Historically, United States Citizenship and Immigration Services (USCIS) has maintained strict guidelines for EB-5 investment funds. One such mandate is that investors are expected to prove that their loans were secured by personal assets.

The groundbreaking case Zhang v. USCIS is reshaping the rules for EB-5 investments. It has taken time, resources, and official court rulings, but USCIS may be finally shifting its stance on unsecured loans. The policy changes unearthed in this case may create more opportunities for EB-5 investors, especially those struggling to meet the minimum EB-5 investment amounts.

Zhang v. USCIS

The history of this case begins in 2013 when Huashan Zhang and Masayuki Hagiwara each invested $500,000 into a new commercial enterprise (NCE). The funds were borrowed from each investor’s own business. The investors planned on meeting the eligibility requirements for participation in the EB-5 program.

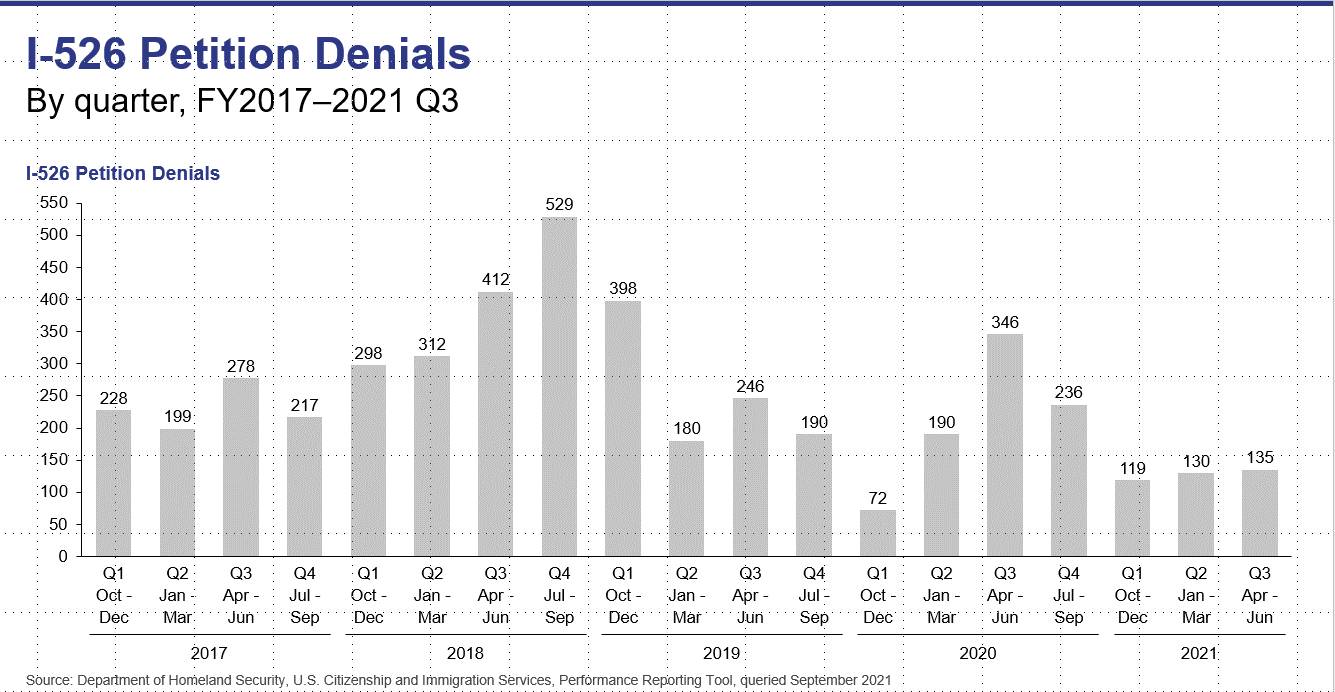

Unfortunately for Zhang and Hagiwara, USCIS adopted a new policy in a 2015 stakeholder meeting that focused on the rules surrounding “cash” and “indebtedness” in the approval of EB-5 investment funds. USCIS determined that cash resulting from a loan (garnered through a third party) is actually indebtedness. This indebtedness would then require collateralization through investor-owned assets. In other words, because Zhang and Hagiwara’s investment was from uncollateralized loans rather than from secured assets, their I-526 petitions were denied.

USCIS’s decision to alter their definitions of “cash” and “indebtedness,” was unpopular. Zhang and Hagiwara decided to file a lawsuit against USCIS.

“Cash” vs. “Indebtedness” in Court

The journey of the Zhang v. USCIS case has been a long one. The filing first went to a district court in November 2018, and the court ruled in favor of the plaintiffs. Then, at USCIS’s insistence, the case then went to the U.S. Court of Appeals for the District of Columbia.

In 2020, the Court of Appeals determined that USCIS had wrongfully imposed collateralization demands on loan investments. After examining the standard definitions of “cash” versus “indebtedness,” the court ruling was that USCIS’s interpretation violated the plain meaning of EB-5 regulations. The court explained that “cash is fungible and it passes from buyer to seller, without imposing on the seller any of the buyer’s obligations to his own creditors.”

Loan Proceeds are “Cash,” and Cash is Qualified Capital

In spite of USCIS’s efforts, the appeals court ultimately ruled in favor of the plaintiffs. Essentially, it was determined that loan proceeds are “cash” and qualify as capital. As such, unsecured loans were classified as a legitimate source of funds for EB-5 investments. This was a victory for the plaintiffs and the EB-5 investment program.

The Future of USCIS and Unsecured Loans

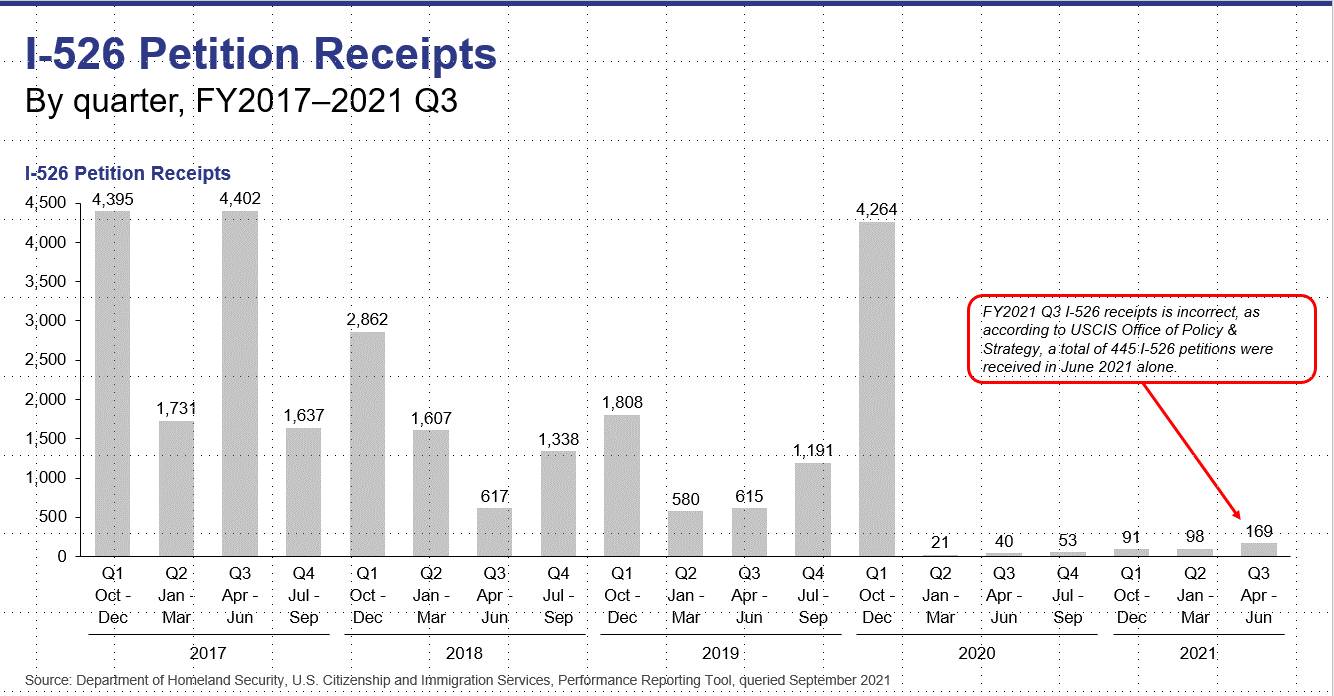

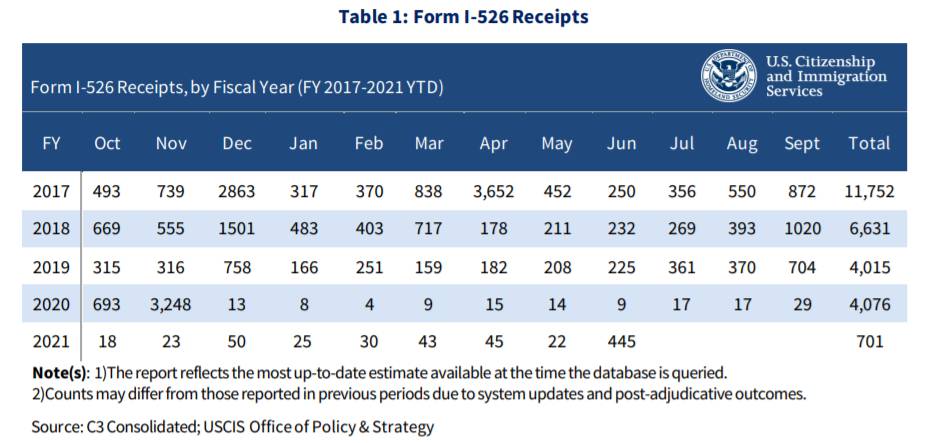

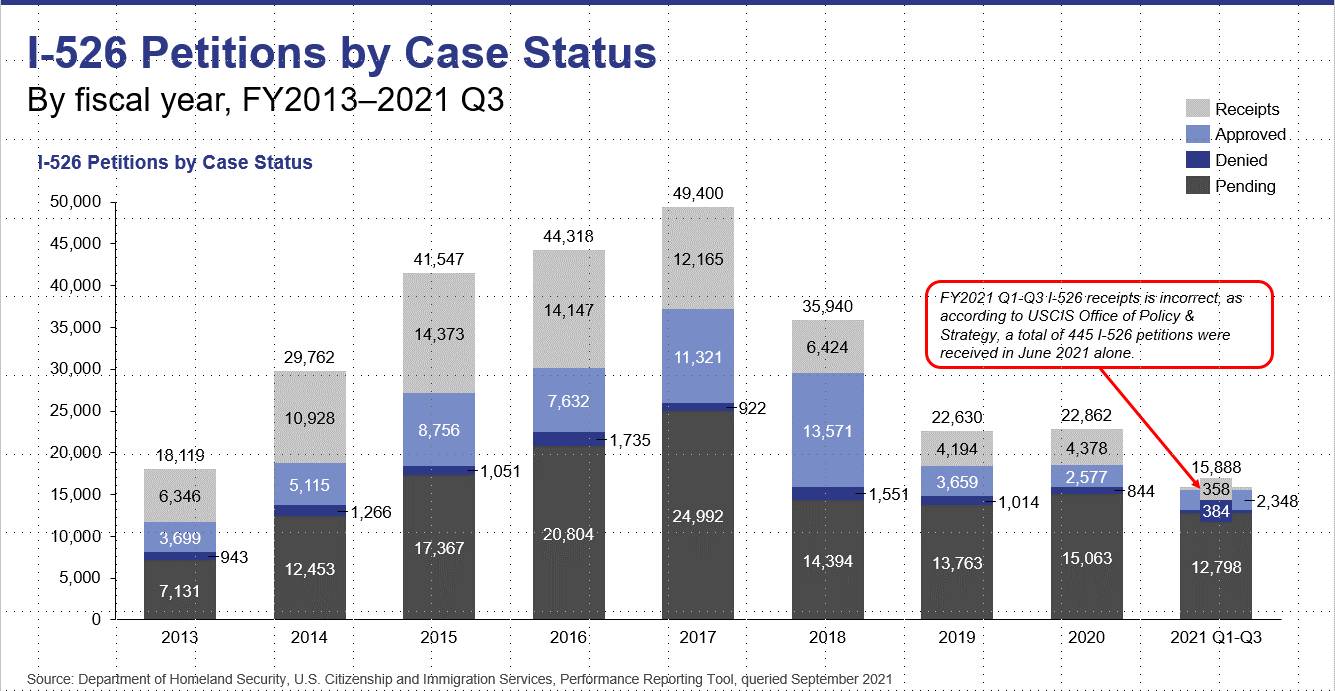

The ruling was binding on USCIS, and Zhang’s victory establishes an important precedent for EB-5 investors. USCIS approved Zhang’s I-526 petition on April 14, 2021. Although the exact future of unsecured loans in the EB-5 investment industry is somewhat unclear, the ruling suggests that these types of loans may eventually become eligible for regular use in the EB-5 investment process.

Using Loaned Funds for an EB-5 Investment

Investors who are considering using a loan to fund their EB-5 capital should note that the majority of USCIS guidelines are still in place for all investors. In order to ensure that their investment capital meets all the source-of-funds requirements, investors should work with an experienced EB-5 legal professional before investing in an NCE. Consulting with an EB-5 firm such as EB5AN can save foreign nationals significant time and resources by avoiding issues that lead to petition denials.