The EB-5 Program may be facing a number of changes in 2017 from a number of sources—a new administration focused on addressing immigration, a legislature poised to enact comprehensive immigration reform, newly proposed regulations by USCIS, and changes to Chinese capital export restrictions. Taken together, these factors indicate a high probability that changes will occur within the EB-5 Program this year, but with limited specific insight and many possible outcomes, the future of the program is somewhat unclear.

Below, the four main change agents listed above will be examined in greater detail with analysis of how they might affect the EB-5 Program and when—as well as how these four elements interrelate.

The Trump Administration

In many ways, the EB-5 Program is consistent with the stated goals of the new administration. EB-5 is about economic development, investment in the U.S., job creation, and legal means to become permanent residents.

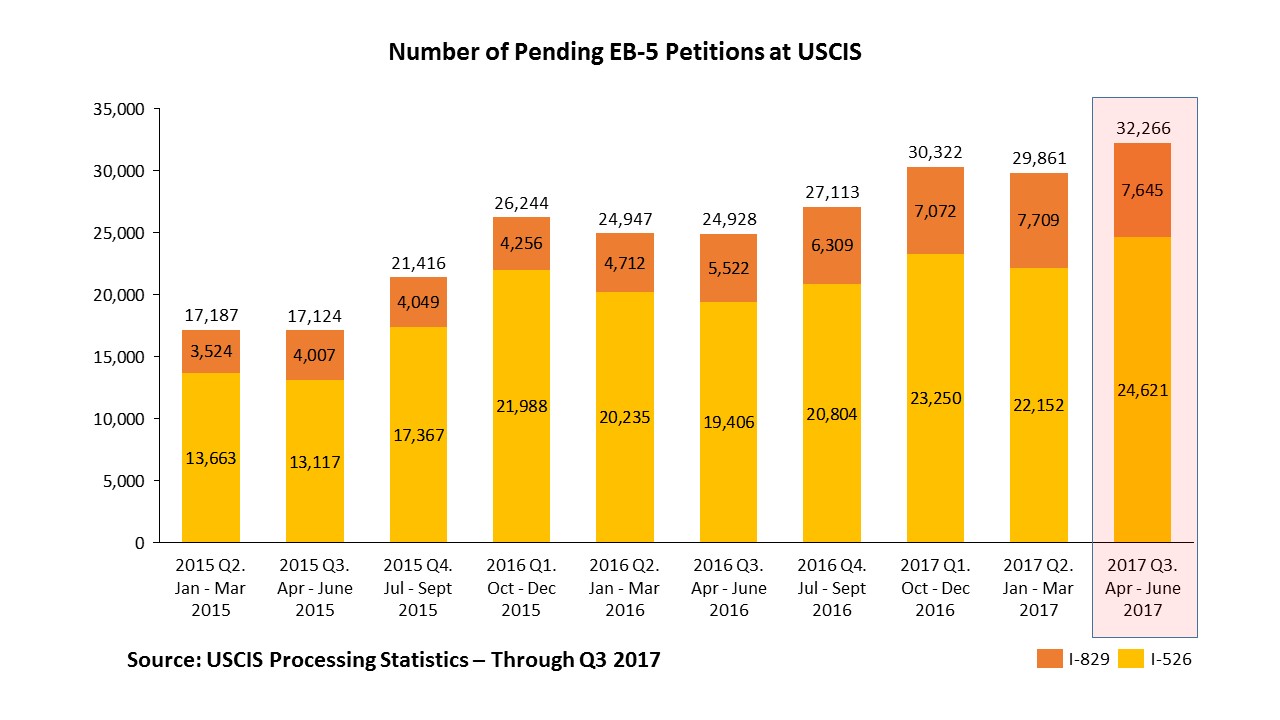

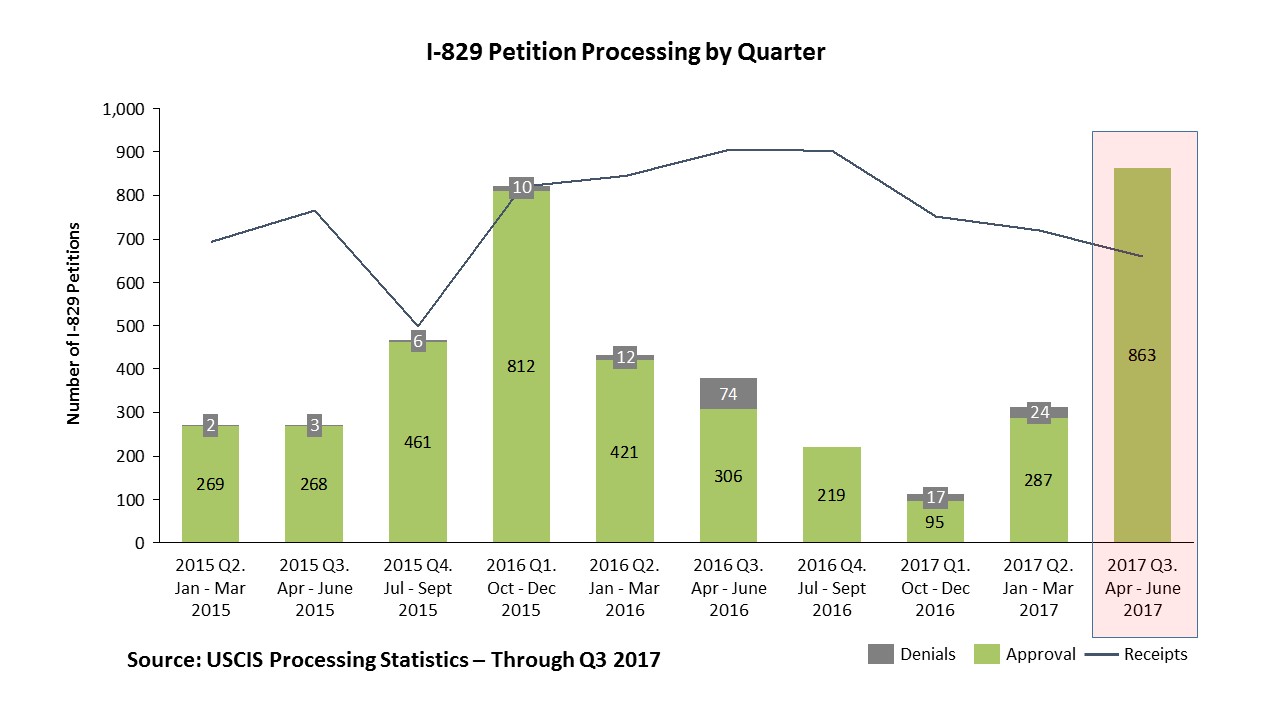

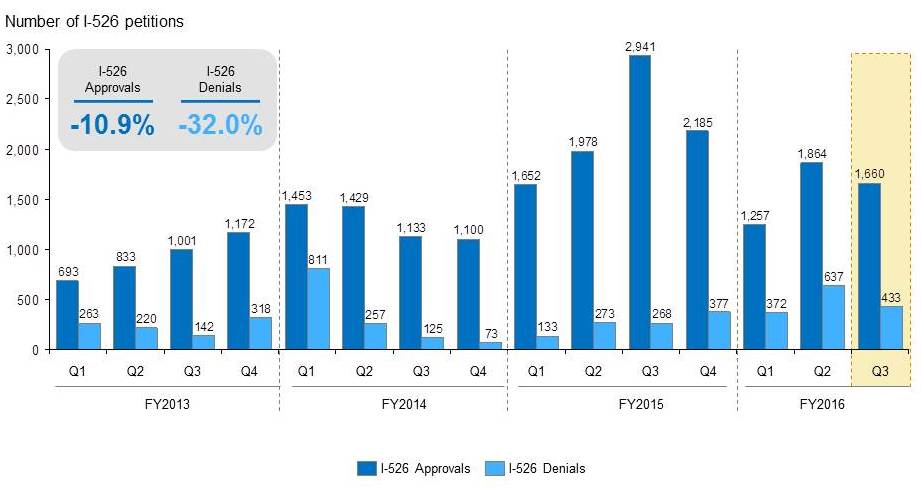

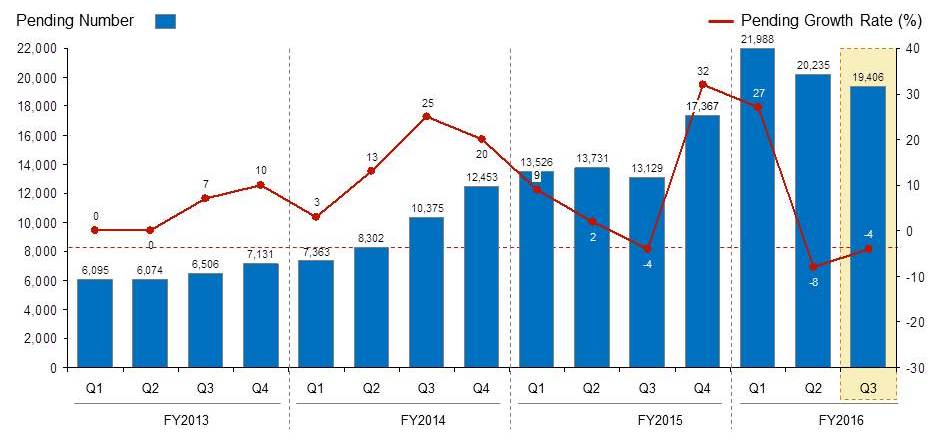

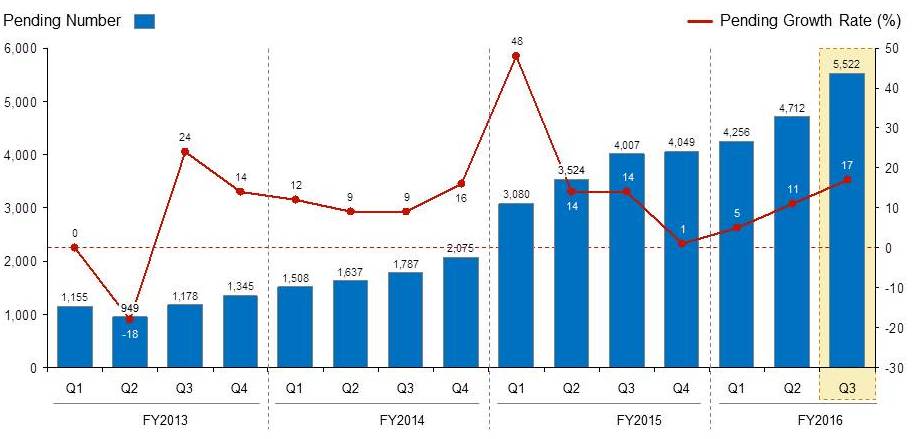

Besides placing pressure on Congress to reform the immigration system, the Trump Administration has the authority to take certain actions that could affect the EB-5 Program. For example, the president has the legal authority to parole any foreign national he considers of particular national interest or benefit. Such authority could be used to help clear the backlog of EB-5 petitioners whose I-526 Petitions have already been approved and whose investments have already been deployed for job creation. Paroling such investors would allow them to enter the U.S. and travel abroad while waiting for their priority date and subsequent I-829 approval.

In addition to actions the president himself has the authority to take, others in the administration (e.g., advisors, cabinet members, and other staff) as well as new ranking members of Senate committees will likely have influence over immigration policy going forward—which will have at least some effect on the EB-5 Program. For example, Senator Feinstein of California, who is the ranking member of the Senate Judiciary Committee, is from the state with the highest participation level in the EB-5 Program, and Attorney General Sessions’ home state, Alabama, had the fifth highest number of EB-5 projects.

Furthermore, a recently released Department of Commerce study of the EB-5 Program demonstrated that from 2012 to 2013, the EB-5 Program contributed $5.8 billion to the U.S. economy and created 174,000 jobs. Cutting or reducing such a program would be counterintuitive for an administration focused on the American economy and job creation.

Congressional Changes

While legislation to reform the legal immigration system—including EB-5 and other employment-based preference categories—is likely to be pursued within the first year or two of the new administration, one of the primary concerns among EB-5 stakeholders is what such legislation might look like in light of the president’s and his advisors’ views on immigration in general. Not surprisingly, President Trump has made strong statements and attempted to take forceful measures with regard to illegal immigration—something he promised to address during his campaign. But current indications suggest the potential for an overall reduction in the number of legal immigrants as well. The effects of such a reduction on the EB-5 Program in particular may or may not be negative.

The targets of any reduction to legal immigration are likely to include the diversity lottery, the family-based preference categories, and the lower-skilled employment-based preference categories. Higher skilled immigrants and immigrant investors may actually benefit from immigration reform legislation.

But EB-5 legislation has been presented in draft form a number of times in the past two years. Senator Grassley and others have sought to enact changes to the program, particularly seeking to increase the minimum investment threshold for investments in targeted employment areas (TEAs) from the current $500,000 to anywhere between $650,000 and $1,000,000. While none of these bills has been sent to the floor for a vote, they indicate some of the intent of Congress with regard to the EB-5 Program.

Apart from the potential for a complete overhaul of U.S. immigration laws, Congress will have to address the EB-5 Program on some level by April 28, 2017, due to the program’s expiration date. Congress is expected to extend the EB-5 Regional Center Program once again, but for how long and with what changes, if any, is unknown.

The length of the extension and the potential for changes to the program largely depend on whether a bill is drafted early enough for discussion, amendment, and a vote before the end of April. With sufficient time, Congress may both pass a long-term extension of the program and a number of changes intended to modernize it. Without sufficient lead time, however, a long-term extension is less likely, and changes to the program become improbable.

The past several program extensions have been short term, and since 2014, USCIS has postponed proposing any regulatory changes pending possible legislation at each renewal of the EB-5 Program. Legislative changes to the EB-5 Program would yield greater stability, making Congress the preferred venue for any changes to the program. But in light of the failure of Congress to produce any such legislation, USCIS has decided to pursue changes through regulation.

USCIS Potential Regulatory Changes

On January 13, 2017, USCIS proposed regulatory changes to the EB-5 Program through a Notice of Proposed Rulemaking, which was published in the Federal Register as DHS Docket No. USCIS 2016-0006 and titled, “EB-5 Immigrant Investor Program Modernization.”

The main changes proposed in this publication are as follows:

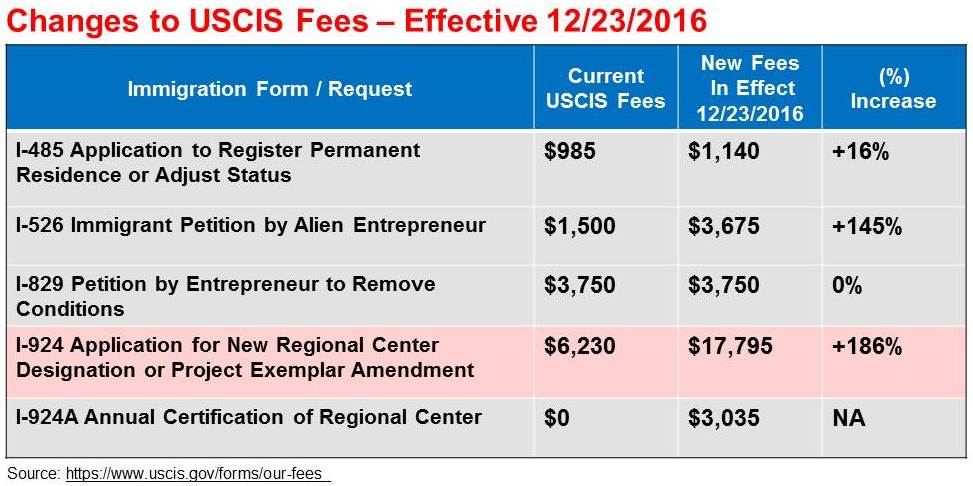

Minimum investment threshold – The proposed regulations establish an immediate increase to the minimum investment amounts from $500,000 to $1,350,000 for TEA investments and from $1,000,000 to $1,800,000 for standard investments. The new standard investment amount is calculated based on inflation as demonstrated through the Consumer Price Index (CPI), and the new TEA investment amount is 75% of the standard investment. These minimum investment amounts would be automatically increased every five years based on inflation.

Targeted employment areas (TEAs) – Under the new regulations, TEA designation authority is transferred from state agencies to the Department of Homeland Security (DHS). Metropolitan statistical areas (MSAs), counties, cities, and census tracts can be designated as TEAs, but for census tracts, only the census tract in which the project is located and any or all immediately adjacent tracts may be used to calculate unemployment.

Priority dates – The proposed changes give investors with approved I-526 Petitions the ability to switch projects and maintain their priority dates. If an investor must submit a new I-526 Petition for any reason (e.g., a project fails or a regional center is terminated), the priority date of the originally approved I-526 will, under most circumstances, be transferred, and the investor will not lose his or her place in line for an EB-5 Visa

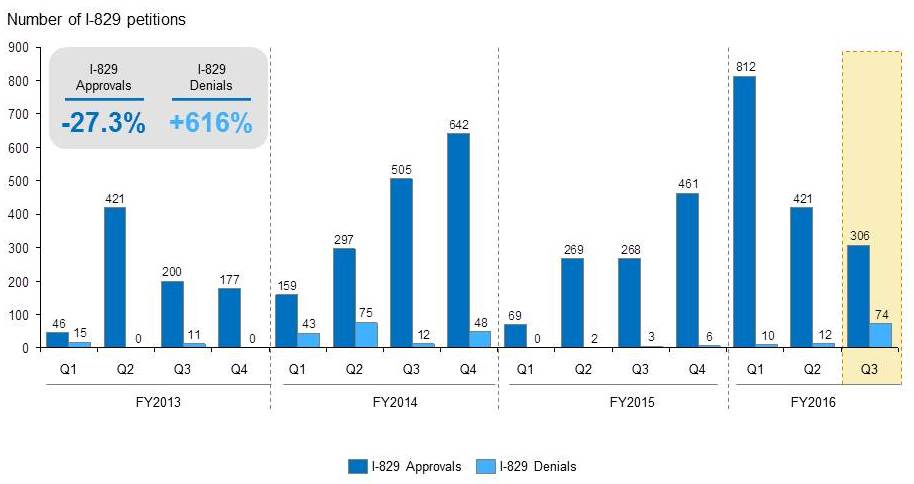

I-829 Petitions – The proposal defines how derivative beneficiaries may file I-829 Petitions if not included in the principal applicant’s petition. Additionally, the new regulations offer more flexibility with regard to the location of I-829 interviews.

I-829 Petition denial – The new regulations change the policy governing termination of status for investors whose I-829 Petitions are denied. Currently, an investor’s conditional permanent resident status is maintained until his or her case is reviewed by an immigration judge and any appeals are heard. This process can take years, and under the proposed changes, the investor would not be able to remain in the U.S. unless some other legal status was obtained.

The proposed regulations are open to public comment for 90 days—until April 11, 2017. USCIS must respond to each comment, explaining why any suggestion is accepted or rejected. Any changes to the proposed regulations must be approved by DHS before a final rule can be issued.

Apart from legislation, which would likely invalidate the proposed changes, these regulations are, in some form, expected to become final. The process may take time—probably no less than 6 months, which will depend largely on the number of responses received during the comment period—but unless the regulatory process is halted by the administration, the EB-5 Program will undergo at least some level of change in the coming months.

China Currency Regulations

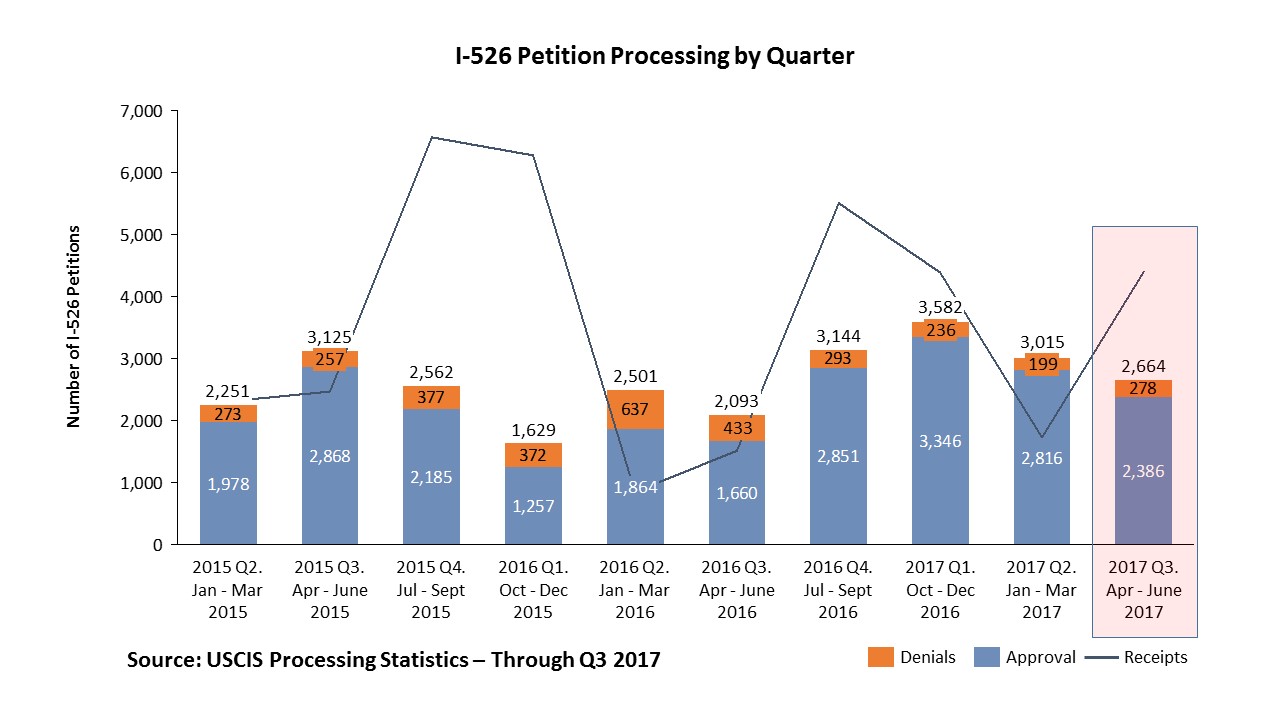

China is another actor that must be considered when examining how the EB-5 Program might change in the months and years ahead. Since the majority of EB-5 investors are from Mainland China, changes to Chinese laws and regulations have the potential to change the landscape of the EB-5 industry.

On January 1, 2017, the Chinese government established further reporting requirements for Chinese nationals investing capital outside of China. These new requirements may discourage, delay, or even prevent Chinese investors from transferring their money out of China and into EB-5 projects.

In addition to these enhanced reporting requirements, China is expected to establish daily currency export restrictions in July 2017—which would create additional roadblocks for Chinese investors seeking to transfer the annual limit of $50,000 out of the country.

Beyond these restrictions, many anticipate a substantial reduction to the annual currency export limit in 2018.

In the short term, these changes—along with the possibility of higher minimum investment thresholds and the fear of even tighter restrictions—may fuel interest in the EB-5 Program among Mainland Chinese nationals. The long-term effects these export restrictions might have on the EB-5 market in China, however, are as yet unknown.