The EB-5 investment program requires a capital commitment of $1.8 million from an immigrant investor seeking permanent residency in the United States. However, investors can reduce the minimum investment requirement to only $900k if they choose an investment located in a targeted employment area (TEA). An area is considered a TEA if it is located in either (i) a rural area or (ii) an area experiencing high unemployment.

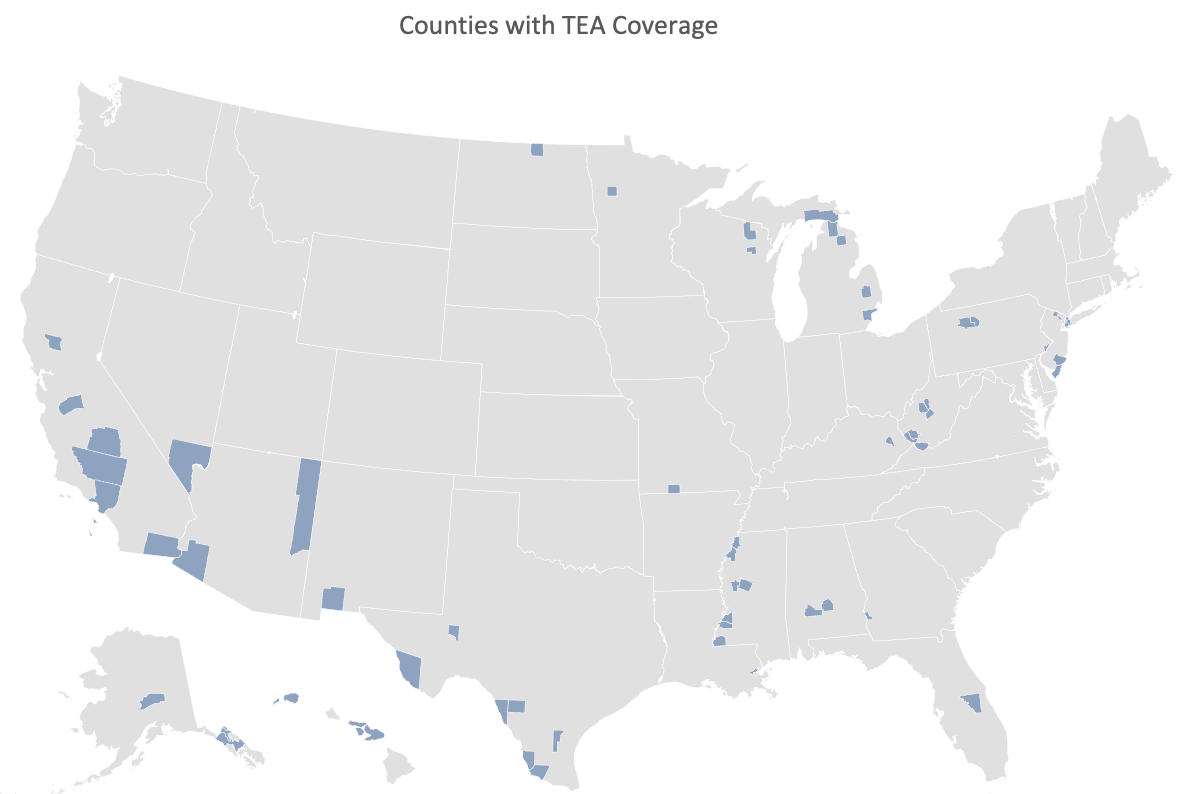

The COVID-19 pandemic has resulted in dramatic increases in national unemployment, with impacts to specific regions differing greatly. Employment data reflecting the impacts of the COVID-19 pandemic was released by the Bureau of Labor Statistics (BLS) in April 2021. EB5AN’s free national EB-5 TEA map, which allows project developers to instantly check whether an address qualifies as a TEA, has been updated to reflect the most current BLS data.

Prior to the latest BLS data release, entire counties qualifying as TEAs were mostly limited to smaller, or more rural, counties. However, as a result of impacts of the COVID-19 pandemic, counties now qualify as TEAs in more populous urban areas such as Los Angeles County, California, and Brooklyn County, New York.

Read below to learn how TEAs are designated and to see a complete list of the full counties that now qualify as high-unemployment TEAs.

How Are TEAs Designated?

A rural TEA must be located outside of a metropolitan statistical area (MSA) and outside of a town or city with a population above 20,000 people. A high-unemployment TEA must have an unemployment rate at least 150% of the national average. High-unemployment TEA designations are made for individual census tracts, a combination of directly adjacent census tracts, or at the county-wide level. If the area is a combination of adjacent census tracts, the weighted average of that group’s unemployment must reach at least 150% of the national average to qualify as a TEA. Additionally, an entire county can qualify as a TEA if the county-wide unemployment rate is greater than or equal to the unemployment rate requirement for the given period.

What Are the Different Methodologies to Determine a Project’s TEA Status?

The burden falls on EB-5 projects themselves to prove that their site qualifies as a TEA. When calculating unemployment rates for high-unemployment TEA designation, projects use one of three methodologies: (i) ACS, (ii) census share, or (iii) county level.

Updated data from the American Community Survey (ACS) is published by the U.S. Census Bureau each December. Updated data from BLS is published each April and applies to the census share and county-level methodologies. This means that the effects of the COVID-19 pandemic on TEA status were only revealed in April 2021.

What Does the 2020 Report from the BLS Reveal?

The BLS publishes unemployment data at the national, MSA, and county levels. Although entire counties have always qualified as TEAs, these counties were typically less populous counties located in more rural areas. However, economic shutdowns in many major cities in response to the COVID-19 pandemic have increased unemployment rates in many urban areas in the United States. As such, many full counties that now qualify as TEAs include those encompassing large cities with high populations.

Below is a list of the counties that now qualify as high-unemployment TEAs based on the most recently published BLS data. The 2020 national unemployment rate according to the BLS was 8.10%, and high-unemployment TEAs must exhibit an unemployment rate at least 150% of the national average. Therefore, for a full county to qualify as a TEA, it must have an unemployment rate above 12.15% (8.10% x 1.5).

Alabama

- Wilcox County (14.73%)

- Lowndes County (13.33%)

Alaska

- Skagway Municipality (21.45%)

- Kusilvak Census Area (19.36%)

- Denali Borough (15.74%)

- Haines Borough (15.62%)

- Hoonah-Angoon Census Area (13.52%)

Arizona

- Yuma County (17.13%)

- Apache County (12.78%)

California

- Imperial County (22.49%)

- Colusa County (15.95%)

- Tulare County (13.21%)

- Los Angeles County (12.80%)

- Kern County (12.52%)

- Merced County (12.19%)

Florida

- Osceola County (13.54%)

Georgia

- Clay County (12.39%)

Hawaii

- Maui County (17.83%)

- Kauai County (16.18%)

Kentucky

- Magoffin County (16.08%)

Louisiana

- Orleans Parish (12.17%)

Michigan

- Cheboygan County (14.58%)

- Wayne County (13.81%)

- Mackinac County (13.35%)

- Montmorency County (13.14%)

- Lapeer County (12.49%)

Minnesota

- Mahnomen County (13.01%)

Mississippi

- Jefferson County (18.40%)

- Holmes County (16.20%)

- Tunica County (14.86%)

- Humphreys County (14.74%)

- Claiborne County (14.43%)

- Wilkinson County (13.36%)

- Coahoma County (12.53%)

Missouri

- Taney County (12.92%)

Nevada

- Clark County (14.73%)

New Jersey

- Atlantic County (17.76%)

- Cape May County (13.82%)

- Passaic County (12.60%)

New Mexico

- Luna County (15.86%)

New York

- Bronx County (16.03%)

- Brooklyn County (12.53%)

- Queens County (12.53%)

North Dakota

- Rolette County (13.43%)

Pennsylvania

- Cameron County (12.57%)

- Philadelphia County/City (12.37%)

- Elk County (12.30%)

Texas

- Starr County (17.32%)

- Maverick County (15.00%)

- Presidio County (14.73%)

- Zavala County (14.11%)

- Crane County (13.61%)

- Jim Wells County (12.98%)

- Zapata County (12.41%)

Virginia

- Petersburg City (13.95%)

West Virginia

- Calhoun County (16.06%)

- Mingo County (14.25%)

- McDowell County (12.59%)

- Clay County (12.50%)

- Roane County (12.44%)

- Logan County (12.17%)

Wisconsin

- Menominee County (15.34%)

- Forest County (12.42%)

If you would like EB5AN to research and monitor a specific project location for you, please send an email with your request to info@EB5AN.com or schedule a call.