For EB5AN, 2018 was an exciting year marked by milestones, accomplishment, and growth. Our partners collectively spent more than 200 days on the ground in foreign markets—including China, India, Brazil, Colombia, and Vietnam (along with many more)—getting a sense for where EB-5 is headed and how we can keep ahead of upcoming trends.

We have now sponsored more than 1,000 investors from more than 30 nations across our regional centers, and we continue to hold a 100% approval rate on all adjudicated USCIS petitions.

Additionally, we are proud of the recognition our company and its principals have received. We were recognized by Entrepreneur Magazine in its 2018 Entrepreneur 360 List, and Managing Members Sam Silverman and Mike Schoenfeld were recognized by Forbes Magazine.

As we enter 2019, we are excited about the opportunities ahead, and we look forward to offering our clients the highest caliber of EB-5 consulting services, Regional Center sponsorship, and document preparation. Our expanded team of specialists is able to quickly respond to client needs without sacrificing quality, and we look forward to all the new client relationships 2019 will bring.

Below, we’ll consider 2018 in light of visa issuance and petition adjudication, program reauthorization, policy updates, and industry trends. We’ve also appended a list of updates to regional centers.

Visa Issuance and Petition Adjudication

This year, the U.S. Department of State provided several key updates regarding visa issuance.

- Estimated visa wait times for mainland-born Chinese nationals increased

- A cut-off date was assigned to Vietnam

- Near term backlogs for India, Brazil, and South Korea were predicted

Beyond these updates, the discussion surrounding EB-5 visa availability has become a mainstream topic, particularly as it relates to marketing projects and making investment decisions.

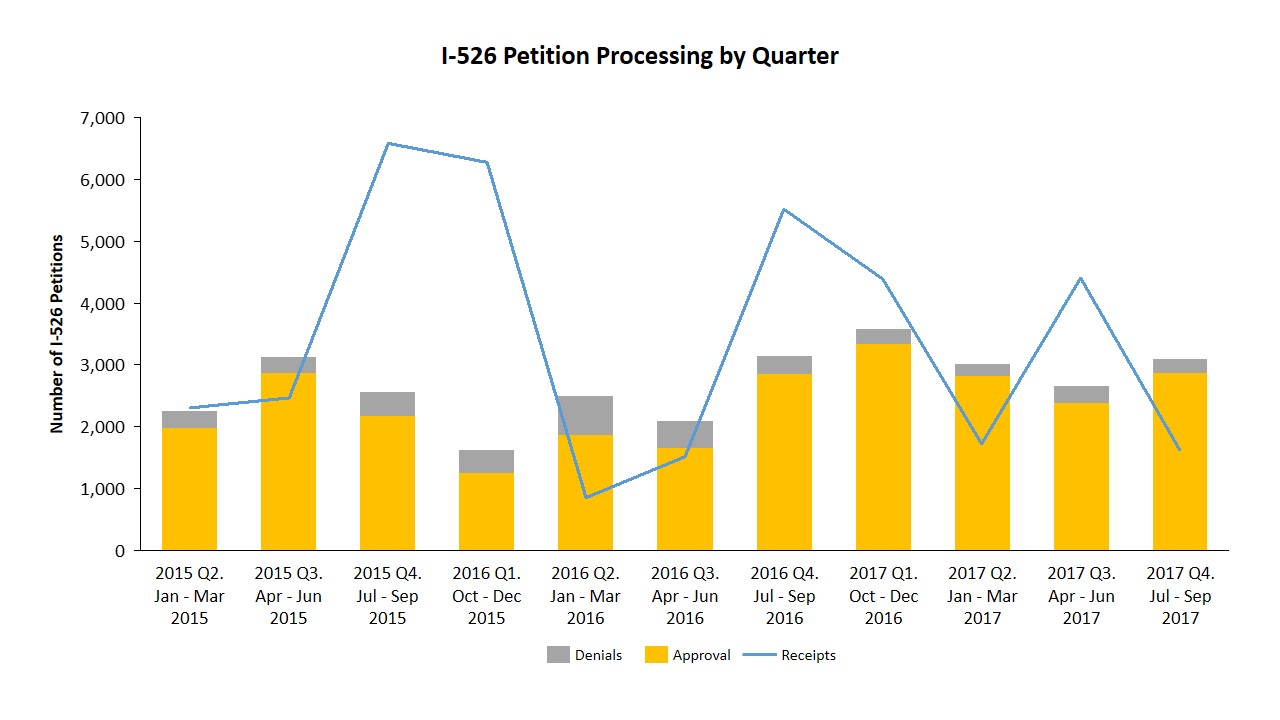

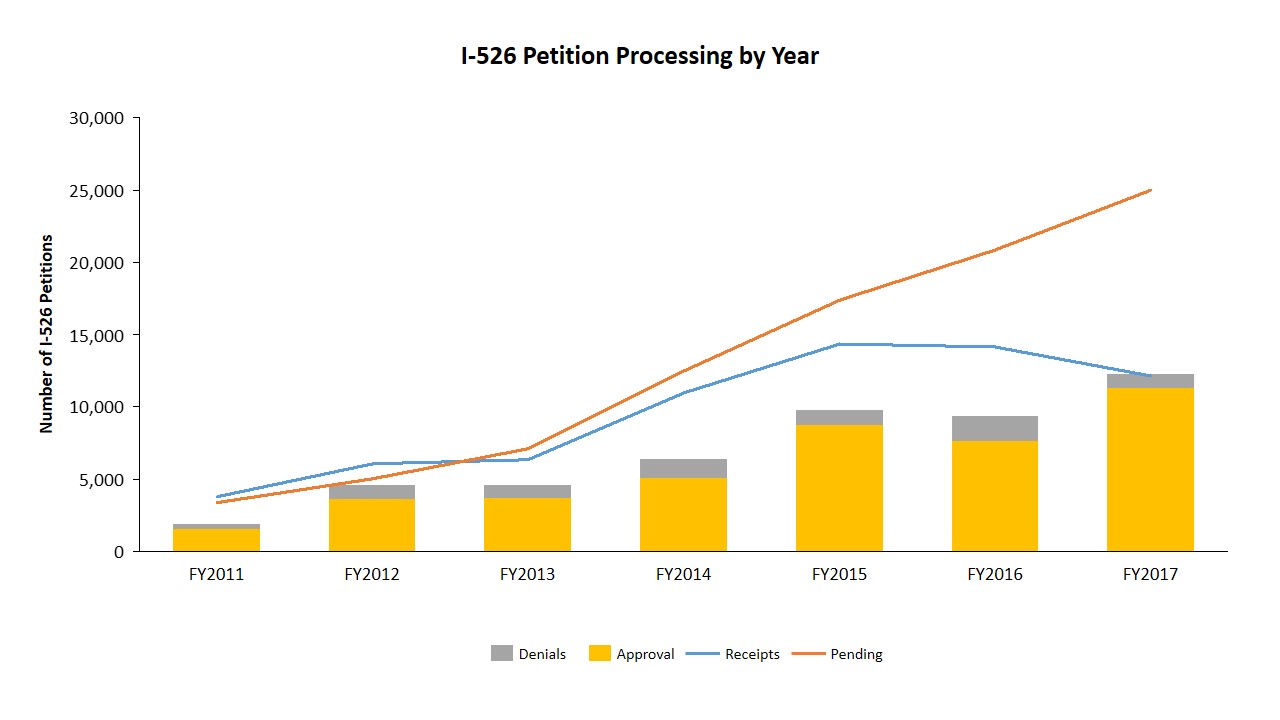

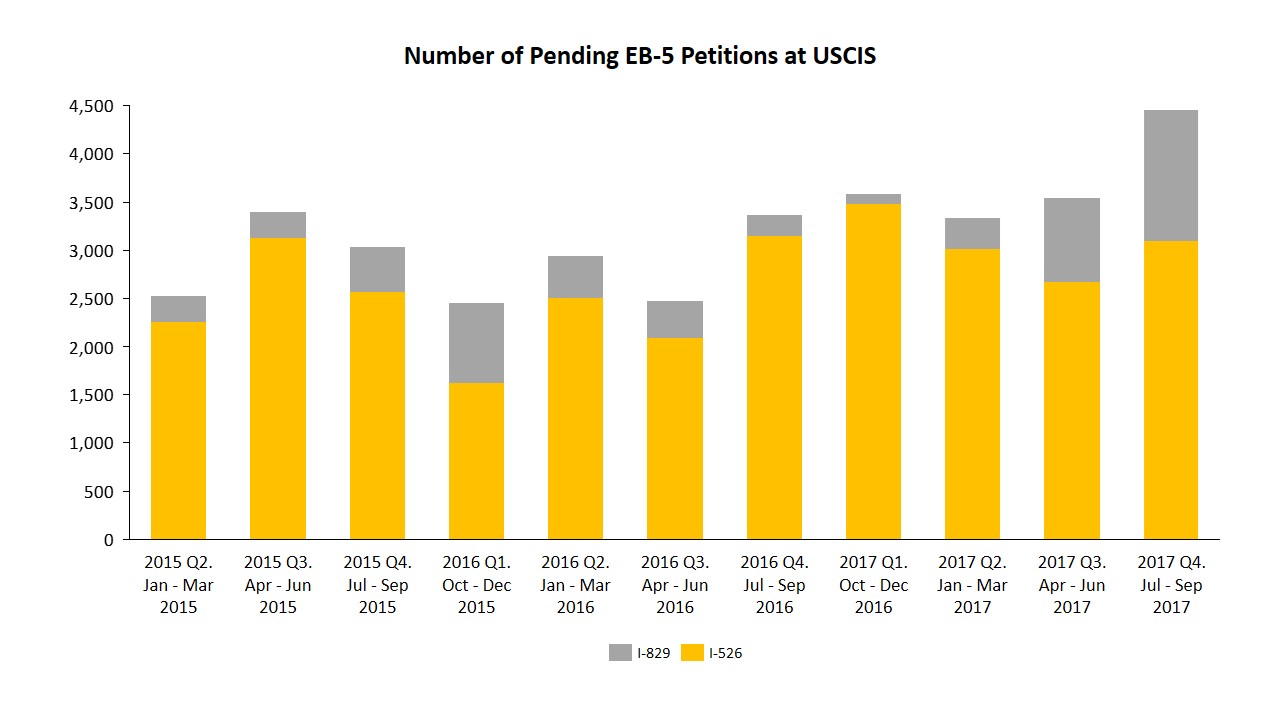

Currently available data shows a drop in total I-526 Petition filings in 2018, with the total by the end of Q3 standing at just 5,086. The total number by Q3 in 2017 was 10,528, and that fiscal year ended with 12,165 filings. Total adjudications for I-526 Petitions, however, increased: by Q3, 2018, approved and denied petitions totaled 11,083 compared to a total of 9,150 by Q3, 2017. Pending petitions dropped from 24,992 in 2017 to 17,126 by Q3 of 2018. This highlights an increase in processing ability and a decrease in new applications, indicating an anticipated faster timeline for adjudications.

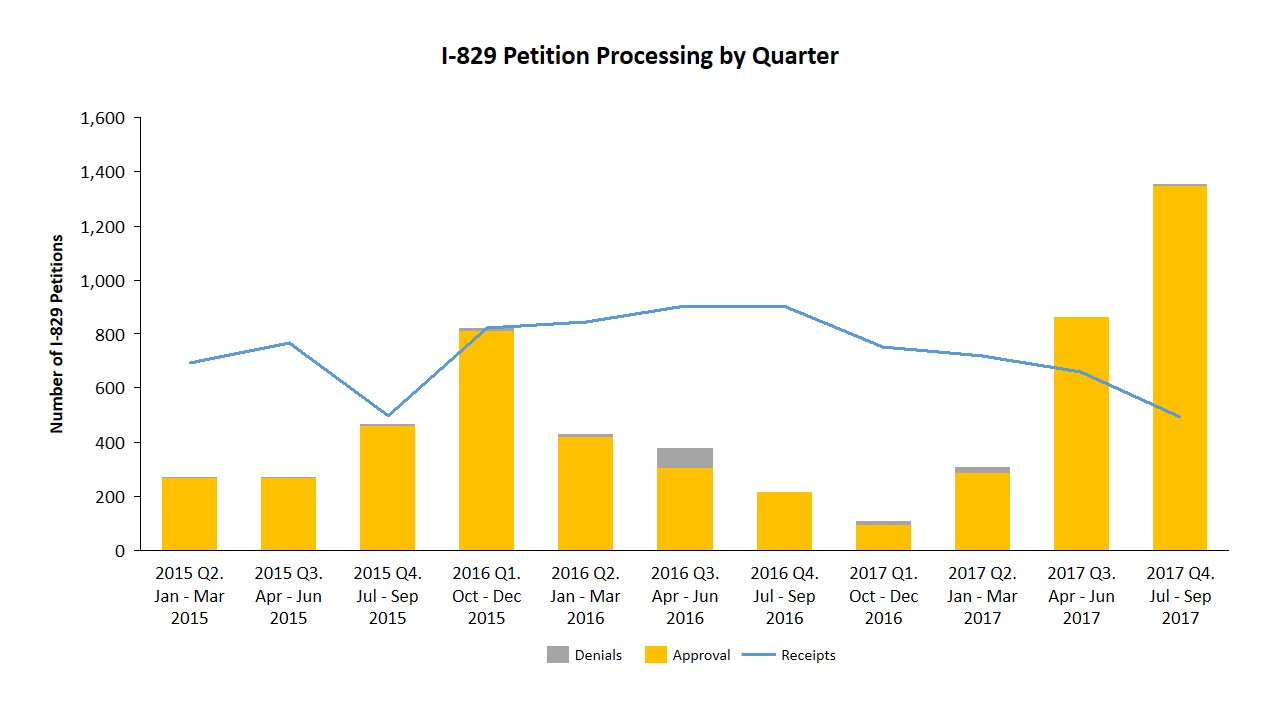

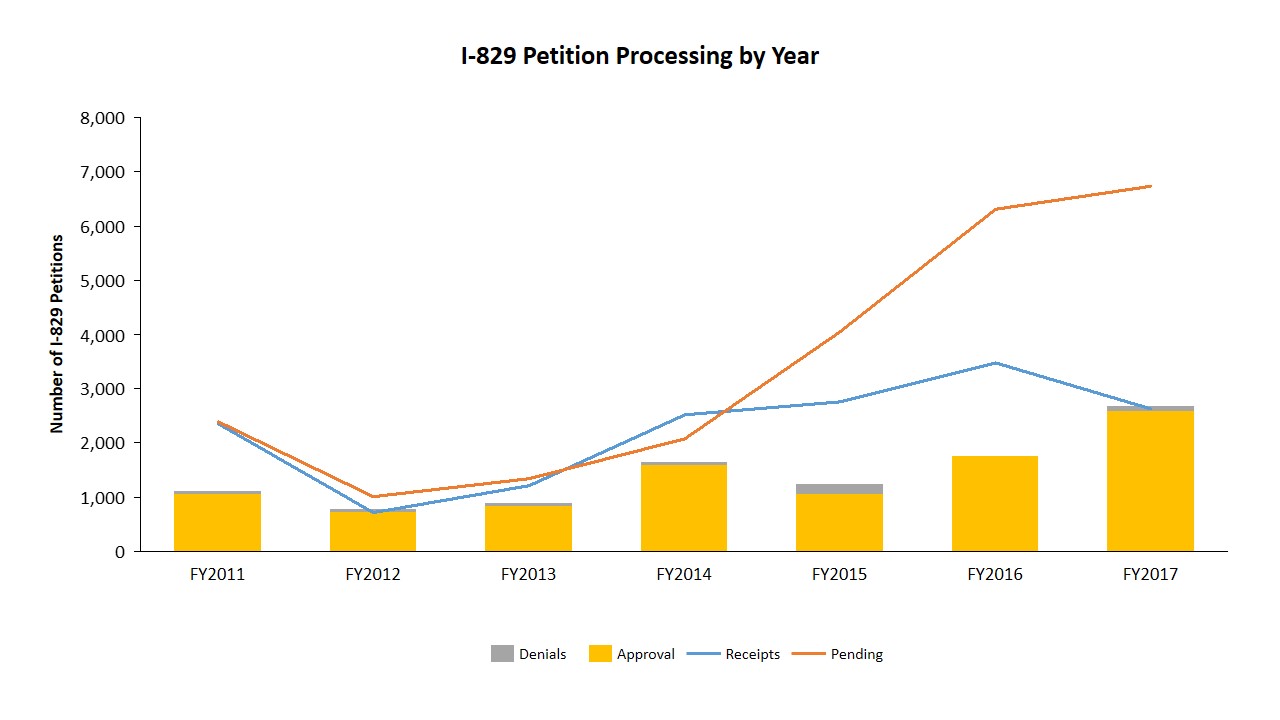

I-829 Petitions rose in 2018, totaling 2,816 by Q3 as compared to 2,132 by Q3, 2017. Current data also reflects a rise in total I-829 adjudications. By Q3, 2018, approved and denied petitions totaled 1,968, while in Q3, 2017, adjudicated petitions totaled only 1,292 (though Q4, 2017, saw a surge in I-829 adjudications, more than doubling this total—we won’t know until new data is available how Q4, 2018, compared to the previous year).

Program Reauthorization

The EB-5 regional center program is subject to periodic reauthorization, which typically is accomplished within appropriations bills. This year, the regional center program required reauthorization five times:

- January 19 – reauthorized on January 22 after government shutdown

- February 8 – reauthorized

- March 23 – reauthorized

- September 30 – reauthorized

- December 7 (amended to December 21) – reauthorized on January 25 through February 15 after extended government shutdown

The failure of Congress to facilitate a smooth appropriations process has resulted in a tumultuous year for the EB-5 Program and has created significant uncertainty for all EB-5 industry stakeholders.

We support legislative measures that would stabilize the EB-5 Program, particularly by either eliminating the need for regional center program reauthorization or by providing long-term authorization. Previous proposed legislation has included five-year regional center reauthorization, and the main industry groups are working to advance a bill that also includes a five-year reauthorization period. We support such efforts and hope that the appropriations drama that unfolded in 2018 does not repeat itself in 2019.

Policy Updates

Proposed regulations from 2017—which would have increased the minimum investment threshold for EB-5 investments, changed how targeted employment areas (TEAs) are certified, and more—were expected to receive a Final Rule by February 2018. The anticipated target date for the rule was then changed to November. To date, no Final Rule has been published. The public generally did not favor the draft rule, and the final details of the proposed regulations, if ever published, remain a mystery.

Despite not finalizing the proposed regulation, the Immigrant Investor Program Office (IPO) did issue four updates to the USCIS Policy Manual.

- May 2 – Reaffirmation that USCIS does provide documentation of investors’ conditional lawful permanent resident (CLPR) status to those who have pending I-829 Petitions

- May 15 – Rescission of prior guidance regarding tenant-occupancy methodology

- August 24 – Updated guidance regarding regional center geographic coverage, requests to expand such coverage, and how such requests affect I-526 Petition filings

- October 30 – Clarification concerning immigrant investors and debt arrangements

Industry Trends

This year, IPO hired a new chief, Sarah M. Kendall, held three stakeholder engagements (all in November), and issued four updates to the policy manual (as mentioned in greater detail above). As already mentioned, I-526 processing volume rose significantly and I-829 processing volume seems to have risen as well (depending on Q4 performance). The rise in petition adjudication times is welcomed, and we hope this trend continues into 2019.

The EB-5 industry in general is trending toward increased fragmentation. Investor origin is diversifying, and new investors are tending to seek out smaller, more niche regional center offerings. Investors are shifting away from larger regional centers and seem to be gravitating toward more personal opportunities in which relationship factors ultimately drive where investors are placing their capital.

Additionally, investors are growing more savvy and are being drawn to projects with reduced administrative fees, fewer intermediaries, and higher returns. Based on our information, preferred equity deals have absorbed a significant share of the market and now represent approximately half of EB-5 regional center project structures—mezzanine debt deals constituting the other half.

As we’ve observed these changes, we continue to offer clients a turnkey solution that remains flexible enough to meet fluctuations in the market. We work with our clients to find solutions that best meet their needs and are experienced at sponsoring and structuring both preferred equity and mezzanine debt deals. We see our time spent on the ground in foreign markets as an invaluable investment that has allowed us to stay on top of these trends.

For more information about how EB5AN can help you structure your project for EB-5, compile the necessary documents, affiliate with one of our regional centers, set up your own regional center, and more, please contact us at info@EB5AN.com.

Changes in Approved Regional Centers

The following regional centers were added to the approved regional center list from September 11 to December 31:

- California – Los Angeles International Regional Center, LLC

- California – Southern California EB-5 Fund, LLC

- Connecticut / New Jersey / New York – York Resources RC Funding, LLC

- Florida – BC Central Florida Regional Center LLC

- Illinois / Indiana – Ameri-Link Midwest Regional Center

- Nevada – Brilliant EB-5 Regional Center, LLC

- Ohio – Ameri-Link Ohio Regional Center, LLC

- Puerto Rico – Mayaguez Regional Center, LLC

- South Carolina – FCA South Carolina Regional Center, LLC

- Texas – American Equity Fund Texas, LLC

- Texas – National EB-5 Wealth Center, LLC

The following regional centers were renamed:

- California / Oregon / Washington – Smith Western Regional Center f/k/a Western Pacific Regional Center

- Illinois, Indiana – Native American Regional Center, LLC, f/k/a Native American EB-5 Corporation

The following regional centers were terminated throughout the year:

- Alabama

- Civitas Alabama Regional Center (9/6/2018)

- Encore Alabama/Florida Regional Center (4/3/2018)

- Arizona

- Central Arizona Regional Center (12/19/2018)

- Arkansas

- Ark of the Ozarks LLC (pending; 4/5/2018)

- Liberty South Regional Center (1/19/2018)

- California

- Altura Regional Center, LLC (4/9/2018)

- Amaxi Regional Center, LLC (5/1/2018)

- AmerAsia EB5 Regional Center SF, LLC (6/7/2018)

- American Altin Regional Center (8/8/2018)

- American Dream Fund San Francisco Regional Center, LLC (10/3/2018)

- American General Realty Advisors Regional Center (4/20/2018)

- Build America Capital Partners Regional Center LLC (7/31/2018)

- Build America Fund 1, LLC (8/9/2018)

- Cal Pacific RC LLC (7/16/2018)

- California Bond Finance Regional Center, LLC (4/12/2018)

- California Global Alliance Regional Center c/o Lewis C. Nelson & Sons, Inc. (8/31/2018)

- California International Regional Center LLC (7/10/2018)

- California Investment Immigration Fund, LLC (CIIF) (3/20/2018)

- California Pacific Regional Center, Inc (6/11/2018)

- Central California Regional Center, LLC (4/13/2018)

- Charter Square Regional Center, LLC (7/10/2018)

- EB5 United West Regional Center, LLC (7/27/2018)

- Encore S. CA RC, LLC (4/18/2018)

- Faustus Capital LLC (5/24/2018)

- Future Resources, Inc. (8/15/2018)

- Global America Regional Center (4/27/2018)

- Golden State Economic Development Fund, LLC (12/6/2018)

- L Global Regional Center, LLC (8/20/2018)

- Manchester Pacific Regional Center (3/28/2018)

- New Energy Horizons Regional Center (4/12/2018)

- QueensFort Capital California Regional Center, LLC (4/12/2018)

- Regency Regional Center, LLC (3/15/2018)

- Regional Economic Development & Investment Group (4/5/2018)

- San Diego Regional Investment Center, LLC (11/16/2018)

- SPG Regional Center, LLC (4/26/2018)

- Colorado

- ADC Colorado Regional Center, LLC (5/1/2018)

- Colorado Growth Fund, LLC (5/15/2018)

- Colorado Headwaters RC, LLC (5/24/2018)

- Encore Colorado RC, LLC (9/24/2018)

- Live in America – Colorado Regional Center LLC (9/7/2018)

- Connecticut

- High Stone Regional Center, LLC (4/9/2018)

- District of Columbia

- Civitas Washington D.C. Regional Center (9/5/2018)

- EB5AN Washington, D.C. Regional Center, LLC (9/13/2018)

- Encore Wash D.C. RC, LLC (5/25/2018)

- TBC Washington DC Area Regional Center, LLC (4/6/2018)

- Florida

- BLMP Florida Healthcare Regional Center, LLC (3/30/2018)

- Citizens Regional Center of Florida (8/24/2018)

- Civitas Miami Regional Center, LLC (9/6/2018)

- Cornerstone Regional Center, Inc. (4/6/2018)

- Florida East Coast EB5 Regional Center LLC f/k/a United States Growth Fund, LLC (4/10/2018)

- Greystone EB5 Southeast Regional Center LLC f/k/a Greystone Florida Regional Center LLC (4/13/2018)

- Georgia

- American YiYo Regional Center (4/12/2018)

- Civitas Atlanta Regional Center (9/6/2018)

- Diversified Global Investment, LLC (1/30/2018)

- Hawaii

- South Pacific Regional Center, LLC (3/29/2018)

- Idaho

- Idaho State Regional Center LLC (7/2/2018)

- Illinois

- American Pioneer Regional Center, LLC (3/27/2018)

- Chicagoland Foreign Investment Group (CFIG) Regional Center (7/16/2018)

- Civitas Illinois Regional Center (9/5/2018)

- Indiana

- Energize-ECI EB-5 Visa Regional Center (5/9/2018)

- Invest Midwest Regional Center f/k/a Civitas Indiana Regional Center (8/21/2018)

- SAA Cedisus EB-5 Projects – SW Indiana Regional Center, LLC (4/18/2018)

- The Mid-American Regional Center, LLC (8/30/2018)

- Iowa

- Iowa Department of Economic Development (IDED) (4/19/2018)

- Island of Guam

E Development Corporation dba EDC (10/15/2018)

- Kansas

- Southwest Kansas Regional Center (2/1/2018)

- Kentucky

- Midwest Regional Center, Inc. (4/5/2018)

- Louisiana

- Civitas Louisiana Regional Center (9/11/2018)

- LIGTT Regional Center (pending; 4/18/2018)

- New Orleans’ Mayor’s Office RC (2/27/2018)

- Maine

- New England Center for Business Development, LLC (5/9/2018)

- Marianas Islands

- Marianas EB5 Regional Center (5/29/2018)

- Rota EB5 Regional Center (6/21/2018)

- Saipan Regional Investment Center, LLC (8/1/2018)

- Maryland

- Maryland Area Regional Center, LLC (1/23/2018)

- USA ODI Regional Center, LLC (3/20/2018)

- Massachusetts

- Americas Green Card Regional Center (7/12/2018)

- Encore Boston RC, LLC (4/18/2018)

- Queensfort Capital Massachusetts Regional Center, LLC (3/29/2018)

- Michigan

- Civitas Michigan Regional Center (9/6/2018)

- Lansing Economic Development Corporation (LEDC) Regional Center (1/23/2018)

- Michigan-Indiana EB-5 Regional Center (3/29/2018)

- Mississippi

- Gulf Coast Funds Management, LLC (8/30/2018)

- Northern Mississippi Regional Center, LLC (9/7/2018)

- Nebraska

- White Lotus Group Regional Center (6/26/2018)

- Nevada

- Nevada Development Fund LLC (7/12/2018)

- Silver State Regional Center LLC (4/11/2018)

- New Jersey

- East Coast Renewable Regional Center, LLC (4/9/2018)

- G.R.E.E.N. Regional Center (4/2/2018)

- North American Regional Center (8/2/2018)

- New York

- North Atlantic Regional Center, LLC (5/1/2018)

- Queens Fort New York Regional Center, LLC (3/28/2018)

- North Carolina

- Carolina EB-5 RTP Regional Center, LLC (12/20/2018)

- Encore Raleigh/Durham Regional Center (4/2/2018)

- North Dakota

- Landy Resources Management, LLC (5/1/2018)

- Ohio

- Mag Ventures 1, LLC (9/11/2018)

- Northeast Ohio Regional Center (7/18/2018)

- Ohio Lakeside Regional Investment Center (5/1/2018)

- Oklahoma

- 5 Starr Regional Center LLC (4/5/2018)

- Chen Roberts Regional Center (3/9/2018)

- Civitas Great Plains Regional Center (9/12/2018)

- Oregon

- American International Venture Fund – Oregon, LLC (4/9/2018)

- APIC Regional Center, LLC (8/8/2018)

- Pennsylvania

- Encore Pennsylvania RC, LLC (EPRC) (8/20/2018)

- Liberty EB5 Regional Center (5/1/2018)

- Puerto Rico

- Commonweaith of Puerto Rico Regional Center Corporation (4/25/2018)

- Omega Puerto Rico Regional Center, LLC (2/15/2018)

- Reside in America Puerto Rico, LLC (5/1/2018)

- South Carolina

- Southeastern Higher Education Regional Center (1/2/2018)

- USHoldings Regional Center (9/24/2018)

- South Dakota

- South Dakota International Business Institute (SDIBI) (5/11/2018)

- Tennessee

- EB5 Memphis Regional Center, LLC (2/26/2018)

- Texas

- Central Texas Properties Regional Center (3/27/2018)

- Central Texas Regional Center (8/21/2018)

- Civitas Laredo Regional Center, LLC (9/6/2018)

- Civitas Rio Grande Regional Center (9/10/2018)

- Collegiate Regional Center LLC d/b/a Texas Collegiate Regional Center (pending; 5/15/2018)

- Global Century (Houston) (4/12/2018)

- Greater Houston Investment Center, LLC (1/26/2018)

- Home Paradise Texas Regional Center, LLC (4/17/2018)

- One World Development Fund, Inc. (4/12/2018)

- QueensFort Capital Texas Regional Center, LLC (4/27/2018)

- RGV EB-5 Regional Center (7/10/2018)

- South Texas EB-5 Regional Center, LLC (3/27/2018)

- US Freedom Capital-Texas, LLC (9/18/2018)

- Utah

- Utah Invest Regional Center, LLC (7/3/2018)

- Vermont

- Vermont Agency of Commerce and Community Development (7/3/2018)

- Washington

- American Bridge Seattle Regional Center, LLC (8/1/2018)

- Encore Washington/Oregon Regional Center, LLC (4/18/2018)

- Great Ocean Regional Center (7/30/2018)

- Liongate Regional Center, LLC (4/27/2018)

- Pacific Northwest Regional Center (4/5/2018)

- Pacific Viniculture (3/22/2018)

- Tacoma EB 5 Regional Center (5/2/2018)

- Washington Foreign Investment Management Group, LLC (4/26/2018)

- Washington State Regional Center (7/31/2018)

Overall, the number of I-526 forms received during the 2017 fiscal year decreased by 14% from the 2016 number, and the number of successfully processed forms increased by 31%. Similarly, 24% fewer I-829 forms were received, and 42% more were adjudicated. Despite the positive changes, the high number of I-526 forms received in 2017 combined with the number of still-pending petitions will take years to process with the current annual immigrant visa issuance limit of 10,000.

Overall, the number of I-526 forms received during the 2017 fiscal year decreased by 14% from the 2016 number, and the number of successfully processed forms increased by 31%. Similarly, 24% fewer I-829 forms were received, and 42% more were adjudicated. Despite the positive changes, the high number of I-526 forms received in 2017 combined with the number of still-pending petitions will take years to process with the current annual immigrant visa issuance limit of 10,000.

The expectation is that processing times will continue to improve during the next fiscal year, adhering to the trend of the past five years. IPO is in the process of adding to its staff in its efforts to continue reducing those times.

The expectation is that processing times will continue to improve during the next fiscal year, adhering to the trend of the past five years. IPO is in the process of adding to its staff in its efforts to continue reducing those times.