The EB-5 Regional Center Program, an integral part of the popular residency-by-investment program, was slated for termination on June 30th, 2021, following its separation from the omnibus funding bill it had traditionally been paired with.

Fortunately, the EB-5 Reform and Integrity Act was launched on May 14, 2022. This new act has brought about changes that impact the direct and regional center EB-5, including an increased minimum investment, amended targeted employment area (TEA) processes and definitions, new structure limitations, and new visa availability restrictions.

In this article, we will take a look at the EB-5 Regional Center Program, the Immigrant Investor Program, and the new EB-5 Reform and Integrity Act, as well as provide some background and updates that you need to be aware of.

What Are the Benefits of the EB-5 Immigrant Investor Program?

- No sponsorship needed

- Flexibility in employment and education

- No language or education requirements

- Access to excellent health care and social benefits

- Business and investment opportunities

What Is the EB-5 Reform and Integrity Act?

The EB-5 Reform and Integrity Act – An Overview and Updates

- A new immigrant investor regional center program is signed into law

- Important changes to the EB-5 Reform and Integrity Act

- Increased EB-5 investment amount for 2023

- Increased EB-5 visa filing fees for 2024

What Is the EB-5 Regional Center Program?

The Final Word

What Are the Benefits of the EB-5 Immigrant Investor Program?

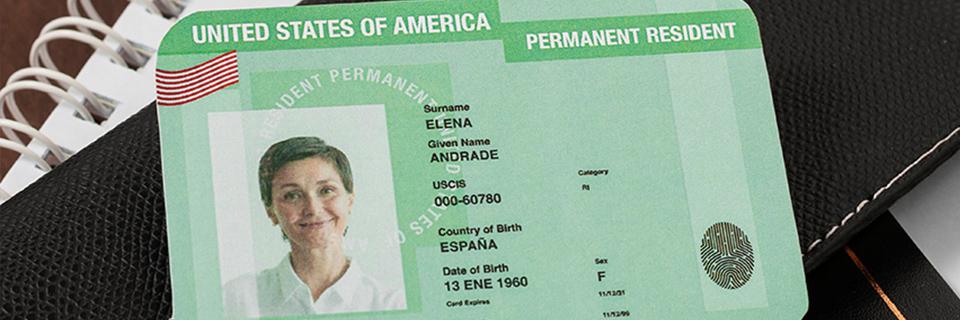

The EB-5 Immigrant Investor Program offers a pathway to permanent residency in the United States through investment into a new commercial enterprise that can be proven to create at least 10 full-time jobs for U.S. workers.

The EB-5 Immigrant Investor Program offers several benefits to foreign investors who participate in the program.

In addition to gaining permanent residency in the United States, as well as access to all the benefits that U.S. citizens enjoy, investors can look forward to becoming eligible to apply for U.S. citizenship through a naturalization process.

This option typically becomes available after the investor and his or her immediate family have maintained permanent residency for at least five years.

Some of the benefits that investors and their immediate families can enjoy, include:

No sponsorship needed

Unlike many other employment-based visa categories, the EB-5 program does not require sponsorship from an employer or a family member.

Investors have the freedom to pursue their own business or investment opportunities in the United States without the need for a specific job offer or family relationship.

Flexibility in employment and education

As permanent residents, EB-5 investors and their family members have the flexibility to work or attend educational institutions of their choice in the United States.

No language or education requirements

The EB-5 program does not have specific language or educational requirements for eligibility.

Investors are not required to demonstrate a certain level of English proficiency or hold a specific educational degree, which can make the program more accessible to a wider range of investors.

Access to excellent health care and social benefits

EB-5 investors and their families have access to the health care and social benefits available to all U.S. permanent residents.

This includes access to quality health care services, Social Security benefits, and other government programs.

Business and investment opportunities

Through the EB-5 program, investors have the opportunity to pursue their entrepreneurial objectives and invest in new commercial enterprises.

They can start their own business, invest in an existing business, or participate in approved regional center projects, all of which can potentially lead to financial growth and success.

What Is the EB-5 Reform and Integrity Act?

The EB-5 Reform and Integrity Act refers to a piece of legislation that is aimed at reforming and making changes to the EB-5 Immigrant Investor Program in the United States.

This act works by implementing stricter regulations, oversight, and compliance measures to prevent fraud and abuse. It also clarifies the job creation requirements for EB-5 projects and defines TEAs.

In addition, the EB-5 Reform and Integrity Act addresses the visa availability and backlog issues with the EB-5 program by allocating visas in a more efficient manner.

The EB-5 Reform and Integrity Act – An Overview and Updates

Republican Senator Chuck Grassley of Iowa and Democratic Senator Patrick Leahy of Vermont co-sponsored the bill, which was introduced to the Senate in late 2019.

Another version was introduced to the House by Greg Stanton (D-AZ) and Brian Fitzpatrick (R-PA).

Both duos showcased the bipartisan nature of the EB-5 program, which offers benefits to politicians all over the political spectrum.

After a number of high-profile problems with fraud and the misappropriation of investor funds, this act was created to reform the rules and regulations relating to the approval of green cards to foreign investors.

In line with this, the bill proposed a number of integrity measures for the EB-5 program, designed to tighten regulations and crack down on fraud, while implementing stronger protections for good-faith investors and developers.

Among the proposals was long-term reauthorization for the regional center program—if the bill was to be passed, it would see the EB-5 Regional Center Program reauthorized through 2026.

A new immigrant investor regional center program is signed into law

On March 15, 2022, President Biden signed a law that included the authority for an EB-5 Immigrant Investor Regional Center Program. This program will now remain in effect until September 30, 2027—a full year further than the original stipulated extension date.

As of April 2023, there are now 640 approved regional centers under the program.

Important changes to the EB-5 Reform and Integrity Act

Over 90% of EB-5 visa applications are managed by Regional Centers. The new EB-5 Reform and Integrity Act includes tougher, industry-wide transparency mandates that ensure EB-5 investors are able to feel more secure about their investments.

One of the most important changes in the new law is the ability to enable concurrent visa filing.

This means that immigrant investors can adjust their status while in the U.S. and no longer need to return to their home countries to do so.

Concurrent filing also allows foreign nationals to apply for adjustment of U.S. resident status (Form I-485) when filing their petitions to participate in the EB-5 program (Form I-526E).

Increased EB-5 investment amount for 2023

According to USCIS, the minimum capital investment amount that a foreign investor must contribute to an EB-5 project depends on the petition filing date and the investment location.

Under the RIA, the minimum investment amount for an EB-5 project in a targeted employment area (TEA) is $800,000. Non-TEA projects require a minimum investment of $1,050,000.

Increased EB-5 visa filing fees for 2024

The EB-5 visa filing fees will increase in April 2024 to allow for faster processing times and cover operational costs.

The table below shows the increase in fees for the various forms required under the EB-5 program, including petitions for regional center operators:

| Relevant EB-5 Form | Current Filing Fee | USCIS Proposed Adjusted Filing Fee | Filing Fee Difference | Rate of Increase |

| Form I-526 (Immigrant Petition by Standalone Investor) | $3, 675 | $11, 160 | $7, 485 | 204% |

| Form I-526E (Immigrant Petition by Regional Center Investor) | $3, 675 | $11, 160 | $7, 485 | 204% |

| Form I-829 (Petition by Investor to Remove Conditions on Permanent Resident Status) | $3, 835 (with Biometrics Fee) | $9, 525 | $5, 690 | 148% |

| Form I-956 (Application for Regional Center Designation) | $17, 795 | $47, 695 | $29, 900 | 168% |

| Form I-956G (Application for Regional Center Annual Statement) | $3, 035 | $4, 470 | $1, 435 | 47% |

| Form I-956F (Application for Approval of an Investment in a Commercial Enterprise) | $17, 795 | $47, 695 | $29, 900 | 168% |

What Is the EB-5 Regional Center Program?

The EB-5 Regional Center Program is an immigration program in the United States that was created to stimulate economic growth and job creation through foreign investment.

Under this program, citizenship and immigration services enable foreign investors and their immediate family members can obtain permanent residency, or green cards, by investing in approved regional center projects.

To participate in the EB-5 Regional Center Program, foreign investors must make a capital investment in a new commercial enterprise that is located in an approved regional center.

The minimum investment is generally $1,050,000; however, if the project is located in a targeted employment area, or TEA, the minimum investment is reduced to $800,000.

💡What is a target employment area (TEA)?

A TEA is an area that either has unemployment levels that are 150% of the national average or is rural. A certain number of green cards are reserved for TEA investors, which means you’re less likely to be put on a waiting list. TEA investors also benefit from lower thresholds and prioritization of their EB-5 application.

One of the key goals of the EB-5 Regional Center Program is to create jobs in the United States. Existing and future investors must demonstrate that their investment will lead to the creation of at least 10 full-time jobs for U.S. workers.

One of the advantages of investing through approved regional centers is that the investor is able to count indirect job creation toward the overall job creation requirement.

In other words, the jobs that this program creates can be direct jobs—where the investment creates employment directly—or indirect jobs which are created as a result of the economic impact generated by the investment.

The Final Word

Due to the changes brought about by the EB-5 Reform and Integrity Act of 2022, foreign nationals can now make EB-5 investments with far greater confidence.

Under the Act, the EB-5 industry has become more transparent and accountable.

These reforms help protect investors against many of the risks associated with EB-5 foreign investments.

As with all investments, however, the EB-5 investment process will always entail some level of risk.

Investors must always carefully weigh the risks of the EB-5 project that they are interested in. Working with a qualified, knowledgeable, and experienced EB-5 attorney can be extremely helpful.

If you would like to explore a future in the United States through the EB-5 Immigrant Investor Program, reach out to us to arrange a consultation today.