EB5AN State of Connecticut Regional Center

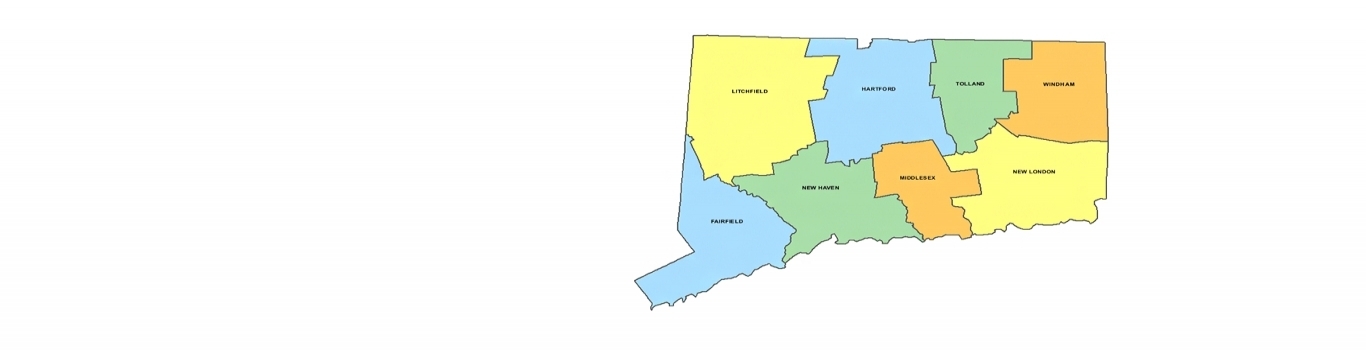

Geographic coverage: Multiple counties in the State of Connecticut

View the official regional center designation letter for the EB5AN Connecticut Regional Center.

Contact us now to learn more about becoming a business affiliate.

Benefits of Affiliation with our Connecticut EB-5 Regional Center

Immediate Ability to Raise EB-5 Capital in Connecticut

Business affiliates of EB5AN, including our Connecticut EB-5 regional center, can immediately begin raising EB-5 investment funds in any of the designated geographic areas that comprise our USCIS-approved regional centers.

Indirect Job Creation Calculations

Business affiliates of our regional centers can calculate job creation through both direct and indirect job methodologies. This leads to higher job creation figures than direct non-regional center calculations of actual payroll employees.

Regional Center Affiliation Process

The regional center affiliation process can be a fast solution and a great fit for those looking to begin a project immediately. The benefits of affiliating with a regional center make this an excellent choice for many project developers.

Our experienced team will work with you to understand whether EB-5 funding is a good fit for your project and whether you qualify to affiliate with our regional centers.

Let Us Help You to Create Your Own Connecticut EB-5 Regional Center

Our Team Will Complete Your I-924 Application for a Connecticut EB-5 Regional Center in Three Weeks

EB5AN has obtained full state regional center coverage in multiple states and has completed more than 100 USCIS-compliant business plans and economic impact studies. The I-924 application process is complicated and requires legal expertise, economic analysis, business plan creation, and an understanding of how USCIS adjudicates applications.

EB5AN has the internal resources to assemble all required aspects of an I-924 application. Additionally, we have extensive experience with I-924 applications and understand all the key components and common pitfalls.

There are various approaches to take when filing an I-924 form; please contact us to learn more about the process and how we can work together to get your regional center approved quickly by USCIS.

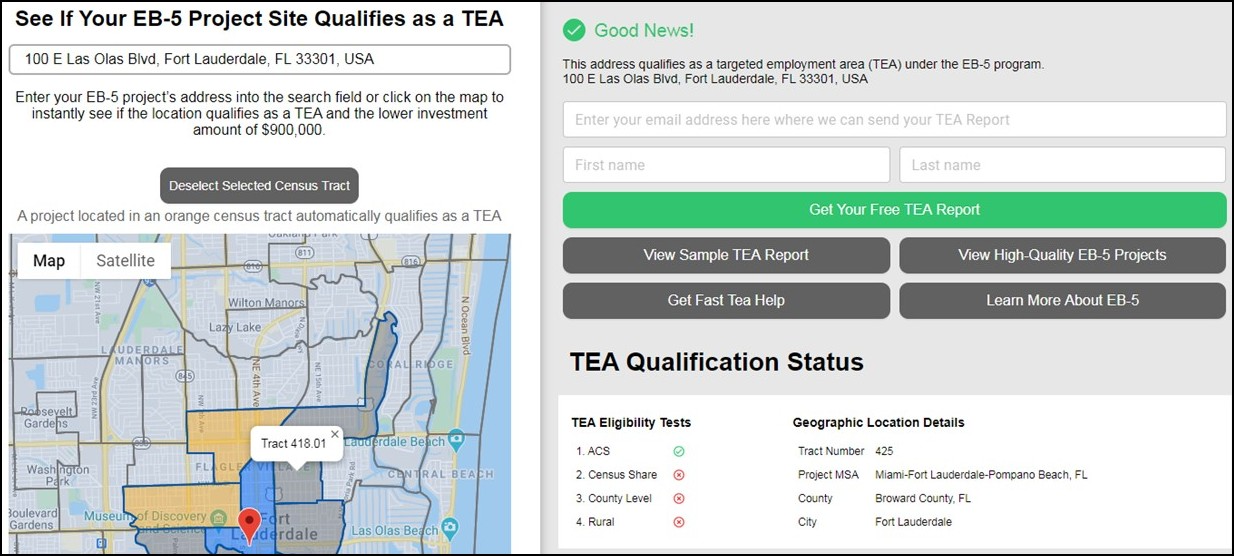

Targeted Employment Area (TEA) Qualification Report in Connecticut for EB-5 Connecticut Regional Center Projects

Please visit our EB-5 TEA Map to determine whether your Connecticut EB-5 regional center project’s location qualifies as a rural or high unemployment targeted employment area (TEA).

Free Targeted Employment Area Map for all 50 States

Click image to view the TEA map and instantly download a free TEA qualification report.

Because TEA designation is crucial to the success of many EB-5 projects, it is important to understand how USCIS reviews TEA designation requests. Once you determine whether your Connecticut EB-5 regional center project is located in a TEA, you can prepare a TEA report yourself. The free downloadable report available through the EB5AN TEA map is also suitable for submission to USCIS.

If you still need assistance with preparing your EB-5 TEA report for your EB-5 regional center project in Connecticut, please contact the EB5AN team directly by phone at 1-800-288-9138 or via e-mail at info@eb5an.com, or simply order an EB-5 TEA Qualification Report.

About the State of Connecticut and the Economic Climate of our EB-5 Connecticut Regional Center

The EB5AN Connecticut EB-5 regional center was created to provide an investment vehicle for qualified foreign investors seeking to obtain permanent resident status in the United States of America through an investment in a USCIS-approved EB-5 regional center with geographic coverage of multiple counties in the State of Connecticut.

Historically, several elected Connecticut public officials, including senators and congressional representatives, have endorsed the EB-5 regional center program as a great opportunity for the U.S. economy and for foreign investors who want to immigrate to the United States and invest in a USCIS-approved Connecticut EB-5 regional center such as the EB5AN State of Connecticut Regional Center.

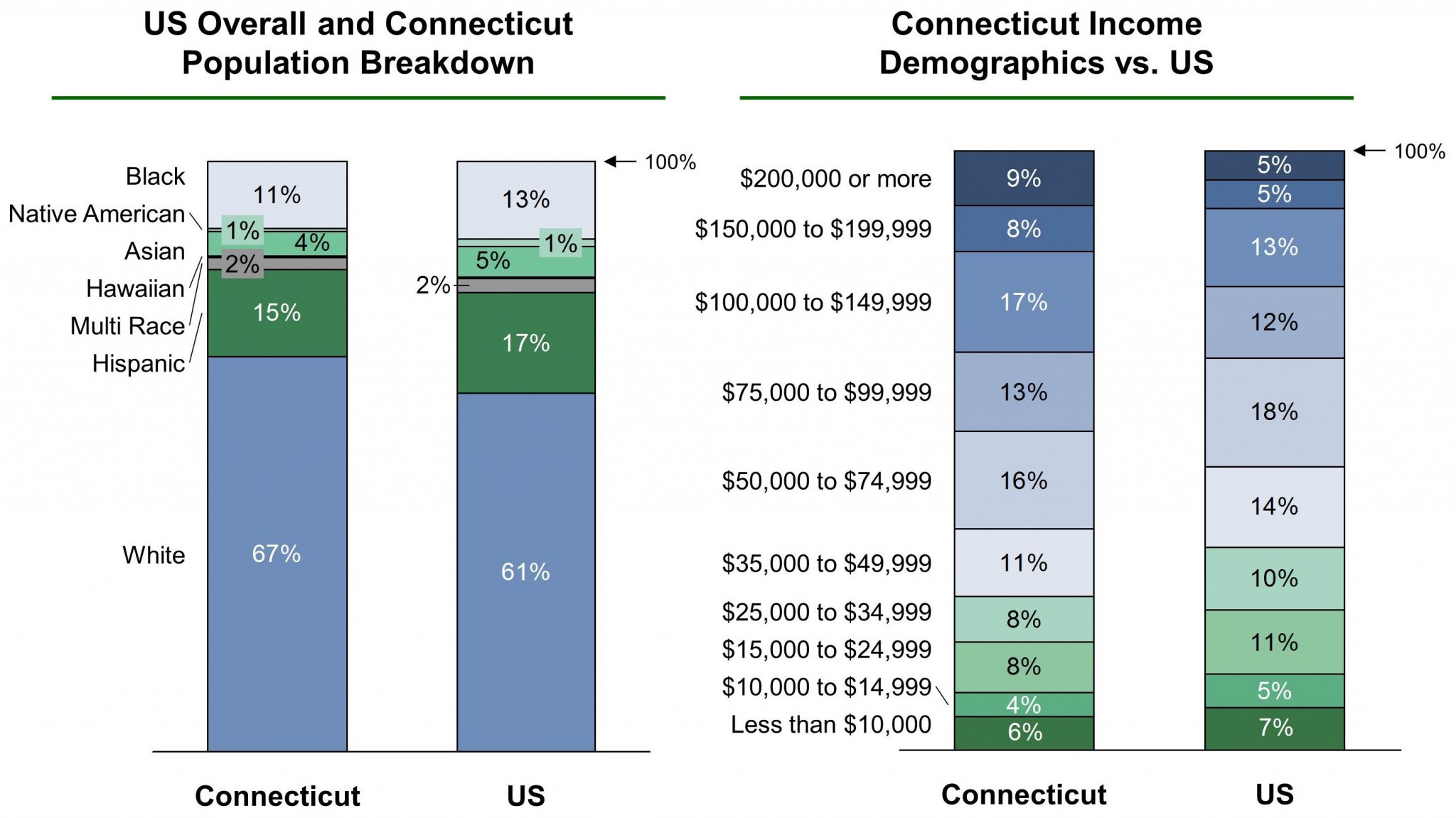

Connecticut: Population and Income Demographics

According to the 2010 U.S. Census, Connecticut has a population of approximately 2.9 million people over the age of 16. Of this, there are approximately 2 million people in the labor force, with 1.8 million who are employed and 191,000 who are unemployed. These population numbers represent approximately 1.4 million households.

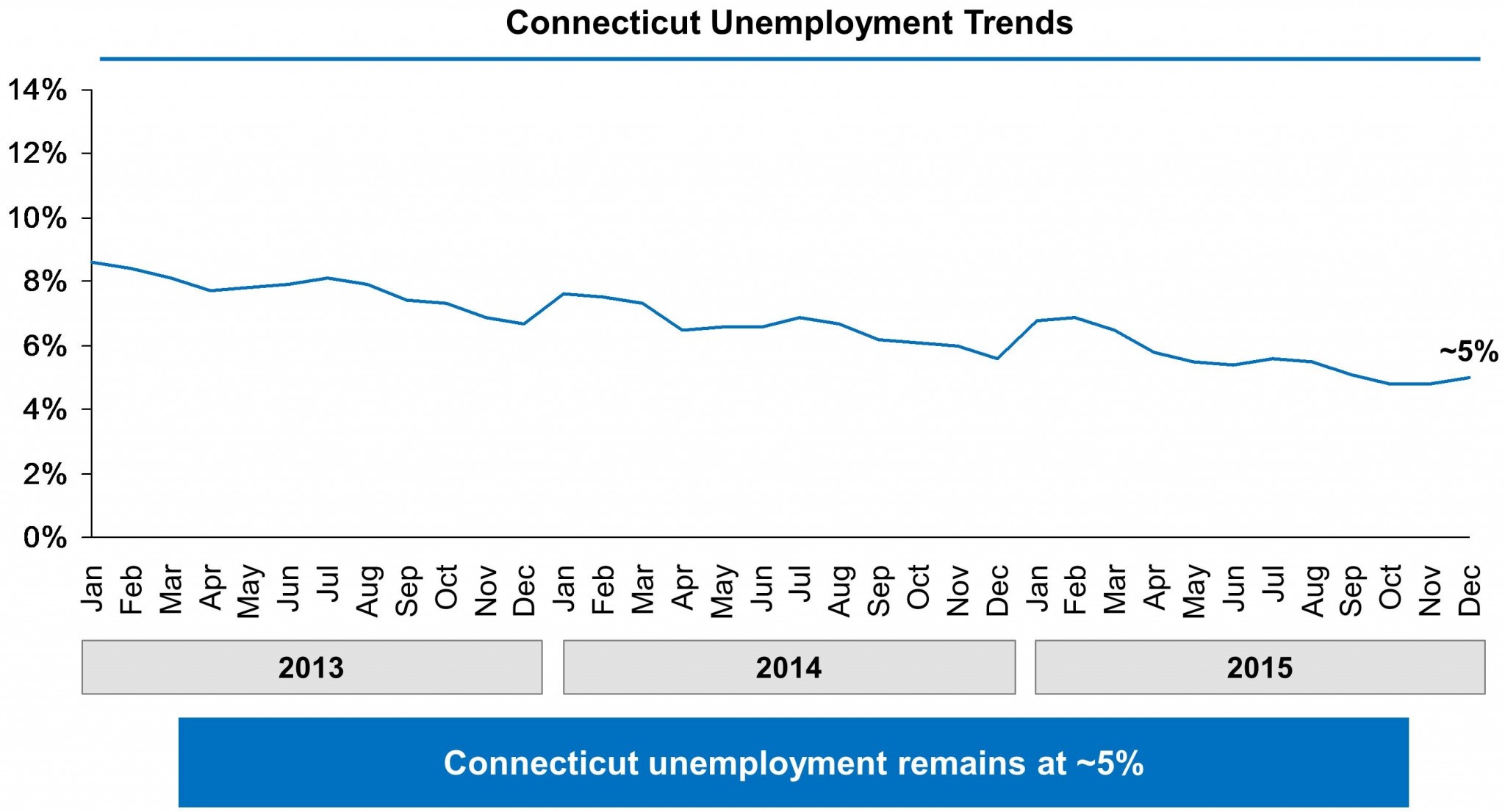

Connecticut: Unemployment Trends

Unemployment statistics for 2015 show average unemployment in Connecticut at 5.6%. Monthly unemployment rates were 4.8% for October 2015, 4.8% for November 2015, and 5.0% for December 2015.

Connecticut covers an area of 5,543 square miles, with a width of 70 miles and a length of 110 miles. This implies a population density of 739 people per square mile, which makes Connecticut the fourth-most densely populated state in the United States.

The capital of Connecticut is Hartford, the largest city is Bridgeport, and the largest metro area is the Greater Hartford area. The gross domestic product (GDP) of Connecticut in 2010 was $237 billion. This implies a compound annual growth rate from 2000 to 2010 of 3.77% and a per capita GDP of $59,132. Connecticut has the 23rd-largest economy in the United States by GDP.

Connecticut’s per capita personal income in 2013 was estimated at $60,847, the highest of any state. There is, however, a great disparity in incomes throughout the state of Connecticut; after New York, Connecticut had the second-largest gap nationwide between the average incomes of the top 1% and the average incomes of the bottom 99%. According to a 2013 study by Phoenix Marketing International, Connecticut had the third-largest number of millionaires per capita in the United States, with a ratio of 7.32%. New Canaan is the wealthiest town in Connecticut, with a per capita income of $85,459. Darien, Greenwich, Weston, Westport, and Wilton also have per capita incomes of over $65,000. Hartford is the poorest municipality in Connecticut, with a per capita income of $13,428 in 2000.

Connecticut State Government & EB-5 Investment Financial and Employment Statistics

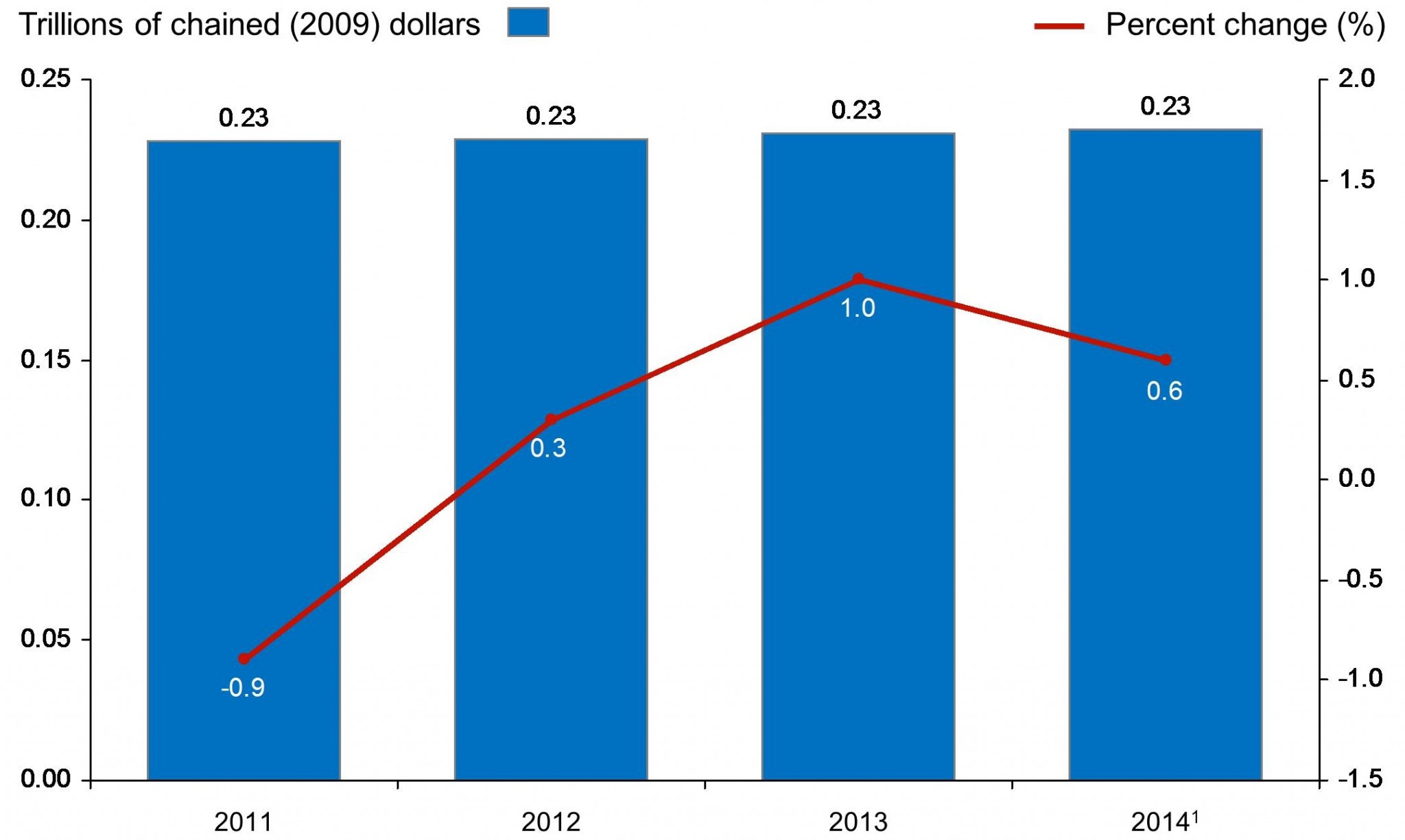

Connecticut: Real GDP (2011–2014)

From 2011 to 2014, Connecticut GDP grew by 0%, with an average annual GDP growth of 25%. In 2014, Connecticut real GDP was $0.23 trillion, 23rd in the U.S. 2012 to 2013 saw the largest percent change in GDP at 1%, signaling a strong and growing economy.

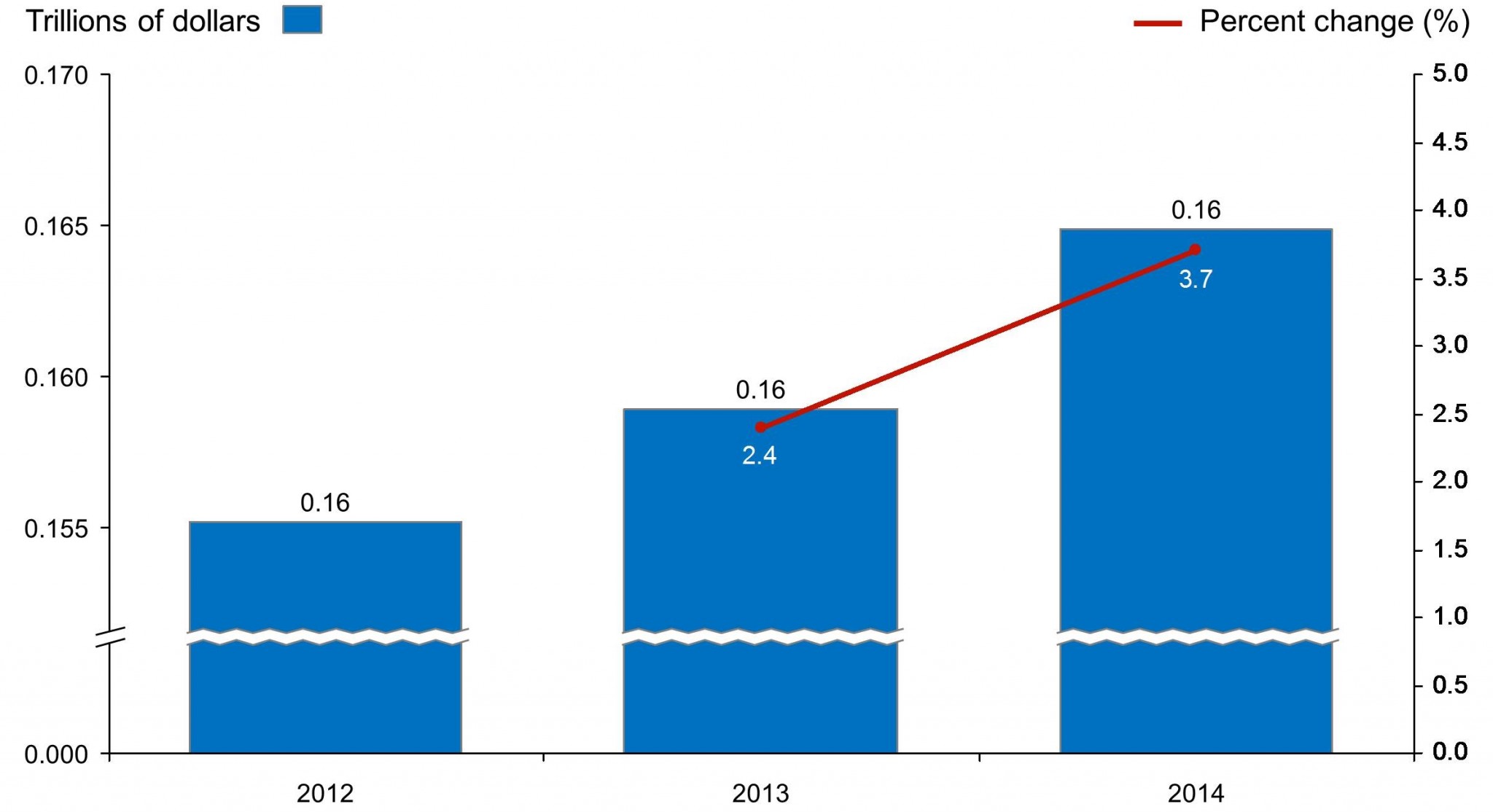

Connecticut: Total Personal Consumption Expenditure (2012–2014)

Personal consumption expenditure is the primary measure of consumer spending on goods and services and is a primary engine driving economic growth. Connecticut personal consumption expenditure remained steady from 2012 to 2014 at $0.16 trillion.

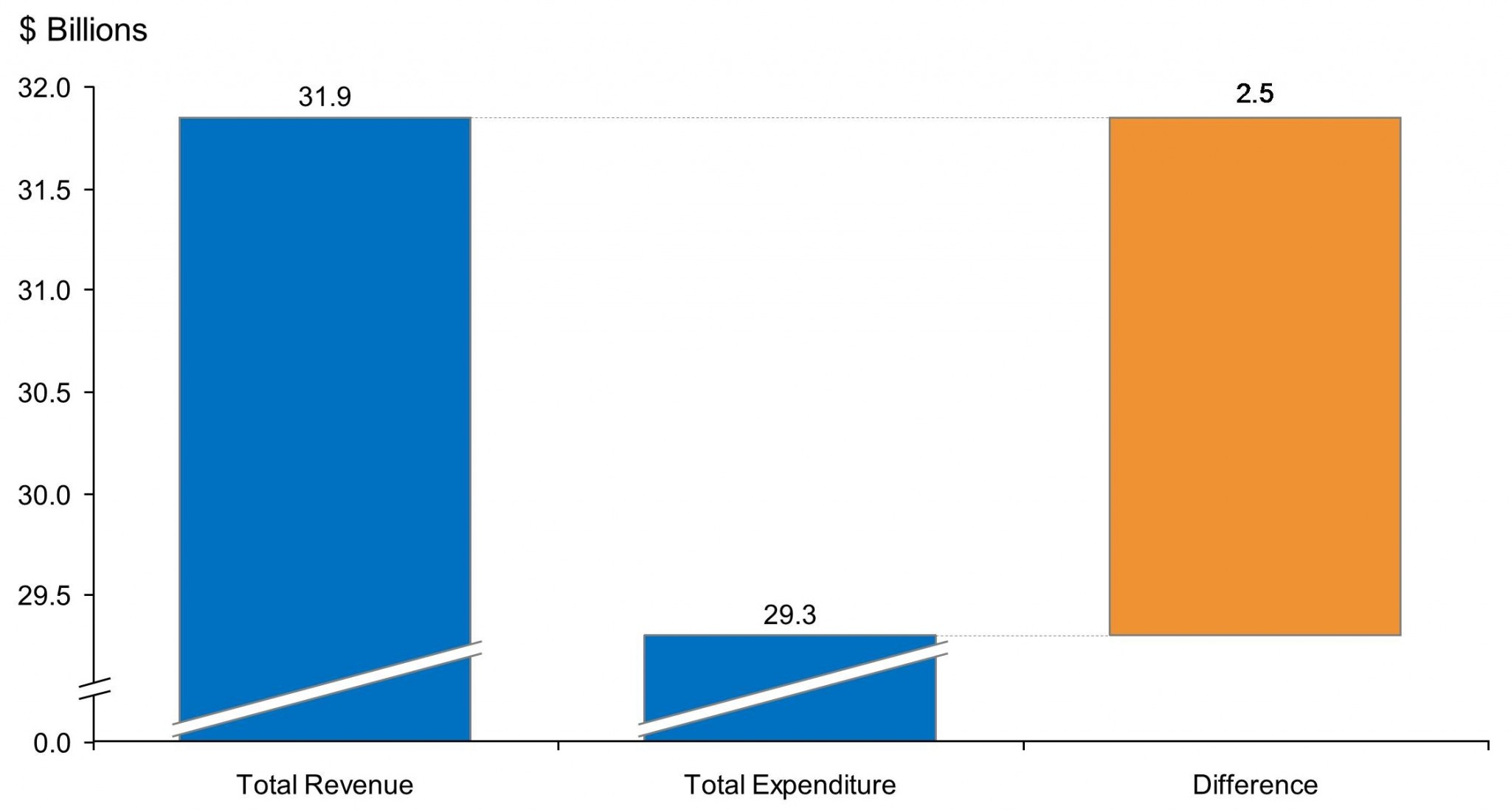

Connecticut: State Government Finances (2013)

In 2013, the government of Connecticut collected $31.9 billion and spent $29.3 billion, resulting in a net difference of $2.5 billion. Revenue is sourced from federal and local taxes, sales tax, and individual and corporate taxes. Expenditures include education, welfare, highways, police, and other social services.

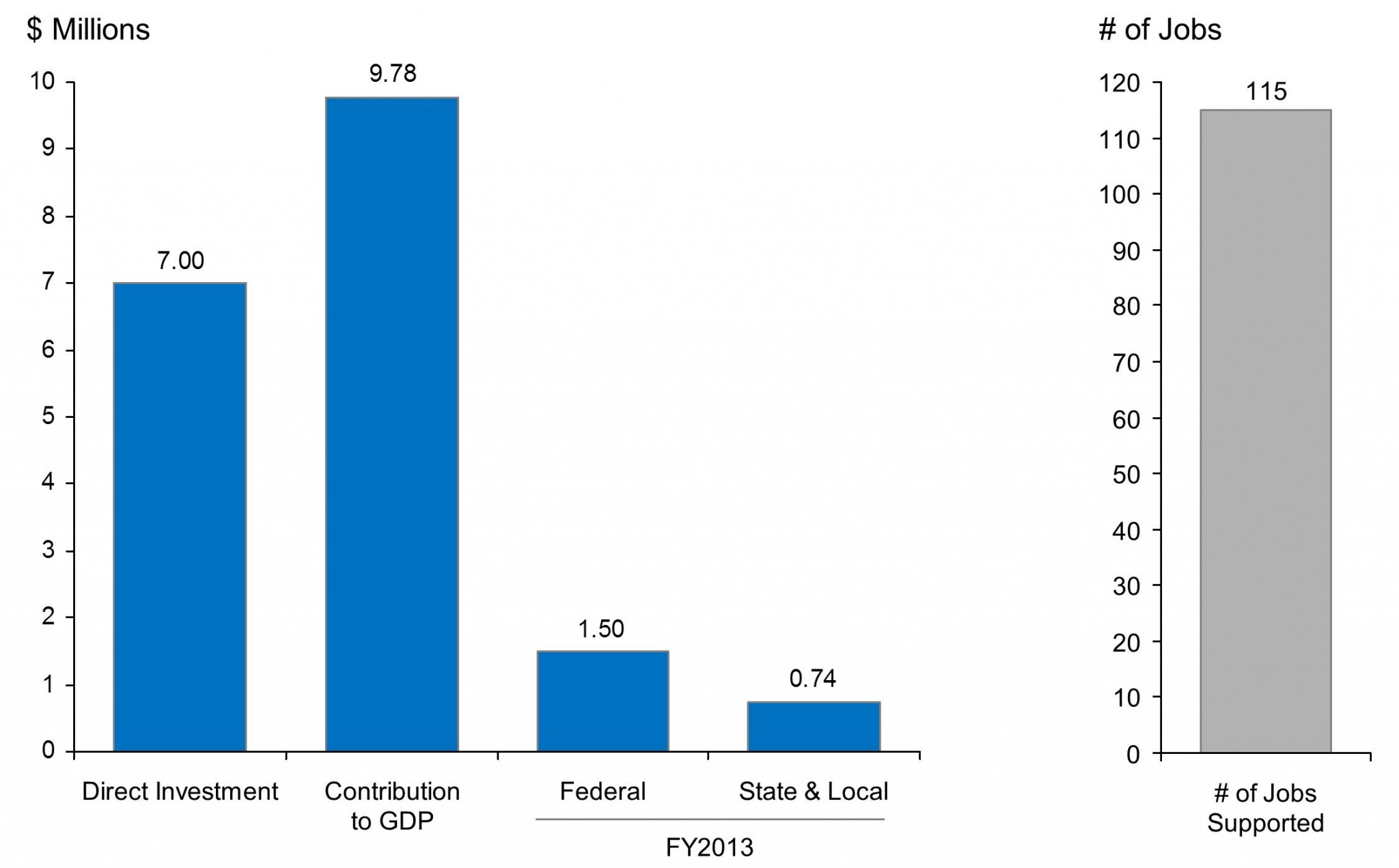

Connecticut: Total Economic Impact of EB-5 Investments (2013)

In Connecticut, EB-5 investment has supported the direct creation of 115 jobs. These jobs were the result of roughly $7 million in direct investment from EB-5 projects, contributing $9.78 million to the state’s GDP. EB-5 investment in Connecticut also contributed $1.5 million to federal revenue and $0.74 million to Connecticut state government and local municipal revenue.

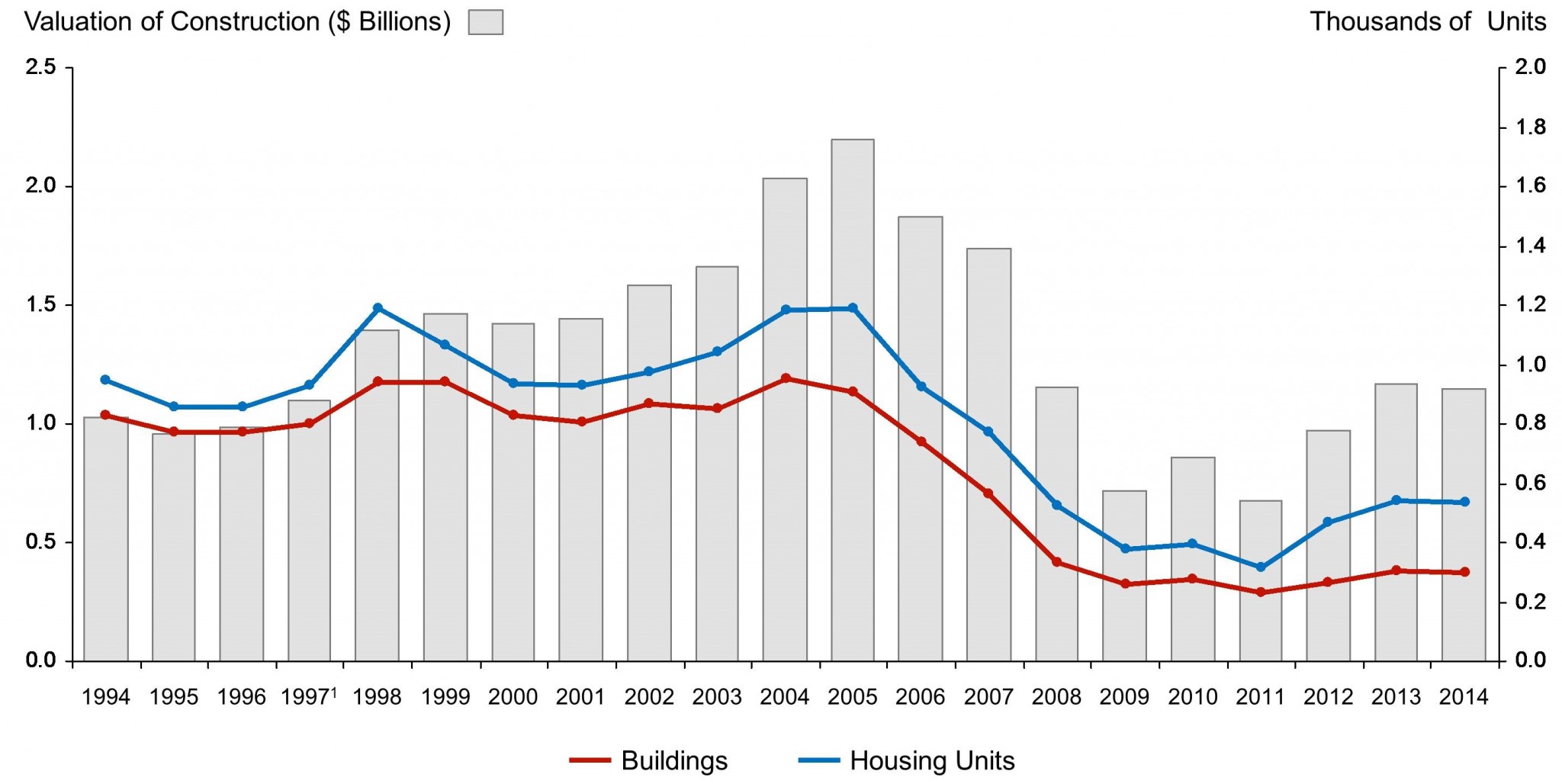

Connecticut: New Privately Owned Housing Units Authorized by Building Permits in Permit-Issuing Places

Since 2009, Connecticut has seen an increased growth of privately owned housing units both in new buildings and housing units. In 2014, roughly 1,000 privately owned units were authorized by building permits. Most of these units are constructed in Connecticut’s largest cities, which include Bridgeport, New Haven, Hartford, Stamford, and North Stamford.

The EB5AN State of Connecticut Regional Center covers the entire state of Connecticut, including Hartford, the capital city and home to numerous insurance company headquarters.