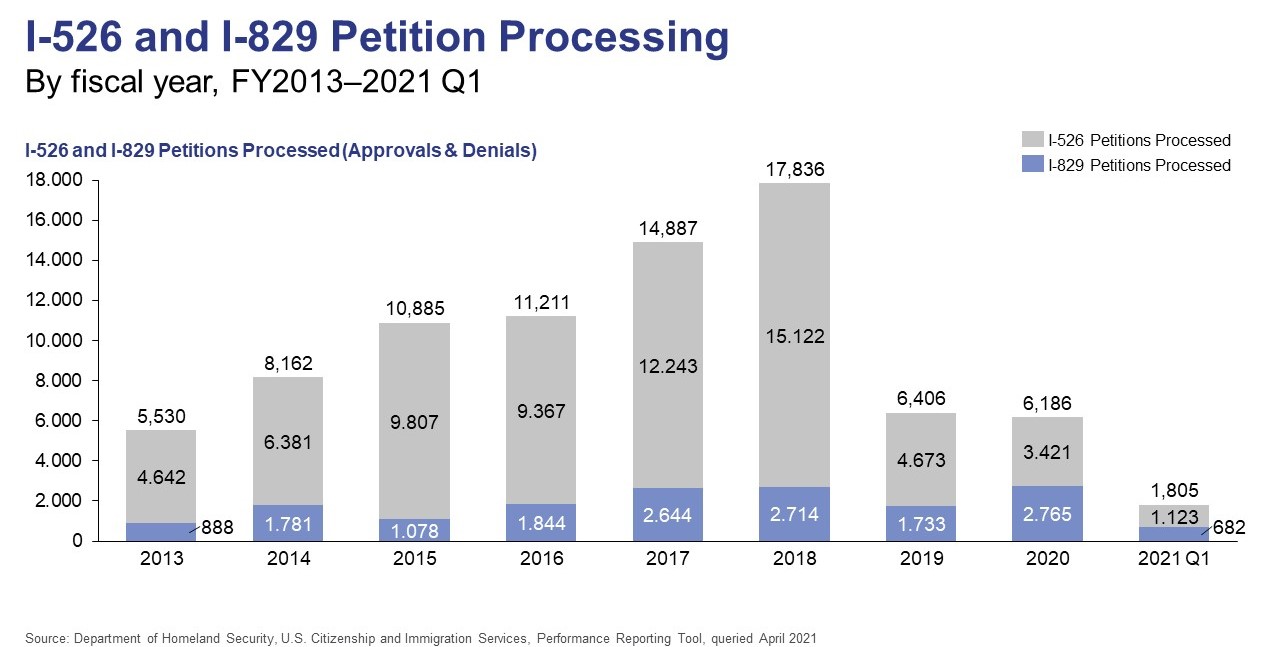

As the world heads into continued turmoil caused by the COVID-19 pandemic, United States Citizenship and Immigration Services (USCIS) has released the EB-5 petition processing data for FY2021 Q1 (October–December 2020). This data release closes out the tumultuous year of 2020, and the figures it offers cannot necessarily be extrapolated for future predictions due to the special circumstances of 2020. Nonetheless, it provides some important insights for foreign nationals currently engaged in an EB-5 investment journey, detailing receipt, approval, and denial rates for I-526 and I-829 petitions.

I-526 Petition Data

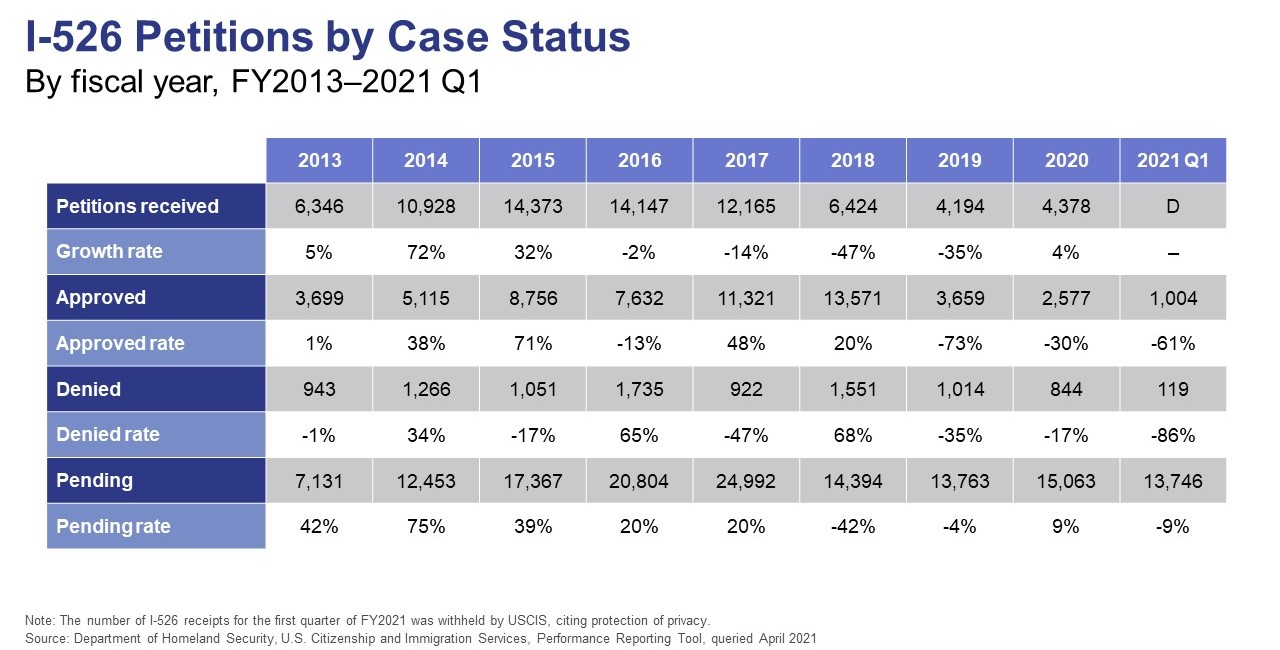

Receipts

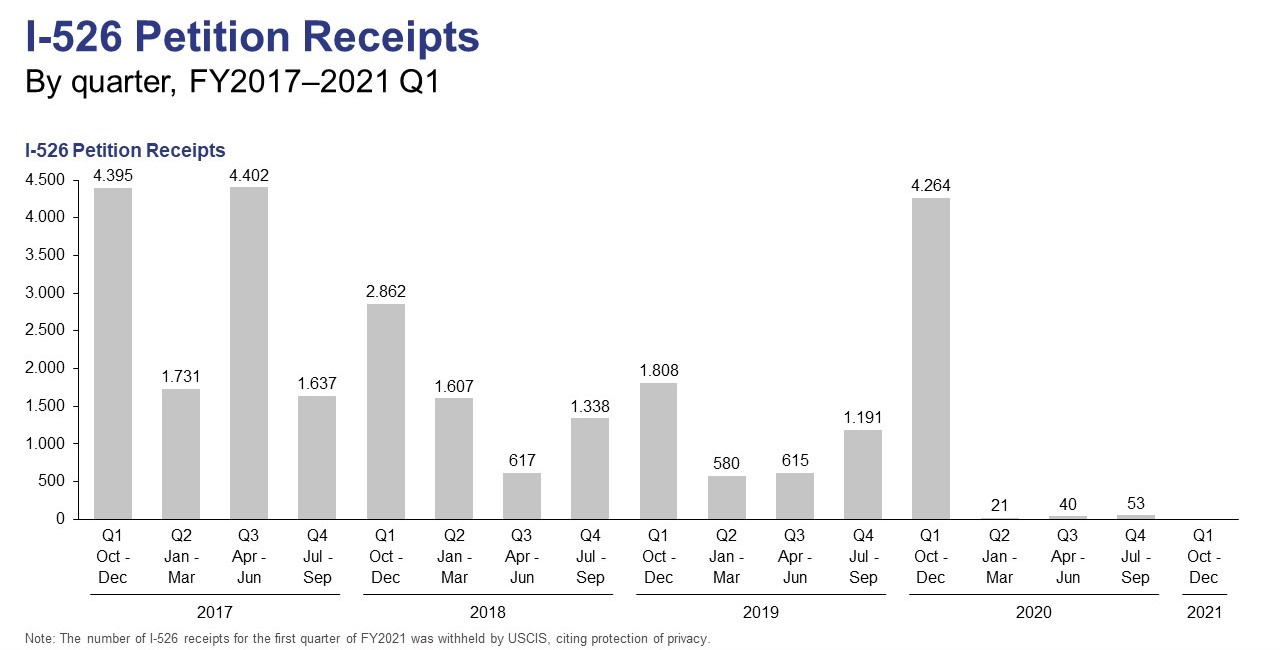

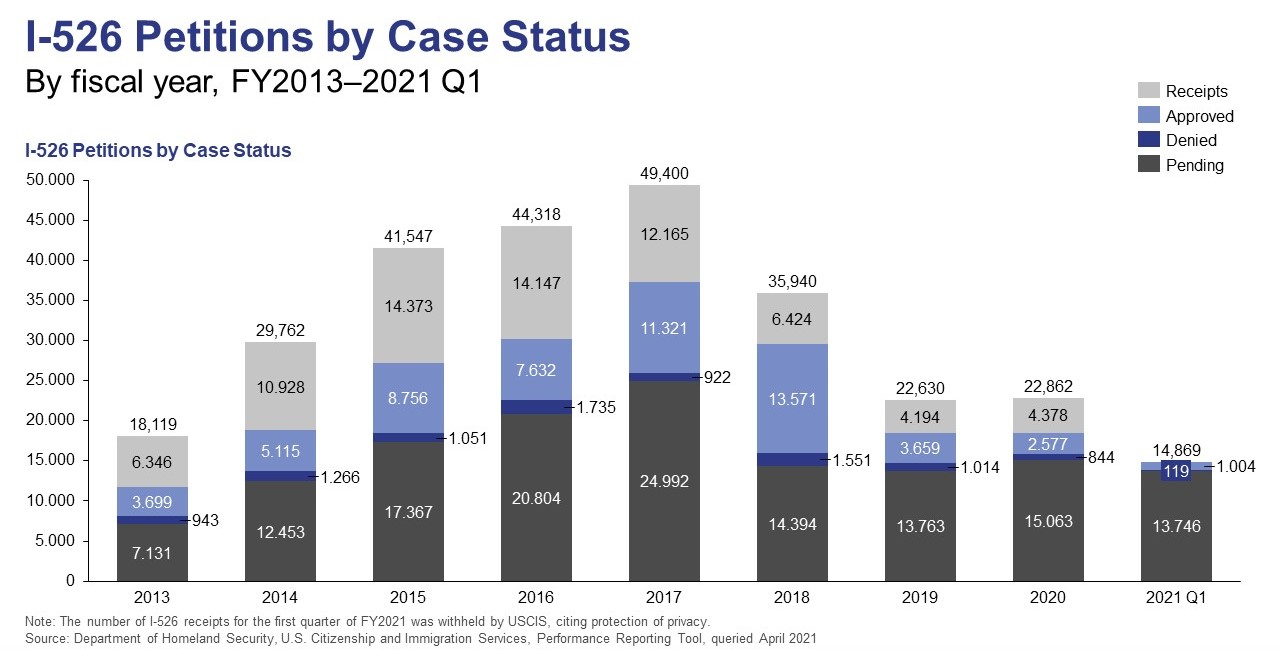

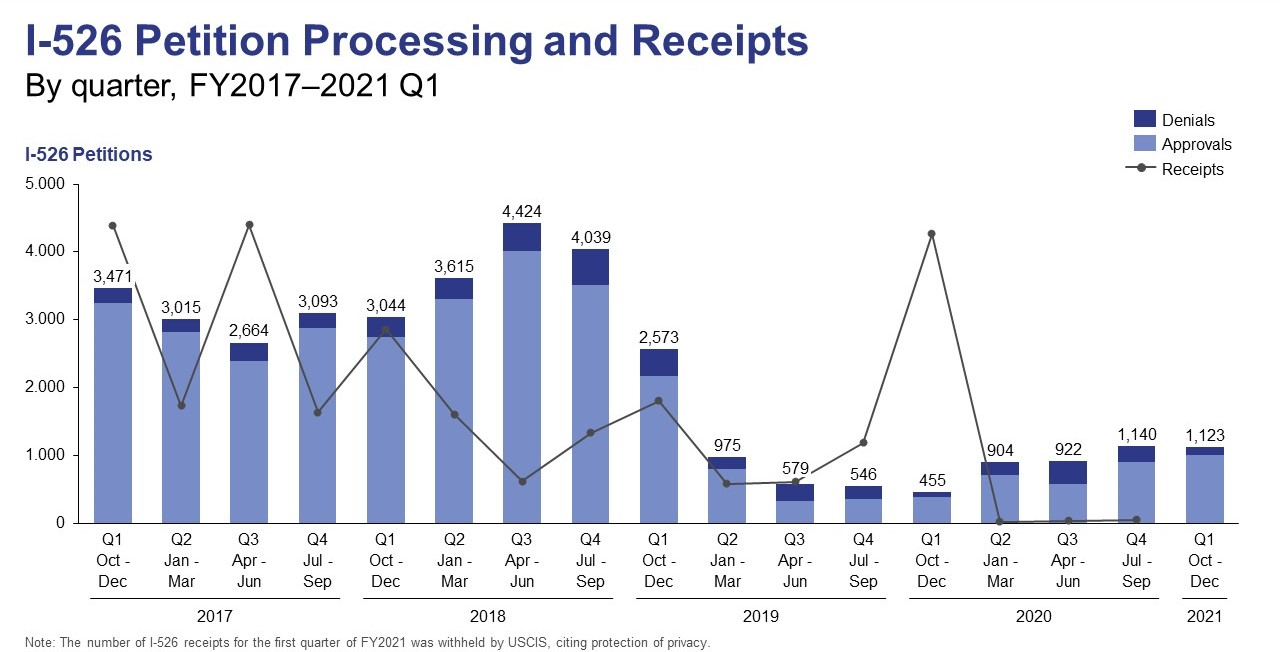

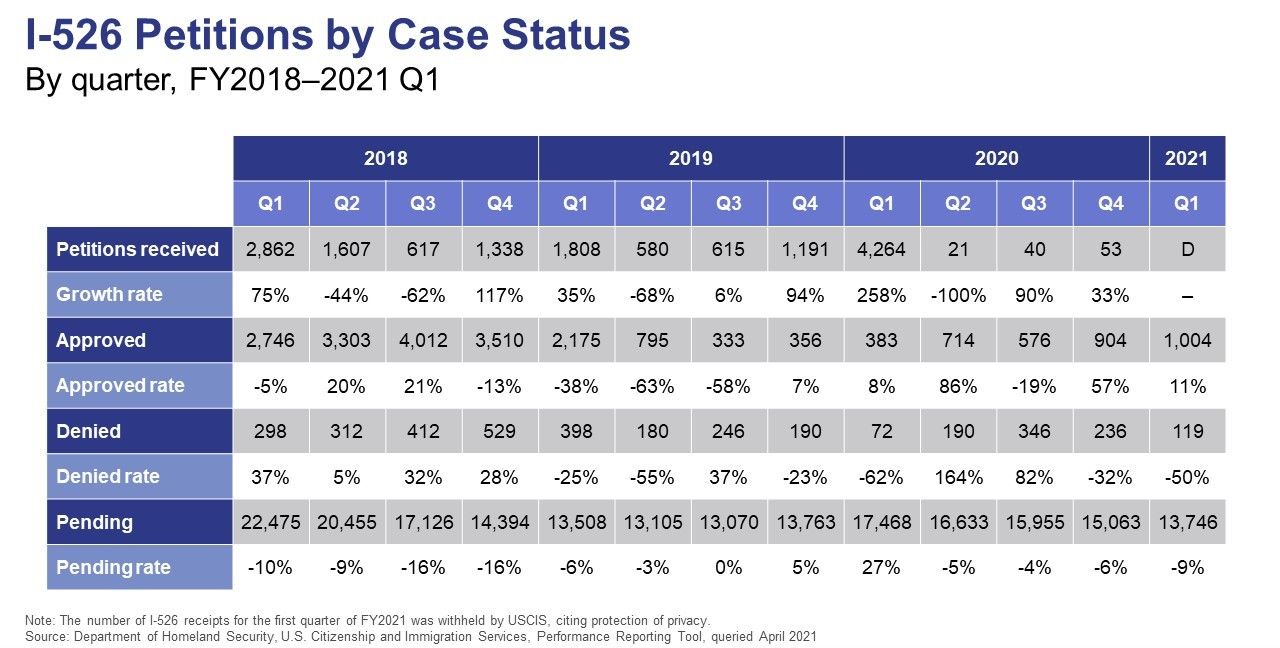

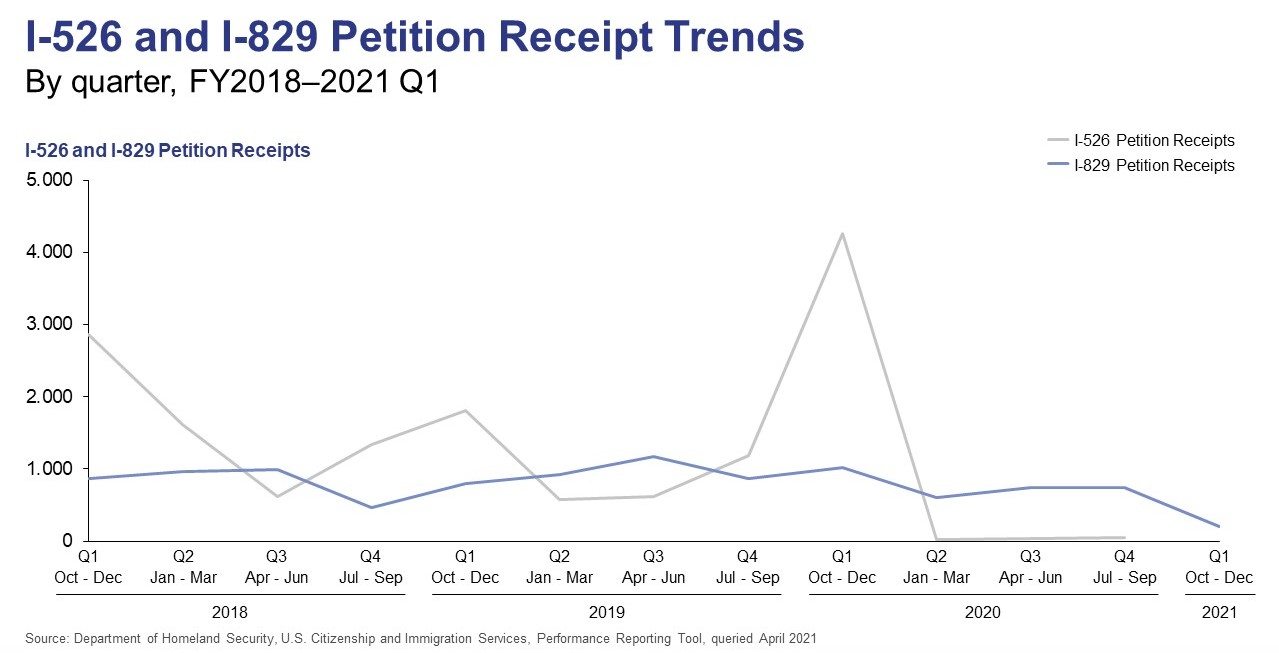

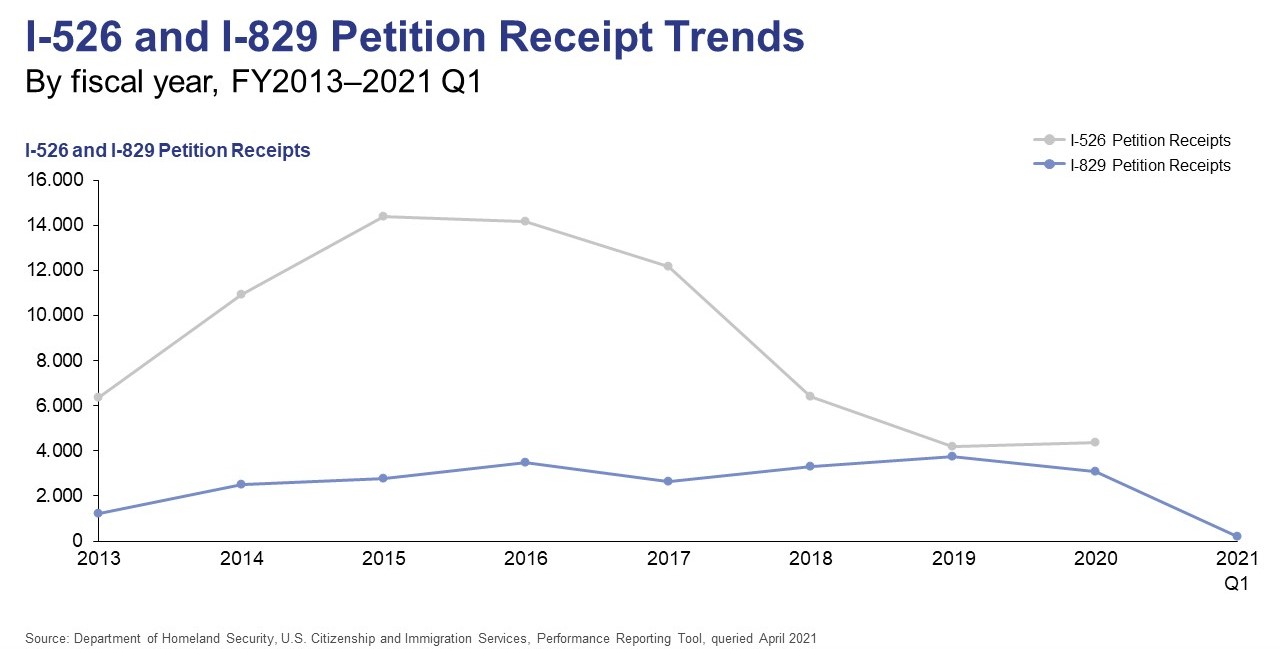

Not a lot can be said about I-526 petition receipts from October to December 2020 because USCIS simply didn’t include the information in the data release. Instead of a number, the official data table included a “D” in the FY2021 Q1 column of I-526 receipts, which stands for “data withheld to protect applicants’ privacy.” However, it’s likely that the figure was low, considering the COVID-19 pandemic that continued to ravage the world throughout the quarter. Historical trends indeed show record-low I-526 receipt figures throughout calendar year 2020, initially sparked by the massive spike in FY2020 Q1 of investors rushing to file their EB5 investment application before the Modernization Rule increased the minimum investment amounts by 80% in November 2019 but further exacerbated by the pandemic.

Approvals and Denials

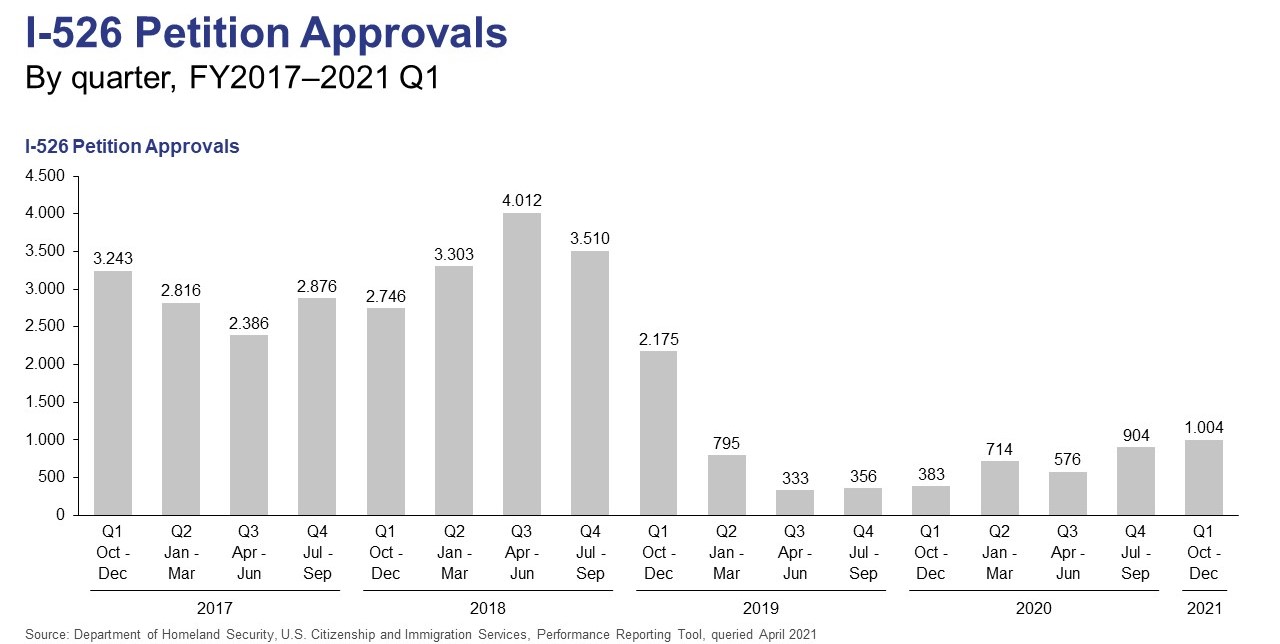

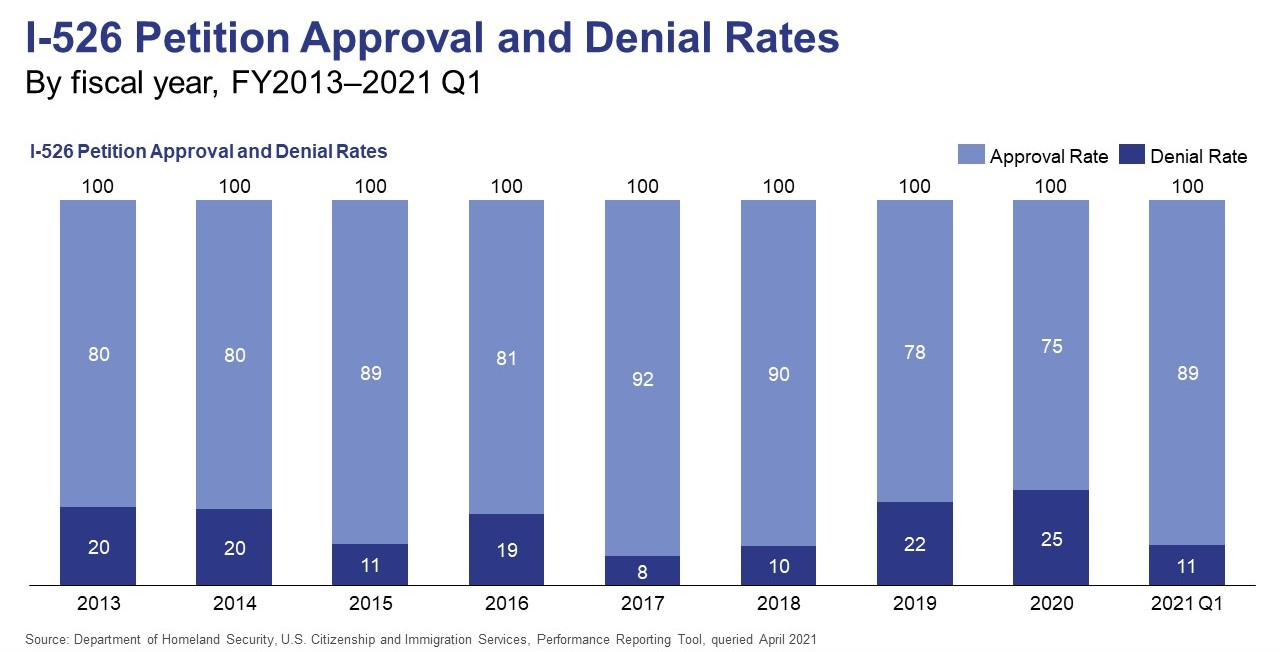

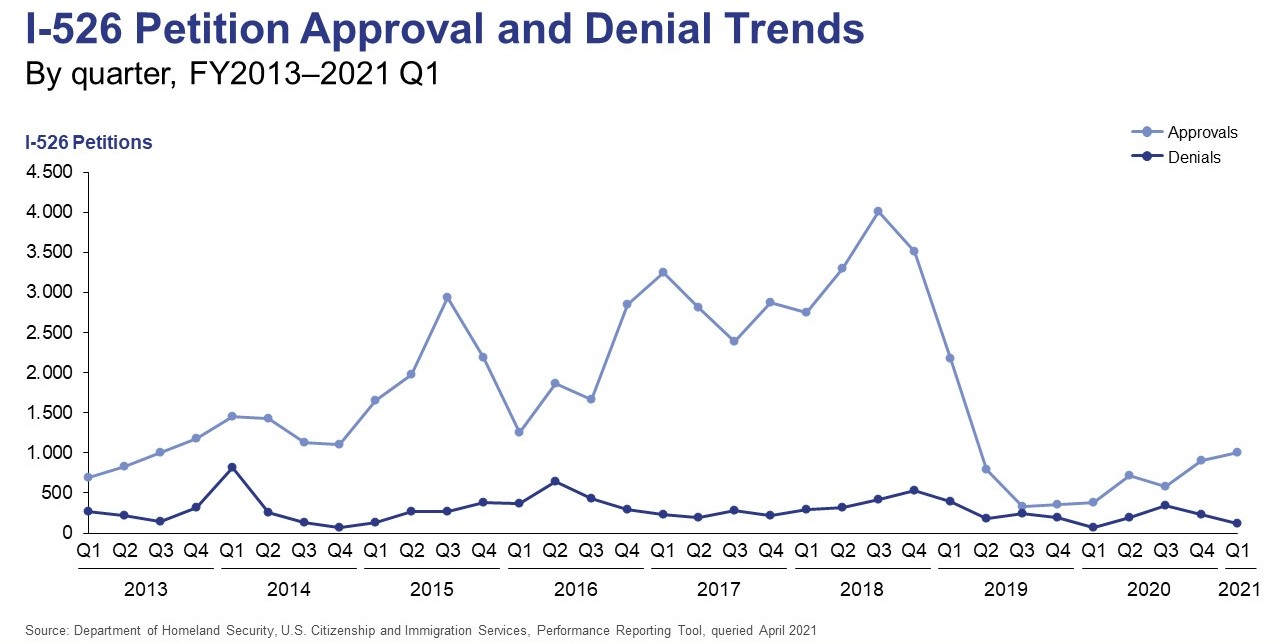

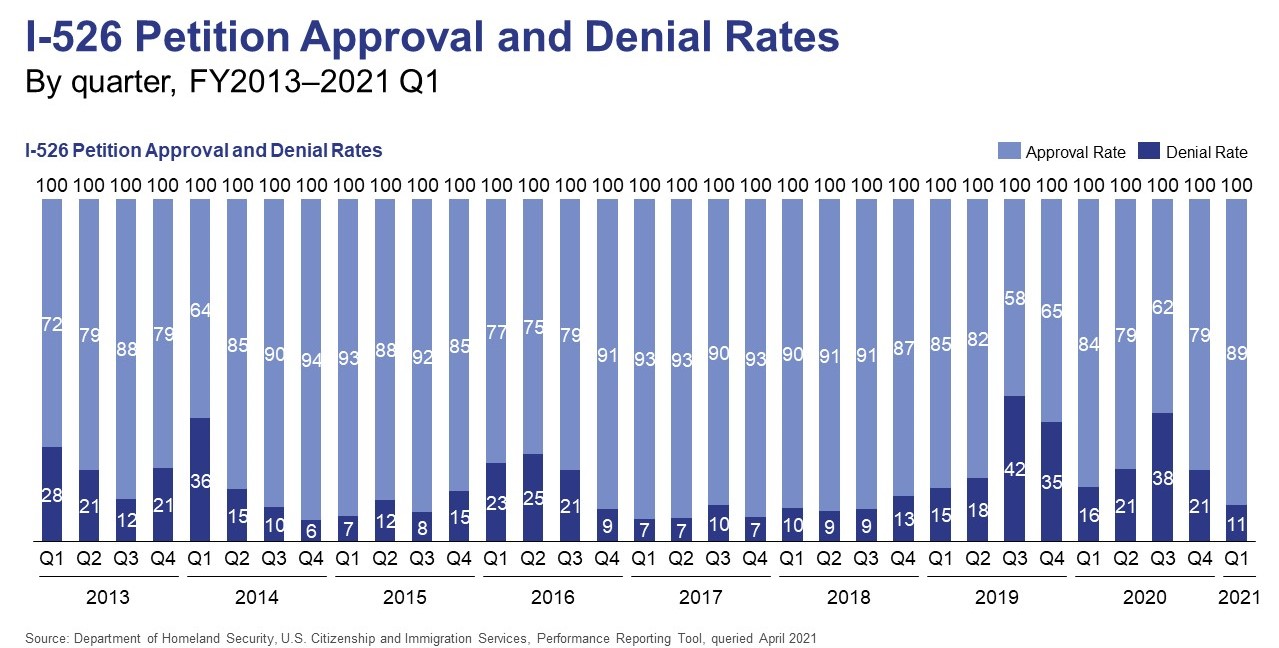

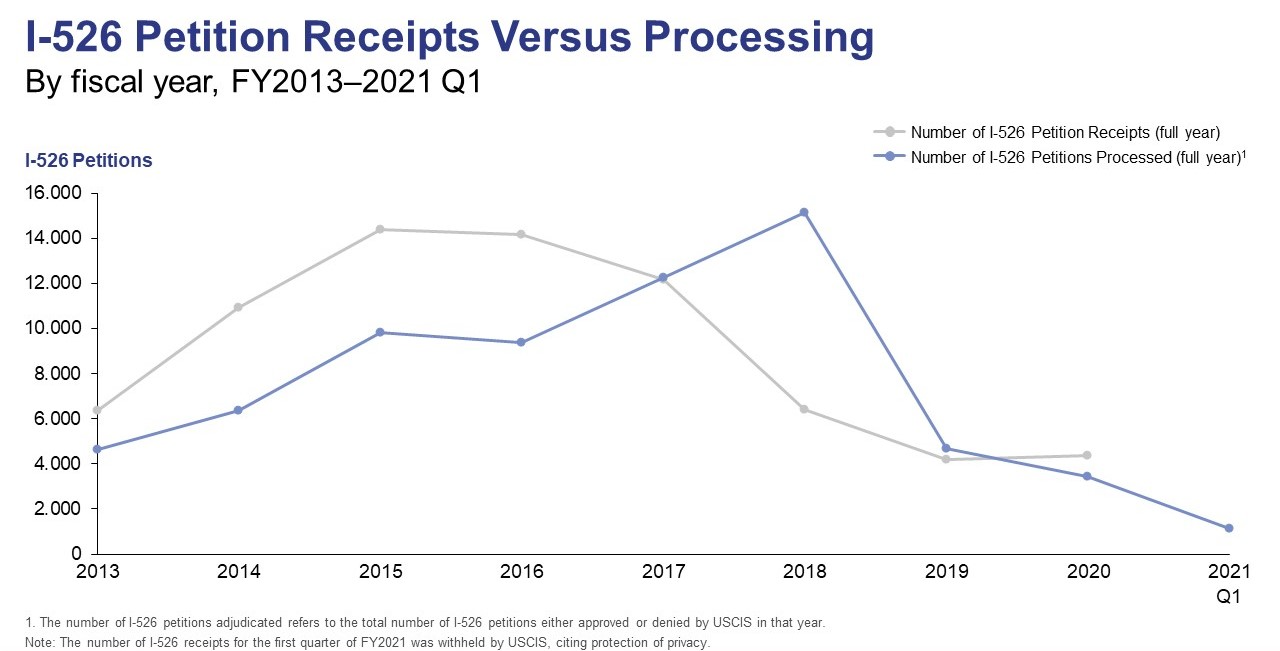

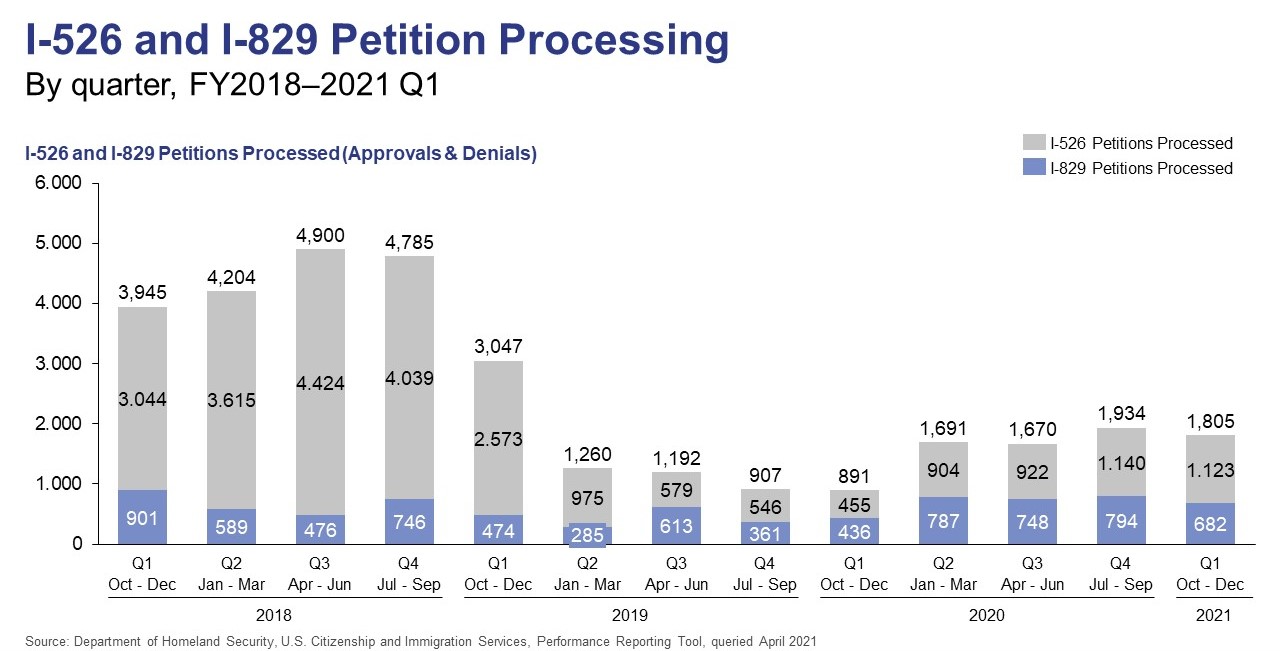

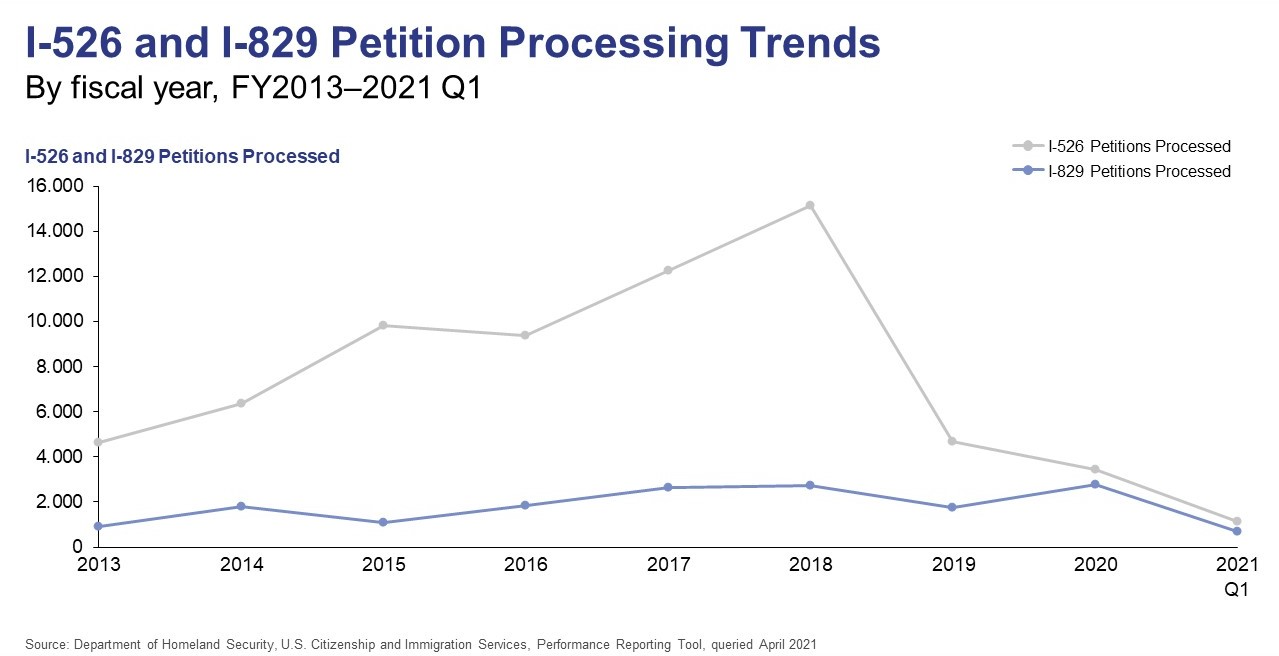

As has steadily held true throughout Sarah Kendall’s tenure as chief of the Immigrant Investor Program Office (IPO), USCIS adjudication remained low throughout all of calendar year 2020, including the first quarter of fiscal year 2021. There has been a slight upward trend in I-526 approvals since a record low in FY2019 Q3, but the figures nonetheless remain abysmal compared to USCIS’s productivity prior to Kendall taking the reins. However, FY2021 Q1 is the IPO’s final year under Kendall’s direct influence, as her LinkedIn page indicates that she left her post at the IPO after November 2020. If the new leadership better manages the office’s productivity, EB-5 investment stakeholders could see these figures shooting up in the next data release.

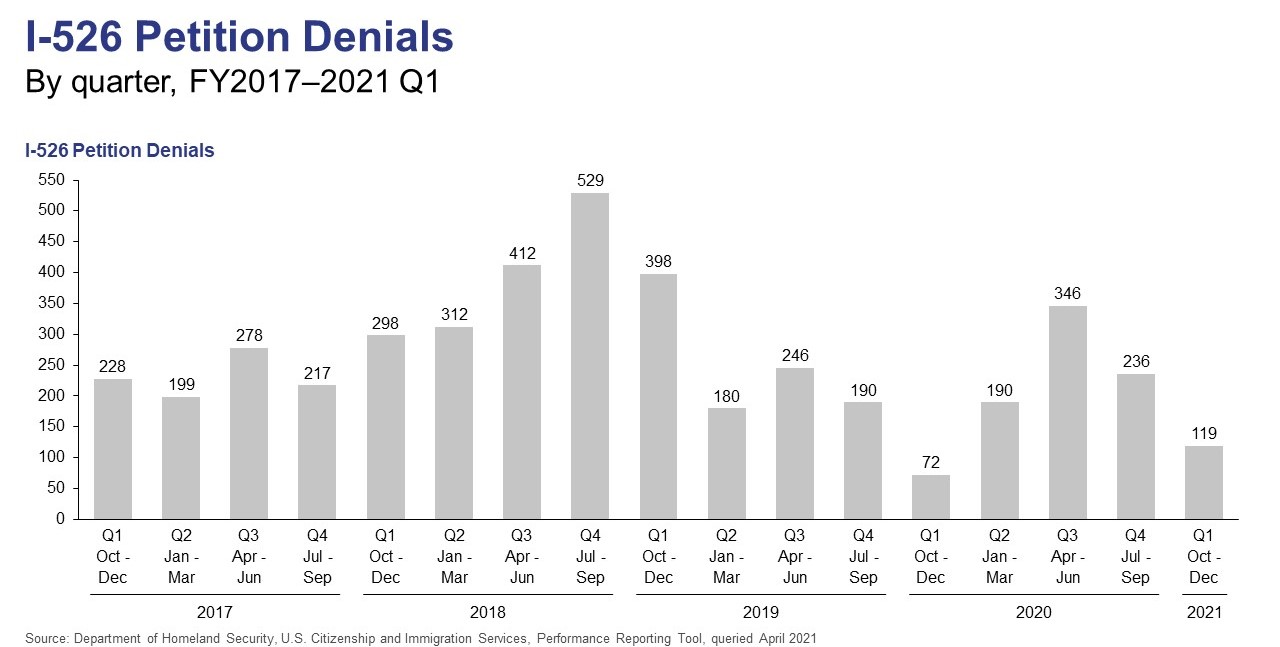

While Kendall’s IPO has continuously faltered on I-526 approvals, denial figures have remained fairly consistent with historical numbers. What this means is that the approval-to-denial ratio has increased, with EB5 investment participants facing a higher likelihood of I-526 denial. This trend is particularly evident when plotted by quarter, with the number of approvals in FY2019 Q3 just barely exceeding the number of denials. While the rate has subsequently improved, it remains far below pre-Kendall figures.

Overall

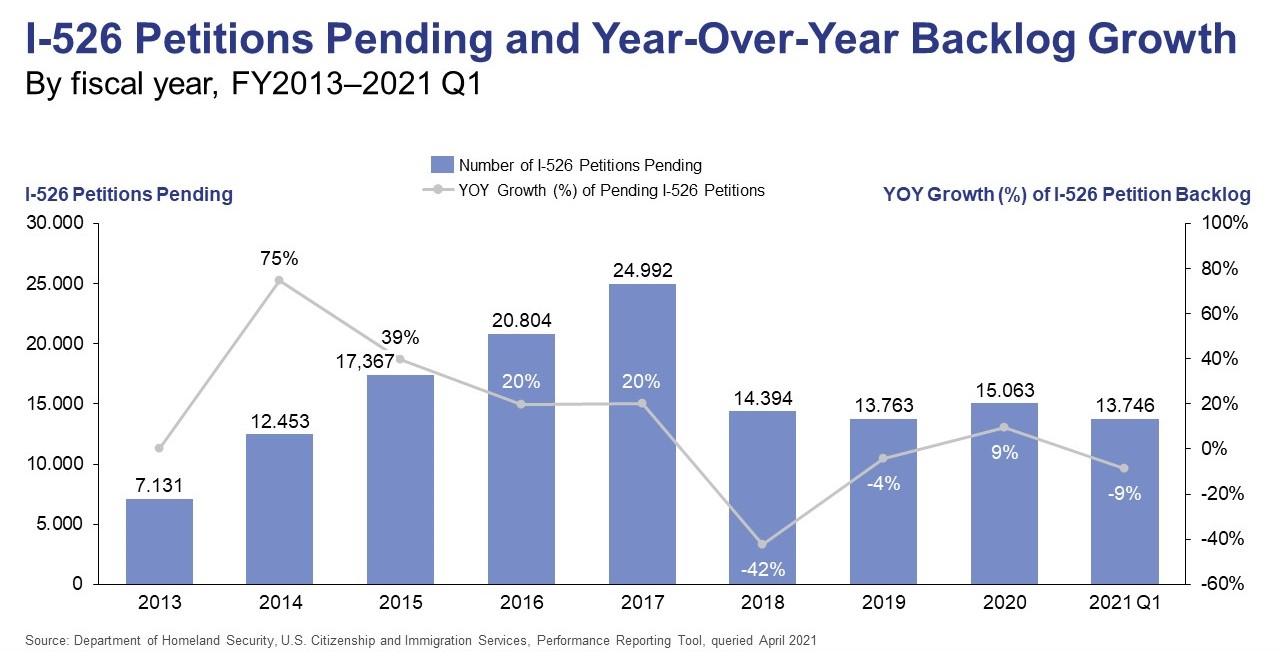

What the charts make clear is that I-526 productivity at the IPO has stayed low. While it’s easy to chalk up low adjudication figures to the effects of the COVID-19 pandemic, it could equally be argued that the IPO had even more opportunity than usual to adjudicate I-526 petitions, given that many other duties at the IPO were likely slashed due to public health protocols, freeing up more time. FY2021 Q1 also represents the first quarter of an extraordinarily high EB-5 investment visa allowance, with the EB-5 program receiving almost double the typical number of annual EB-5 visas. Barring consular service interruptions, USCIS has the perfect opportunity to whittle down the EB-5 backlogs, but so far, they have chosen to forgo this opportunity.

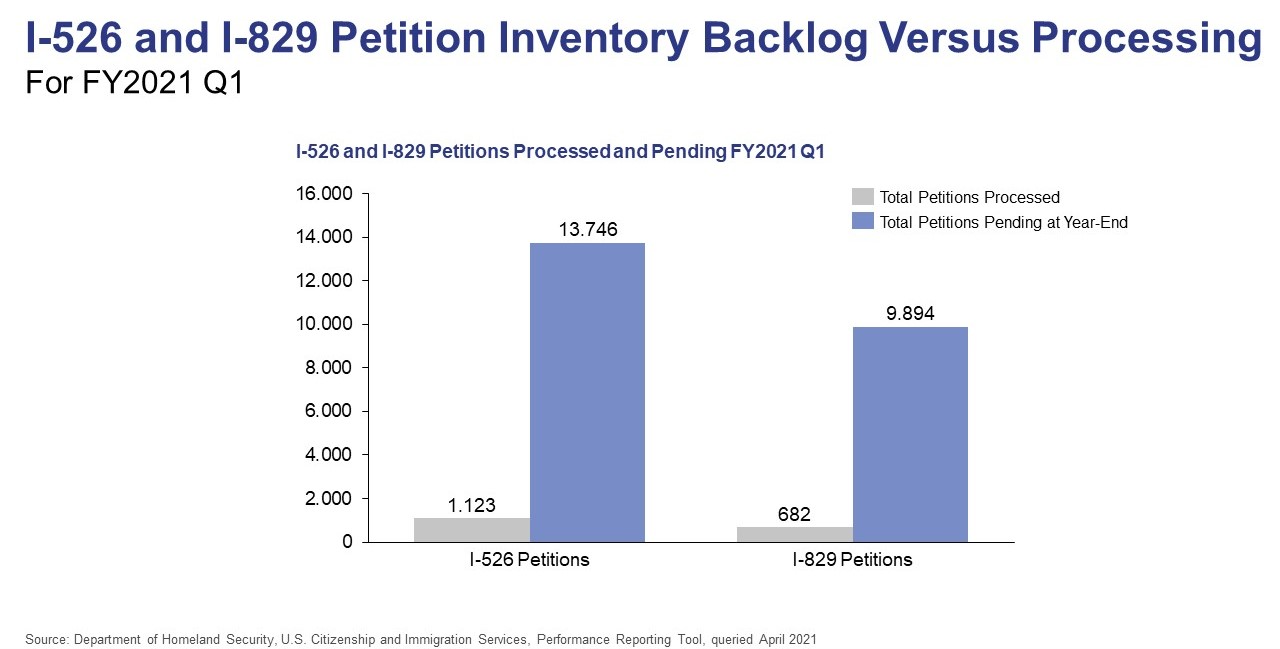

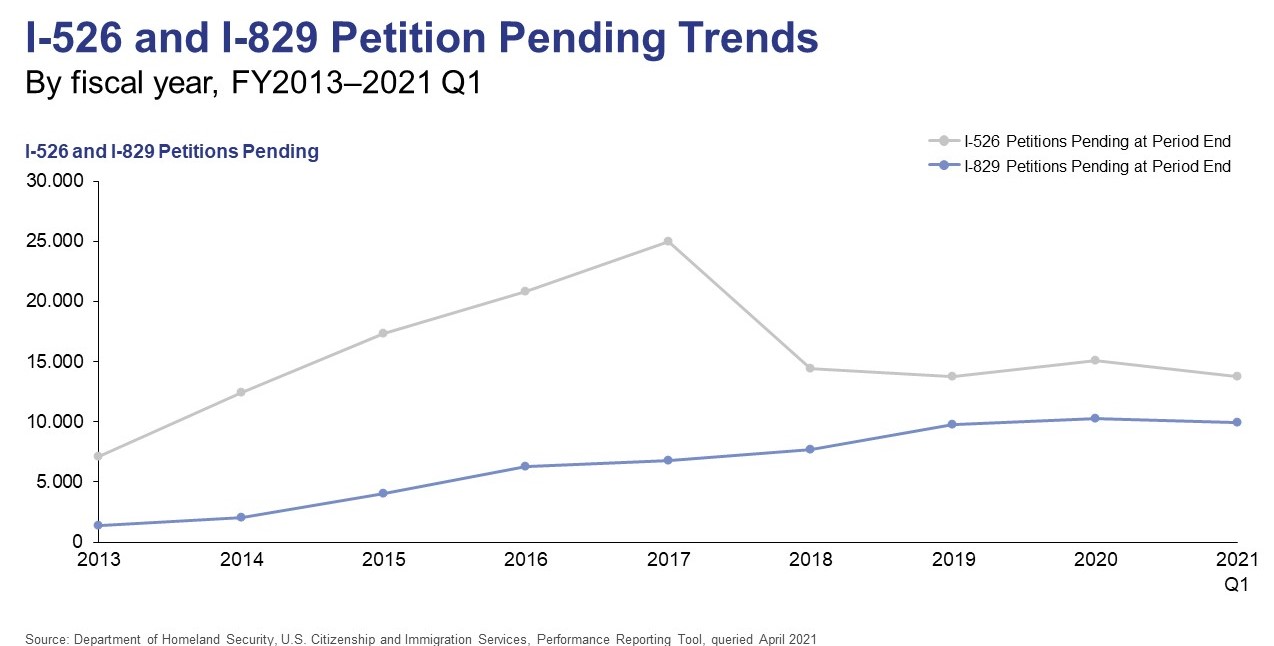

The good news, however, is that quarterly approvals are up from FY2020 Q4, and if the trend continues, FY2021 will record higher numbers overall than FY2020. The I-526 petition backlog also decreased by 9% in FY2021 Q1, as opposed to the 9% increase recorded in FY2020. Though this may be due more to a lack of incoming I-526 petitions rather than adjudication productivity, the figures are still good news.

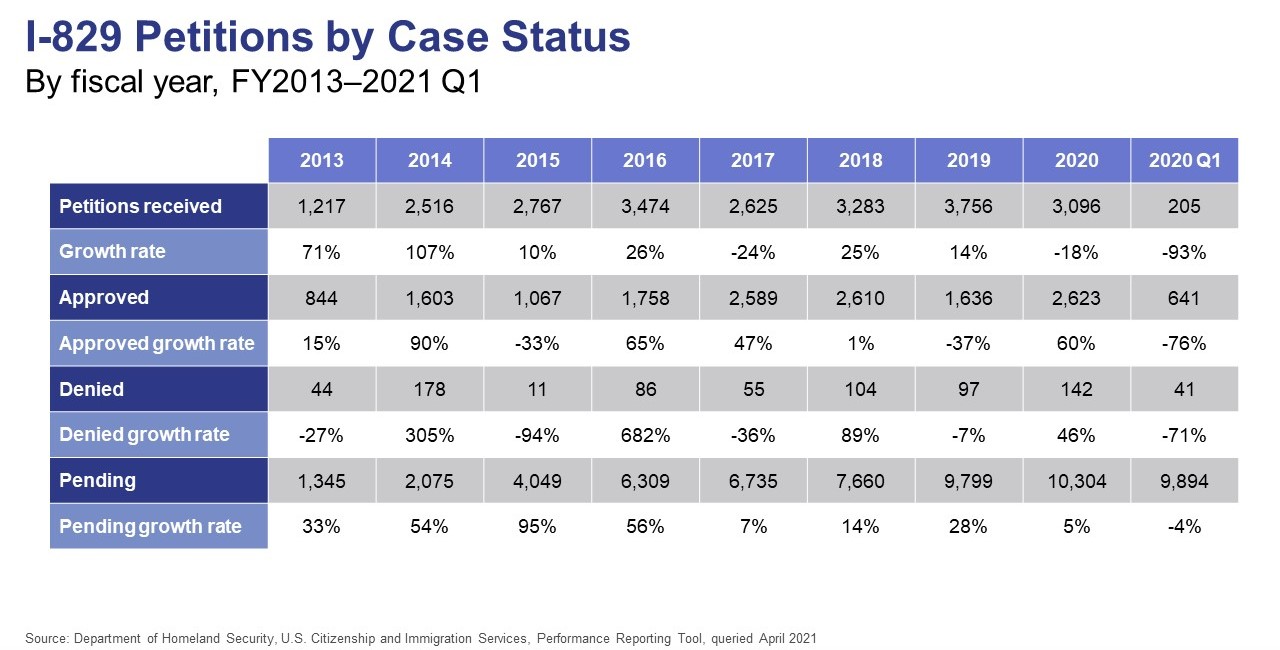

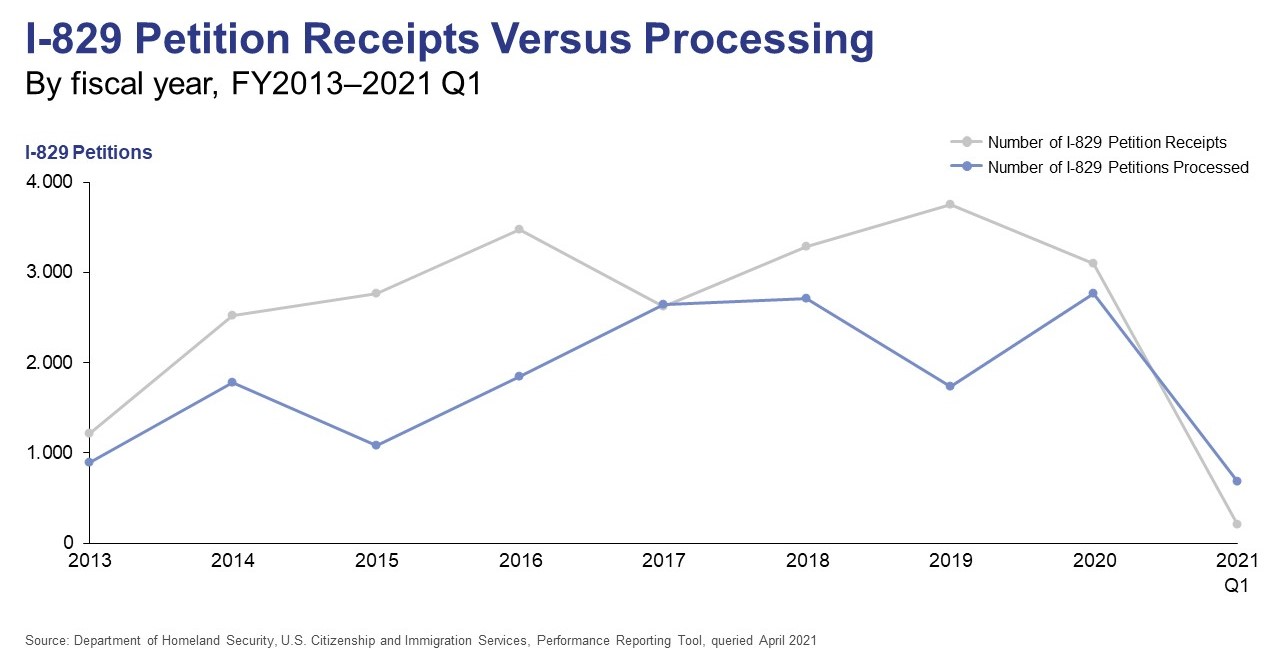

I-829 Petition Data

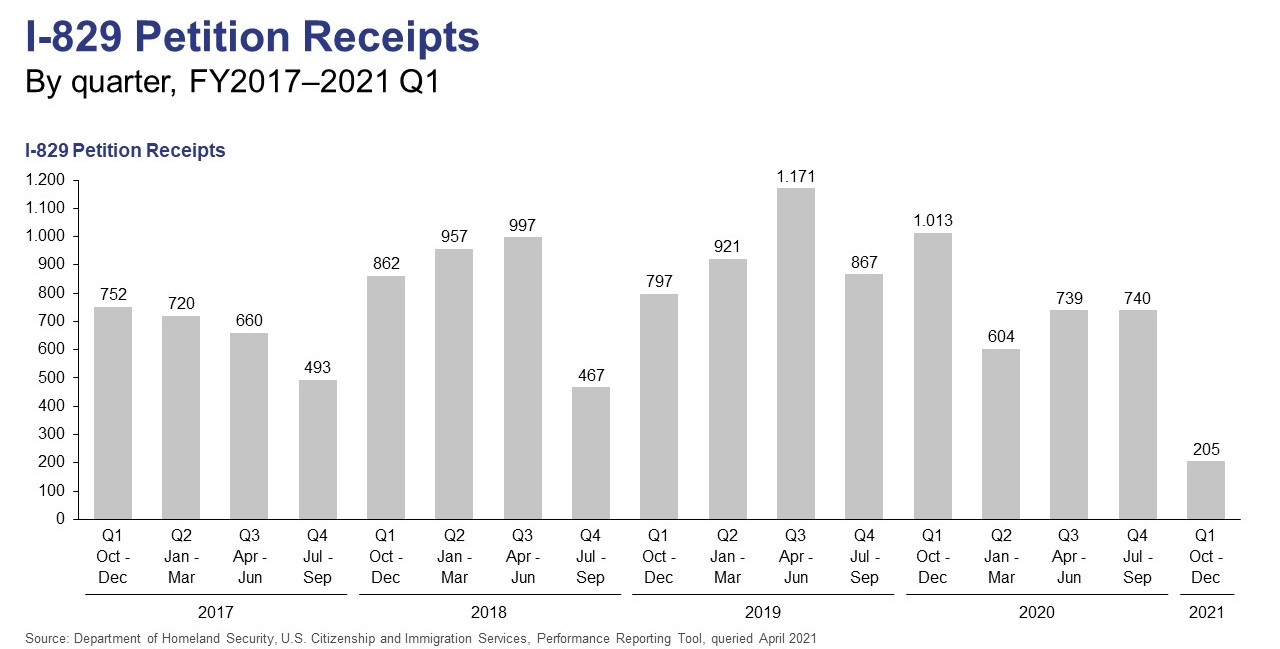

Receipts

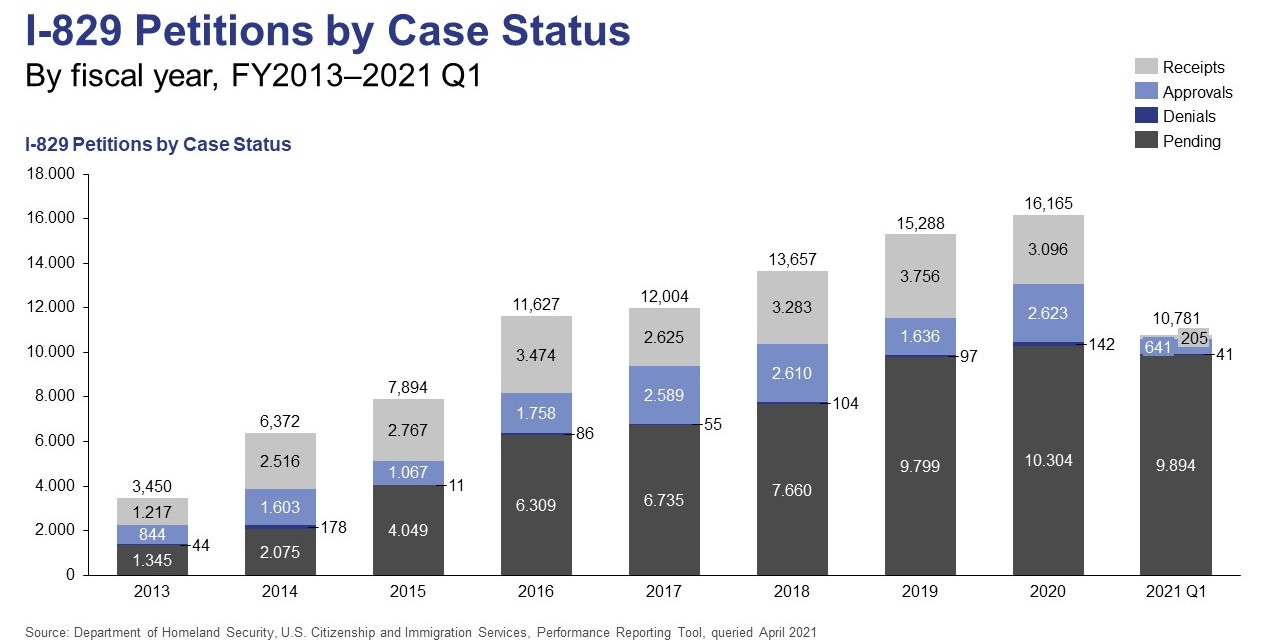

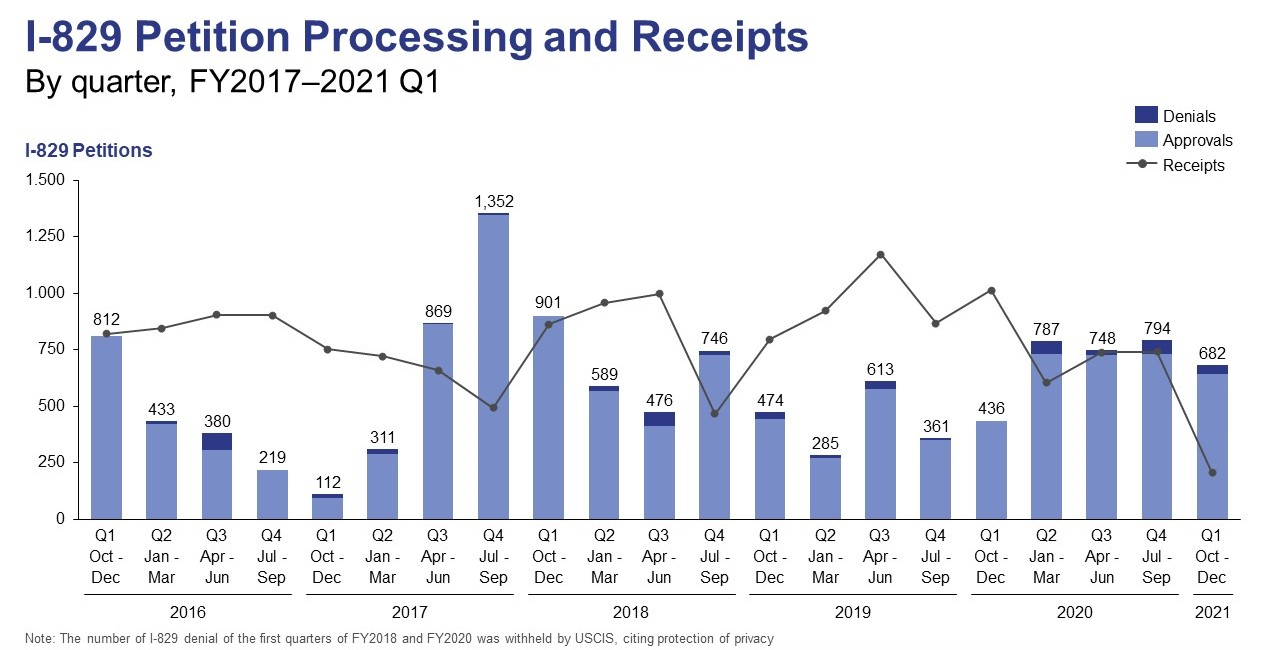

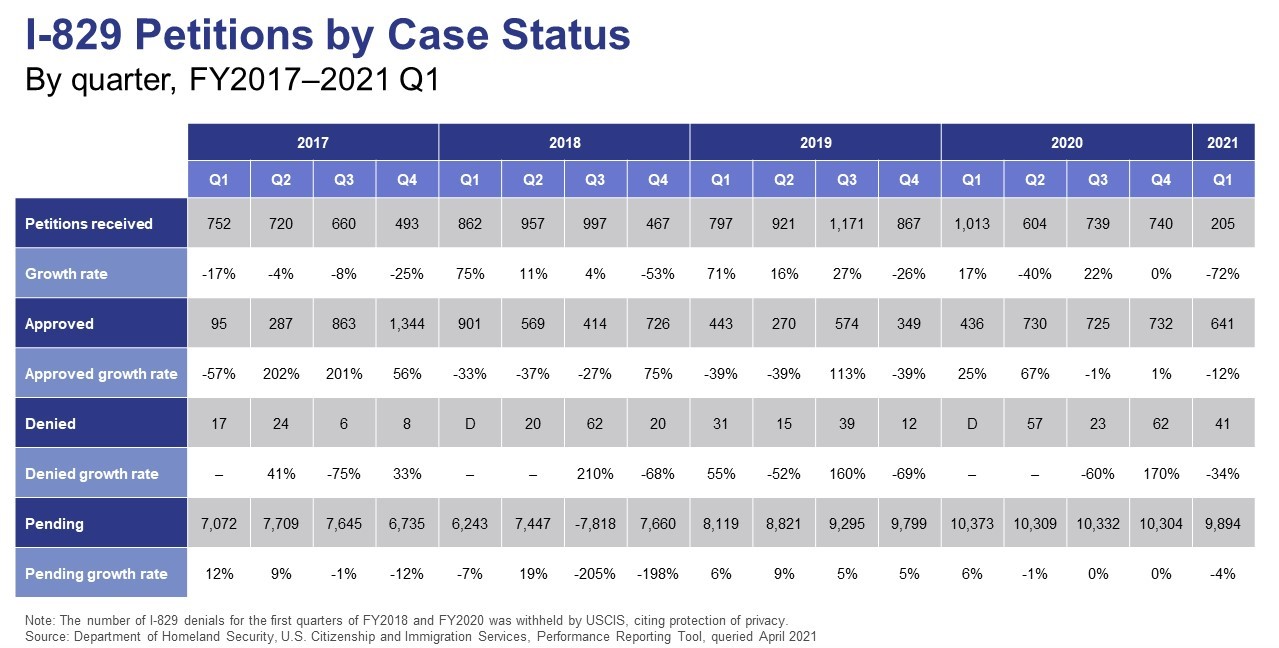

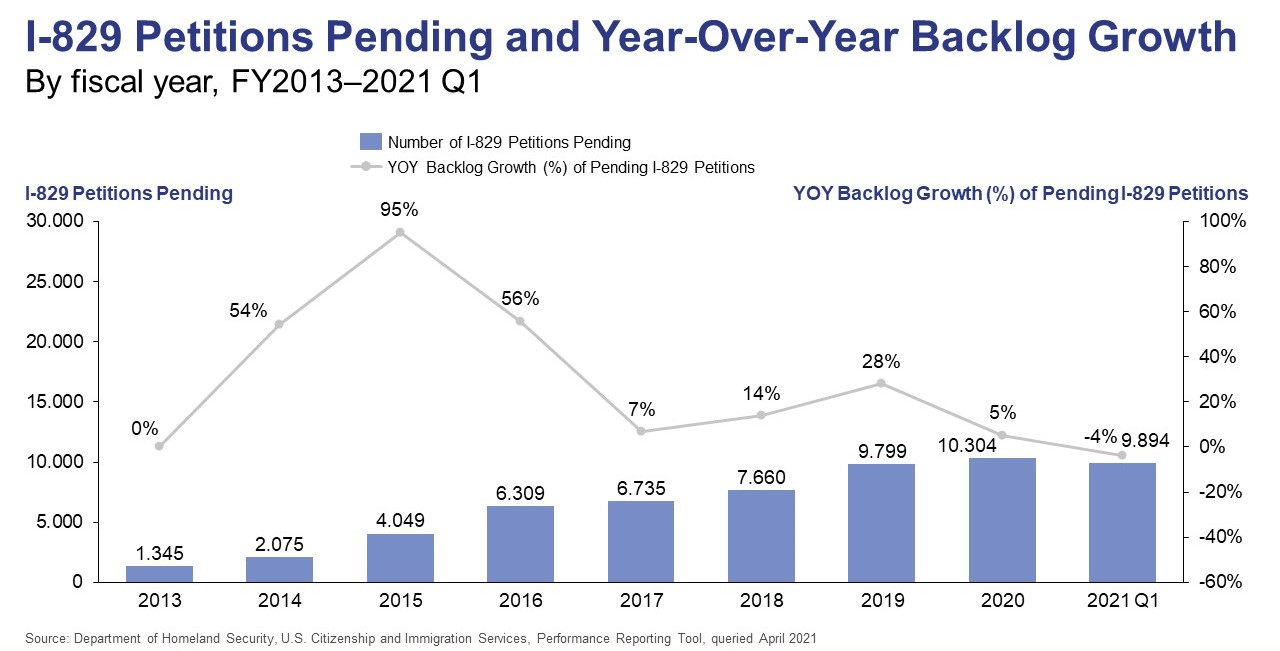

Perhaps most striking about the I-829 petition receipt data for FY2021 Q1 is the low number of receipts. Since I-829 petitions must be filed within the final three months of an EB-5 investment participant’s two-year conditional residency period, they should logically reflect I-526 approval figures from a few years prior. With FY2017, FY2018, and FY2019 exhibiting high I-526 approval figures, the low rate of I-829 petition receipts in FY2021 Q1 is concerning. However, USCIS’s inefficiencies in the face of COVID-19 may ultimately be to blame—the agency struggled to issue I-829 receipt notices throughout 2020, which may have resulted in significant underreporting of the number in the current data release. If this theory is correct, FY2021 Q2 may show a spike, unless USCIS continues its failure to issue I-829 receipt notices in a timely manner.

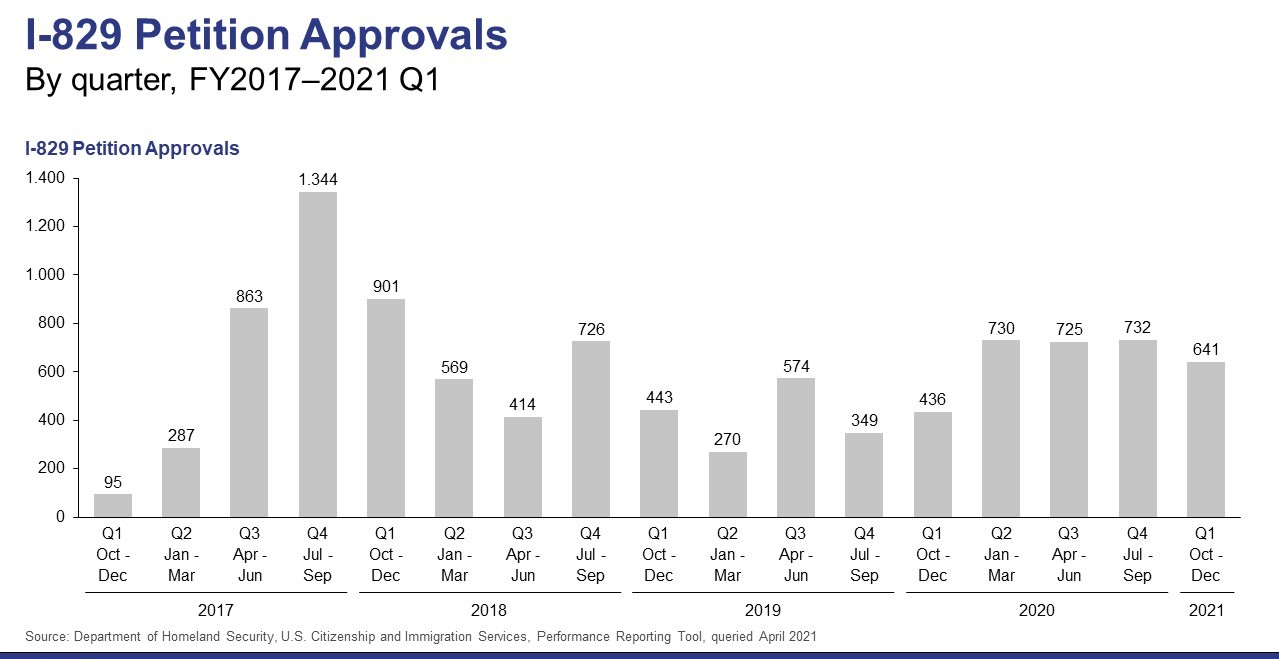

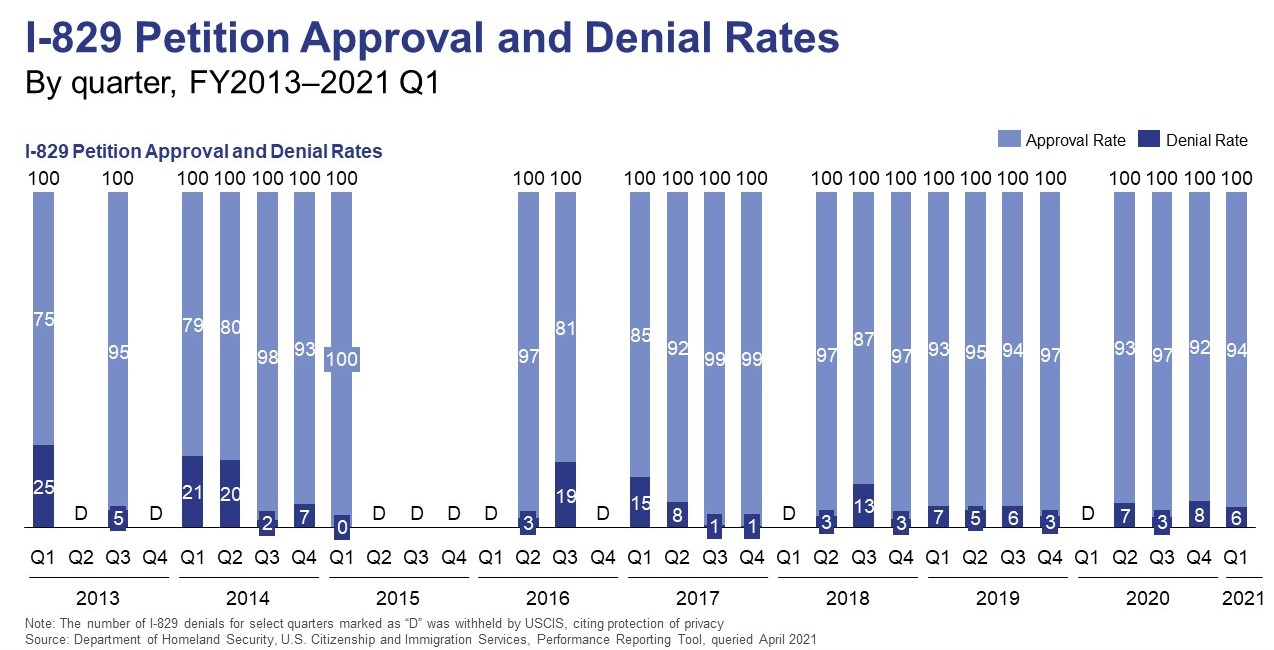

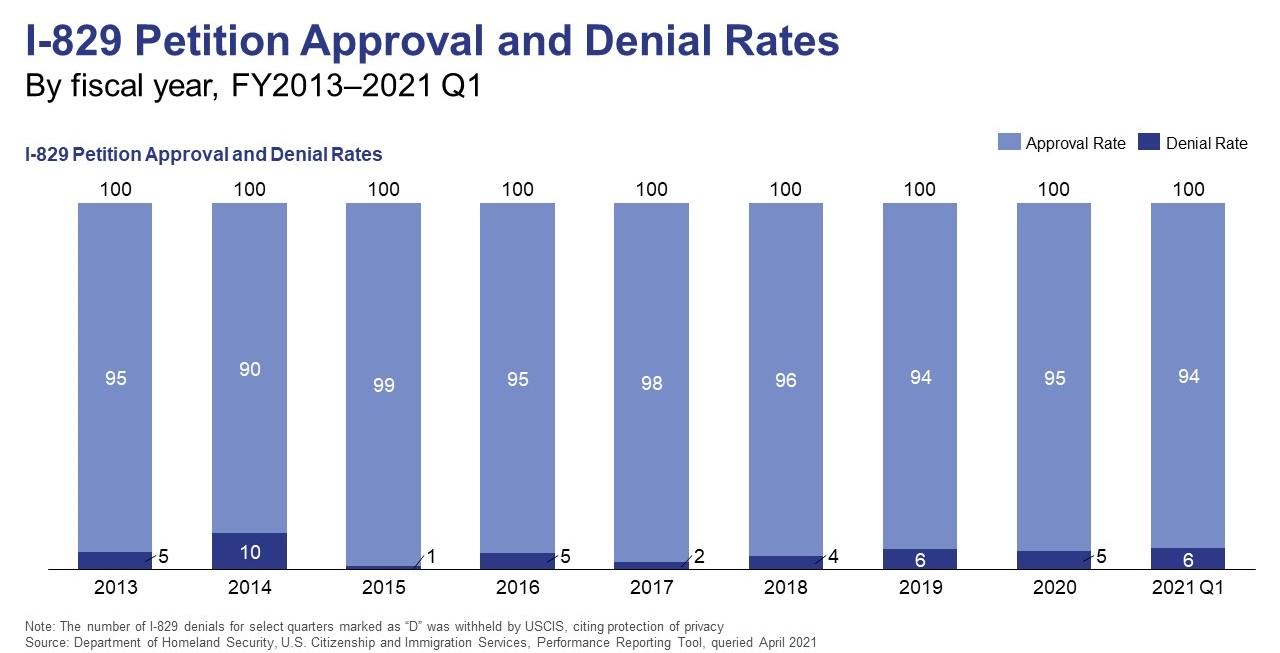

Approvals and Denials

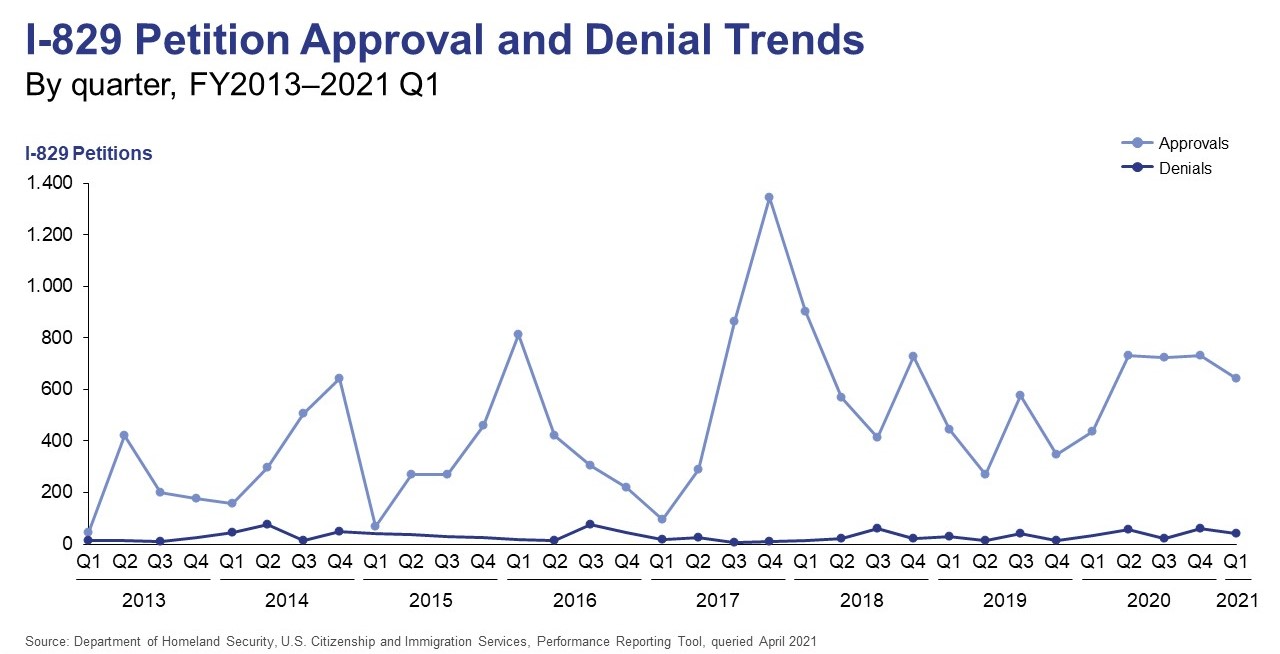

While investors in the I-526 stage of the EB-5 investment journey may not have harbored much love for Sarah Kendall, the I-829 processing situation at the IPO under her leadership was significantly more favorable. Putting a clear focus on I-829 petitions, Kendall delivered higher I-829 approval figures than many of her predecessors. In FY2021 Q1, the number of I-829 approvals was down slightly from the previous three quarters, but it remained higher than the quarterly figures from previous years.

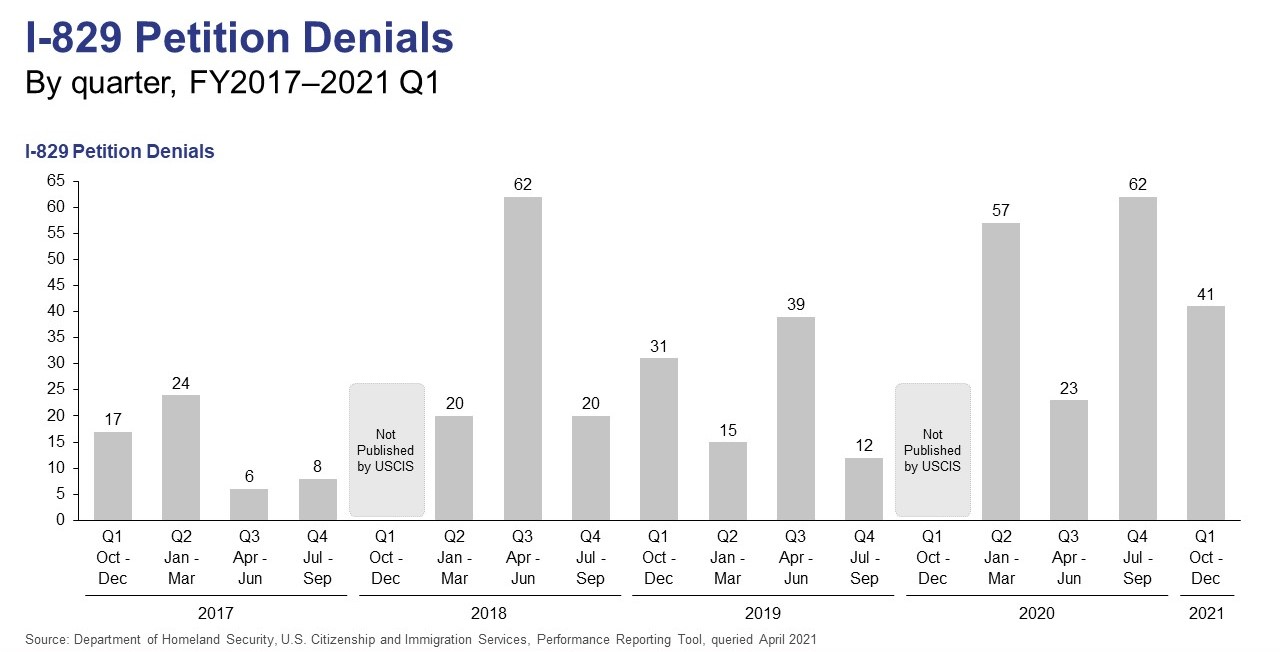

In terms of I-829 denials, figures are also a bit higher throughout Kendall’s reign compared to the numbers recorded by previous IPO chiefs. However, the increase in overall I-829 processing more than compensates for the relatively high denial figures, with the IPO demonstrating a relatively high approval-to-denial rate for I-829 petitions throughout FY2020 and FY2021. The rate has come down slightly in FY2021 Q1 but nonetheless remains higher than many historical rates. All in all, the last few fiscal years have been a positive period for I-829 processing, and the future situation depends on how the new IPO leadership behaves.

Overall

The I-829 processing figures for FY2021 Q1 are somewhat difficult to interpret due to the absence of the receipt figures, but overall, it’s clear that while I-829 adjudication has taken a hit compared to FY2020, processing is still higher than in many previous years. Compared to FY2020 Q4, the I-829 approval number in FY2021 Q1 has decreased by 12%, but compared to the first quarters of previous years, FY2021 is doing relatively well. EB5 investment stakeholders can only hope the new leadership will maintain high I-829 processing while simultaneously increasing I-526 adjudication.

In terms of the I-829 backlog, FY2021 has so far recorded a decrease in the number of pending I-829 petitions. Although it’s only 4%, it’s still much better than previous years, as the I-829 backlog has seen a steady increase since FY2013. However, EB-5 investors shouldn’t get their hopes up prematurely—the drop is likely a result of the low I-829 receipts recorded in FY2021 Q1, which, in turn, may be due to challenges in issuing receipt notices. The data release for FY2021 Q2 should provide more insights into the question of I-829 receipts.

I-526 and I-829 Processing Data Comparison

The takeaway from USCIS’s FY2021 Q1 data release is that I-526 petition processing has continued to underperform, while I-829 petition processing has continued to overperform. No significant differences from FY2020 Q4 can be detected, although processing figures are slightly down in both categories. Massive backlogs remain for both I-526 and I-829, so EB-5 investment participants can continue to expect long wait times to begin their new life in the United States.

However, this data release is somewhat lacking, making it difficult to draw conclusions. The absence of I-526 receipt data means EB5 investment stakeholders won’t know the current EB-5 demand until the FY2021 Q2 data comes out, and the unusually low I-829 receipt data could be due to USCIS inefficiency, but we won’t find out until the next quarter’s data is released.

With all the turmoil of the world in 2020 and 2021, EB-5 investment figures in the next quarters are difficult to predict. The COVID-19 pandemic and the various mutations of the virus threaten additional restrictions and shutdowns, which could impact the ability of U.S. embassies and consulates to process EB-5 visas. EB-5 demand could remain low because of the 80% increase in the minimum required EB5 investment amount, especially after so many businesses and individuals have suffered financial hardship in the face of the pandemic. Finally, Sarah Kendall’s relinquishing of the reins at the IPO might signal a new era for the EB-5 program, depending on what direction the IPO takes under the leadership of new chief Nick Colucci.

Insights to all of these uncertainties may be revealed in the FY2021 Q2 data release. Until then, EB-5 investment stakeholders should focus on the imminent sunset date of the EB-5 Regional Center Program because if the program fails to be reformed by June 30, 2021, it may face termination. The EB-5 community is backing the EB-5 Reform and Integrity Act, which has been introduced in the Senate, as many believe it’s the program’s sole chance at reauthorization.