Welcome to EB5AN

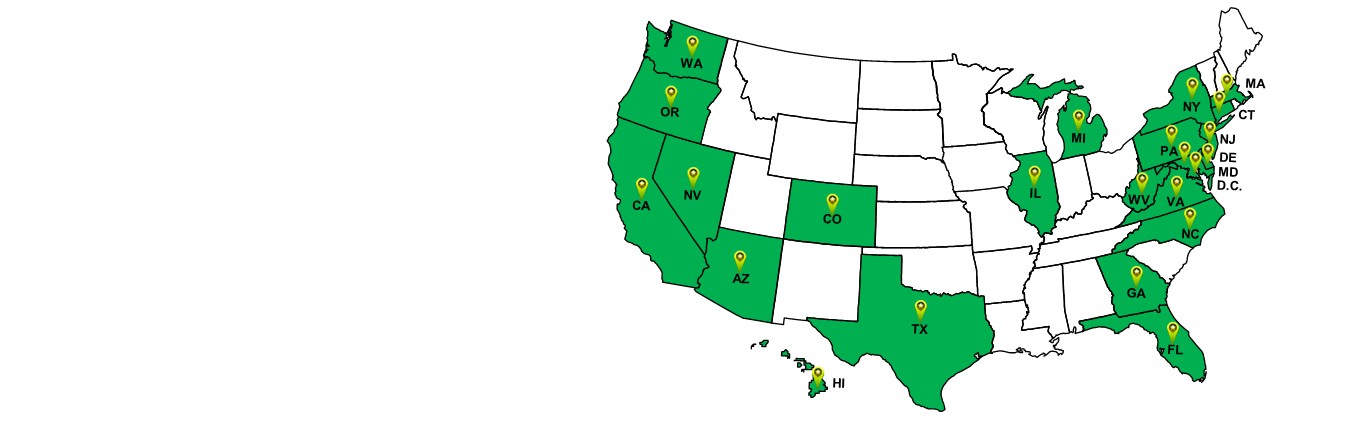

EB5AN is a national leader in the EB-5 visa investment field, dedicated to serving both EB-5 project developers and EB-5 investors. Through our network of 10+ EB-5 regional centers operating in more than 48 states and Washington, D.C. and Puerto Rico, we provide turnkey EB-5 services to help you structure your own EB-5 project under an existing regional center, or find the ideal EB-5 visa project for your personal immigration and EB-5 immigrant investment needs.

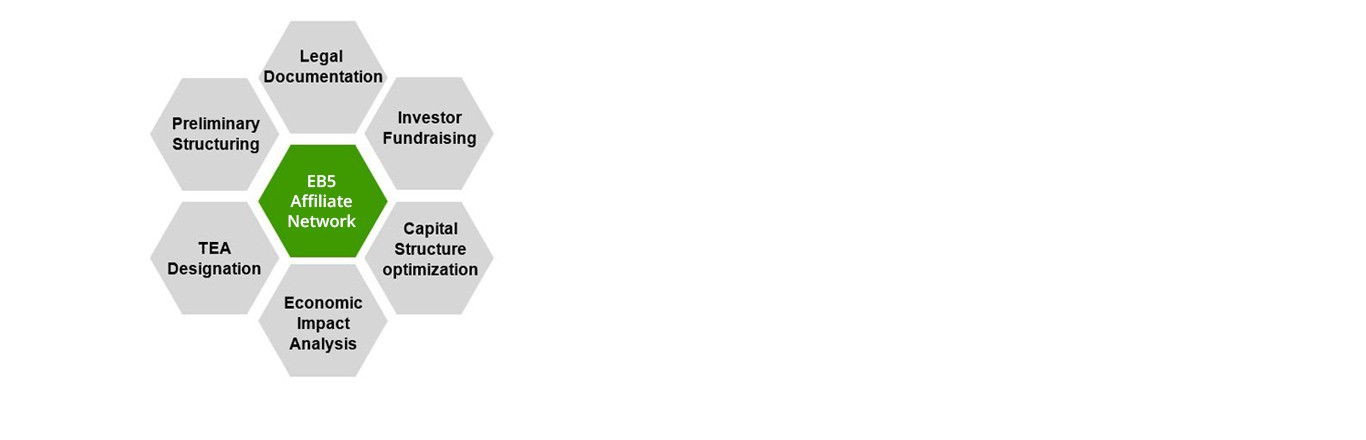

EB5AN partners with best-in-class developers across asset classes to offer a full-service EB-5 solution to customers who are interested in obtaining comprehensive EB-5 project documentation, who want to rent an EB-5 regional center, or who are seeking EB-5 regional center sponsorship. Because we have successfully obtained USCIS approval on many EB-5 projects and EB-5 regional center applications, we have the expertise to guide project developers in the EB-5 documentation process for both projects and new regional center applications. Similarly, we have helped over 2,300 foreign investors from more than 60 countries to become permanent U.S. residents through EB-5 immigrant investments.

EB5AN also provides a wealth of free EB-5 resources for developers and investors. We are best known for our free EB5AN National TEA Map, which allows users to quickly and easily assess whether their project sites would qualify as TEAs. Other free EB-5 tools and resources include our EB-5 Job Creation Calculator and EB-5 Project Risk Assessment Questionnaire.

The EB5AN team has extensive experience in business strategy, investment evaluation, and securities, tax, and immigration law. With in-house service as a hallmark, we have partners and offices in the United States and abroad, including in India, Brazil, and China. To learn more about the latest developments in the EB-5 investment program, visit our EB-5 Insider blog.

If you are interested in structuring your own EB-5 project or investing in an existing EB-5 visa project, please contact EB5AN, and a member of our team will quickly reach out to you.

Featured by