Year by year, the EB-5 Immigrant Investor Program grows in popularity, attracting more and more foreign nationals who wish to invest in the U.S. economy to obtain a green card. The U.S. Department of State – Bureau of Consular Affairs recently released the EB-5 data for fiscal year 2019, and it reveals explosive EB-5 growth since FY17 in several countries.

It’s general EB-5 knowledge that investors from Mainland China dominate the program, and it’s also quite well known that India, Vietnam, South Korea, Taiwan, and Brazil have been steadily approaching China’s lead over the past several years. Since this isn’t news, we’ll concentrate on the EB-5 growth in the countries next in line.

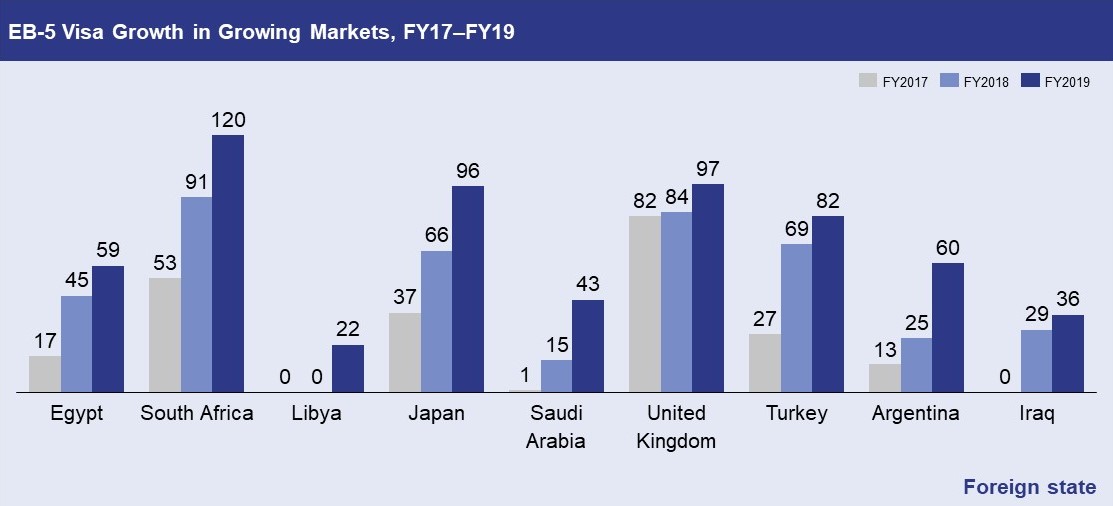

EB-5 Growth from FY17 to FY19

Wealthy individuals and families in growing EB-5 markets are increasingly choosing to invest in the EB-5 program for various reasons. As word spreads of the opportunities the EB-5 program provides, more and more investors wish to dive into the program before the backlogs grow too large. The following are some of the key advantages of the EB-5 program that investors list:

- The EB-5 program grants visas to not only the investor but also his or her spouse and unmarried children younger than 21.

- The EB-5 program provides investors with a path to U.S. citizenship, which investors may apply for after only five years of permanent residency.

- The EB-5 program allows investors to enroll their children in the U.S. public education system and increases their children’s chances of admission to U.S. colleges.

- The United States is a rich, safe, highly developed nation that offers citizens and residents a wealth of opportunities to succeed and live the life they desire.

- In addition to permanent residency in the United States, EB-5 investors can potentially make handsome monetary gains from their EB-5 investment.

As the graphic shows, Libya and Iraq jumped to 22 and 36, respectively, from 0. The growth in Japan and South Africa is also significant, although there was already a fair number of EB-5 investors from these countries in FY17. Growth in the United Kingdom was slower, but there is still an upward trend.

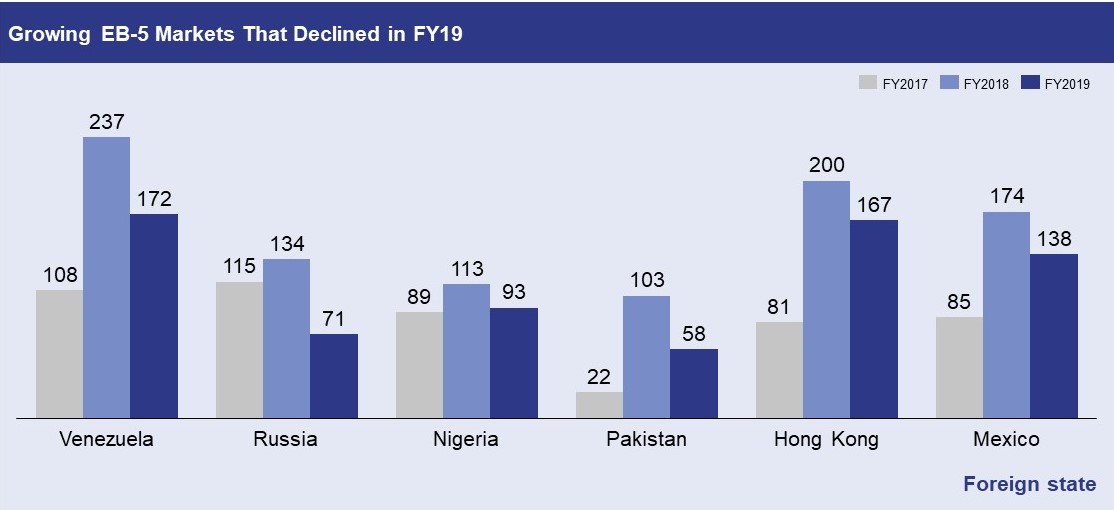

EB-5 growth did not occur all across the board, however. In a handful of countries, while there was growth—in some cases significant growth—in the number of EB-5 visas from FY17 to FY18, figures dropped in FY19. In Russia, the number of EB-5 visas in FY19 even dropped below FY17 figures. Nevertheless, despite the decline, all six countries in the graph below remain relatively strong EB-5 markets.

The data can be misleading because the figures do not represent the number of I-526 petitions filed during the respective fiscal year. Instead, they represent the number of investors from each country who received their visas during the respective year. For most countries, it takes around two years for United States Citizenship and Immigration Services (USCIS) to process the I-526 petition, so in most cases, these numbers reflect EB-5 demand from two years prior.

Why does an investor’s country of origin matter?

USCIS can only issue around 10,000 EB-5 visas per year, regardless of the demand. To make distribution among different countries fair, the maximum number of visas available annually for each country is capped at around 700. For investors from countries like China, India, and Vietnam, where the demand is higher than the supply, visa backlogs can cause wait times of several years.

Until recently, country of origin only mattered in the visa application process, with I-526 petitions being processed on a first-in-first-out basis, but USCIS has announced, effective March 31, 2020, that new I-526 petitions will be processed based on visa availability. This will further push back the wait times for investors from China, India, and Vietnam, but it could foster further growth in underrepresented markets such as Japan, South Africa, and the UK, as it offers investors from these countries a faster path to a U.S. visa.