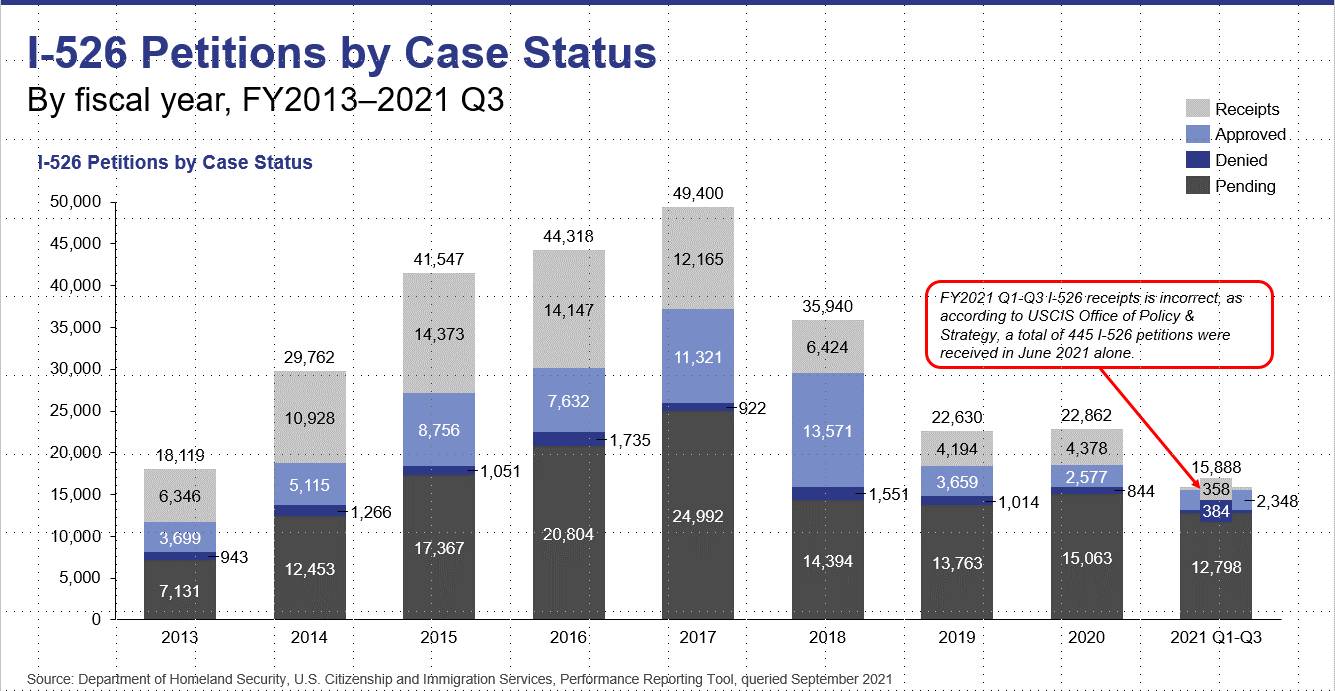

United States Citizenship and Immigration Services (USCIS) uses its monthly Visa Bulletins to indicate which EB-5 investors are eligible to apply for and receive conditional permanent resident status. EB-5 investors must undergo this two-year conditional residency period before permanently relocating to the United States.

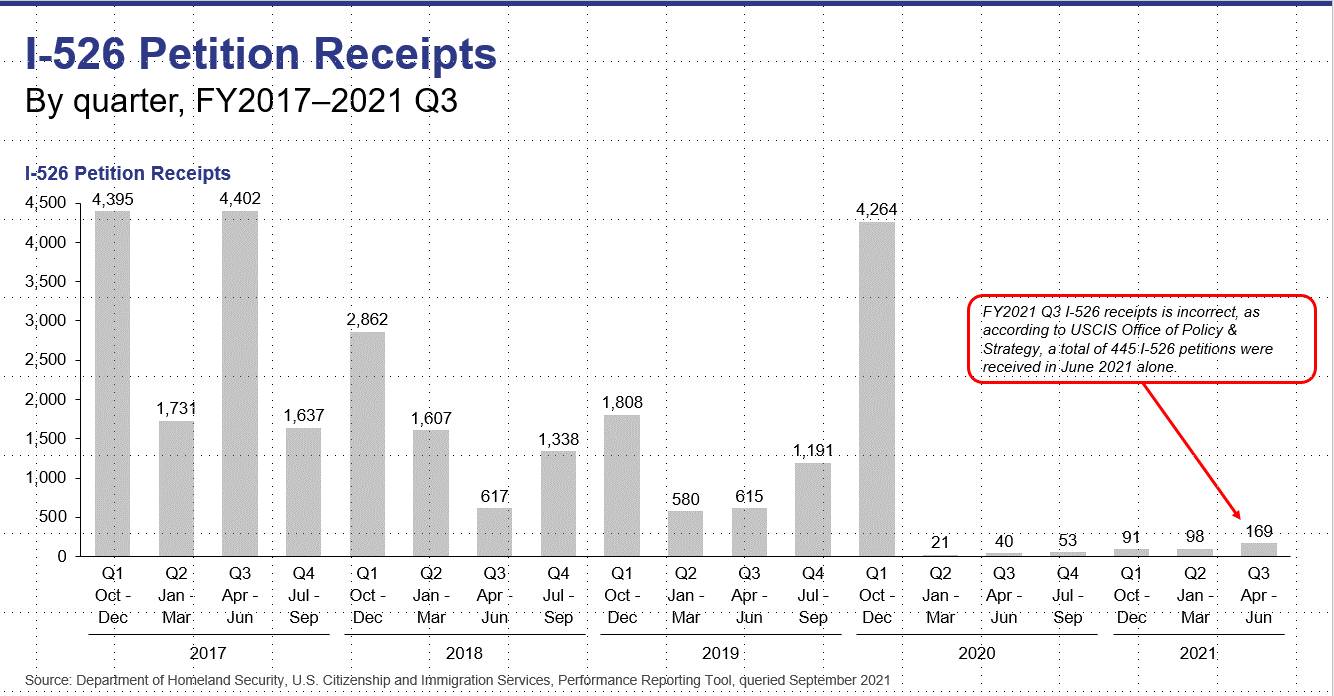

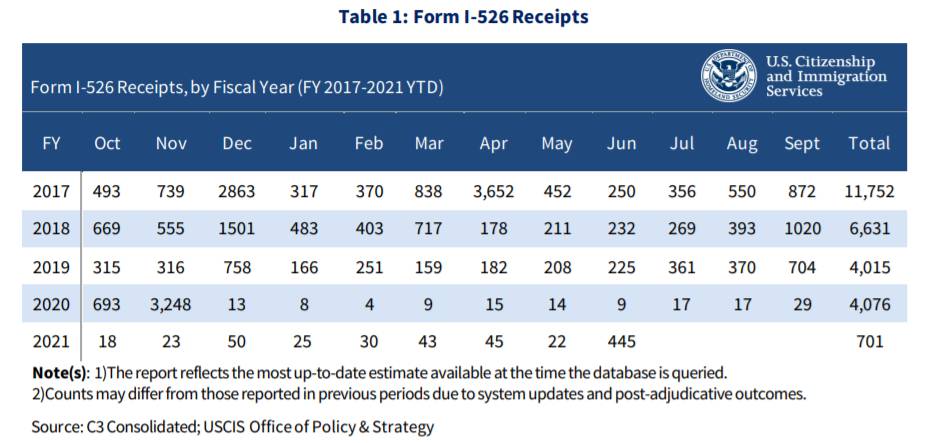

Unfortunately, the EB-5 investment industry has long been plagued by slow processing times for Form I-526, the visa petition that grants investors conditional permanent resident status. USCIS typically takes several years to process I-526 petitions. Moreover, certain countries with high volumes of EB-5 investors have been subject to final action dates that limit when conditional green cards can be granted. Even though India and Vietnam previously experienced backlogs, these had been cleared by the August 2021 Visa Bulletin. Moreover, the final action date for China, the country with the largest EB-5 backlog, made steady progress between the June and September 2021 Visa Bulletins after more than a year of inactivity. Unfortunately, the November 2021 Visa Bulletin shows no progress toward clearing the Chinese EB-5 backlog. It may be that China’s EB-5 backlog is in for another extended period of stagnancy.

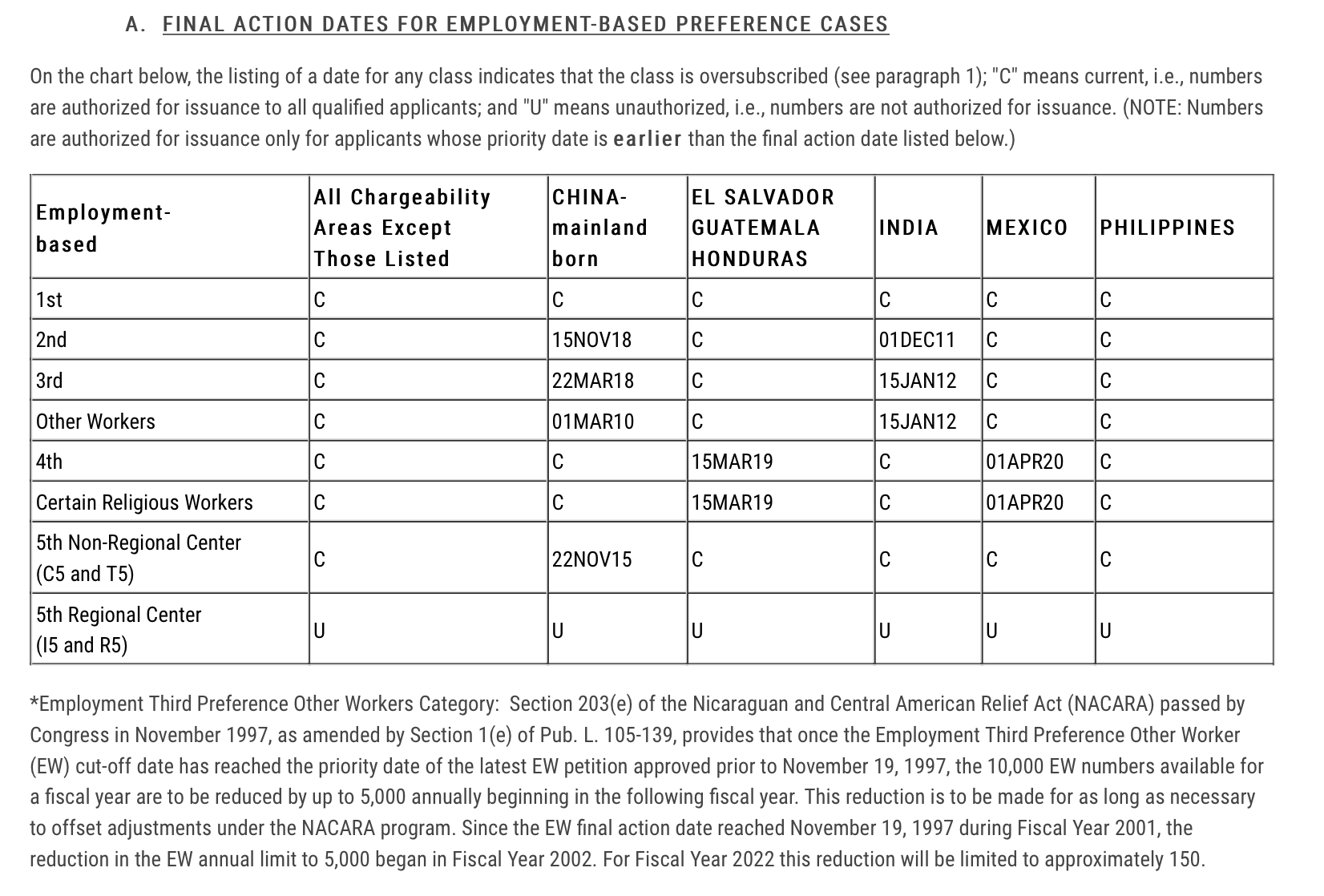

Chart A, “Final Action Dates for Employment-Based Preference Cases”

Chart A of the November 2021 Visa Bulletin shows that China is the only country that is still subject to a final action date: November 22, 2015. This date has remained the same since the September 2021 Visa Bulletin.

Due to USCIS’s processing inefficiency, Chinese EB-5 investors who submitted their I-526 petitions after November 22, 2015, cannot receive conditional permanent resident status. In addition, the regional center values are marked as “U” (unauthorized) due to the expiration of regional center EB-5 investment. It is unclear when the regional center program will be revalidated, and USCIS is no longer accepting I-526 petitions associated with regional centers. All pending regional-center I-526 petitions filed before the program’s expiration on June 30, 2021, will not be adjudicated for the time being.

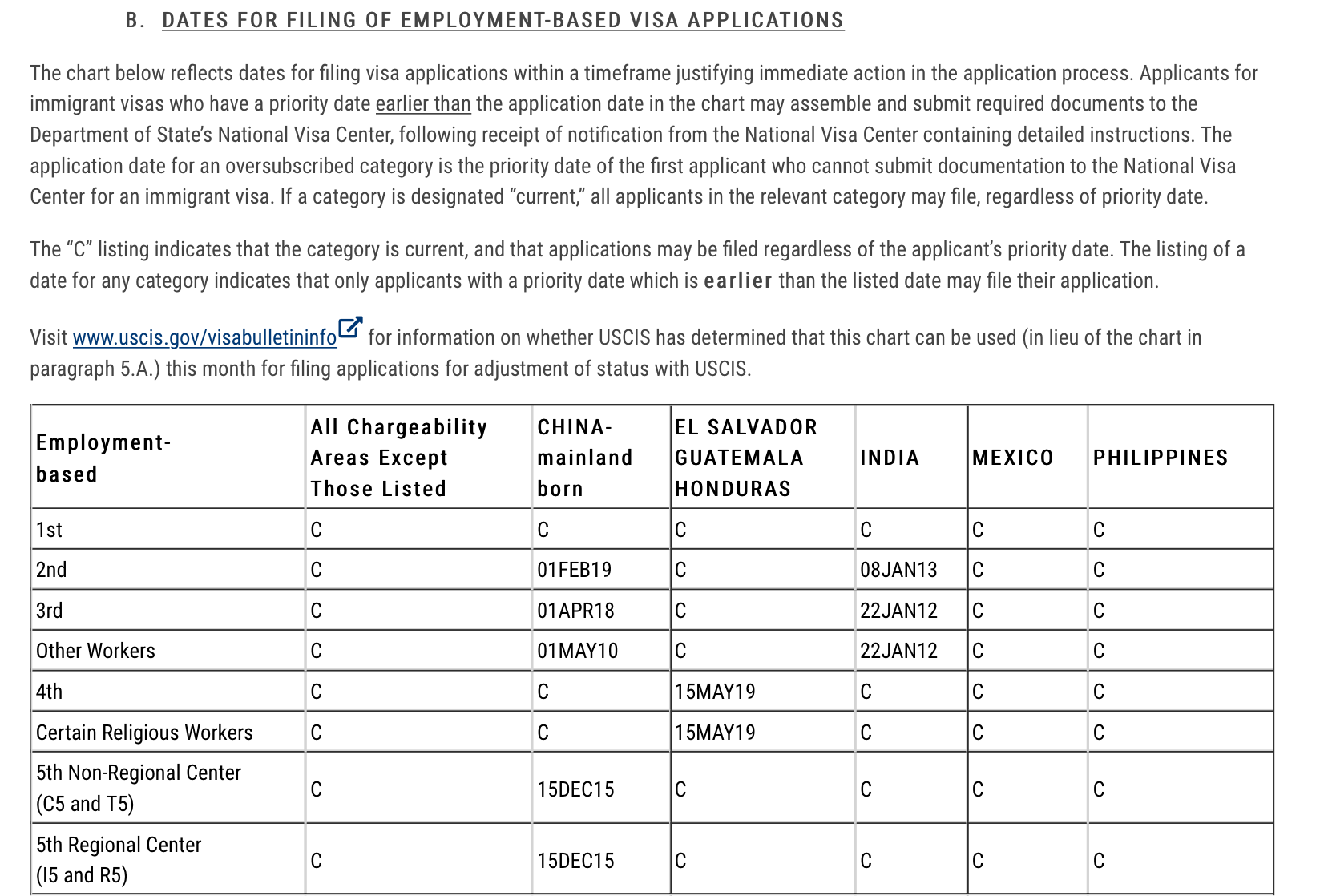

Chart B, “Dates for Filing of Employment-Based Visa Applications”

Chart B of the November 2021 Visa Bulletin likewise shows no progress in China’s date for filing, which dictates when Chinese EB-5 investors can apply for their conditional visas. The Chinese date for filing is still December 15, 2015—it has not progressed in more than 12 months. Unfortunately, Chinese EB-5 investors still have to wait before requesting their conditional green cards, even if their I-526 petitions have been approved.

The November 2021 Visa Bulletin is indicative of the EB-5 investment industry’s dire need for expedited processing times. USCIS needs to allocate more resources toward adjudicating EB-5 visa petitions; foreign nationals who have complied with all EB5 investment regulations deserve to have their petitions approved within a reasonable timeframe. Ur Jaddou, who was appointed as director of USCIS on July 30, 2021, has said that she will work on reducing the EB-5 visa backlogs.