Industry expert Charles Oppenheim, who heads the United States Department of State’s Visa Control & Reporting Division, provided insights for FY2021 with a virtual keynote address on EB-5 investment visa availability in November 2020. In it, he presented his thoughts on the future effects of consulate activity slowdowns in 2020 and how adjustment-of-status protocols may be a viable solution to the bottlenecking of EB-5 visas expected in 2021 (but likely won’t be implemented as such). He also delved into an area of great interest but that involves little concrete science—EB-5 visa wait times.

As with any investment, very little is ever 100% guaranteed in the EB-5 Immigrant Investor Program. Dealing with predictions on EB-5 visa wait times is a less than absolute science, and that uncertainty lies squarely in the variables—visa availability, backlogs, petition withdrawals and denials, and the time it takes for the investor to develop a petition packet, just to name a few. While published wait times do not officially guarantee a timetable, they should not be entirely dismissed, either. Rough (but educated) estimations are especially helpful for identifying issues with visa availability.

Basic Wait Time Theory: The Law of Supply and Demand

The greatest influencer of EB-5 investment visa wait times is I-526 petition volume. The I-526 petition the submission that initiates the EB5 investment process through United States Citizenship and Immigration Services (USCIS). In the best-case scenario, if many prospective investors file this petition, eventually many prospective investors will be deemed eligible for EB-5 visas. However, the fluctuating volume of I-526 forms to be processed affects the volume of available visas. Increased numbers of eligible investors mean increased wait times due to annual visa quota constraints. Additionally, folks who file early on during a demand surge will experience shorter wait times than those who submit later on.

The Supply of EB-5 Visas Typically Underserves Demand

In a typical fiscal year (October 1–September 30), only around 10,000 visas are earmarked for the EB-5 Immigrant Investor Program. This relatively small number of visas may be allocated to both eligible investors and their qualifying family members. On average, USCIS sees applications for two family members per EB5 investment participant, which amounts to roughly 3,300 visas being available for different EB-5 investments each year.

These visas are also evenly divided among participating countries, regardless of overall population, with 7% assigned to each country of origin. Simple math shows that this leaves about 700 visas available to each country in a normal fiscal year. Any unclaimed visas are reassigned to countries with higher demand for the program. Overall, EB-5 investment visa demand has outpaced supply, thus impacting EB-5 visa wait times.

EB-5 Visa Bulletin Attempts to Balance Supply and Demand

The Department of State (DOS) publishes its Visa Bulletin monthly, wherein it lists cut-off dates by country, which are meant to determine visa availability. USCIS establishes a cut-off date each month for individual countries in which demand significantly exceeds visa availability, which is supposed to ensure fair distribution across all 10,000 visas. Only applicants with priority dates (the date by which USCIS received their application) falling before the cut-off date listed in the bulletin are eligible for EB-5 investment visas or green cards during that month. Eligible applicants with priority dates earlier than the published cut-off date are allowed to apply for permanent residency in the United States. Furthermore, according to USCIS, in order for an adjustment in status to occur, an EB-5 visa must be available to the applicant from the time of submission to the time adjudication is complete.

Visa Retrogression

Visa retrogression is the state in which application volumes (demand) begin to exceed visa availability (supply). For the EB-5 program, if visa retrogression occurs, it usually continues through to the end of the fiscal year but then returns to pre-retrogression levels. Throughout a fiscal year, high-demand EB-5 countries like China or Vietnam may exhaust their allotted limit of EB-5 visas for the year, triggering visa retrogression, but they are also the first candidates for any leftover visas at the end of the year. Thus, most years, once the fiscal year ends on September 30 and the new fiscal allocation takes effect on October 1, dates return to pre-retrogression dates. Additionally, cut off dates typically move forward depending on the current supply and demand of a given country.

Predicting the Ebb and Flow of EB-5 Wait Times

Essentially, a review of the monthly Visa Bulletin offers a glimpse into how long other EB-5 investment participants have had to wait and which priority dates are currently being processed. This is not exactly a concrete foundation for how long it will take to process applications in the future, true. However, considering backlogs and current visa limits in an investor’s country of origin can at least offer insight into how long it will take.

Standard Formula for Calculating EB-5 Visa Wait Times

Here is the industry standard for estimating EB-5 visa wait times:

A ÷ B = C

A: Estimated number of EB-5 investment participants currently in line for a visa

B: Estimated average number of visas available each year (generally ~700)

C: Estimated wait time

Oppenheim’s Use of Standard Calculations

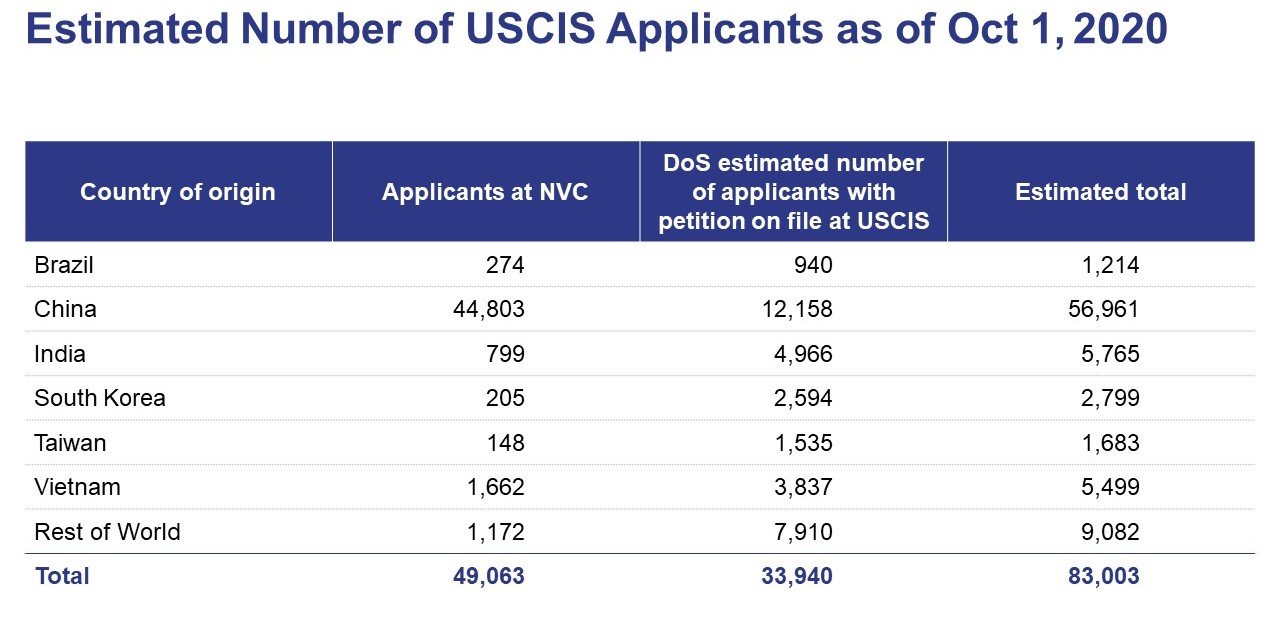

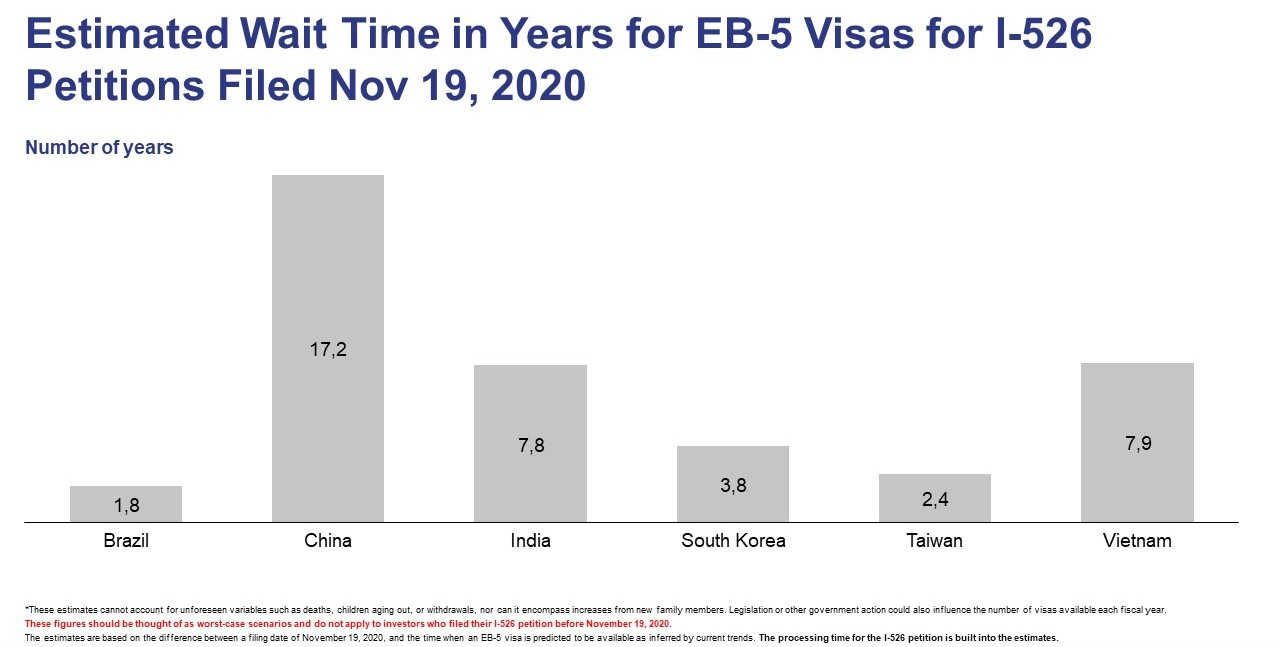

This same calculation is used in Oppenheim’s November 2020 presentation. The last column in the first graphic represents variable A, and the gray bars in the second one equal variable C. Oppenheim’s assumptions in B may be inferred by dividing A by C.

Even Charles Oppenheim’s predictions aren’t fail-proof, however. Let’s take a closer look at why…

The Primary Issue with Oppenheim’s Predictions

Oppenheim’s timing predictions are specifically applicable to a single point in time: October 1, 2020. As petitions are adjudicated daily, the estimated years to visa availability are technically subject to change every day, too. As a queue issue, at any other point in time, the remaining wait time of each individual investor standing in line is uniquely dependent upon how close or far they are from the front of the queue. Thus, instead of saying “the wait time for China,” a better way to conceptualize the queue would be to day “the wait time for a Chinese EB-5 investor who entered the queue at this certain point in time.”

Moreover, Oppenheim’s calculations are specifically based on the very back of the queue on October 1, 2020. EB-5 investors who have been in the queue longer than others will have a shorter wait time than the estimated wait time for the country as a whole. One way to obtain a more accurate estimate is by factoring in data from the DOS on the number of applicants who have earlier I-526 filing dates than a specific investor.

Oppenheim Also Discounts Applicants

Also note that the the first two columns in the above tables do not equal the total inventory of future EB-5 applicants. He only counts EB-5 investors in two categories: USCIS’s pending I-526 petitions and the National Visa Center’s pending documentarily qualified applicants. In other words, those with pending I-485 petitions and those who have already received I-526 approval but are experiencing delays in some other part of the process are left out of the calculation.

While he may have valid reasons for discounting the other applicants, these missing categories of EB5 investment participants can significantly alter wait times. For instance, an estimated 50% of Indian EB-5 investment applicants are working on status adjustments inside the United States.

For those who wish to leverage the extensive experience Charles Oppenheim brings to the table, the real question then becomes whether an EB-5 investor thinks he overestimates or underestimates EB-5 visa wait times in his calculations.

Are Oppenheim’s EB-5 Wait Times Over- or Underestimated?

The easiest way to answer this question is that it’s complicated. Going back to the industry standard equation, A ÷ B = C, Oppenheim’s estimations for C (wait times) are dependent upon the accuracy of the data used in variables A and B. There’s no way around the fact that there must be assumptions about future filings in order to settle on those variables. Anyone who wishes can challenge his calculations with questions regarding future family size and the entire categories of applicants discounted.

An entirely new job description could be made of EB-5 industry professionals laying out tables and playing what-if games with the variables and formulas to estimate how long it will take for EB-5 visas to be processed. A better use of time, however, is to assist individual EB-5 investors on a case-by-case basis, evaluating their unique circumstances to better derive an estimated wait time.

A great starting point for any individual EB-5 investment participant is to understand each of the five basic steps in the EB-5 process and to work with an experienced EB-5 professional to ensure extended waits can be avoided wherever possible.

Five Steps to the EB-5 Investment Process

Generally speaking, from start to finish, an EB5 investment usually takes several years to complete. Below are the five main steps in the process.

Step 1: I-526 Petition Packet Submission

When an EB5 investment participant files their I-526 petition packet and USCIS receives it, the investor is assigned a priority date. Any eligible investor may initiate the process at any time.

Step 2: Awaiting I-526 Adjudication and Approval

The processing of petitions is based on visa availability. Investors from countries that still have visas available are prioritized. I-526 processing often takes years, depending on visa supply and demand and the efficiency of USCIS adjudication.

Step 3: Consular Processing

Applicants who live abroad must visit the closest National Visa Center to become documentarily qualified after receiving I-526 approval. After applying for a U.S. green card and undertaking a visa interview, they are eligible to receive an EB-5 visa, if available.

Step 4: I-485 Petition for Adjustment of Status

Once the previous steps have been completed, EB-5 investment participants already living in the United States may file an I-485 Adjustment of Status application when visas become available. This is the stage in which the monthly Visa Bulletin becomes relevant. Applicants whose countries have a “current” status in the bulletin are least likely to be at risk for missing the 700-visa limit. For others, this step can also cause delays that span years.

Step 5: Petition to Have Conditions Removed

Within the last 90 days of an EB-5 investor’s two-year conditional residency period, they must submit a Form I-829, which petitions to have their conditions removed and their residency in the United States made permanent.