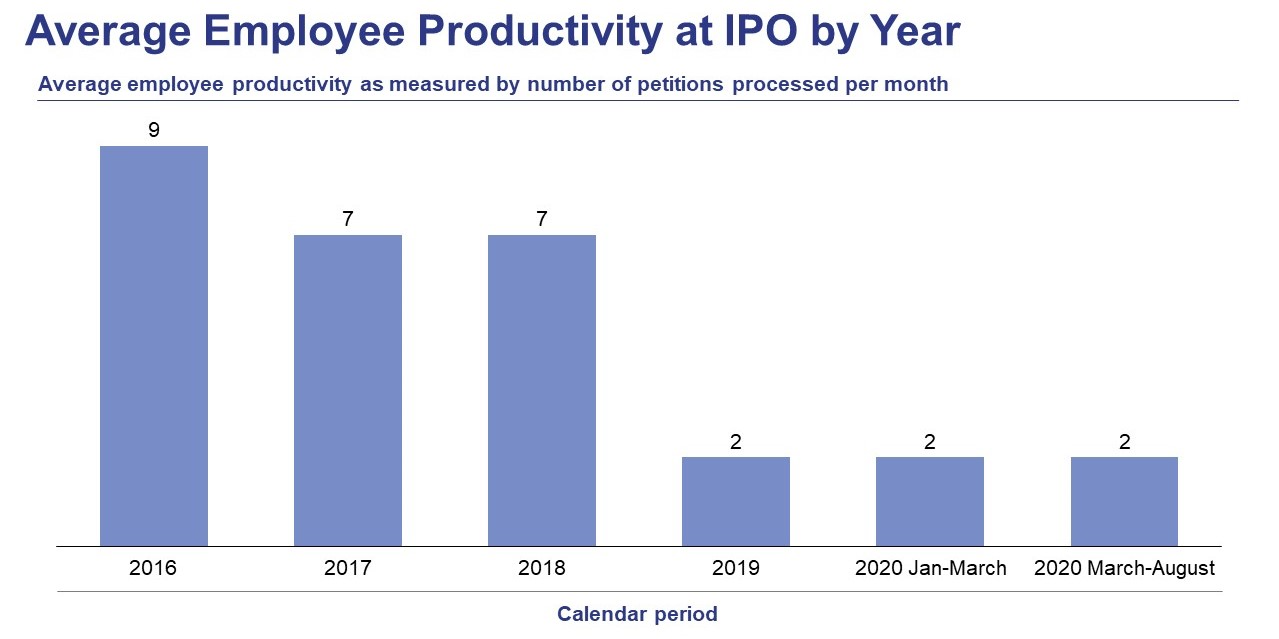

Charles Oppenheim provided a number of charts related to EB-5 investment visa issuance data over the last few years to demonstrate how EB-5 visas were distributed over the last fiscal year and this one.

Here are some of the key communications that can be gleaned from his commentary and the data from these slides:

- Due to consular slowdown since March 2020, only 3,602 of 11,112 available EB-5 investment visas were issued in FY2020.

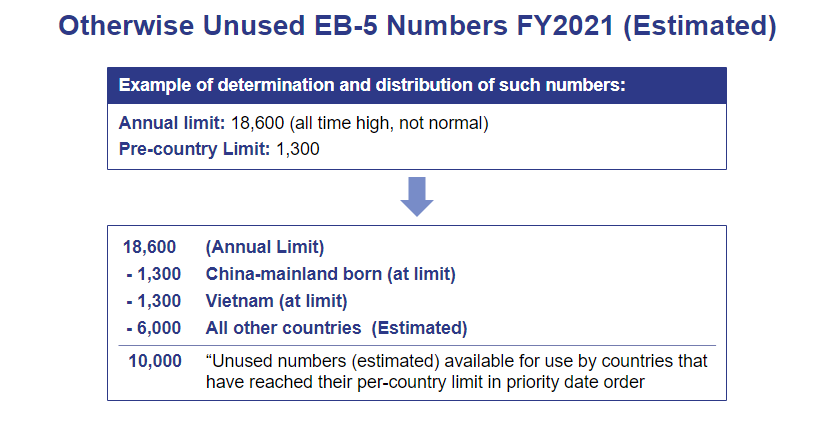

- After the appropriate rollover of various immigration visas took place, the FY2021 quota set for EB-5 visas was 18,600.

- Without the full resumption of consular visa issuance activities having taken place, however, Oppenheim offered an informal estimate that for the remainder of the year, only a small percentage of those could logistically be issued.

Based on the snail’s pace of operations resumption to date, the EB-5 program may see another year before backlogs and delays caused by the pandemic will self-correct through the redistribution of visas across immigration programs. Thus, it is quite possible another mass rollover of visas will occur at the end of this fiscal year, and Oppenheim seems to suggest through his estimates that the EB-5 quota may be raised to 14,200 or more in FY2022.

Oppenheim Opines on Adjustment of Status as a Solution for Consular Slowdown

One solution to getting more visas into the hands of qualified immigrant investors has been floating through the EB-5 community: a shift in focus to adjustment-of-status applications. But is the government willing (or even able) to get the ball rolling in a truly meaningful way in FY2021? Could their efforts genuinely compensate for the ongoing limitations of consular processing? Oppenheim and plenty of other industry experts don’t seem to be holding their breath.

Reasons Adjustment-of-Status Applications Aren’t Likely to Advance

The published presentation reflects a total of 1,117 EB-5 investment visas being issued in FY2020 via an adjustment of status. This is fewer than average in a normal year, and it wasn’t for a lack of available EB-5 visas. Only about a third of available visas were issued through the EB-5 program in FY2020, in fact.

The low figure isn’t due to a lack of demand, either. Oppenheim pointed to the 2,500 I-485 petitions awaiting USCIS adjudication for Chinese EB-5 investors alone. That leaves two possible obstacles:

- The DOS specifically chose not to shift visa bulletin dates in a way that would allow advances of adjustment-of-status applications over consular processing applicants.

- USCIS’s delayed pace simply blocked this pathway to greater visa issuance (which is entirely possible).

Frankly, either or both is possible based on a historical understanding of these processes. Combine that with Oppenheim’s informal (and rather bleak) estimates sprinkled throughout his presentation, and it makes sense that one might hold limited expectations that adjustment-of-status applications might effectively loosen the noose on visa availability—at least for now.

What we do know is that things are likely to be different after the U.S. election. The incoming administration is interested in repairing and strengthening global relations and is far more immigration friendly than the last. We may just see several politically motivated roadblocks moved away from the EB-5 path to U.S. permanent residency sooner than we think.

Expectations for the EB-5 Visa Bulletin in FY2021

An important topic in the EB5 investment community, Oppenheim addressed standing speculations on changes to the relationship between Hong Kong and Mainland China. On the question of whether applicants from the region are considered a part of Mainland China, he stated, “Hong Kong is still at this point treated as a separate foreign state, for IV purposes, going forward.” Furthermore, seemingly low demand for the EB-5 investment program from outside of China, Vietnam, and India indicates little expectation from Oppenheim of any other country reaching its EB-5 visa limits throughout the remainder of the fiscal year.

What kind of movement can we expect in coming issues of the 2021 EB-5 Visa Bulletin based on Oppenheim’s presentation?

China’s Holding Pattern Is Likely to Continue through FY2021

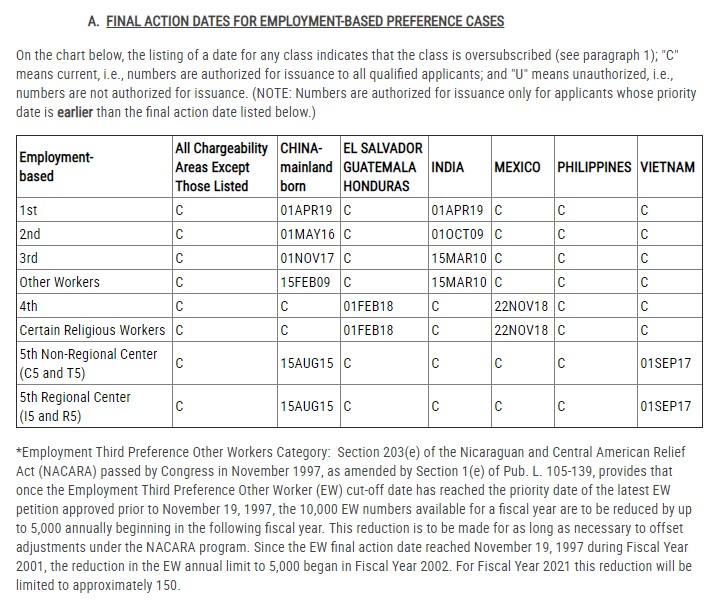

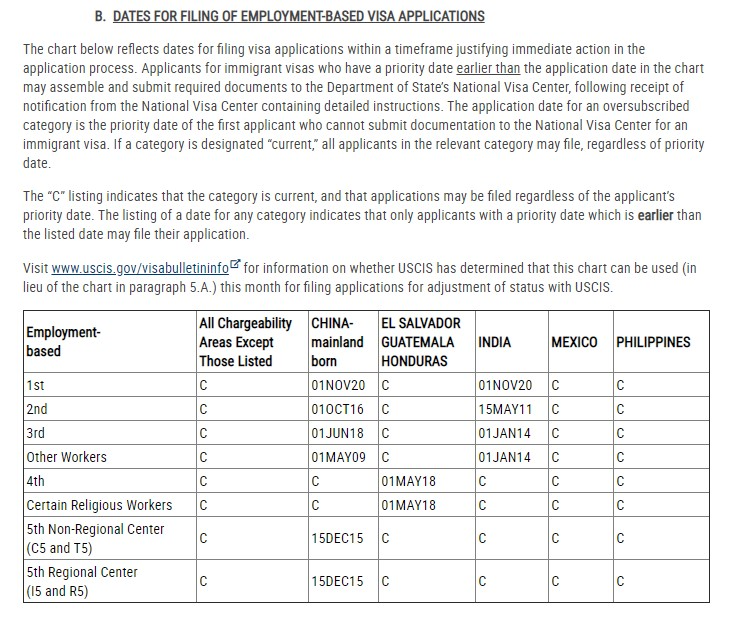

Oppenheim predicts Chart B will not advance for Chinese investors for the foreseeable future due to its nearly 8,000 applicants at the ready. He informally predicted that only about 3,000 visas could reasonably be issued in the remainder of FY2021, and only between 3,500 and 4,000 could go out in FY2022. Based on those estimations, China’s dates for filing found in Chart B would not need to be adjusted until late into 2022.

Two key factors could change this expected holding pattern:

- If DOS were somehow able to shift into high gear and actually issue the estimated 11,300 EB-5 visas available to Chinese EB5 investment participants in the next nine months.

- If USCIS elected to maximize Chinese adjustment-of-status processing for investors already in the queue while outside consulates remain inoperable.

Vietnamese Dates Could Shift Again Before FY2021 Ends

The movement shown in the December 2020 Visa Bulletin for Vietnam informed Oppenheim’s report of nearly 500 Vietnamese EB5 investment applications being ready for processing. Because he also offered up an estimate of DOS being able to reasonably issue at least 600 EB-5 visas of the 1,302 technically available to Vietnam in FY2021, it makes sense that dates will shift again for this country before the year is out.

India Expected to Stay Current, Omitted from List of Countries “At Limit”

Oppenheim did not specifically predict that India will remain current in FY2021. However, he did omit the country from his slide indicating countries “at limit.” This is likely due in large part to India’s 87% backlog on I-526 processing. Unless the number of India-born EB-5 investment participants begins approaching 1,300 (total estimated Indian EB-5 visas available in FY2021), its visa bulletin limits will not change this year.

Overall, this can be mixed news for Indian EB-5 investors. On one hand, EB-5 applicants from India who are at the head of the line and who manage to hurdle the I-526 approval process will be able to proceed unhampered in filings toward final action. On the other, those left at the end of the line may see little movement as (i) the I-526 train chugs forward ever so slowly and (ii) reduced consular activity has seemingly destined far fewer visas to be issued this year.