One of the most significant changes to the EB-5 Immigrant Investor Program following the enactment of the EB-5 Reform and Integrity Act (RIA) of 2022 was that individuals present in the United States who hold other types of visas became eligible for EB-5 concurrent filing, through which immigrant investors can submit Form I-526 and Form I-485 simultaneously.

As a result, prospective EB-5 investors can apply for the program and go through the interview process while continuing to work in the United States under a different non-immigrant visa, thereby significantly streamlining the application process.

In this article, we will discuss the benefits EB-5 concurrent filing presents by accelerating investors’ transition to permanent resident status.

What Is EB-5 Concurrent Filing?

What Is Form I-526/I-526E?

What Is Form I-485?

Why EB-5 Concurrent Filing Presents Such a Considerable Advantage to Immigrant Investors

Who Is Eligible for EB-5 Concurrent Filing?

What Are the Main Steps in the Process of EB-5 Concurrent Filing?

EB5AN Can Help You Get Started with EB-5 Concurrent Filing

What Is EB-5 Concurrent Filing?

EB-5 concurrent filing is the act of submitting both Form I-526/I-526E and Form I-485 to U.S. Citizenship and Immigration Services (USCIS) at the same time. Concurrent filing of these two petitions allows eligible EB-5 investors who are already present in the United States to accelerate the process of obtaining a Green Card.

However, foreign nationals must meet certain eligibility criteria to be able to submit these two forms simultaneously. It is recommended that EB-5 investors seek legal guidance and advice from experienced immigration professionals to navigate the EB5 concurrent filing process most effectively and efficiently.

What Is Form I-526/I-526E?

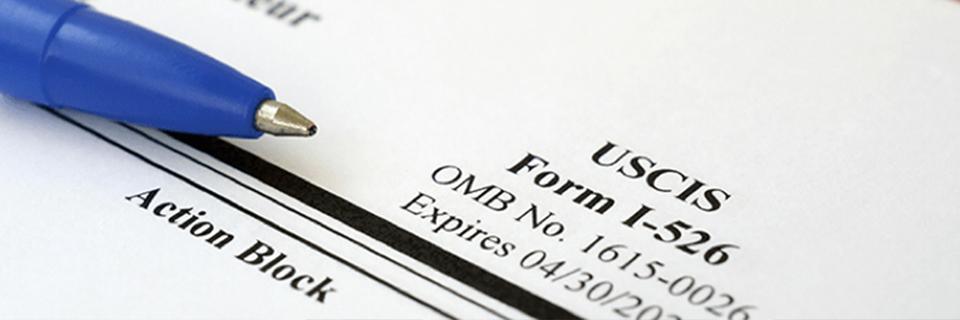

One of the very first steps in the typical EB-5 application process is submitting Form I-526/I-526E to USCIS. If, like the vast majority of EB-5 program applicants do, the foreign national made their investment via a regional center, then they must submit Form I-526E.

Form I-526/I-526E is used by immigrant investors to demonstrate their eligibility for the EB-5 program, and must include key information about the individual’s chosen investment project.

An I-526 or I-526E petition should include:

- The applicant’s full name, date of birth, country of birth, and current address.

- An explanation of how the applicant’s investment in a new commercial enterprise (NCE) will meet EB-5 program requirements, specifically how it will create at least 10 full-time jobs for U.S. workers.

- A comprehensive business plan pertaining to their NCE investment.

- Information showing the lawful source of their NCE investment funds.

- Financial and bank statements, property records, tax returns, and more supporting documentation.

What Is Form I-485?

Typically, after USCIS has approved an EB-5 investor’s I-526/I-526E form, they become eligible to obtain conditional permanent resident status. To do so, EB-5 investors already living in the United States must submit Form I-485 to USCIS, while applicants living outside the United States submit Form DS-260 and then attend a visa interview at the U.S. embassy or consulate in their home country.

Once this petition is approved, an applicant’s conditional EB-5 Permanent Resident Card remains valid for two years, allowing the investor, their spouse, and their dependent family members to live in the United States.

Why EB-5 Concurrent Filing Presents Such a Considerable Advantage to Immigrant Investors

EB-5 concurrent filing benefits immigrant investors in several ways, including:

1. Streamlining the EB-5 Application Process

Perhaps the most significant benefit that EB-5 concurrent filing provides to immigrant investors is making the process significantly more efficient. Filing and gaining approval of Forms I-526/I-526E and Form I-485 can be extremely time-consuming. As of the most updated data provided by USCIS, 80% of I-526/I-526E petitions are processed within 55.5 months, and within 88 months for applicants from China.

Processing times for Form I-485 can be difficult to predict because it can vary depending on a wide range of factors, including the applicant’s form category, USCIS workload, and the specific field office or service center where the application is being processed. The most up-to-date estimates are available on the USCIS website. EB-5 investors can typically expect the wait time for processing an I-485 petition to be around a year, but it can be much longer.

Because of the unpredictability and often lengthy processing times for Forms I-526/I-526E and I-485, the prospect of combining these two processes into one with concurrent filing—and thereby significantly shortening the wait time for obtaining a conditional permanent residence—is appealing to EB-5 investors.

2. Avoiding Consular Processing

In addition to the time that EB-5 concurrent filing saves immigrant investors by allowing them to file Forms I-526/I-526E and Form I-485 simultaneously, individuals may also be able to save more time by avoiding consular processing. By filing Form I-485 at the same time while in the United States, EB-5 investors may be able to avoid the need for consular processing in their home country, which can often involve additional delays.

3. Providing Earlier Work and Travel Authorization

EB-5 concurrent filing allows immigrant investors to potentially become eligible for work authorization and travel permits while their applications are pending, thereby allowing them to work and travel during the adjudication process. Typically, applicants would need to wait for their Form I-526/I-526E to be processed, and then file Form I-485 to enjoy this privilege, but EB-5 concurrent filing provides investors with this important level of freedom and flexibility right away.

4. Potentially Providing Significant Cost Savings to EB-5 Investors

EB-5 concurrent filing can provide substantial cost savings to investors by combining the filing of Form I-526/I-526E and Form I-485. Typically, the application fee for Form I-526 is more than $3,500 (subject to a price increase to $11,160 as of April 2024) while the application fee for Form I-485 is more than $1,000.

Applicants also generally incur legal fees and other associated costs to make sure that they provide the necessary documentation at each step of the process. By combining these two critical steps into one, EB-5 concurrent filing has the potential to save immigrant investors thousands of dollars in fees.

5. Speeding Up the Transition to EB-5 Permanent Residency

Ultimately, EB-5 concurrent filing accelerates the transition to EB-5 permanent resident status in the United States, granting immigrant investors earlier access to all of the benefits enjoyed by Green Card holders.

Who Is Eligible for EB-5 Concurrent Filing?

EB-5 concurrent filing is available to individuals living in the United States on non-immigrant visas who are eligible for adjustment of status to lawful permanent resident status (e.g., individuals on H-1B or L-1 visas). It is recommended that individuals on B-1 and B-2 tourist visas, TN visas, E-2 visas, and O-1 visas wait 90 days before attempting to adjust status.

Individuals are also not eligible for EB-5 concurrent filing if their home country is subject to visa retrogression—that is, when the demand for visas from a particular country exceeds the annual quota set by the U.S. government. When visa retrogression occurs, the priority dates for certain immigrant visa categories move backward, causing delays for applicants from those countries.

What Are the Main Steps in the Process of EB-5 Concurrent Filing?

The step-by-step process of EB-5 concurrent filing includes:

1. Prepare, Complete, and Submit Form I-526/I-526E And Form I-485

As outlined above, EB-5 investors eligible for concurrent filing must gather all necessary documentation for Form I-526/I-526E, including their personal information and details pertaining to their investment, and their source of funds, in addition to bank statements, property records, tax returns, and more supporting documentation.

EB-5 program applicants must also complete Form I-485 with their personal information, immigration history, and more required details. When both forms are complete and all supporting documentation is assembled, the two forms are submitted together to USCIS.

It is highly recommended that individuals seek professional guidance to ensure that they submit all of the required information. Failure to do so can result in significant delays or a rejected application.

2. Submit Form I-131 and Form I-765 If Necessary

After submitting Form I-526/I-526E and Form I-485 to USCIS, EB-5 investors may submit Form I-131 (for advance parole document) to apply for permission to travel internationally.

Individuals on employment-based visas can continue working in the United States as long as their work visa remains valid. Otherwise, immigrant investors may submit Form I-765 (for employment authorization document) to request permission to work legally in the United States while awaiting the decision from USCIS.

3. Attend Biometrics Appointment

After USCIS receives an applicant’s concurrently filed Form I-526/I-526E and Form I-485, they will schedule a biometrics appointment, during which the applicant will provide fingerprints, photographs, and other information typically required for criminal background checks.

4. Attend Interview If Necessary

After USCIS receives an applicant’s concurrently filed Form I-526/I-526E and Form I-485, they may also schedule an interview to further assess the applicant’s eligibility for the EB-5 program. During the interview, applicants may be asked to provide additional information about their investment project, their source of funds, and more. It is highly recommended that EB-5 immigrant investors seek guidance from an immigration attorney for this step in the process.

5. Await USCIS Decision and Receive Conditional Green Card

After Form I-526/I-526E and Form I-485 are successfully processed, USCIS will make a decision on whether to grant the applicant conditional permanent resident status, which allows them (as well as their spouse and qualifying dependents) to live and work in the United States for two years.

6. Submit Form I-829

Once the EB-5 investor reaches the final 90-day period before their conditional Green Card is set to expire, they must submit Form I-829 to USCIS, providing the required evidence that they have met all conditions of the EB-5 program and requesting the removal of conditions on their permanent resident status.

EB5AN Can Help You Get Started with EB-5 Concurrent Filing

In allowing for EB-5 concurrent filing of Form I-526/I-526E and Form I-485, the EB-5 Reform and Integrity Act (RIA) of 2022 presented a unique opportunity to speed up the process of obtaining permanent resident status in the United States via the EB-5 program.

Still, legal and professional guidance is crucial for successfully navigating the process. EB5AN has helped more than 2,300 families from 60 countries relocate to the United States as lawful permanent residents. Our expert team has more than a decade of experience, and offers clients first-rate, low-risk EB-5 regional center projects with 100% USCIS project approval rate to date.

For help answering your questions about EB-5 concurrent filing, or to get started on your EB-5 journey, schedule a free consultation with our EB-5 team. To learn more about our available EB-5 projects, click here.