On June 16, 2020, IIUSA held a webinar with Charles Oppenheim, the chief of the Visa Control and Reporting Division of the U.S. Department of State. Oppenheim offered a wealth of valuable EB-5 information, primarily about EB-5 processing in FY2020 and how processing may look going forward. In total, the call lasted about one and a half hours, including a Q&A session with IIUSA panelists. This post explores the most important information Oppenheim shared in the webinar.

Consulate Closures

The most significant way in which the COVID-19 pandemic has affected the EB-5 Immigrant Investor Program has been the worldwide U.S. embassy and consulate closures, which has prevented overseas EB-5 immigrants from scheduling visa appointments and thus prevents them from claiming their U.S. green cards. Oppenheim revealed the U.S. Department of State is in talks to reopen consulates but could not offer any concrete dates or information. He emphasized that each consulate would take a different approach, so they will resume visa services at different times.

However, while consulates worldwide remain closed, the National Visa Center (NVC) is still offering services. Overseas EB-5 applicants can maximally expedite their visa process in the chaotic year of 2020 by becoming documentarily qualified through the NVC before the consulates reopen. That way, they’ll be ready for a visa interview immediately and will be able to claim their EB-5 visa soon after the consulates resume routine visa services. Oppenheim revealed that more than half of EB-5 applicants in a position to become documentarily qualified and pay the necessary fees have yet to do so, which could limit the number of EB-5 visas United States Citizenship and Immigration Services (USCIS) can issue in FY2020. He encouraged all investors presently able to become documentarily qualified to do so.

Issuance of EB-5 Visas in FY2020

In FY2020, more than 11,000 visas have been allocated to the EB-5 program. In a typical year, the allocated visas are distributed evenly throughout each quarter, but the COVID-19 pandemic has rendered even distribution impossible in FY2020. Oppenheim estimated that only around 4,500 EB-5 visas have been issued in FY2020 so far, as we near the end of the third quarter. This leaves more than 6,000 EB-5 visas to issue in a single quarter before September 30, 2020.

Oppenheim suggested USCIS could indeed issue most of the remaining EB-5 visas in FY2020 if the consulates reopen soon. Currently, the Immigrant Investor Program Office (IPO) is issuing EB-5 visas to domestic investors who have filed I-485 petitions to change their immigration status in the United States, but if statistics from previous years are anything to go by, domestic applicants account for only a minority of EB-5 investors. While Oppenheim is not authorized to reveal how many I-485 petitions are pending at the IPO, he did state they “don’t have a lot” and doubts the IPO can issue all allocated EB-5 visas through domestic processing alone.

FY2020 Visas Issued to Chinese EB-5 Investors

In October 2019, the beginning of FY2020, USCIS estimated Chinese investors would receive more than 5,000 EB-5 visas in FY2020. Those estimates did, of course, assume a pandemic would not sweep the globe and shut down public life in all parts of the planet. In reality, only 1,000 Chinese EB-5 investors received visas before the U.S. consulate in China stopped offering visa interviews in February 2020. According to Oppenheim, the one-week advancement of the Chinese final action date in the July 2020 Visa Bulletin frees up around 400 Chinese domestic investors and 3,000 Chinese overseas investors to claim an EB-5 visa, but with the consulate closed, only the 400 domestic investors will actually be able to proceed. Oppenheim added that the Chinese consulate likely couldn’t handle that many visa interviews even if it reopened immediately.

Oppenheim also had good news for Chinese investors: Despite uncertainty around Hong Kong’s status as an independent political actor, the EB-5 program will continue to treat Hong Kong applicants as separate from Mainland Chinese applicants. This way, the IPO can issue visas to Hong Kong investors without increasing the backlog for Chinese investors. The IPO will only alter its treatment of Hong Kong if U.S. immigration law changes.

FY2020 Visas Issued to Indian EB-5 Investors

Of the 11,000 or so EB-5 visas allocated for FY2020, 778 were earmarked for Indian investors. According to Oppenheim, a significant portion of these visas—possibly as many as 550—have already been granted to Indian investors. This has in part been possible due to the rapid advancement of the Indian EB-5 final action date, which, in the July 2020 Visa Bulletin, has finally become current, in line with predictions USCIS made in March 2020. Oppenheim further revealed that he believes the Indian final action date will remain current for the rest of FY2020.

FY2020 Visas Issued to Vietnamese EB-5 Investors

Oppenheim also touched on the prospects for the third major EB-5 country, Vietnam, but only vaguely. He provided no figures on the number of EB-5 visas issued to Vietnamese nationals thus far in FY2020 but did mention Vietnam’s final action date would likely continue to progress at the rate it has been during the pandemic (i.e., a few weeks at a time).

EB-5 Visa Availability in FY2021

Although the EB-5 program may lose large numbers of allocated visas in FY2020, FY2021 is expected to be a much brighter year. Assuming the world will have largely begun its “new normal” by the beginning of FY2021, EB-5 processing will be back to normal, and the number of visas allocated to the EB-5 program may be significantly higher than average. Each year, the EB-5 program is allocated 7.1% of all EB visas designated for that year. The number of EB visas is expected to be up in FY2021 because any unused family-based visas at the end of the fiscal year roll over to the EB programs the next year. Family-based immigration is also significantly down in FY2020—so much so that Oppenheim estimates EB visas in FY2021 will, at a “bare minimum,” be up 60,000, totaling more than 200,000.

India’s Rapid Final Action Date Advancement and the Possibility of Retrogression

Oppenheim’s webinar provides positive news for Indian EB-5 immigrants: He does not believe Indian investors will experience visa retrogression moving forward. The announcement came as a surprise to many EB-5 industry participants, who assumed the recent rapid advancement in the Indian final action date was primarily driven by the U.S. consulate closures and that the resumption of consular visa services would trigger a major retrogression. Oppenheim was firm in his stance, however, emphasizing the final action date movements as “measured” and “trying to avoid retrogression.” He stated clearly that he anticipates wait times for Indian EB-5 investors filing their I-526 today to be lower than the estimate in October 2019, which suggests a large number of Indian investors may be documentarily qualified and ready to receive their EB-5 visas in FY2020 or FY2021.

Oppenheim even suggested that the final action date for all countries could become current in FY2021 for a brief period, but the chances are extremely slim. This could possibly happen at the beginning of FY2021 if the consulates remain closed past September 30, 2020, and if there are enough domestic investors to justify moving the final action date forward.

IPO Processing Productivity

Processing productivity at the IPO has fluctuated dramatically in recent years, from record highs in FY2018 to a sharp decrease in FY2019. While the IPO has not released processing data for FY2020, the change between FY2018 and FY2019 was marked by a change in leadership, with Sarah Kendall, the chief in FY2019, continuing to head operations in FY2020. Oppenheim claimed the IPO was processing I-526 petitions rapidly and forwarding many investors to the next stage of the EB-5 process. He named Chinese investors specifically, implying a large number of petitions from Chinese investors may have been assigned for adjudication before the new visa availability approach debuted in April 2020.

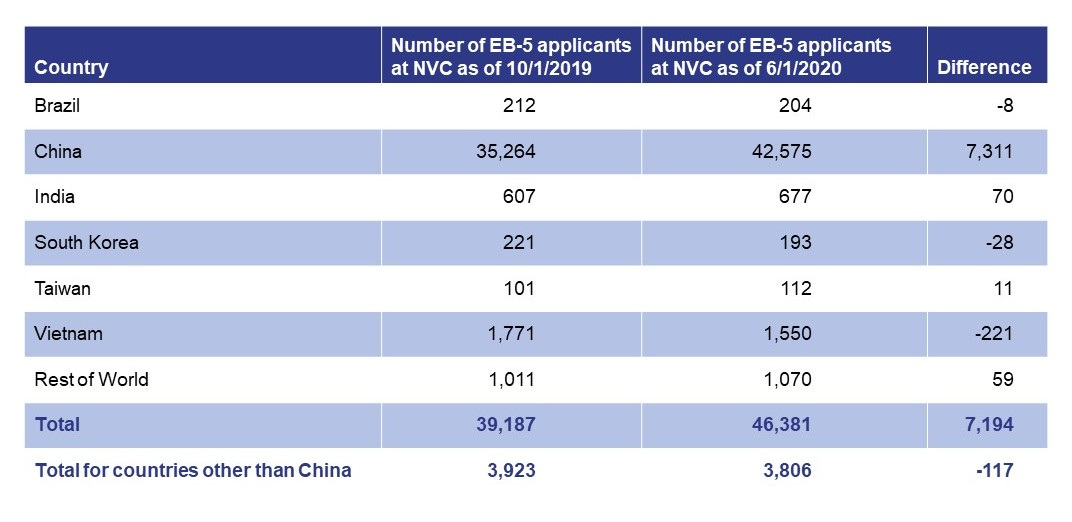

The large number of new Chinese investors at the NVC seems to support Oppenheim’s claims of increased productivity. Other countries have increased only marginally or even decreased, which could imply a concentration on Chinese investors before the new visa availability approach kicked in. However, the increase in Chinese investors at the NVC could also simply be due to the Visa Bulletin date for filing moving forward and enabling many more investors to file their visa applications, and since rest-of-world applicants are favored in the visa availability approach, their low numbers suggest the IPO’s processing in FY2020 may be more in line with FY2019 figures. Of course, some investors take time to become documentarily qualified after receiving I-526 approval, and some file an I-485 petition instead of going through the NVC, so the truth will remain unclear until USCIS provides more information on the matter.