The EB-5 immigrant investor program is one of the quickest ways for foreign nationals to gain lawful permanent residency in the United States.

However, navigating its process and requirements can be confusing. In addition to the minimum required investment amount, investors are responsible for paying EB-5 administrative fees and filing fees, which can vary between individuals and also change from time to time.

Because of this, it’s not surprising that many EB-5 investors ask us how much an EB-5 visa costs.

You’ll want to be aware of these fees to ensure your budget will accommodate them at each stage of your EB-5 journey.

This article explains the different fees you can expect to pay throughout the application process.

What Fees Does an EB-5 Investor Need to Pay?

Form I-526 or I-526E Filing Fee

Form I-485 Visa Application Fee

Form I-829 Filing Fee

Immigration Lawyer Legal Fee

Business Plan Costs

Regional Center Administration Fee

Documentation Translation

Save Time and Money With EB5AN

What Fees Does an EB-5 Investor Need to Pay?

Investing in a New Commercial Enterprise

The main EB5 visa cost is the investment in a new commercial enterprise that will create 10 full-time jobs for American workers.

Ordinarily, the minimum investment amount is $1,050,000. EB-5 investors can invest a lower minimum of $800,000 for a project located in a targeted employment area (TEA), which is typically a rural or high-unemployment area. Certain infrastructure projects are also eligible for this lower investment amount.

Investors are likely to get this money back after the project they invested in achieves success.

Administrative and Professional Costs

Administrative and professional services costs make up the rest of what an EB-5 investor must pay.

Most of the funding for United States Citizenship and Immigration Services (USCIS) comes from filing fees. The agency reviews them every two years to ensure it is bringing in enough revenue to cover its costs and avoid excessive processing delays.

Some of these fees have increased recently. On January 31, 2024, USCIS announced in the Federal Register that it would raise immigrant petition filing fees, among some others.

Altogether, these additional administrative and professional expenses can add up to $100,000 or more. However, we cannot give precise figures because some of these fees (for example, the charges from your lawyer) will vary depending on your individual circumstances.

Let’s explore the EB5 visa cost breakdown in greater detail.

Form I-526 or I-526E Filing Fee

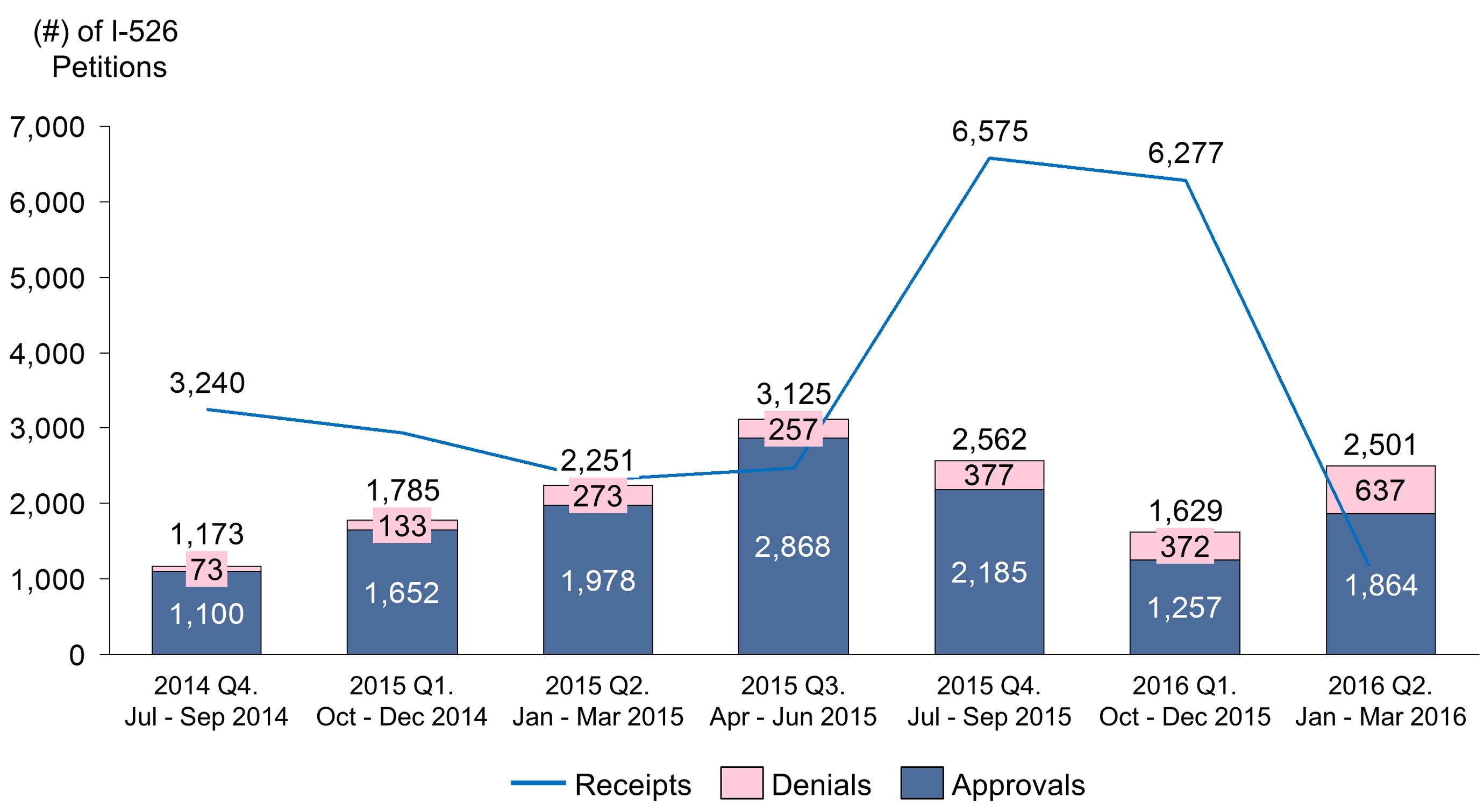

At the time of writing, an investor must pay USCIS an application fee of $11,160 to submit either the initial I-526, Immigrant Petition by Standalone Investor, or I-526E, Immigrant Petition by Regional Center Investor.

This is a 204% increase over the previous fee of $3,625 from before 2024.

Additional Fee for Investors Outside the United States

Note that an investor physically located outside the United States must also pay a supplementary fee of $345 for Form DS-260 consular processing.

This would bring the total up to $11,505.

EB-5 Integrity Fund Fee

According to the new edition of USCIS’s fee schedule, an investor also needs to pay a fee of $1,000 to the EB-5 Integrity Fund of the U.S. Treasury while filing their initial Form I-526E.

Other Fees

In addition, an investor may have to pay legal fees, money transfer fees, etc., as part of the I-526/I-526E application process.

Form I-485 Visa Application Fee

Most EB-5 investors file Form I-485, Application to Register Permanent Residence or Adjust Status, to adjust their immigration status concurrently with Form I-526E. Doing so saves time. Approval of this form confers conditional permanent resident status.

Each family member at or above the age of 14 can expect to pay $1,440. Those who are under 14 will pay $950.

These fees have also increased recently. Prior to 2024, they were $1,225 (including a separate biometrics services fee) and $750 respectively.

In addition, investors will pay other USCIS processing fees that should come out to about $490.

Attorney fees and money transfer fees may be applicable at this stage, too. Typically, an immigration attorney will file Form I-485 on your behalf.

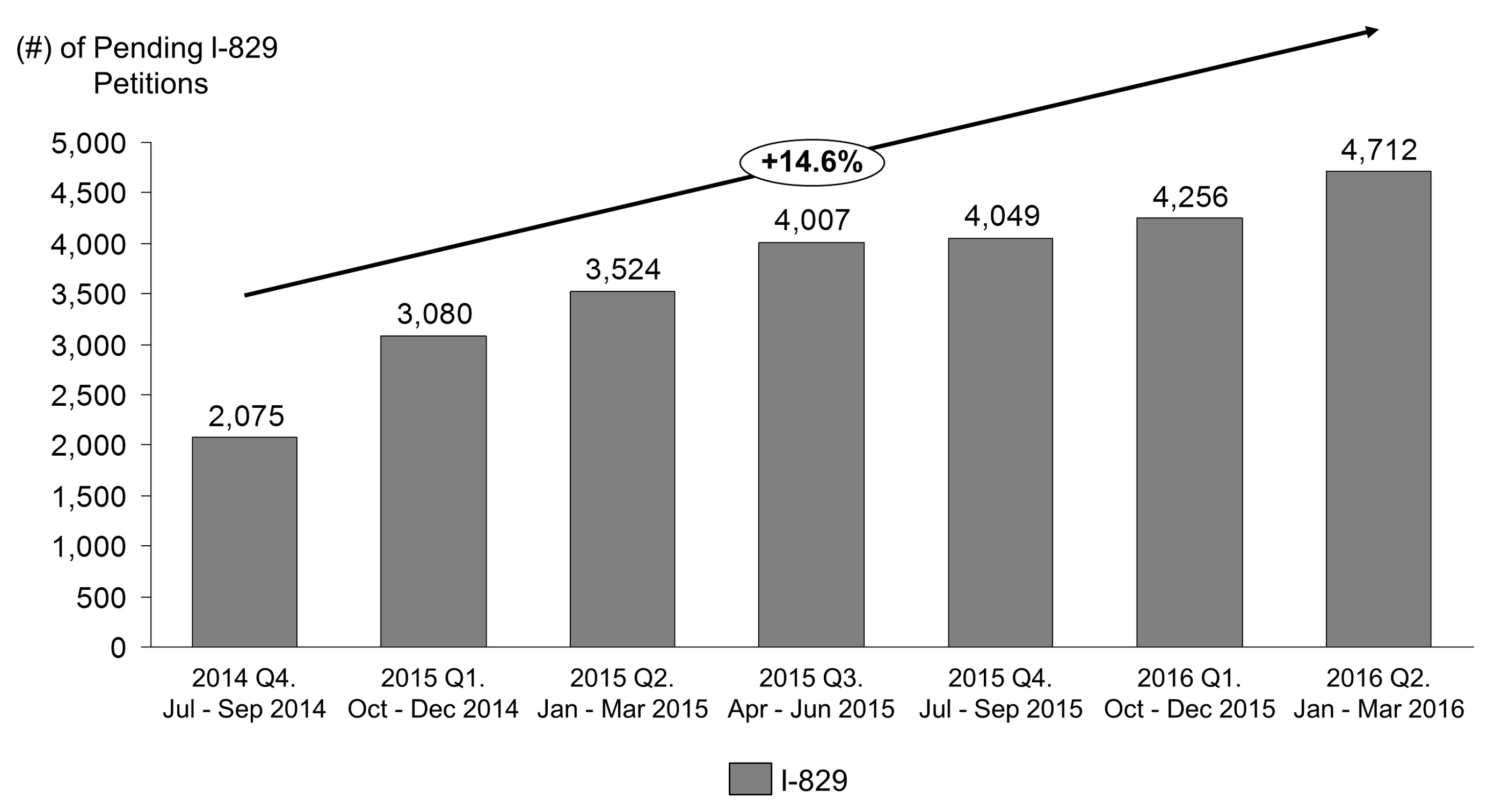

Form I-829 Filing Fee

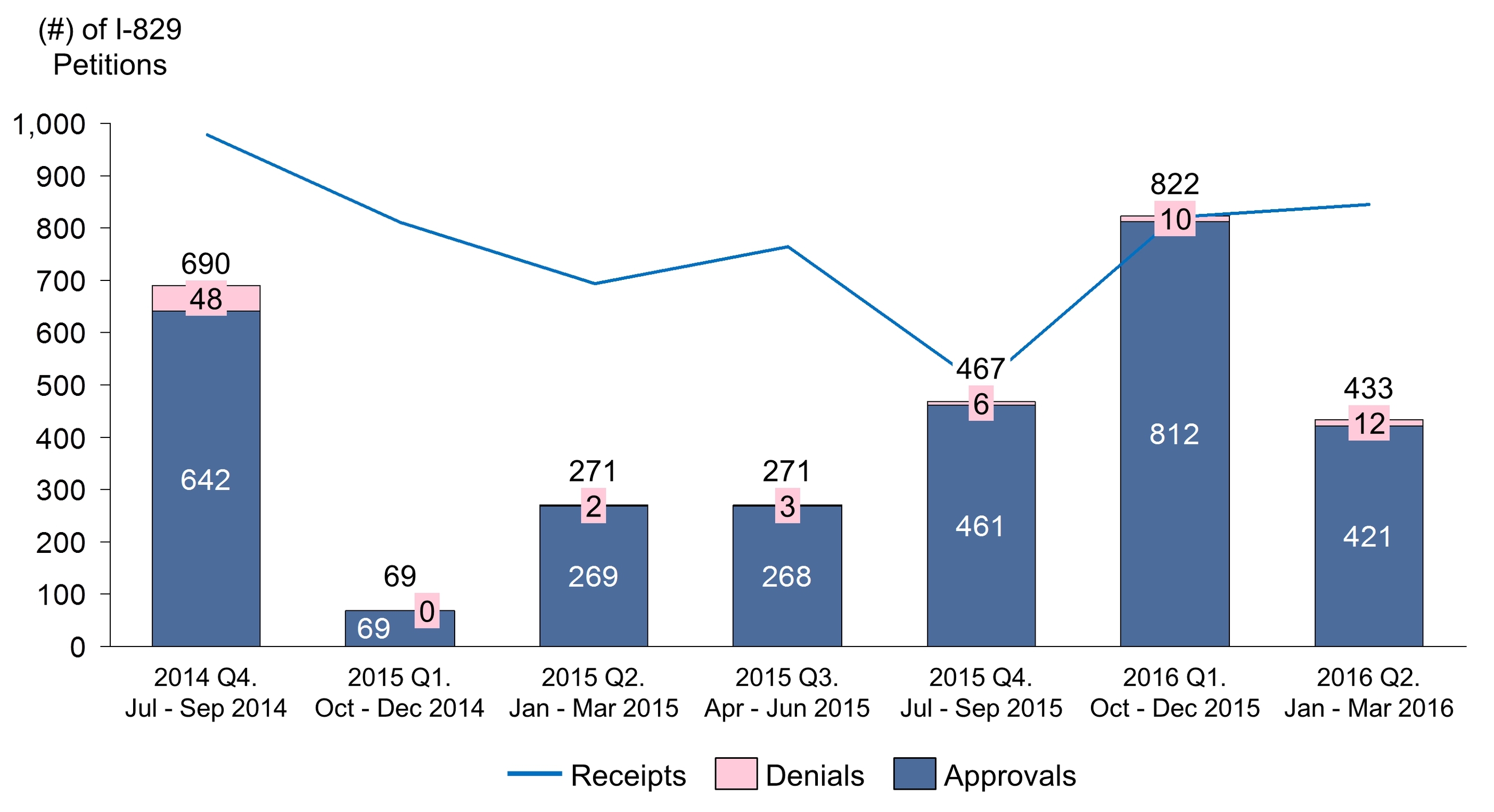

Toward the end of the EB-5 visa process, an investor will file Form I-829, Petition to Remove Conditions on Permanent Resident Status. This is the final step for a foreign investor and their qualified family members who want to become lawful permanent residents of the United States under the EB-5 program.

This form must be submitted within the 90-day period at the end of the two-year conditional permanent residency window.

The USCIS processing fee is $9,525, plus other legal fees, processing fees, and money transfer fees. This is a 148% increase over its previous cost of $3,835.

Your immigration attorney will probably file Form I-829 on your behalf, too.

Immigration Lawyer Legal Fee

The EB-5 application process can be complicated and time-consuming even for experienced immigration attorneys. You can expect to pay at least $20,000 in such legal fees.

However, this amount can vary considerably, depending on the attorney you hire and the complexities of your individual circumstances.

Business Plan Costs

An EB-5 investor must have a business plan to prove to USCIS that the project meets EB-5 requirements. A successful business plan must be detailed, comprehensive, credible, and well-organized.

The cost of a business plan may range between $3,000 and $5,000. Regional center investors typically don’t need to worry about providing a business plan themselves, as it is handled by the regional center.

Regional Center Administration Fee

EB-5 participants can make a direct investment or invest via regional centers. Most investors choose the regional center route. This approach requires fewer day-to-day management responsibilities because regional centers handle much of the documentation, recruitment of additional investors, and EB-5 program compliance requirements.

These expenses make up the regional center administration fee. These admin fees vary between regional centers. The amount typically ranges from $30,000 to $70,000.

Documentation Translation

As part of the EB-5 application process, you may need to hire someone from a certified document translation company to translate certain documents (such as financial statements or birth certificates) into English. The translator must also include a signed statement indicating the translation was done accurately.

The fees to translate these documents are variable, depending on the translator you hire, the urgency of your request, and the volume of material you must have translated.

Save Time and Money With EB5AN

It’s worth it for foreign investors to make sure they understand the assorted fees that must be paid under the EB-5 program in advance. It takes a substantial investment of time and money to obtain lawful permanent resident status in the United States.

Trying to do this alone means you’ll end up paying far more than you need to in time and money for your immigrant visa.

That’s why it’s critical to work with EB-5 professionals who have a proven record of success.

EB5AN has helped more than 2,300 families from 60 countries relocate to the United States as lawful permanent residents. Our expert team has more than a decade of experience, and offers clients first-rate, low-risk EB-5 regional center projects with a 100% USCIS project approval rate to date.

Please book a free call with us today to learn more.