While many issues negatively affecting the success of an EB-5 project and the associated immigration process are related to fraudulent practices, that is not always the case. At times, financial difficulties may arise that put an investor’s immigration at risk. When this happens, a project is labeled as “troubled” and must be carefully monitored. All potential issues should be addressed appropriately in the original project documents, specifically in the loan documents and partnership agreement documents. The two main categories of issues, immigration issues and financial issues, will be addressed separately in the following section.

Issues Affecting Immigration

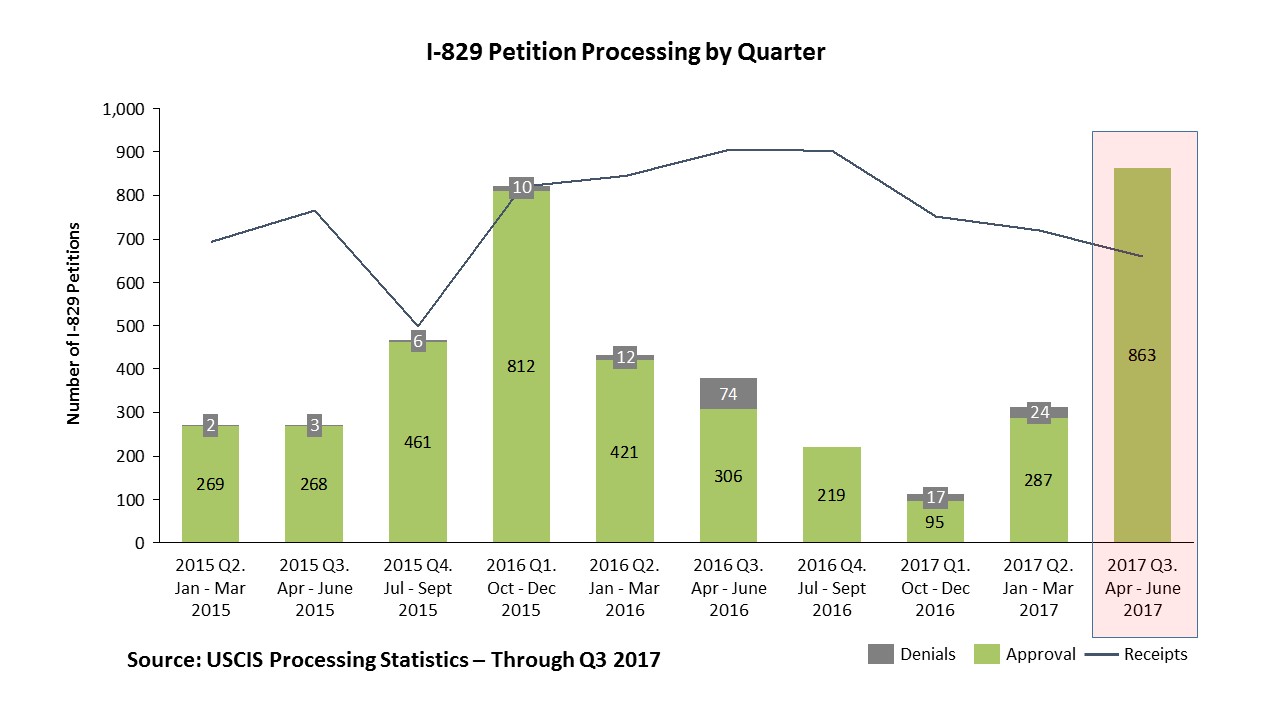

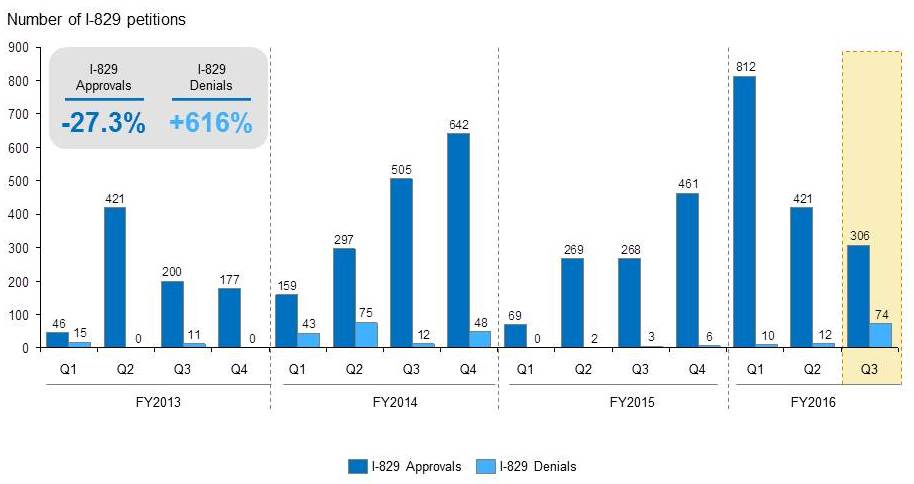

Successful immigration with an EB-5 immigrant investor visa depends on the creation of an adequate number of jobs per investor and the continuing at-risk status of the investment funds. If construction of the EB-5 project is not able to be completed within the necessary timeframe or if the new enterprise, once operational, does not product the projected amount of revenue that additional job creation is dependent on, investors may not be able to have their I-829 Petitions approved. The minimum number of jobs (10 per investor) must be created for successful immigration.

Other issues may arise over the course of the project that may put immigration status at risk. A lack of adequate financing is only one; others include a delay in project construction or other issues arising due to partner disputes—basically, anything that prevents project developers from obtaining the needed financing or seeing the project through within the required timeframe.

Issues Affecting Investor Finances

Immigrant investors enter the EB-5 process hoping (and expecting) to receive a return on their investment. While the issues already mentioned can affect this as well, there are also other factors that may come into play. For example, changes to the original project plan that may have a negative effect on the project’s financial status can prevent investors from receiving a full return. Changes to material costs or financing terms and the inability of the project developer to obtain needed tenants, licensing, or brand name can have a detrimental affect on the financial viability of the project.

Involved Parties and Respective Roles

To avoid encountering difficulties such as those presented above, it is vital to associate with professionals who have the competence and experience necessary to overcome obstacles as they may arise. Each professional plays a valuable role in this process, which should be considered carefully when planning investments.

The immigration attorney. Due to the sensitive immigration issues involving “Matter of Ho” compliance and the creation of jobs, especially given the status of the delay in investors obtaining visas from China, the issue of materiality must be taken into account. If there is a possibility of a material change in the project at any point before investors are able to complete the immigration process, that may have a negative affect on investors who are not yet temporary residents of the United States. Because of the importance of ensuring that projects are compliant with EB-5 regulations and the necessary number of jobs are created, an immigration attorney can be an important source of guidance during this process.

The general partner: The general partner of the new commercial enterprise that is receiving the investment funds must be actively involved in salvaging each investor’s capital if the project takes a turn for the worse. The drafted agreement needs to clearly state what actions various parties can take independently and what actions require a majority vote of investors.

The investor. Investors must provide consent for important decisions that may affect the viability of the project as well as approving the release of EB-5 funds do the selected project.

The lenders. The lenders of an EB-5 project need to be able to protect their investments should difficulties arise. Details regarding what action they can take should be included in loan agreements, such as in the case of loan default. Information about any guarantees of completion should be obtained as well.

Restructuring Projects Due to Financial Difficulties

Troubled projects always come with financial issues. There may be a scarcity of adequate capital to finish project construction or start operation of the completed project. In this case, regional centers and partners who have adequate experience may be able to make arrangements for bridge funding or obtain additional capital from other sources. At times, this can include taking over management of a project by mutual agreement or as a result of legal action being brought against the project developer.

Most investors will be either unwilling or unable to provide more funding if a project is in trouble. Thus, it is recommended that EB-5 projects are also associated with another third-party source of capital and appropriate experts.

Another issue that may arise when a project becomes troubled is a financial agreement with the lending financial institution that prevents any other funding from coming into play until the original loan is paid off. Occasionally an exception is made in the agreement to allow for a qualified partner to take on the role of the project developer in certain situations. Successful completion of a troubled project requires the mutual efforts of all involved parties and sincere effort to complete the project in a timely manner and ensure the creation of the needed jobs.

When fraud becomes a factor, the U.S. Securities and Exchange Commission (SEC) can take action to appoint someone to oversee the project and associated funds if the current project developer is found to be engaging in fraudulent or otherwise inappropriate practices. This process involves freezing all project assets and then changing project management, but as this can take a longer period of time to implement as well as being expensive, it is not always the most desirable option. For the most part, the SEC is concerned about capital involved in EB-5 projects as opposed to the job creation aspect of them. In the recent Jay Peak case, however, the SEC made decisions in consideration of job creation as well as the status of the finances.

While many problems leading to a troubled business can be fixed internally, thereare other problems that are not controllable by the parties involved with the project. Changes in the environment, such as economic recession or a change in the market, are concerns that cannot easily be handled in this manner. For this reason, a backup plan that prepares for contingencies is always recommended when preparing to implement an EB-5 project. Perhaps a construction project is no longer able to be used as the planned business due to market changes; plans can be made to use the building for another purpose as a backup. Businesses that do not involve real estate are at greater risk of facing barriers due to changes in the market. Thus, flexibility is a necessary component for EB-5 project plans to prepare for these potential issues.

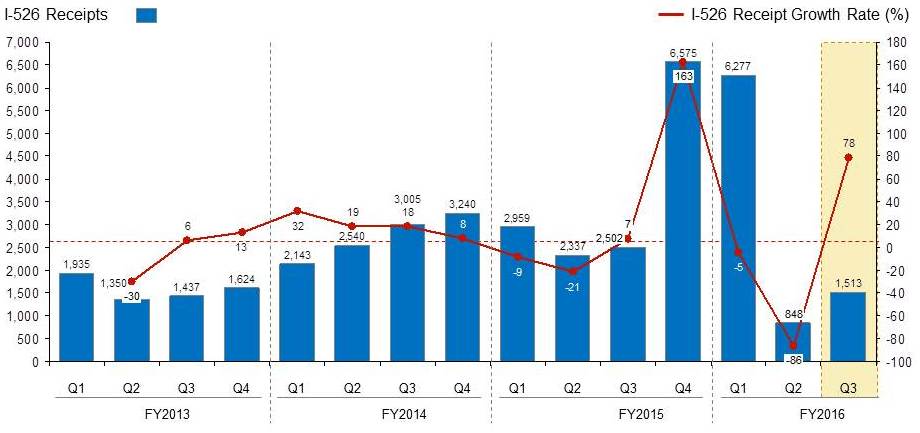

With the rapid expansion in EB-5 investments, an accompanying increase in troubled businesses is also expected. To prepare for financial and immigration difficulties that may arise over the course of the EB-5 process, professionals should be retained to guide participants through the process and protect the project’s viability.