The EB-5 Investment Program is a great option for foreign nationals who are planning to relocate to the United States. In the decades since its creation, the program has helped thousands of investors and their families gain U.S. permanent residency.

With its unique advantages and business opportunities, the EB-5 program offers a gateway to permanent residency for qualified investors and their families. It also allows them to invest in the thriving U.S. economy.

If you’re Canadian and wondering whether the EB-5 program is right for you, this article can help you understand what it’s all about. In it, we discuss why the EB-5 visa is such an excellent immigration opportunity, and everything you need to know to apply successfully.

Why Are Canadians Moving to the United States?

Although Canada has historically been a country with a very high quality of life, many of its most attractive characteristics have faced challenges in recent years. This has led to a rise in the number of Canadians looking to move to the U.S. to secure a brighter future for their families.

Many students also move to the U.S. and account for more than one million of the international learners currently enrolled in schools. To add to this, the U.S. is a popular choice among foreign workers who can obtain temporary employment through H-1B visas.

Data from the Migration Policy Institute shows that many Canadians have moved to the U.S. for a better quality of life. Over 95% of Canadian immigrants have access to healthcare in America, and around 65% of those who move to the U.S. are able to find full-time employment.

Canadians may also consider moving to the U.S. because of its lower taxation rate. Data shows that, in 2021, as much as $14,493 per capita was collected for tax in Canada, whereas only $11,365 per capita was collected in the U.S.

There are currently more than 800,000 Canadians living and working in the United States, making up around 60% of immigrants in this country. Of those, around 30% have settled in California and Florida, two states known for their excellent living conditions and work opportunities.

Why Is the EB-5 Program a Great Option for Canadians?

The EB-5 Immigrant Investor Program is an appealing investment opportunity for Canadians looking to immigrate to the United States. With the potential to obtain citizenship, the program offers long-term residency stability and access to various benefits in a strong economic environment.

Unlike many other immigration pathways, the EB-5 program allows participants to bypass many of the complexities foreign nationals face when they want to secure permanent residency. With the EB-5 program, investors won’t have to worry about securing employer sponsorship or adhering to strict travel regulations to maintain their residency status.

The program allows foreign nationals to become business owners by investing in EB-5-approved projects. Not only do these projects promote economic growth, but they also give investors a great opportunity to expand their investment portfolios. Investors can also live and work anywhere in the country, including in any of the nine states that don’t require income taxes.

Brief overview EB-5 program

The EB-5 Immigrant Investor Program is run by the United States Citizenship and Immigration Services (USCIS) and provides an opportunity for foreign investors to obtain permanent residency in the country.

The program requires applicants to make a qualifying investment of at least $800,000 into a new commercial enterprise (NCE) if the NCE is located in a targeted employment area (TEA), or $1,050,000 if it’s not. An NCE is an entity designed to create and maintain at least 10 jobs for full-time U.S. workers.

Investors can also choose to invest money through the EB-5 regional center program—largely because of new project regulations that were approved in 2022—which offers different job creation opportunities within the project.

Certain EB-5 program requirements are a bit more flexible when you make an investment via a regional center. For example, investing in a regional center allows both indirect and direct jobs to be counted towards the required total of 10. If you invest directly in an NCE, you can only count direct jobs.

Wondering which EB-5 investment would work for you? Consider our Twin Lakes Georgia EB-5 Project. You can find more details

HERE.

The advantages of the EB-5 Investment Program for Canadians

Applying for U.S. citizenship through the EB-5 program has various advantages for Canadian investors:

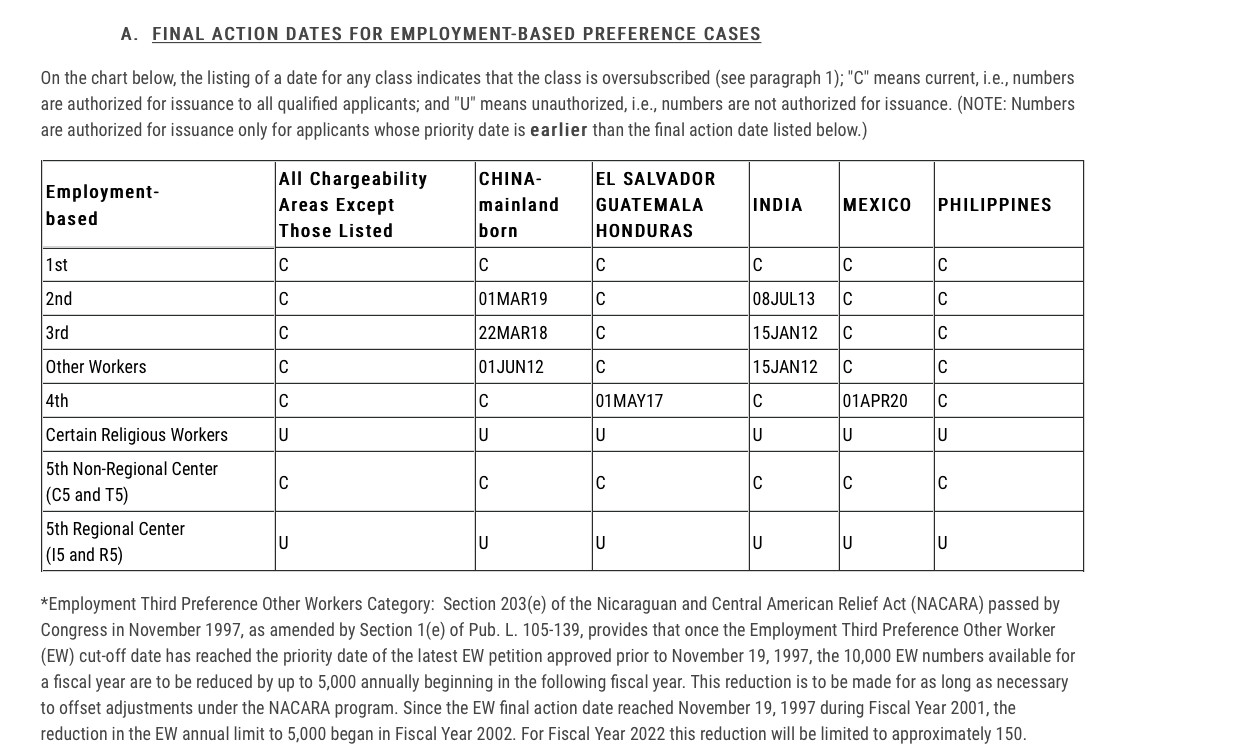

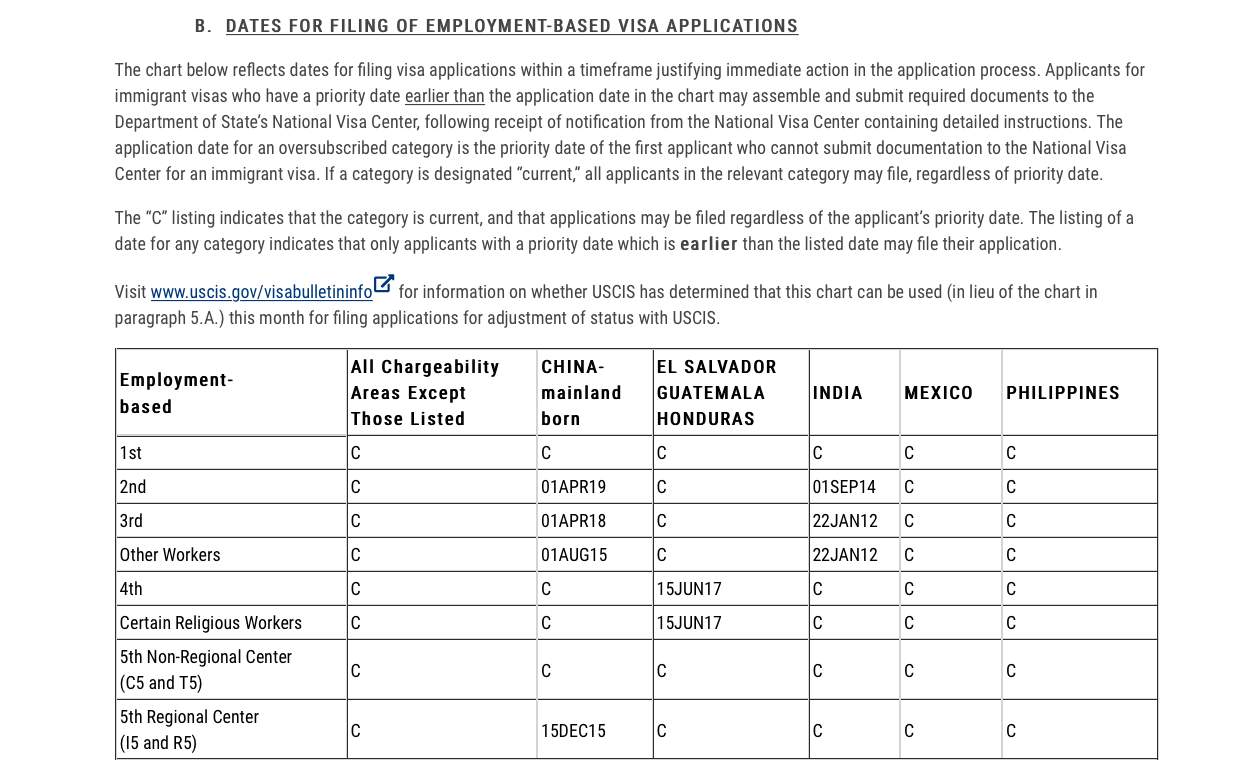

- Faster pathway to obtaining a Green Card: The EB-5 program is generally considered as one of the fastest ways to gain permanent residence in the U.S., because it’s not restricted to visa limitations. Some immigration categories only allow for a certain number of visas to be issued per year, often causing thousands of applicants to be rejected. Of the 700 EB-5 visas available annually for Canadians, only around 35 are claimed, making it a non-competitive environment.

- No required visa sponsors: An EB-5 investor and their dependent family members are automatically eligible for a Green Card and won’t have to secure employment or educational sponsorship first.

- Lucrative investment opportunities: NCEs in the U.S. can be highly profitable. U.S. economic development is one of the largest and most diverse in the world, making it a great option for investors.

- Access to American education: EB-5 investors’ children can attend public school in the U.S. for free. As permanent residents, they will also have a chance to be accepted into various top-rated colleges and universities at a lower tuition rate.

- Potential for U.S. citizenship: Obtaining citizenship through the EB-5 program is one of the easiest ways to secure your future in the United States. With this program, you can apply for citizenship after five years of receiving your permanent resident status.

Requirements for the EB-5 Investor Visa Program

There are a number of requirements that EB-5 applicants must meet for their applications to be successful. These include:

- Making the required capital investment into an approved entity in the United States

- Demonstrating that this investment will create and maintain at least 10 full-time jobs

- Provide evidence that the invested capital was obtained lawfully. This evidence can include financial or bank statements

- File the correct forms and supporting documentation

It’s important to note that this isn’t an exhaustive list, and each requirement has many steps that you need to fulfill. These can be tricky to navigate, so it’s recommended to make use of an immigration lawyer to help you.

Key Point: EB-5 Visas vs. E-2 Visas

Canadian foreign nationals may also consider the E-2 visa for treaty investors. This is an employment-based visa that allows the majority of immigrant investors from treaty nations to enter the United States for business purposes.

Similar to the EB-5 visa, E-2 visas also allow an investor’s immediate family members to receive their Green Cards. However, you’ll have to renew your E-2 visa every two years, whereas the EB-5 visa allows you to apply for citizenship after five years if you’ve met the necessary requirements.

What Is the Application Process for the EB-5 Program?

The application process for the EB-5 program involves several key steps that you must follow to have your documents approved. This process is outlined below.:

- Determine your eligibility: Potential applicants must ensure that they meet certain eligibility criteria, which include making the necessary investments and fulfilling other program requirements.

- Select a sustainable EB-5 project: Investors typically choose a project that aligns with their business investment goals and risk tolerance.

- Make the qualifying investment: The minimum investment amount varies depending on whether you put money into a TEA or non-TEA project. For non-TEA projects, the minimum amount is $1,050,000, and for TEA projects, it’s $800,000.

- File Form I-526, Immigrant Petition by Regional Center Investor: Applicants must file this form to demonstrate their eligibility and provide details of their investment to USCIS.

- Obtain conditional permanent resident status: If your Form I-526 petition is approved, you and your family members can apply for conditional permanent residency in the United States. This status is valid for two years.

- File Form I-829, Petition by Entrepreneur to Remove Conditions: Before the end of your two-year residency period, you must file Form I-829 to request that any conditions placed on your status be removed.

- Obtain permanent resident status: If your Form I-829 petition is approved, you and your family can obtain permanent residency. After five years, you can apply for citizenship.

How long does it take to get an EB-5 visa?

The processing times for an EB-5 visa can vary depending on the complexity of your application, changes in immigration policies, and the current workload of the USCIS offices.

Recent investors in rural TEA projects have obtained I-526 approval in as little as 11 months through priority processing.

Once you have filed your application, you’ll be issued with a case number that you can use to track its progress. USCIS will also upload any updates or requests for evidence (RFE) under this case number, so it’s important to check their website regularly to ensure you don’t miss anything important.

Choose the Right Investment Project with EB5AN

It is essential for foreign nationals to seek the help of an immigration attorney to guide them throughout the EB-5 investment process and ensure they follow the strict regulations set out by USCIS. This gives them the best chance to have their application approved.

There may also be significant changes in the future for Canada, which makes this the right time to consider immigrating. The EB-5 investment visa is a good opportunity for Canadian citizens to relocate and start fresh in the United States.

To learn more about finding a qualifying investment project and other information about the EB-5 program, reach out to EB5AN.

Don’t Delay Your Future in the U.S.

The EB-5 visa program and application process can be challenging for individuals to navigate while ensuring they meet all its specific requirements. That’s why EB5AN is here to help. EB5AN has over a decade of EB-5 experience, successfully guiding more than 2000 families from over 40 countries through the project development and investment program.

With a nationwide network of USCIS-approved regional centers that covers more than 30 states and territories and a 100% petition approval rate, EB5AN is well-equipped to streamline your EB-5 visa investment process.

For more information on how our experienced team can help you obtain permanent residency through the EB-5 program, contact EB5AN today.